Things To Consider When Filing Your Taxes Online

Heres what to look for in your tax software when filing your taxes online:

What Is So Important About The Tfsa Contribution Room

Like the RRSP. TFSA has a contribution room limit. If you go over your contribution room, you will have to pay a 1% monthly penalty on the excess amount.

This is the formula used to calculate it:

- Your TFSA dollar limit for that year

- Plus any unused contribution room from previous years

- Plus any withdrawals in the previous year

The annual TFSA dollar limits since 2009 are:

- 2009 to 2012 was $5,000.

- 2013 and 2014 was $5,500.

- 2015 was $10,000.

- 2016 to 2018 was $5,500.

- 2019 and 2020 was $6,000.

- 2021 is $6,000.

For example

Carls had $6,000 in his TFSA account in 2010. He did not contribute to his TFSA in 2011 but he withdrew $1,000 in 2011 from his account. His unused contribution room for 2020 will be calculated as follows:

Carls unused contribution room at the beginning of 2020 = contribution limits from 2009-2020 contributions he made so far + withdrawals

Carls unused contribution room at the beginning of 2020 = $69,500 $6,000 + $1,000 = $64,500

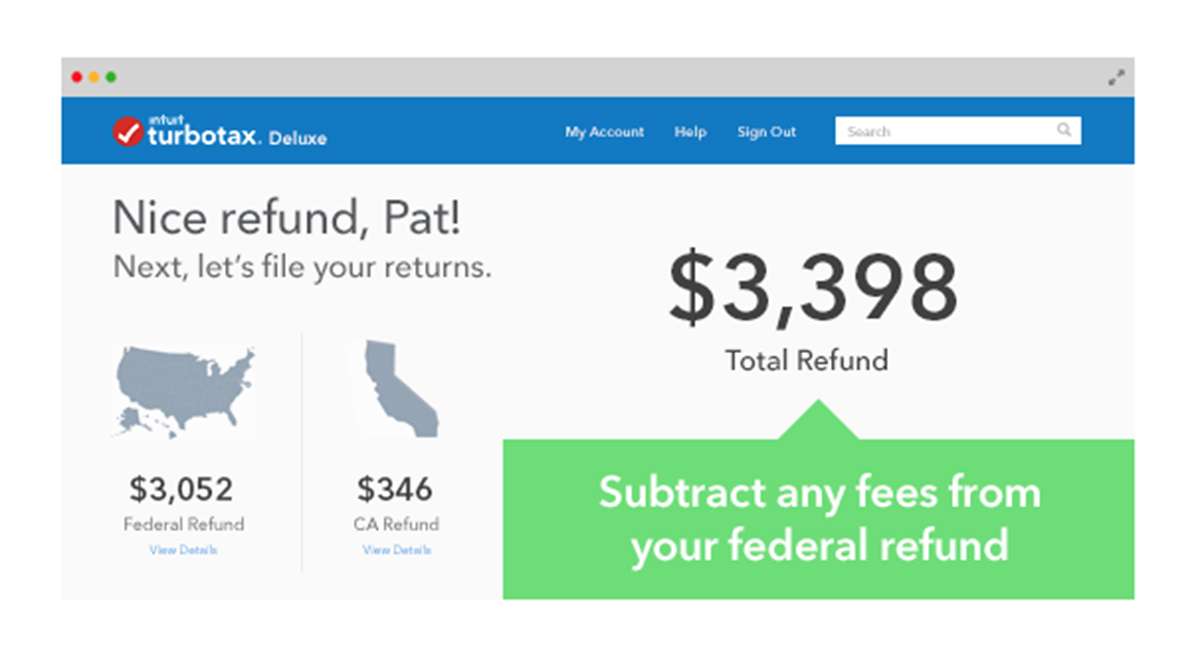

If Youre Getting A Refund

No matter how you file, you can choose to receive your refund several ways.

A direct deposit to a bank account is the fastest option. You can also have it loaded onto a Turbo Visa Debit Card or sent as a paper check.

Other options include applying the refund to next years taxes and directing the IRS to buy U.S. Savings Bonds with your refund.

You have the option of paying for the software out of your refund. But theres a $40 charge to do that.

Also Check: What’s The Capital Gains Tax

How Do I Use Free Tax Software

Free tax preparation software allows you to complete all of the necessary forms for your tax return and file them with the IRS. Simple, guided interviews let users answer questions that populate electronic IRS forms for completing their income tax returns.

These free tax programs include reviews of your tax return and options to receive your tax refund by direct deposit or as a check in the mail.

Free tax software users should be wary of paid upgrades. Some software publishers earn money by enticing free filers to upgrade for extra support or required IRS forms that aren’t included with free versions. If the software you’re using requires an upgrade while you’re filing, see if Cash App Taxes will work for you — it includes the vast majority of IRS forms at no cost.

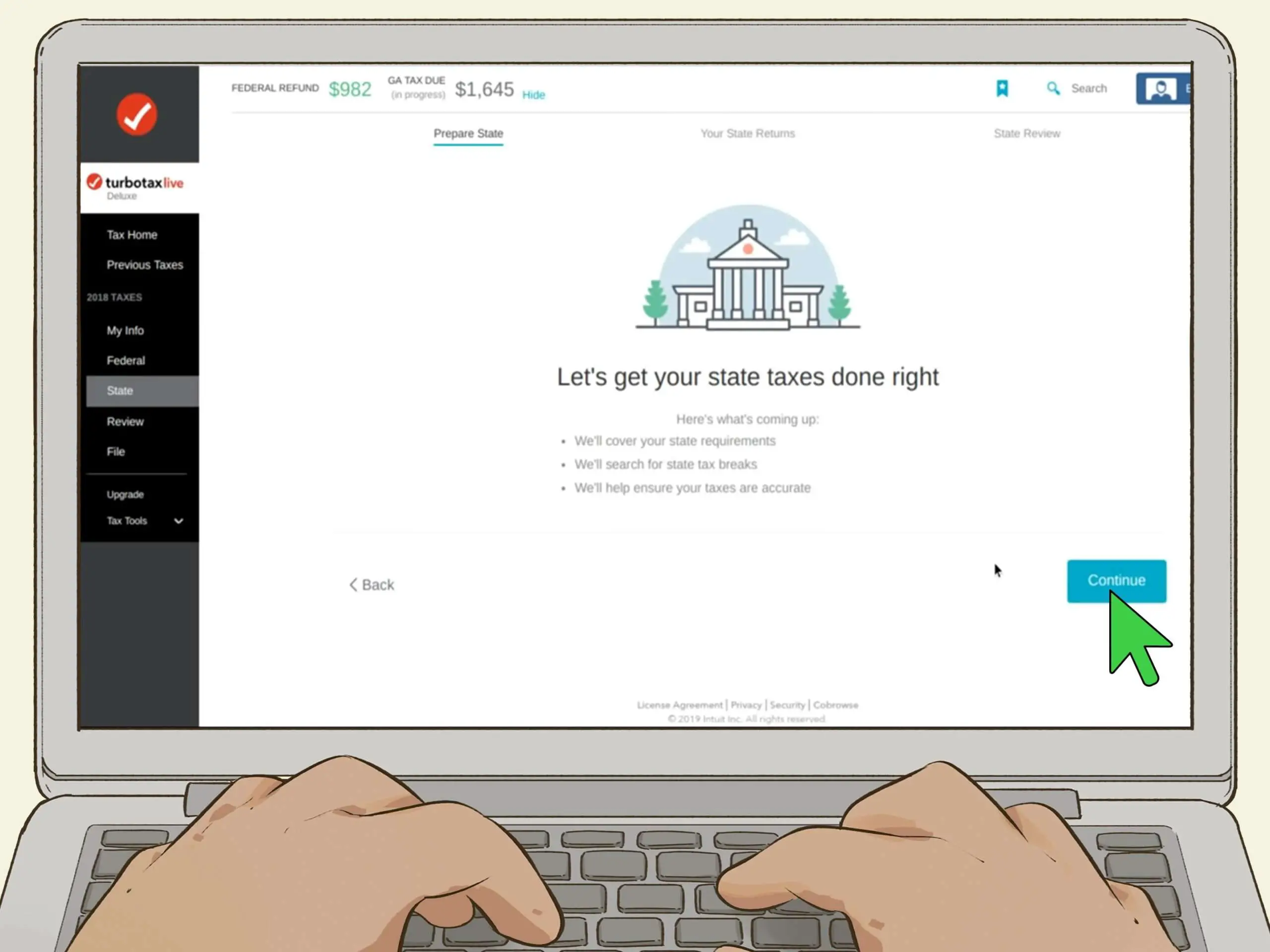

How To File For Free With Turbotax

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow’s legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 9,820 times.

Under an agreement with the IRS, TurboTax and other tax software companies offer a Free File Program that allows you to use their software to file your federal taxes for free. However, the free file program may be difficult for you to find on your own. If you file your taxes on the regular TurboTax page, you may end up being charged a fee to use the service. Make sure you qualify, then go directly to the website for the TurboTax Free File Program. That way, you can be certain that you won’t be charged by TurboTax to file your federal taxes.XResearch source

Also Check: Can I Pay My Taxes In Monthly Installments

Free Canadian Tax Software

TurboTax Free costs $0. File your simple Canadian tax return for free with no hidden fees.

Follow a simple step-by-step process to fill out your return and our software does the math for you and stores your information to use on next year’s return.

Save time by importing your tax slips into your return from the CRA with Auto-fill my return.

TurboTax Free protects all your personal tax info so you can file your taxes confidently.

Browse our TurboTax Community forum 24/7 or post a tax question for our users and experts.

TurboTax Free is ideal for simple tax situations:

Employment and unemployment income

Why customers love TurboTax Free

Infreefile Vendors For Tax Season 2022 Are Posted Below Be Sure To:

Notes:

- To ensure you can file both your federal and state return for free, access INfreefile products from this page.

- Please note that you will need to create a new account each year with the vendor to ensure a no-cost filing.

- Read our INfreefile FAQ below.

Returning Users

Follow the vendors directions for returning users as listed on their website. You may be required to create a new account. If you used INfreefile last year and your adjusted gross income increased, you may no longer be able to use specific vendors or may be ineligible for INfreefile.

|

Free electronic preparation and filing services for both Federal and Indiana tax returns to eligible Indiana taxpayers.

|

Read Also: How To Check Your Tax Status

File A Simple Return With Turbotax Live Basic By March 31

TurboTax is also offering its TurboTax Live Basic product at no cost for qualifying federal and state returns for a limited time. Youll need to file your return by March 31, 2022, and youll need to have a simple return to be eligible to use this service.

With this option, you can prepare your taxes while getting some assistance. As you prepare your return, you can chat with a tax expert. You can also set up a time to video chat. A tax expert will also review your tax return before filing it.

If you qualify for a simple return and file before March 31, 2022, this service will cost you $0.

Missing Stimulus Payments And Other Tax Software Concerns

Wed be remiss if we didnt address the concerns many people have with major tax software companies like TurboTax and H& R Block. Both companies have faced multiple lawsuits and investigations regarding their marketing, lobbying, and other business practices. Adding to that public distrust, many people who filed their 2019 tax returns with these companies did not receive their stimulus payments .

Its not quite the same thing, and were not trying to make excuses for shady business practices, but just as all printers suck, all tax software options are flawed. TurboTax is arguably the easiest yet most thorough and accurate way to file your taxes on your own. But if you have qualms about using that service and want to do your own taxes, you could use MyFreeTaxes , use one of the IRSs Free File partners, or manually fill out the IRSs Free File Fillable Forms . These options provide less hand-holding and have more frustrating interfaces than TurboTax and H& R Block, which means you could potentially make more errors, but theyre completely free. For live help, the IRSs Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs provide assistance from certified volunteers for those who qualify.

Also Check: Do You Need To Claim Unemployment On Taxes

How To Do Your Taxes For Free With Turbotax

Free. Free. Free. Free. Free. Weve all heard that TurboTax slogan, but can you actually file your taxes for free with TurboTax? The short answer is: yes, but its tricky. There are two separate programsIRS Free File Program delivered by TurboTax and TurboTax Free Edition. The first is free for eligible individuals through the IRS, while the second will likely end up costing you, even when it shouldnt.

Sound confusing? It absolutely is, but the Groupon Coupons team is here to break it down for you.

File A Digital Return With Free Tax Help

If you earn $73,000 or less, youre eligible for free tax help from companies that have partnered with the IRS.

A tax prep service walks you through the filing process and makes sure you have the right information and documents. But it also performs important calculations on your return. Some services even include a free state tax return.

Important RemindersYou must access the services through the IRS website. If you go to the providers directly, any account you create there will not work on the Free File system.

The tax prep service is a public/private partnership between the IRS and third-party providers. This years partners are: 1040Now.NET, ezTaxReturn.com, FreeTaxReturn.com INC, FileYourTaxes.com, On-Line Taxes at OLT.com, TaxAct, FreeTaxUSA, and TaxSlayer.

Two of the third-party services offer their tool in Spanish: ezTaxReturn.com and TaxSlayer. None of the remaining services offer any language other than English.

How to Find ItGo to the Free File webpage on the irs.gov website and click the Choose an IRS Free File Offer button. > > From this page you can choose to browse the offerings or to use the finder tool which pinpoints the service best suited for you.

For the browse tool, click the Browse All button. > > Here youll see each of the services, along with important information to help you decide which is the right one for you.

Also Check: Is Nursing Home Care Tax Deductible

How To File Your Taxes Using Turbotax

TurboTax is built with the idea that everyone should be able to file their tax returns easily online.

To start, gather all your paperwork and .

The software takes you through a short questionnaire in order to figure out the forms you need to complete. Once your profile is completed, the rest is a guided step-by-step process that ensures you are able to get the maximum tax refund possible.

Before you submit your return, TurboTax checks that everything is good to go. The electronic submission of your tax return to CRA via NETFILE is immediate and your tax refund is usually deposited in your bank account within 8 business days.

TurboTax System Requirements

TurboTax is available on computers, tablets, and smartphones .

For computers, the following browsers are supported:

Microsoft Windows Computers: Google Chrome, Mozilla Firefox, Microsoft Internet Explorer, and Microsoft Edge.

Mac OS X: Google Chrome, Apple Safari, and Mozilla Firefox.

Make sure you have the latest versions of these browsers installed on your computer.

What Is The Turbotax Free Edition

TurboTax Free Edition is the name for a free version of TurboTax. It is not the same as the TurboTax Free File edition, which is part of the IRS program.

TurboTax Free Edition is free for people who are filing very simple returns only.

Warning: TurboTax Free Edition is not always free. It puts many people on track to pay.

Read about how TurboTax tries to hide its Free File edition.

Read Also: How To Figure Out Tax Deductions From Paycheck

Other Good Tax Software

MyFreeTaxes runs on the TaxSlayer platform. Its completely freeno income, age, or geographic limitations. Whats the catch? As far as we can tell, there isnt one, except that we dont particularly like TaxSlayers interface. This is a service provided by the charitable organization United Way to anyone and everyone. But the software is clunky, and the guidance is less thorough than what you get from our picks, so we recommend it primarily for those who are willing to spend extra time puzzling over how to enter their info in exchange for totally free federal and state filing.

TaxSlayers commercial offerings are attractively priced: The Classic edition, which includes all forms, is $17 for a federal return and $32 for each state tax return. (TurboTax Deluxe, in contrast, costs $39

for a federal return and $40 for each state tax return, and it doesnt include every form.) But if you go through MyFreeTaxes, you get the same TaxSlayer service for free.

An added concern: A screen at the beginning of the interview process asks you to sign a privacy policy to continue entering your information. This step actually grants TaxSlayer the permission to use your info to provide you with offers, from the company or from third parties. Other tax software does this, too, but TaxSlayer doesnt make it clear that agreeing is entirely optional we recommend that you skip this page.

How Do I Get My Missing Stimulus Money

If you qualified for the third stimulus payment but didn’t receive it, you can claim the Recovery Rebate Credit on your tax return.

Qualifying parents who had a child last year, or those who added a dependent, such as a niece, parent or grandparent, can also receive additional stimulus payments for their new family members.

Read Also: Can I Do My Tax Return Online

Are There Other Changes I Need To Be Aware Of

Maybe. If you don’t normally file a tax return because your income is too low, the IRS is encouraging you to do so this year. You might qualify for certain tax credits, like the Recovery Rebate Credit or Child Tax Credit.

And if you normally do file a return and qualify for the Child Tax Credit, you likely received advance payments for half of the total amount throughout 2021. On your tax return, you will reconcile what you received from the IRS with the total amount you are eligible for.

Then, you will receive the other half as part of your refund, or have it put toward any money you owe the IRS. It is also possible that you may owe some money back to the IRS if you received more than you were eligible for.

Additionally, any unemployment benefits received in 2021 could affect your refund if taxes were not withheld. And you can deduct up to $300 in charitable donations per person this year, even if you take the standard deduction. That means if you are married and filing jointly, you can deduct $600.

CNBC Make It will be covering everything else you need to know this tax season in the coming weeks, including tips for crypto investors, important IRS notices and more. Follow along, and happy filing.

Miltax For Military Families

Service members and families have the option of using MilTax, the tax service of Military OneSource. According to the IRS, MilTax “offers online software for eligible military members, veterans and their families to electronically file a federal return and up to three state returns for free.”

The software is tailored to military life, accounting for deployments, living in multiple states, and combat and training pay, according to its website. It’s available online from Military OneSource.

Read Also: Do I Need W2 To File Taxes

When Are Taxes Due

This year, your federal return is due April 18. April 15, the standard due date, is a Friday and a holiday in Washington, D.C., which pushed back the deadline. Residents of Maine and Massachusetts have until April 19.

Most state tax deadlines are also the 18th, although there are a handful that are later than that, including Virginia on May 2 and Louisiana on May 16. And of course, residents of states with no income tax, including Alaska, Florida, Nevada, Tennessee, Texas and Washington, among others, don’t have to worry about filing a separate return.

You can file for an extension if you need more time, which would shift your deadline to Oct. 17. But if you owe money to the IRS, technically you need to pay that by April 18, even if you request an extension. If you don’t, you’ll be hit with late payment penalties.

Is It Free To File With Turbotax

Asked by: Jedidiah Mosciski DVM

TurboTax Free Edition: $0 Federal + $0 State + $0 To File offer is available for simple tax returns only with TurboTax Free Edition. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest.

Don’t Miss: Where Can I Get Oklahoma Tax Forms

Get Our Top Investigations

Heres what happened when we went looking.

Our first stop was Google. We searched for irs free file taxes.

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word free five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasnt going to be free at all. Turns out the house cleaner didnt qualify because he is a independent contractor. The charge? $119.99.

Then we tried with a second scenario. We went back to TurboTax.com and clicked on FREE Guaranteed. This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay this time because theres an extra form if you dont have insurance. The charge? $59.99.

But wait. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? No! According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free.