If I Am Not Required To File Form Nc

If you are not required to file Form NC-3, you may still have a requirement to file certain information returns with the Department. If you directly or indirectly pay or control the payment of any income to any taxpayer in North Carolina, then you are required to file certain W-2 and 1099 statements with the Department. For a detailed list of statements required to be filed with the Department view this table.

Note: The information reporting requirements generally apply to payments made in the course of your trade or business therefore, if you pay an independent contractor to make improvements to your personal residence, you are not required to file an information return with the Department to report the payment of this income to the independent contractor. However, payments made to an employee, even if they are not in the course of your trade or business, are reportable to the Department. For example, if you are required to file a Form W-2 with the IRS for a household employee, you must also file a copy of the Form W-2 with the Department if the Form W-2 was issued to a resident of North Carolina or to a non-resident for services performed in North Carolina.

For more information, reference general statute G.S. 105-154.

Attach Statement To Tax Return

If you do need to attach your 1099 to your tax return, make sure you do so correctly. Like with most things concerning the IRS, there are very specific rules and requirements regarding the way forms must be attached to your tax return. There is an Attachment Sequence No. located in the top right corner of each schedule or form that lets you know in which order these forms must be attached. Supporting documents need to be arranged in the same order as the forms and schedules they are supporting.

References

How To Complete Form 8949

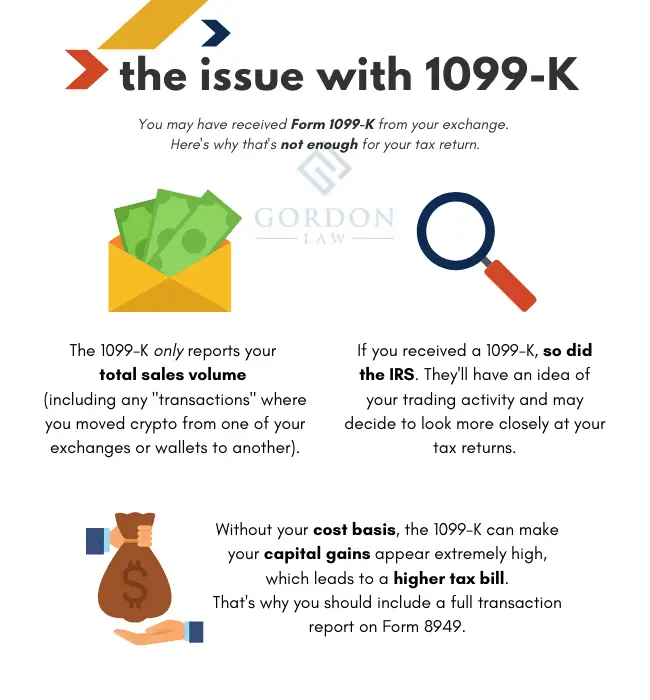

Form 8949 makes tax reporting of trades more complicated than ever for active traders and investors. Likely, congress had envisioned a simpler and more accurate reporting process when they passed cost basis reporting legislation. But the resulting IRS regulations are far from simple.

The Form 8949 instructions from the IRS rely on the concept that broker-provided 1099-B reporting contains the information needed for tax reporting. In theory, this concept is good, but in reality there are serious flaws and challenges. In a 2013 poll conducted by TradeLog Software, 97% of active traders had circumstances that made the 1099-B incomplete for Form 8949 requirements.

Ideally, the IRS wants taxpayers to fill out Form 8949 with all of the information from the 1099-B, then correct that information if necessary and make additional adjustments not accounted for by the broker. In addition, any trades not reported on 1099-B would need to be accounted for. This can be an overwhelming task for active traders and investors with hundreds or thousands of trades, and often more than one trading account!

It is very important to remember, despite what a broker reports on Form 1099-B, you are still obligated to maintain and report accurate trade history records. Your broker is NOT required to provide you with IRS-ready tax reporting.

Recommended Reading: How To Do Taxes For Shipt

What Determines If A Security Is Covered

The IRS has determined which securities are covered and non-covered. Basically, a covered security is one that the broker must report on the 1099-B and must report cost basis data for, by law. Non-covered securities may be reported on your 1099-B and may even have cost basis data reported, but they are still classified as non-covered because they are not required by the IRS. Below is a list of typical securities and whether they are covered or non-covered this list is not exhaustive or definitive. Your broker is required to classify and report securities according to the law and they are accountable for their reporting.

Stocks and Bonds

- Typically, all stocks and bonds are reported by brokers on Form 1099-B.

- Stocks purchased before 2011 are NON-COVERED securities.

- Stocks purchased after 2010 are COVERED.

Mutual Funds

- Typically, mutual funds are reported by brokers on Form 1099-B.

- Mutual funds were NON-COVERED before the 2012 tax year.

DRPs

- Dividend reinvestment plan stocks are typically reported by brokers on Form 1099-B.

- DRPs were NON-COVERED before the 2012 tax year.

ETFs/ETNs

Options

- Option contracts opened BEFORE January 1, 2014 are NOT typically reported by brokers on Form 1099-B

- Option contracts opened on or AFTER January 1, 2014 are typically reported by brokers on Form 1099-B

- Option contracts opened before 2014 are NON-COVERED.

Futures and Other Section 1256 Contracts

Single Stock Futures

Does Form 1099 Need Attached

You do not always have to attach a copy of your 1099-MISC to your tax return. Instructions for IRS Form 1040 state that you only need to attach supplemental forms if federal taxes were withheld. Because no federal income taxes or Social Security and Medical contributions are typically withheld from earnings reported on the Form 1099-MISC, you likely won’t need to attach it to your return only statements that prove withholding should be attached. But, if for some reason your 1099-MISC does show any federal or state withholding, you’ll have to submit it attached to your IRS Form 1040, U.S. Individual Income Tax Return.

Read Also: When Are Irs Taxes Due 2021

How Should I Submit Files That Were Rejected Because Of An Error

You can test files prior to submission in the eNC3 and Information Reporting Application. If you receive an error, attempt to correct the file and retest. If the error cannot be corrected, file Form NC-3 and required W-2 and 1099 statements in paper form on or before the due date of Form NC-3.

Note: If this situation applies to you, then you may request a waiver of the penalty for failure to file an informational return in the format prescribed by the Secretary by submitting Form NC-5501. On the penalty waiver form, select “Other” reason in Part 4. Reason for Waiver and indicate that your attempt to electronically submit Form NC-3 and the required W-2 and 1099 statements via the eNC3 and Information Reporting Application was rejected because of an error and you were unable to correct the error. The Department will notify you of its decision to either grant or deny said request.

Who Needs To Use Form 8949

The IRS Instructions for Form 8949 state that it is used to report sales and exchanges of capital assets. Form 8949 is used by both individual taxpayers as well as corporations and partnerships. Form 8949 is used with the Schedule D for the return you file, including Forms 1040 and 1065, along with most other common tax return forms. See page 1 of the IRS Instructions for a complete list.

Don’t Miss: How Much Is Franchise Tax In Texas

Why Am I Receiving An Error Stating Invalid Entry When I Enter My Account Id

Check to make sure you are entering a NC withholding ID number this is the number you received when you registered for withholding tax with the Department. You can confirm the validity of your NC withholding number by calling 877-252-3052.

Note: If you registered for a new NC withholding number in December of prior year, you may not be eligible to submit Form NC-3 and the required W-2 and 1099 statements using the eNC3 and Information Reporting Application. In this case, a paper Form NC-3 must be filed with the Department on or before the due date. Be sure to attach all required W-2 and 1099 statements to Form NC-3.

If this situation applies to you, then you may request a waiver of the penalty for failure to file an informational return in the format prescribed by the Secretary by submitting Form NC-5501. On the penalty waiver form, select “Other” reason in Part 4. Reason for Waiver and indicate that your attempt to electronically submit Form NC-3 and the required W-2 and 1099 statements via the eNC3 and Information Reporting Application failed because you received an “Invalid Entry” error when you entered your Account ID. The Department will notify you of its decision to either grant or deny said request.

I Am Required To File All Income Record Forms In Magnetic Media Format Or Can I Choose Different Filing Formats

It depends. Issuers with 250 or more income record forms must use MTO to send a magnetic media formatted file electronically. Issuers with fewer than 250 income record forms, may utilize any filing option listed in Treasury’s Income Record Form Remittance Guide. Business taxpayers, issuers, and service providers are encouraged to send state copies of W-2s and 1099s to Treasury electronically whenever possible.

Recommended Reading: What Is Futa Payroll Tax

Who Can File Form 1099

Brokers must submit a 1099-B form to the IRS and send a copy directly to every customer who sold stocks, options, commodities, or other securities during the tax year. The IRS requires submission of the form to serve as a record of a taxpayers gains or losses. Forms are sent to investors in January and February.

For example, let’s assume you sold several stocks last year. The proceeds of the sale were $10,000. That figure will be reported to the IRS from two sources: One from the brokerage on a 1099-B and the second from you as a report of a taxable capital gain.

The form may also be filed by companies that participate in certain bartering activities with others. For the latter, the form is used to report changes in capital structure or control of a corporation in which you hold stock.

The broker or barter exchange must mail a copy of a 1099-B form to all clients by Feb. 15 of the year following the tax year. If you don’t receive yours, contact the issuer for a replacement copy.

What Is Publication 1220 And How Does It Apply To Filing Income Statements With Michigan

Publication 1220 is an IRS document, updated annually, to provide guidance on the electronic remittance process for various federal returns, in magnetic media format, through the Filing Information Returns Electronically System. Taxpayers and service providers may use the layout or schema outlined in Publication 1220 to send magnetic media to Michigan.

Certain income record forms filed through the FIRE System will be automatically shared with Michigan through the CF/SF Program. The exception to this general rule is Form 1099-NEC. While Form 1099-NEC is included in the CF/SF Program beginning tax year 2021, Michigan requires the state copy be filed directly with Treasury. Taxpayers and service providers wishing to take advantage of this program must apply with the IRS.

Also Check: How Much Will I Get Back In Taxes 2021

Instructions For Form 1099

Future Developments

For the latest information about developments related to Form 1099-B and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1099B.

Reminders

In addition to these specific instructions, you should also use the 2021 General Instructions for Certain Information Returns. Those general instructions include information about the following topics.

-

When and where to file.

-

Electronic reporting.

-

The definitions of terms applicable for chapter 4 purposes that are referenced in these instructions.

-

Other general topics.

You can get the general instructions from General Instructions for Certain Information Returns at IRS.gov/1099GeneralInstructions or go to IRS.gov/Form1099B.

Online fillable copies.

To ease statement furnishing requirements, Copies B, C, 1, and 2 are fillable online in a PDF format available at IRS.gov/Form1099B. You can complete these copies online for furnishing statements to recipients and for retaining in your own files.

Irs Form 8949 Explained

Beginning with the 2011 tax year, the IRS requires most active traders and investors who file a Schedule D to report their detailed trade history on Form 8949 – Sales and Other Dispositions of Capital Assets. This new form replaces the Schedule D-1 used prior to tax year 2011. The IRS Schedule D was also redesigned in order to coexist with Form 8949.

Read Also: Do I Need Previous Year’s Tax Return To File

How Do I Attach Multiple 1099b Pdfs To A 1041 Return

“How do I attach multiple 1099B pdfs to a 1041 return”

That function is not officially supported by TurboTax Business.

However, if you have PDF software capable of inserting pages into an existing PDF, then you should be able to insert the multiple 1099B PDFs into the Form 8453-FE file and upload that new file to TurboTax Business as an attachment.

Am I Required To Send Income Statements To Michigan Electronically

It depends. Issuers with 250 or more income record forms must use Michigan Treasury Online to send a magnetic media formatted file electronically. Issuers with fewer than 250 income record forms, may utilize any filing option listed in Treasury’s Income Record Form Remittance Guide.

Business taxpayers, issuers, and service providers are encouraged to send state copies of W-2s and 1099s to Treasury electronically whenever possible.

You May Like: Where Do You Go To File Taxes

Red Flag #: Claiming Unsupported Deductions

The IRS keeps a careful eye on certain tax deductions in order to discourage abuse, particularly if the deduction is especially large or unusual, such as a big donation to a charity. Be sure to keep meticulous records to support the deductions on your tax return, and for charitable donations, verify that the government recognizes any organization that you donate to as a tax-exempt entity. You can confirm an organization’s tax status with the IRS’s “Exempt Organizations Select Check” tool.

Tracking Down The Data

The easiest way to get this missing data is to call the employer, bank or investment company and ask for your income information over the phone. Most companies also allow you to check your accounts and tax documents online. And in some cases, the amounts that would be on a 1099 are readily available from documents you already have.

For example, your bank may put a summary of the interest paid during the year on your accounts December or January statement. Many financial companies make the interest figure available through customer service phone lines or websites. And most investment firms include the years Form 1099 cumulative amounts as part of quarterly dividend statements.

If your missing 1099 does finally show up, dont discard it because you got the information elsewhere and already filed your return. Check the form to ensure the amount it contains is the same as what you reported. If there is any discrepancy, call the issuer to reconcile the differences.

When the late-arriving data are correct and what you filed is not, youll need to file an amended return Form 1040X. If you dont, expect to hear from the IRS, usually by mailed notice, because the agency will use the final 1099 as its basis for reviewing your return for accuracy.

Recommended Reading: Is My Ira Contribution Tax Deductible

Is My Loss Limited Can I Carry My Loss Forward

Total Losses are limited to a $3,000 Capital Loss per year. Any Carryover amount will be automatically calculated and reported on the Capital Loss worksheet. You may use the loss carryover amount on your next years return. In the next year go to:

- Federal Section

- Capital Gain and Losses Schedule D

- Other Capital Gains Data

Can I Import 1099

You can securely import your 1099-B, 1099-DIV, 1099-INT, 1099-OID, or 1099-R into TurboTax if your broker or financial institution is on our list of TurboTax Import Partners. If they’re not, you can upload your form from your computer or type it in yourself. … Sign in to TurboTax and open or continue your return.

Recommended Reading: What Is The Sales Tax In Georgia

Worksheet For Basis Adjustments In Column

If the basis shown on Form 1099-B isn’t correct, do the following.

|

| 1. |

Basic Layout Of The Irs Schedule D

The first step to biting into the Schedule D form is to understand how it is laid out. The 1040 Schedule D form is laid out in three parts:

- Part I – Short-Term Capital Gains and Losses – Assets Held One Year or Less

- Part II – Long-Term Capital Gains and Losses – Assets Held More Than One Year

- Part III – Summary

The holding period of the trade is what determines whether it is long or short term. Anything held one year or less is considered short term, and anything held for more than one year is considered long term. Therefore one of the primary functions required in completing Schedule D is to determine whether each trade is long or short term.

The first two parts of the Schedule D are essentially identical when it comes to listing your trade activity for the current tax year.

Lines 1 through 3 and lines 8 through 10 segregate amounts based on Form 8949 classifications: Box A, Box B, and Box C for short-term Box D, Box E, and Box F for long-term. Those classifications will be explained later in this guide.

New for 2013: The IRS has created lines 1a and 8a for 1040 Schedule D. These lines allow a taxpayer to simply enter totals from their broker-provided 1099-B for covered securities. However, this is only used if there are no adjustments required. Most active traders and investors do require adjustments to 1099-B reported amounts for a number of reasons which we outline in our special report The 1099-B Problem.

Within each part there are four columns as shown below:

Don’t Miss: Can You Pay Estimated Taxes Online