When Are My 2020 Taxes Due

Youve now got until May 17 to file your taxes, a roughly one month extension from the usual deadline.

Not ready when the deadline comes around? You can file for an extension before that date. Special rules apply to people serving in the Armed Forces who are in a combat zone or contingency operation, or have been hospitalized owing to an injury sustained in such an area. Those individuals have 180 days after they leave the area to file and pay taxes.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

What To Prepare Before Filing Starts

Now is a good time to get your tax matters ready to ensure a smooth filing experience! Make sure that you have received your IRP5/IT3s and other tax certificates like medical certificate, retirement annuity fund certificate and any other 3rd party data that are relevant in determining your tax obligations. Reset your eFiling username and password if you have forgotten them. Update your personal information such as banking details, address and contact details online on eFiling or the SARS MobiApp.

Follow us on Social Media for daily Tax Tips or keep an eye on this webpage for all the information.

Read Also: How To Figure Federal Income Tax On Paycheck

The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Get A Larger Tax Refund Next Year

If you want a bigger tax refund next year, then there are a few ways you can increase the amount of money the government will give you as a tax refund. One of the easiest ways is by contributing to a tax-deferred retirement plan such as a 401, the Thrift Savings Plan, or by opening a Traditional IRA, which allows you to deduct up to an additional $5,500 on your taxes each year . You can open an IRA in a variety of locations, including banks, brokerage firms, independent advisors and more.

Also Check: Can I File Bankruptcy On State Taxes Owed

Taxpayers Can Access Irs Free File In Four Easy Steps:

Where To Get Help

Given ongoing high call volume continues, we understand the filing experience is more difficult for taxpayers who need to interact with us. We encourage you to turn first to online resources. This area has been a huge focus for the IRS, and critical tools are available that people may overlook. The online tools and resources range from tax account and refund tracking tools, to tax law research tools like the Interactive Tax Assistant and answers for Frequently Asked Questions on dozens of subjects. Use the Wheres My Refund online tool and the automated tools available through the Online Account on IRS.gov.

The IRS’s Volunteer Income Tax Assistance program still offers face-to-face help preparing taxes in some locations across the country. It offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. The VITA/TCE Site Locator can help you find the nearest community-based site staffed by IRS-trained and certified volunteers.

Doug ODonnellIRS Deputy Commissioner, Services & Enforcement

Read Also: When Can You File For Taxes 2021

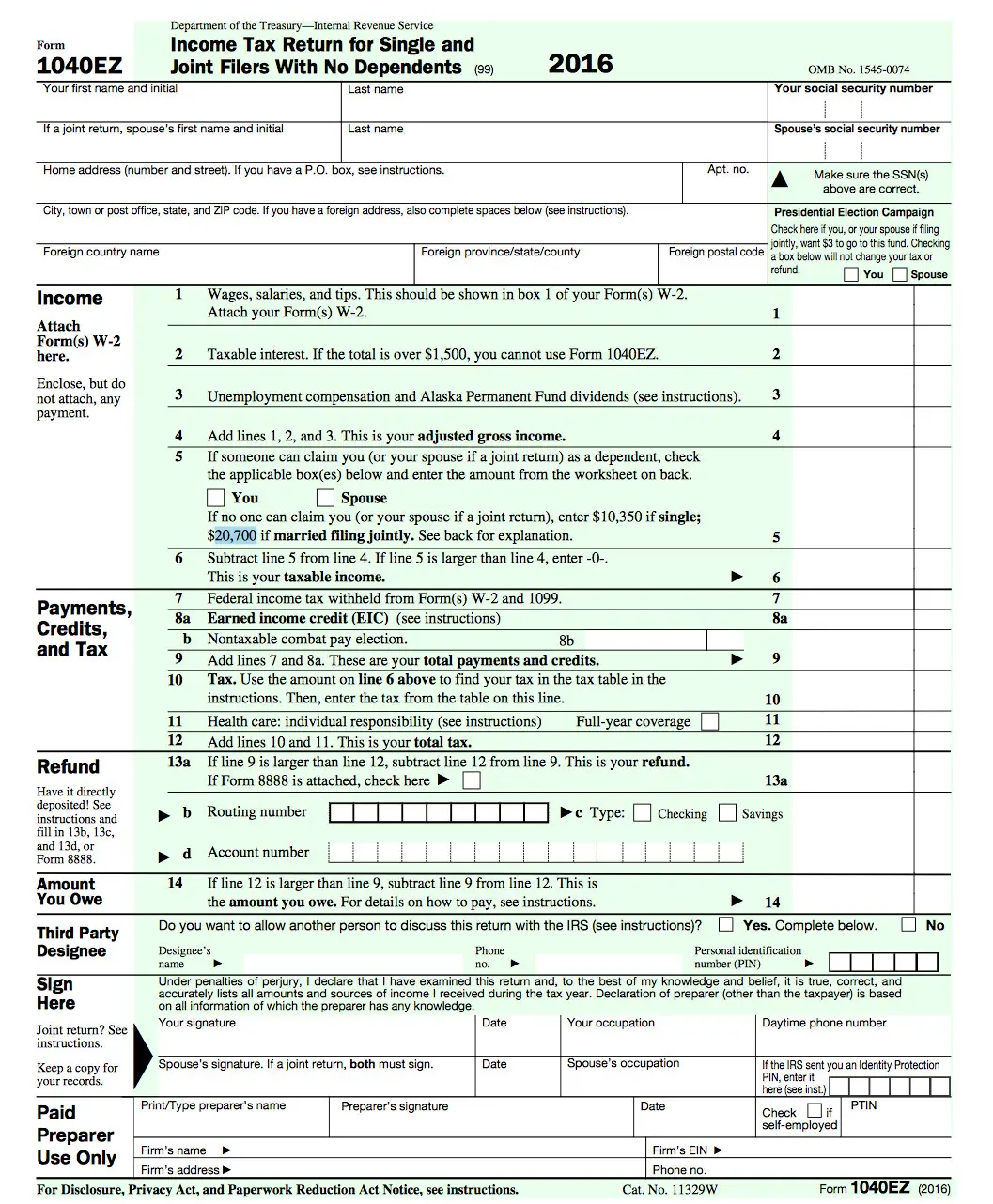

How Can I File My Taxes

The IRS accepts tax returns filed one of two ways:

A reported 88% of individual tax returns are e-filed per year. Any tax return filed by a tax professional in an H& R Block tax office, using the H& R Block tax software, or through the H& R Block online filing program is usually e-filed. However, you can always choose to have your return printed to mail yourself.

E-file is the quickest filing method and typically helps you receive a tax refund faster.

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

As a result, delays in completing paper returns have been running from six months up to one year.

Also Check: How Does Withholding Tax Work

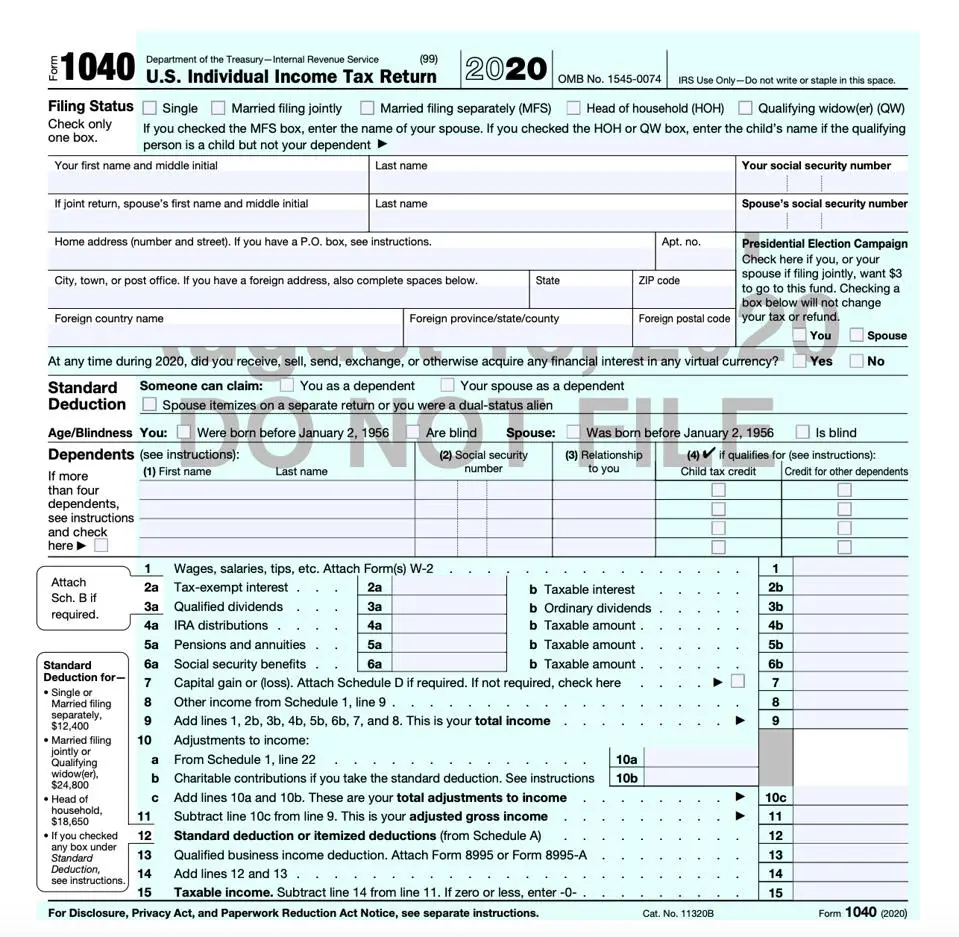

What Common Tax Mistakes Should I Look Out For

Small errors can have big repercussions. And little things can do everything from delay your refund to put you at higher risk of an audit. Here are the most common errors, according to tax officials.

- Missing or inaccurate Social Security numbers

- Misspelled names

- Errors in figuring tax credits or deductions

- Incorrect bank account numbers

© 2022 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell My Personal Information | Ad Choices FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.S& P Index data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Terms & Conditions. Powered and implemented by Interactive Data Managed Solutions.

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

Don’t Miss: What Tax Year Is The Third Stimulus Based On

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Volunteer Income Tax Assistance

The IRS’s Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if there’s a community-based site staffed by IRS-trained and certified volunteers still open near them.

Don’t Miss: Where To Get Tax Forms

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

When Do I Get My Tax Refund

The answer to when will I get my tax refund depends from year to year.

Generally, the IRS has said that about 90% of refunds are issued within 21 days of when the return was received.

You can check on the status of your refund on the IRS website or at our Wheres My Refund page. Live updates will appear the same day e-file opens. Using this tool, you can easily track the progress of your return as it is processed.

You May Like: How To Calculate Long Term Capital Gains Tax

Do I Have To Pay Taxes On My Unemployment Benefits

As unemployment rates soared during the early days of the pandemic, millions of people received unemployment benefits to help them get by. You might have to pay taxes on that money, but the recently passed American Rescue Plan makes it a lot more unlikely.

The bill, signed into law by President Joe Biden on March 11, made the first $10,200 of unemployment income tax-free for people with adjusted gross income of less than $150,000 in 2020.

If you had already filed your taxes before that date and paid taxes on unemployment, the IRS is working on a fix that will save people the effort of filing an amended tax return and still refund them what they paid for unemployment benefits.

Extended Deadline Nears For Filing Income Tax Returns

BOISE, Idaho Times running out to file your 2021 Idaho income tax return.

The Idaho State Tax Commission says taxpayers who qualified for an automatic extension to file must send in their return and full payment by Oct. 17.

We expect to receive about 36,000 individual income tax returns in October, Tax Commission Chairman Jeff McCray said. Thats in addition to the 925,000 returns weve received so far this year.

Idaho law allows you to avoid a penalty for filing a late return if you have an extension, but youll still owe 3% interest on any income tax due that you didnt pay by April 18, the original due date.

You can file your income tax return electronically, and you might qualify to prepare and file it online for free. Visit tax.idaho.gov/freefile to learn more.

You also can pay taxes electronically through tax.idaho.gov/epay. The free Quick Pay option lets you make a payment without creating a special account.

If you qualify for Idahos two 2022 tax rebates, youll receive them after the Tax Commission has processed your 2021 tax return.For more information:

You May Like: How To Apply For State Tax Extension

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take eight-12 weeks to process. If you do not receive an amended tax return refund within eight weeks after you file it, then you should contact the IRS to check on the status.us.

Also Check: What Is The Current Capital Gains Tax Rate

How Do I Know That The Data Is Correct

This year, for the first time, you can view third-party data certificates submitted by third party data providers on your behalf. Simply log in to eFiling and following the steps below:

- Once successfully logged in, click on Third Party Data Certificate Search menu option displayed as part of the left menu option.

- Once you have selected the Third Party Data Certificate Search menu option, the Request Third Party Certificates screen will be displayed.

- On the Request Third Party Certificate form, select the Certificate Type and Tax Year.

- Click on the Certificate Type drop down list and select the appropriate certificate type.

- Click on the Tax Year drop down list and select the appropriate tax year.

- Once you have made the applicable selection, click on the Submit Query button displayed at the bottom of the page.

- The Certificate Type selected will be displayed and you will be able to click on to view your Certificate.

- Note the certificate cannot be used to submit to SARS.

If there is an error or the data is incomplete:

When Will My Refund Be Available

Keep in mind that it may take a few days for your financial institution to make your deposit available to you, or it may take several days for the check to arrive in the mail. Keep this in mind when planning to use your tax refund. The IRS states to allow for five additional days for the funds to become available to you. In almost all cases, a direct deposit will get you your tax refund more quickly than in five days, and in some cases, it will be available immediately.

You May Like: What Are New Market Tax Credits

Irs Refund Schedule Chart

Here is a chart of when you can expect your tax refund for when the return was accepted . This is an estimate based on past years trends, but based on past information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status.

When can you file your 2021 tax return? Anytime between January 24 and April 18, 2022.

Now, when to expect my tax refund based on when it’s accepted!

|

2022 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

||

If, for some reason, you didnt receive your return in the time specified above, give or take a few days, you can always use the IRSs tool called Get Refund Status. Since the link requires personal information, here is the non-html version: https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp.

Once you enter all your information, it will tell you what is going on with your refund. Remember, if you input the wrong SSN, it could cause an IRS Error Code 9001, and might make your return be held for Identity Verification.

Also, many people are concerned because they received a Reference Code when checking WMR. Here is a complete list of IRS Reference Codes. Just match up the code with the one in the list, and see what the problem could be. As always, if you are concerned, you can .