How To Report Tax Fraud Anonymously

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.There are 15 references cited in this article, which can be found at the bottom of the page. This article has been viewed 51,811 times.

Tax fraud may seem like a harmless game that people and businesses play with the government. In reality, it is a serious issue and, depending on the circumstances, may be a crime. Tax fraud also costs everyone money through higher taxes or reduced services. You may want to make a report, but don’t want to identify yourself for fear of reprisal. Because of these concerns, all taxing jurisdictions will accept anonymous reports and investigate your complaints.

Next Steps To Report Someone To The Irs If You Cant Do It On Your Own

In a case where you can’t report someone to the IRS on your own, you can find someone to do it on your behalf. Government agencies provide consumer protection divisions mandated to help you with the reporting process.

If you aren’t sure how to go about this, you can visit the IRS Identity Theft Resource Center to find help. You can also call 1-800-366-4484 , and you’ll remain anonymous.

The process can be long and exhausting when you choose to do it on your own. However, DoNotPay has your back. Its new tax fraud product allows you to report someone to IRS for not paying taxes with one tap of a button.

Can I Get In Trouble If I Dont Report Fraud

If you are aware of fraudulent activities but decide not to report to the government, you may not get in trouble. However, if you are supporting the criminal act and participating in it in any way, you may get in trouble.

It is always advised to take action and report fraud as soon as possible to protect yourself and others. This is one reason why it is important to learn how to report someone for tax fraud.

Recommended Reading: When Did I Last File Taxes

How To Make A Report

Fill in the online form to tell HMRC what you know about the person or business.

You do not have to give your name or contact details unless you want to. Any information you give will be kept private and confidential.

Do not send supporting information. You can tell HMRC if you have any when you make your report. HMRC will only ask for more information if needed, as long as youve given your contact details.

For your own safety you should not try to find out more or let anyone know youre making a report.

How To Recognize Tax Evasion And Fraud

Tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. Tax evasion and fraud may look like:

- failing to file a return,

- failing to report total income,

- failing to remit monies collected, and

- selling untaxed liquor, motor fuel, and cigarettes.

Note: If you believe you are the victim of identity theft, please see Identity theft affecting your tax records.

Also Check: How Much Of Social Security Income Is Taxed

How To Report A Tax Cheat

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Every year, you save your receipts, track your expenses andwhen April comes aroundpay your taxes. But what if you know of someone who isn’t as honest as you are? Someone who skims on their income or misreports information in order to be placed in a lower bracket.

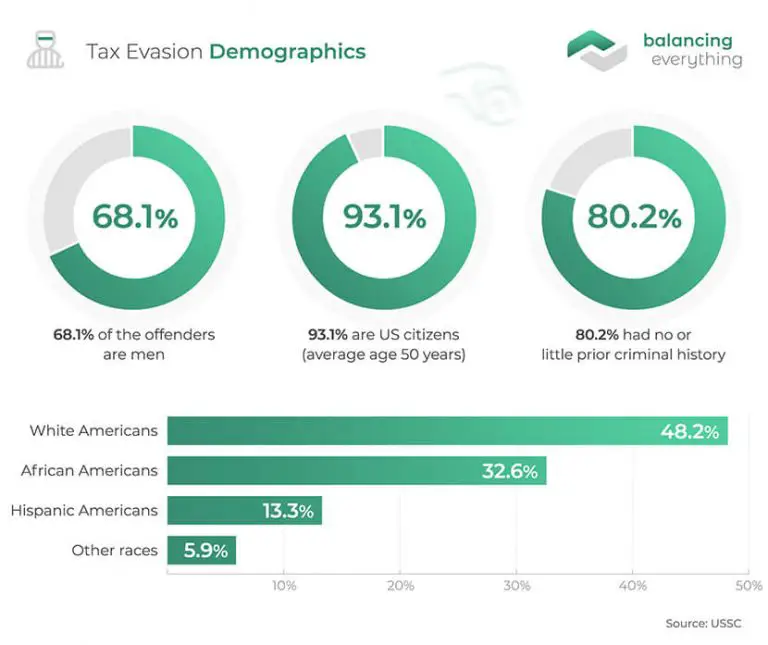

The Internal Revenue Service estimates that Americans underpay their taxes by about $441 billion every year. Enforcement efforts lead to the recovery of about $60 billion. This process requires the employment of thousands of revenue officers, agents and special agents. Unfortunately, this type of enforcement happens every year and often spans to multiple previous years. In the end, there is still a large amount of $381 billion in tax money that goes unpaid.

There’s definitely a gap between the tax evader and the IRS. Evaders are usually exposed due to a slip-up on their part or a tip from a bystander. If you’d like to help close that gap, you can. But why should you, and how is it done?

Report Suspected Tax Fraud Activity

At the California Department of Tax and Fee Administration we have an Investigations team whose job it is to identify tax evasion problems, identify new fraud schemes, and actively investigate and assist in the prosecution of crimes committed by individuals who are violating the laws administered by the Department. Tax fraud hurts everyone, so help us help you.

Don’t Miss: What Is Child Tax Credit And How Does It Work

Can I Use The Irs Fraud Hotline To Report Someone

Despite what its name might imply, you cant actually file a report through the IRS fraud hotline. Instead, the hotline is an automated system that guides you toward the correct type of form to use for reporting a possible violation.

When you call the hotline, youll get a recording that tells you

- How you can submit a fraud report

- How to download a reporting form from IRS.gov, the IRS website

- How to order the form over the phone, using the hotline

- How to send a letter

Why Use Donotpay To Report Tax Fraud

Often people find it hard to report tax fraud on their own. If you are one such person, then DoNotPay is here for you.

Don’t Miss: What Is The Tax Rate For Federal Income Tax

Suspect Tax Fraud: Here’s How To Report Tax Fraud

Tax fraud negatively impacts the average citizen. It is against the law and takes money away from the government, police, and firefighters. Roadways, libraries, and parks may also suffer because someone, usually a business, evades paying their IRS obligations.

If you suspect that someone is being dishonest with the government, you must take a little time to file a tax fraud report. This article offers detailed information on how to report tax fraud.

Promoters Of Abusive Tax Schemes Or Preparers Of Fraudulent Returns

Common abusive tax scams include anti-tax law, home-based business, trust, and off-shore schemes.

To report promoters of these scheme types or any other types you are aware of that are not listed here, please send a completed referral formPDF, along with any promotional materials to the Lead Development Center:

Mail:

Recommended Reading: Can We File Taxes Now

Report Scams To Third Parties

You may want to report the scam to organizations outside of the government. Third parties may be able to get your money back or remove fraudulent charges.

Report a scam that happened with an online seller or a payment transfer system to the companys fraud department.

If you used your credit card or bank account to pay a scammer, report it to the card issuer or bank. Also report scams to the major credit reporting agencies. Place a fraud alert on your credit report to prevent someone from opening credit accounts in your name.

How To Turn Someone In To The Irs

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 350,568 times.

Some American taxpayers find themselves in the uncomfortable position of witnessing another persons tax evasion and fraud. The Internal Revenue Service welcomes whistleblowers. You can choose to report anonymously, or you can provide your name. The IRS also has a program that allows you to report tax fraud for a financial reward.

Read Also: What Address Do I Mail My Tax Return To

What Are Other Ways To Report Suspected Fraud

Of course, if you dont want to call the fraud hotline, you dont have to. The IRS website provides the forms you need to report different types of fraud.

Heres a quick guide to some of the forms that apply to each potential tax fraud situation. You can mail or fax these forms to the IRS.

- To report a business or individual, mail or fax Form 3949-A. Or, if you dont want to use the form, you can send a letter with details of the alleged violation. You dont have to identify yourself, although the IRS says its helpful if you do and that it will keep your identity confidential.

- To report a tax preparer whom you suspect of fraud, or an abusive tax scheme by a tax return preparer or tax preparation company, mail Form 14157.

- If you suspect a tax return preparer didnt file a return when they said they did, or changed your return without your approval and you want the IRS to update your tax account, use Form 14157-A and mail it along with Form 14157.

- To report someone you suspect is promoting or engaging in an abusive tax-avoidance scheme, mail or fax Form 14242.

- If you suspect a tax-exempt organization such as a church, charity or trade association isnt following tax laws, you can mail, fax or email Form 13909.

Each form comes with instructions that list the kinds of violations the form covers and information on where to mail or fax the form. Be sure to read the instructions to verify the form applies to your situation.

How To Report Tax Fraud Using Donotpay

If you want to report tax fraud but don’t know where to start, DoNotPay has you covered. Create your own cancellation letter in 5 easy steps:

You May Like: How To Pay Taxes On Etsy Sales

How Can You Report Someone For Lying About Their Taxes With The Help Of Donotpay

If you want to report tax fraud but don’t know where to start, DoNotPay has you covered. Create your own cancellation letter in 5 easy steps:

How To Report Tax Fraud To The Franchise Tax Board

Thanks to Hollywood, there is the common misconception that tax fraud only happens among those who have large sums of money. However, nothing could be further from the truth. Tax fraud occurs among all income classes and businesses of all sizes. It occurs more often than people realize, and the chances of you knowing someone who has committed tax fraud is high. The good news is there is something you can do about it. Report tax fraud to the tax board and protect the interests of everyone.

The problem is that tax fraud affects everyone. When individuals and companies do not pay their share of taxes, the burden falls on the shoulders of average Americans. This is your guide on how to report someone who owes money to the franchise tax board and how DoNotPay can make this process faster and easier.

Read Also: How To Find Out How Much You Owe On Taxes

What Is Tax Fraud

Tax fraud is a broad term that encompasses intentionally avoiding paying taxes by failing to report accurate income. There are several different ways this can happen. Tax fraud can be committed by an individual, small business, corporations, non-profit organizations, and more. The goal of a taxpayer committing tax fraud is to avoid paying what they owe in taxes. If found out, the consequences are very serious and can include:

Reporting suspected tax fraud is a civic duty that benefits all citizens at both the federal and state level. At the state level in California, suspected fraud activity should be reported to the Franchise Tax Board.

What Is The Franchise Tax Board

Also known as the FTB, the Franchise Tax Board is the organization that is responsible for enforcing income tax collection and assessment. It is the state tax agency that operates under the California Government Operations Agency. Duties of the FTB include:

The FTB is comprised of the following key players:

You May Like: How Do You Avoid Capital Gains Tax

Why You Should Report Tax Fraud

The first thing you must understand before filing IRS fraud report forms is that there are many types of fraud. Some may be worth reporting, while others could boil down to simple human error. The IRS says that some of the most common ways that people and businesses commit tax fraud are:

Reporting Other Information To The Irs

If you have information about tax noncompliance but are not interested in an award, or you have other information you believe may be of interest to the IRS:

- For information on how to Report Suspected Tax Fraud Activity, if you have information about an individual or company you suspect is not complying with the tax law, and you do not want to seek an award. You can remain anonymous.

- The IRS sets professional standards for attorneys, certified public accountants and enrolled agents who represent taxpayers before the IRS. To learn more about those professional standards, or how to report a violation, see Office of Professional Responsibility At-A-Glance and Circular 230PDF Violations.

- Report Fraud, Waste and Abuse to Treasury Inspector General for Tax Administration , if you want to report, confidentially, misconduct, waste, fraud, or abuse by an IRS employee or a Tax Professional, you can call 1-800-366-4484 . You can remain anonymous.

Read Also: How Much Taxes Does Illinois Take Out Of Paycheck

Can I Remain Anonymous

If youre worried about repercussions for reporting suspected tax cheating, or just prefer not to have your name attached to any information you submit, thats generally fine.

Some of the tax fraud forms have a section for you to include your personal information so that the IRS can contact you for further information . But its not always necessary to fill out this section, so check the instructions for the form to be sure. On some forms, like the information referral form for tax fraud , the IRS says that any personal information you provide wont be shared with the person or business youre reporting.

But there may be exceptions in certain situations. For example, if youre reporting a tax professional for suspected activity around your tax refund, the IRS may need your information to process your report and may even need to share certain information with your bank.

Can I Get In Trouble If Im Wrong And There Is No Fraud

If you have reported a tax fraud and then realized that you were mistaken wont get you in trouble as long as you inform the government about your mistake and prove otherwise.

Its crucial to always gather enough evidence before reporting fraud to avoid wasting your time, the alleged suspects time, and the governments time and resources.

You May Like: How Do I Paper File My Taxes

Irs Fraud Reporting How To Do It

Tax fraud happens when someone provides false tax information. When people and corporations dont pay what they owe, the burden falls unfairly on everyone else. Before the government can prosecute anyone for tax fraud, it has to have proof. Thats often hard to obtain. Thats why the government relies on its citizens to help by reporting any known or suspected tax fraud.

How To Report Fraud To Irs On Your Own

If you know someone who is committing tax fraud, then report them to the IRS. You can even file an anonymous complaint against them. The IRS treats all tax evasion complaints seriously and tries to check the veracity of each complaint.

You should give as much information about the evader for the IRS to investigate them. Make sure that you include the following information:

- Taxpayer’s or Business’ Name and address

- Social Security Number or Employer Identification Number

- Description of the taxpayer’s business

- The type of tax return filed for each year

- An estimate on how much you think the evader owes in back taxes

- Any evidence including but not limited to W-2s, 1099s, bank records, etc.

Use Form 3949-A to lodge a report to the IRS. You cannot report fraud to the IRS over the phone. After you file the complaint with the IRS, they will take necessary action to investigate and collect back taxes from the evader, making life difficult for them. You should report any such malpractices to check tax evaders and bring back lost money into the economy.

You May Like: When Will I Get My Taxes 2021