If You Get A Reference Code On Your Wmr

If you check Where’s My Refund and see you have a reference code, you should identify the code and see if any action is required.

In many cases, no action is required on your part. One of the most common codes is 9001, which, as you can see, just means you accessed WMR using a different SSN or TIN. Once the IRS analyzes to ensure no fraud has taken place, you will get your return like normal.

If there is an issue, the IRS will typically send you a letter to your mailing address within 90 days stating what the issue was, and any additional information required.

If you have any questions, you can contact the IRS directly at 800-829-1040.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

When Can I File My Tax Return

The first official day to file your 2020 tax return is February 12, 2021. However, many tax software programs will allow you to complete your return and file it before that date. They will then hold the returns until the IRS begins accepting them. Some taxpayers who submit their electronic tax return early may be able to participate in the IRS HUB Testing program. This is a controlled testing of the federal tax return system. The IRS processes a small percentage of tax returns from major software providers to test the tax return submission process and allow for fixing bugs before opening the doors to all taxpayers.

Recommended Reading: Tax Deductions Doordash

Why Does It Happen

Imagine you own a business but your customers can only pay once every quarter and some of them do not even pay on time. This may hinder budgeting, expansion or worse, failure to operate.

This is the same with the BIR. Most taxpayers are required to pay their taxes quarterly or even yearly. There are also instances that some taxpayers evade paying taxes by under-declaring sales or not filing at all. This is why the BIR created a withholding tax system, a system to allow taxpayers to pay in advance.

But what does this have to do with refunds? The withholding tax system works by estimating your annual income. Of course, as much as we want to have more earnings, there are times that our forecasts are wrong and the actual sales are lower, resulting in tax refunds because you paid more than you owe the government.

Refund Schedule: How Long Do I Have To Wait Until I Get My Tax Refund

Weve based these timelines on historical data noting that most refunds will be issued by the IRS in less than 21 days after the return has been accepted. Certain things can affect the timing of your refund, including:

- How you sent your return Sending your return electronically allows the IRS to process it faster than if you mail it in.

- When you filed The earlier you file, the earlier your return could be processed.

- Which credits you claimed Claiming certain credits can cause your refund to be delayed .

Don’t Miss: Tsc-ind Ct

How To Get A Faster Tax Refund

Here are four things that can help keep your “Where’s my refund” worries under control.

Avoid filing your tax return on paper. It’s a myth that your IRS refund status will be “pending” for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering “where’s my refund?” by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Don’t let things go too long. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

But The Irs Told Me To Wait 6 Or 9 Weeks Is That True

No. If you had no issue with your account, you don’t have to wait 6 weeks or 9 weeks. Even if you get an Error Code 9001, you don’t have to wait.

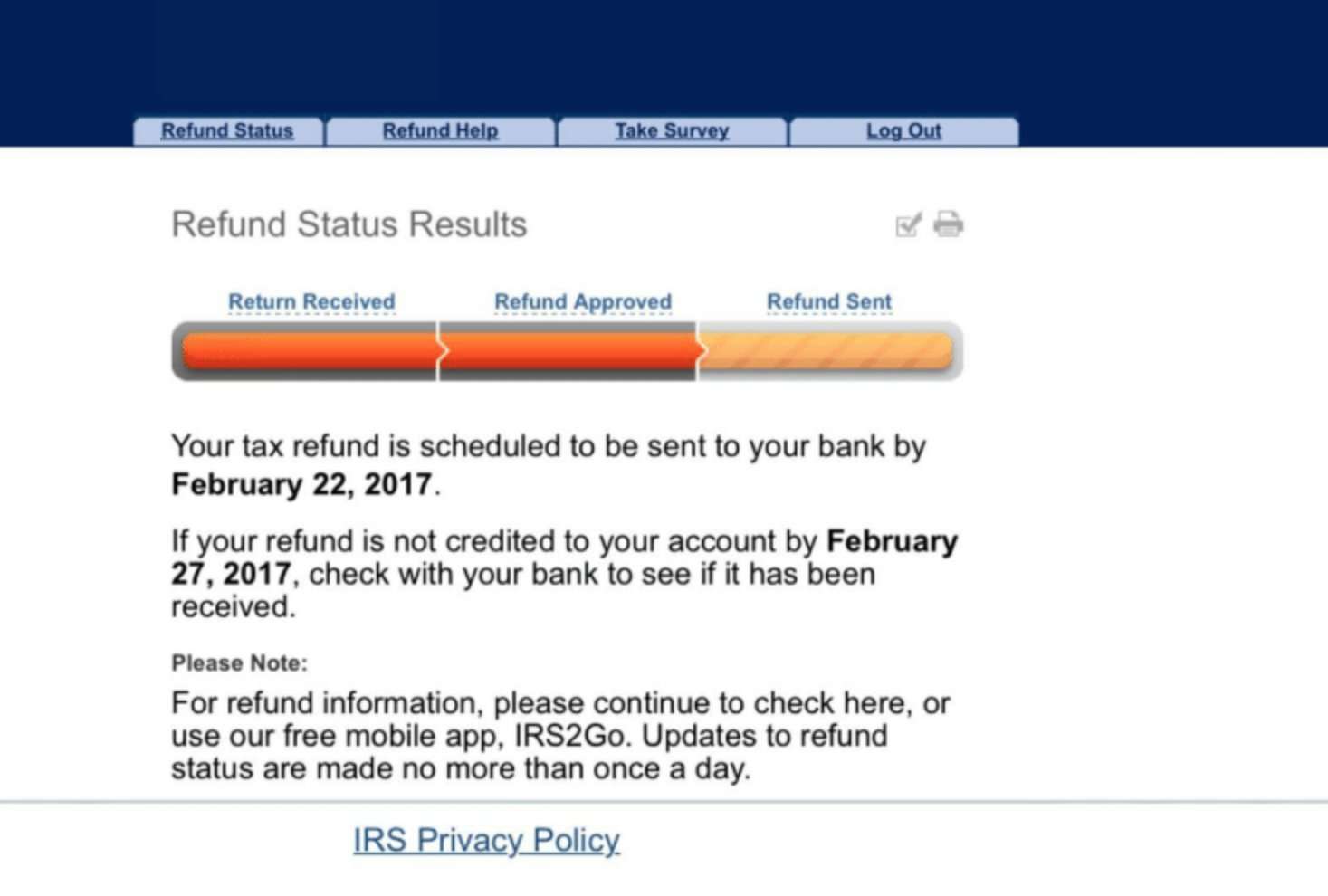

Don’t believe me? Well first, here’s a screenshot from one of our readers who got the 9001 error on 2/5, and now has a direct deposit date:

Second, still don’t believe me? Why would these IRS agents tell me that I need to wait? Because that’s what the operations manual tells them to do.

We went digging because a lot of people were talking about it, and here’s why they tell you this :

If the return was received, but not processed, one of the following will happen:

That sounds scary, but what does each of them mean?

So where did the 9 weeks come from? We couldn’t find it anywhere, but we think that it has to do with reps really trying to advice you NOT to call, because you don’t have to!

Don’t Miss: Is Freetaxusa Legitimate

For Taxpayers Who Have Yet To File

The extended May 17, 2021, deadline to submit your 2020 tax return is really just around the corner.

If you’ve procrastinated, we have a few tips for you:

-

$0 to $290 federal, $0 to $55 per state

-

Free version

What If I Miss The Deadline

Taxes are due on Monday, April 18, 2022. If you file your return after the deadline, you could be charged late filing fees and other penalties. The good news is, if you need more time to file you can request an extension with the IRS. It is important to note that an extension does not give you more time to pay your taxes. It only gives you more time to file your return. In other words, if you owe money on your taxes, your payment is still due by April 18th. If you request an extension, will have six more months to send your return to the IRS. The deadline to submit extensions for tax year 2021 is October 17, 2022.

Read Also: Square Dashboard 1099

What Is Income Tax Refund

Income tax refund means a refund amount that is initiated by the income tax department if the amount paid in taxes exceeds the actual amount due and is known as an income tax refund. The tax is calculated after taking into consideration all the deductions and exemptions at the time of filing of Income Tax Return.

Factors That Can Affect Timing

Your tax refund may be delayed for several reasons, including if your return is incomplete, includes errors, was affected by fraud or identity theft, or requires further review.

There are also specific items that can hold up your refund. For example, tax returns that include Form 8379: Injured Spouse Allocation may take up to 14 weeks to process.

If you claim certain tax credits, the earliest you will receive your tax refund is the first week of March. Under the Protecting Americans from Tax Hikes Act, the IRS is prohibited from issuing refunds before mid-February for taxpayers who claim the EITC or the Additional Child Tax Credit .

Read Also: How To Do Taxes For Doordash

Irs Refund Schedule For Direct Deposits And Check Refunds

The following tax refund table is based on previous refund tables released by the IRS to help taxpayers know when they should receive their tax refund. The IRS moved to the Modernized E-file System in 2013 . The IRS only issued refunds once per week under the old system. They now issue refunds every business day, Monday through Friday .

Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years. The following chart is based on IRS statements, published guidelines, and estimates from past years. This IRS refund schedule should only be used as a rough guideline.

Tips For Making The Most Of Your Refund

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you do not have any pressing debts to pay off, you may want to put your refund right into the bank. In that case, look for a high-interest savings account. Getting the highest interest rate possible will make your money work for you.

- Another way to use your refund is by putting it toward retirement. That may not sound very fun but its important to ensure you can live your golden years doing whatever you want to do.

Don’t Miss: Louisiana Paycheck Tax Calculator

How Long Will I Have To Wait For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Why Do Paper Returns Take So Long

Paper returns have to be input manually into the system for processing. Even when the IRS isn’t understaffed in the middle of a pandemic, the process normally takes six to eight weeks.

“Submitting a paper return circumvents the limited automation that the IRS has in place for cross-referencing returns with information received from third parties,” says Richard Lavinia, CEO and co-founder of Taxfyle. “Paper returns require this information to be inputted by hand and then manually reviewed by an IRS agent.”

Also Check: License To Do Taxes

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15.

Advance Child Tax Credit Payments In 2021

Important changes to the Child Tax Credit are helping many families get advance payments of the credit:

- Half the total credit amount is being paid in advance monthly payments. See the payment date schedule.

- You claim the other half when you file your 2021 income tax return.

Advance payments are sent automatically to eligible people. You do not need to take any action if we have your tax information.

Also Check: Efstatus.taxact.com Login

Are You Sure I Had To Verify My Id

I keep getting tons and tons of questions about ID verification, so I tracked down the IRS Operational Guidelines, and here is what the IRS is going to do whenever you call and inquire about your tax refund. This is straight from the IRS operational manual:

For purposes of identification and to prevent unauthorized disclosures of tax information, you must know with whom you are speaking, complete name and title and the purpose of the call/contact. It may be necessary to ask the caller or visitor if he or she is an individual taxpayer , a business taxpayer , or an authorized third party.

Inadequate authentication of the identity of a caller could result in an “unauthorized disclosure” of return or return information. If an IRS employee makes a knowing or negligent unauthorized disclosure, the United States may be liable for damages. See IRC section 7213, IRC section 7213A , and IRC section 7431. If an IRS employee makes a voluntary, intentional disclosure, the employee may be subject to criminal penalties including a fine, imprisonment, and loss of employment.

Required authentication probes:

So what does that all mean? It means that you have to verify your identity whenever you contact the IRS! So stop worrying about it or thinking that it had anything to do with your return.

When & How To Apply For Refund Reissue

First verify your Income Tax Return, then track the status of your income tax refund with the department. In case, you have still not received your refund then one of the reasons for the ITR refund delay could be due to a problem in your bank account or address details.

In such a situation, you can make a refund reissue request to the Income Tax Department but only after receiving an “Intimation”

Simple steps to apply for Refund Reissue:

- Step 1: Go to

- Step 2: Log in with your PAN card details and password.

- Step 3: After logging in, you will see a dashboard

- Step 4: Click on the pending action tab and refund reissue

- Step 5: When you click on refund reissue, you will see a window with a tab refund reissue.

- Step 6: Once you select the Refund Reissue tab visible on your screen, you will be redirected to the refund reissue page where you need to create a refund reissue request.

- Step-7: Select the bank account in which you want your refund and click proceed to move to the verification stage.

- Step 8: For successful submission of Refund Reissue request, users must have EVC. (Users must authenticate the refund reissue request through Aadhaar OTP & EVC code.

- Step-9: Click on the submit Button

Once all these steps are done successfully, you can then check the refund status on the dashboard.

You May Like: Efstatus.taxact.xom

Financial Help During Covid

Your refund will be automatic if your income is from:

- employment

- investments

- an employee share-scheme benefit where tax is already deducted

- schedular payments

- New Zealand superannuation .

If youre self-employed or get income from somewhere not listed above, you need to:

Log in to Inland Revenue to see if you have a refund.

While youre there:

- check your contact information is correct

- nominate a bank account where IR can deposit your refund.