How To Check When You Will Receive Your Tax Return

IRS2Go is the official mobile app of the IRS, which you can use to check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips and more. The app is available in Spanish and English, and you can download it from Google Play, the Apple App Store or Amazon.

You can also use the Wheres My Refund tool on the IRS website. To check your refund status, you will need your social security number or ITIN, your filing status and the exact refund amount you are expecting.

The IRS updates the tools refund status on a daily basis, usually overnight, so check back in routinely for the most up-to-date information.

If its been more than 21 days since you e-filed your federal tax return, you should you call the agency directly.

If you havent filed your taxes for the 2021 tax year yet, consider going with a tax prep software that offers expert tax assistance. Speaking with a tax-prep expert may help ensure that your return is accurate, which can help facilitate a timely return.

Here are Selects top picks for best tax filing software:

- Best overall tax software: TurboTax

Recommended Reading: How To Report Tax Fraud To The Irs

Why Havent I Gotten My Refund Yet

There are numerous reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. Here are the most common.

- Your return had errors or was incomplete

- You owe the IRS money

- Your bank account info was incorrect

- You filed a paper return

- You didnt properly enter your stimulus payments

- The IRS suspects identity theft

- You filed an amended return

- Your return needs further review

In testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that, in 2021, the agency received far more than 10 million returns in which taxpayers failed to properly reconcile their stimulus payments with their recovery rebate credit, which required a manual review and resolution.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If theres a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

If youve requested a paper check for your tax refund, thatll take longer, too about six to eight weeks, according to the IRS.

After Viewing Their Information A Taxpayer Can:

- Select an electronic payment option.

- Set up an online payment agreement.

- Go directly to Get Transcript.

Taxpayers balance will update no more than once every 24 hours, usually overnight. Taxpayers should also allow 1 to 3 weeks for payments to show up in the payment history.

To access their information online, taxpayers must register through Secure Access. This is the agencys two-factor authentication process that protects personal info. Taxpayers can review the Secure Access page process prior to starting registration.

Taxpayers can also visit IRS.gov to use many other self-service tools and helpful resources. These include Wheres My Refund? and the IRS2Go app. These are the best ways for taxpayers to check the status of their tax refund. These tools are updated no more than once a day, so taxpayers dont need to check more often.

Also Check: How Much Income To File Taxes

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If youre expecting a tax refund and want it quickly, file electronically instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and havent received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesnt correspond with the amount we have on file.

Check cashing services

Also Check: How Do I Track My Taxes

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Recommended Reading: Are Donations To St Jude Tax Deductible

How Can I Check To See If I Missed A Year Filing Taxes

Contacting the IRS is the only way to know the accurate answer to that question since all returns would go through them no matter how they may have been filed.

You can request transcripts of your prior year returns or call the IRS directly to ask. Use 1-800-829-1040 to call the IRS. Use the following link to get started ordering a transcript of prior year returns: IRS Get Transcript

Be aware that tax return transcripts are only available for the current year return and the previous three years .

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

You May Like: Which States Are Tax Free

Stage : Refund Approved

This means the IRS has processed and approved your return. This usually happens about three weeks after the IRS indicates theyâve received your return.

Once the IRS processes your return, youâll see an estimated date for when the money will be deposited into your bank account, like so:

If you donât receive your refund by the date mentioned on this page, the IRS suggests contacting your bank first, to make sure there arenât any problems with your account.

Recommended Reading: Do 16 Year Olds Have To File Taxes

The Tool Displays Progress In Three Phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their financial institution to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Recommended Reading: Why Are My Taxes Taking So Long

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property

What Is The Phone Number For The Irs

Phone support from the IRS is currently very limited. If you have questions about payments that affect the economy, call 8009199835. Where is my refund? Are you waiting for a refund? The IRS gives more than 9 out of 10 refunds in less than 21 days. 4 weeks after sending the paper declaration. Where is my refund? They invite you to contact us.

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

The most convenient way to check on a tax refund is by using the Where’s My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Recommended Reading: Can I File My Taxes Online Now

Irs Timeline For Paper Returns

Representatives manually review each paper tax return for errors. They correct those that can be easily fixed and forward them to the refund processing center. Payment is remitted based on the method the taxpayer selected on their return. A paper check must be printed and mailed via the postal system if you don’t request direct deposit. Transferring the funds electronically is a much quicker process.

Read More:How Long Does It Take to Get Tax Refunds From Electronic Filing?

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

You May Like: How Do You File Back Taxes

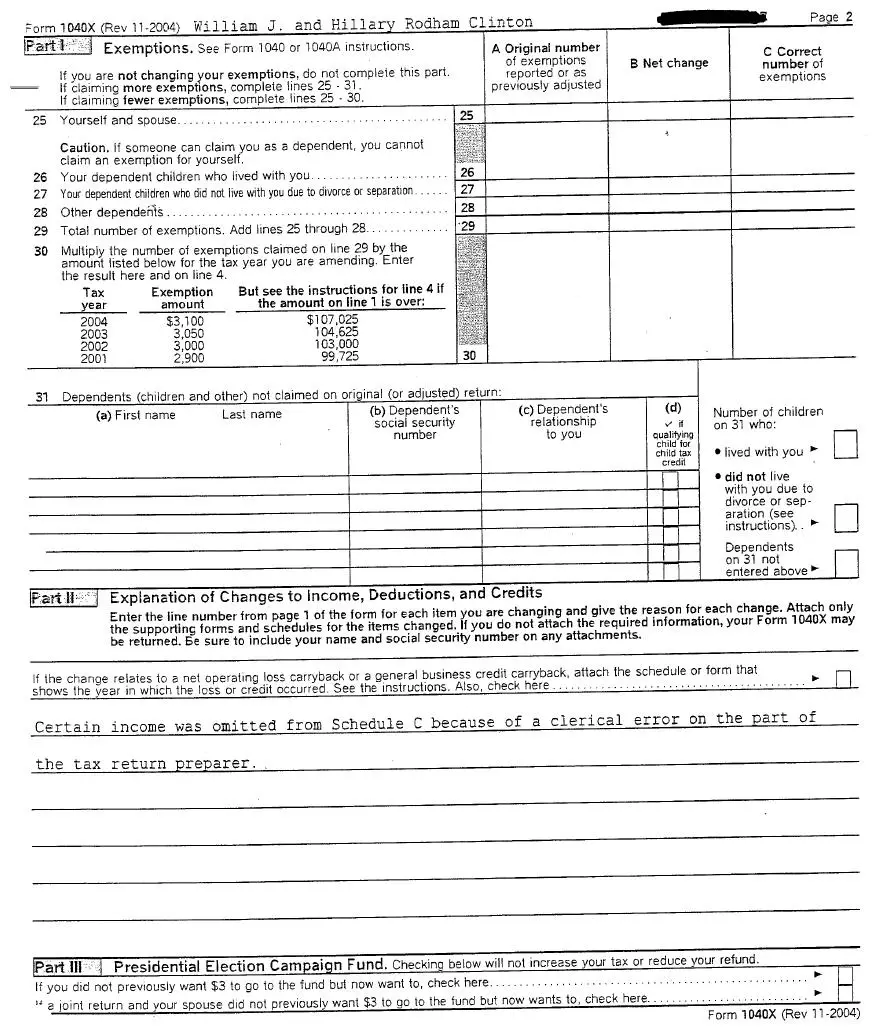

Will The Irs Contact You If Your Taxes Are Wrong

Remember that the IRS will catch many errors itself For example, if the mistake you realize you’ve made has to do with math, it’s no big deal: The IRS will catch and automatically fix simple addition or subtraction errors. And if you forgot to send in a document, the IRS will usually reach out in writing to request it.

Can I Call The Irs If Im Waiting On My Refund

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Heres the best number to call: 1-800-829-1040.

Read Also: Federal Small Business Tax Rate

You May Like: When Do I Have To Do Taxes

I Just Filed My Return How Do I Check My Tax Refund Status

You can check your tax refund status online using the IRSâs handy Whereâs My Refund? tool.

Youâll need three pieces of information to login to the tool:

Your Social Security number or Taxpayer Identification Number

Your filing statusâ”Single,â “Married Filing Joint Return,â âMarried Filing Separate Return,â âHead of Household,â or âQualifying Widowâ

Your exact refund amount

Hereâs what the login page for the Whereâs My Refund? tool looks like before you login:

What Do These Irs Tax Return Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if youre owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Read Also: How To Pay My Federal Income Taxes Online

Got More Tax Refund Questions We Have Answers

One way is to qualify for more tax deductions and tax credits. They can be huge money-savers if you know what they are, how they work and how to pursue them. Heres a list of 20 popular ones to get you started.

But beware of big tax refunds. Theyre a direct result of overpaying your taxes all year, and that often happens because youre having too much tax withheld from your paychecks. Get that money in your hands now by adjusting your Form W-4 at work. Heres how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Heres how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Heres how to do it. Note that youll need to have an IRA account first. Heres how to do that, too.

If youre behind on your taxes, the IRS will withhold what you owe from your federal tax refund. Youll get a letter from the IRS explaining what it adjusted.

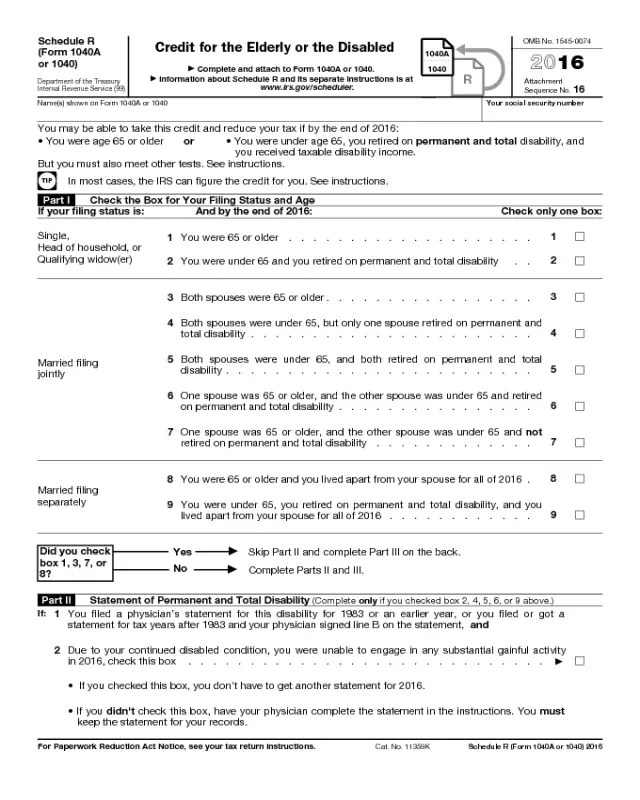

You can fix it by filing an amended tax return using IRS Form 1040X. Heres how to do it.

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

Recommended Reading: Is Roth 401k Pre Tax

Refund Delays Due To Fraud

Fraudulent activity connected with your Social Security number can also cause a delay in processing. You likely wont even be aware of this until you file.

Fraudulent tax activity occurs when someone uses your Social Security number to file a return and get a refund. The agency will know that something is afoot when you try to file your own return and they already have one filed on your behalf.

Read More:What Happens If You Don’t File Taxes?

How To Check If Your Return Was Filed

Bookmark the IRS Refund Status page when you’ve filed your tax return. It can be found at irs.gov/refunds. Youll also see a link to the refund page on the main IRS site.

Provide your Social Security number, your filing status and the exact amount of the refund youre expecting to check your refund status. The site should have information about your return 24 hours after you submit it electronically. The information updates every 24 hours, usually overnight. You probably wont see any data on the IRS Refund Status page for at least four weeks if you mail in a paper return.

The IRS updated taxpayers by phone on refund status before it set up this status page. You can still call the IRS for these updates, but the most current information is provided on the refund status page. The agency continues to experience delays with live phone support during the ongoing COVID-19 pandemic.

The IRS recommends calling only if it’s been 21 days or more since you e-filed or six weeks or more since you mailed in your return unless the IRS Refund Status page tells you that you should contact the IRS. Otherwise, the website is the best resource.

Read More:The Federal Gift Tax and Holiday Giving

Read Also: How To Find Tax Id