Federal Income Tax Deadline In 2022

After the COVID-19 pandemic pushed back the filing deadline for federal income taxes two years in a row, taxes for the 2021 tax year will once again be due in April.

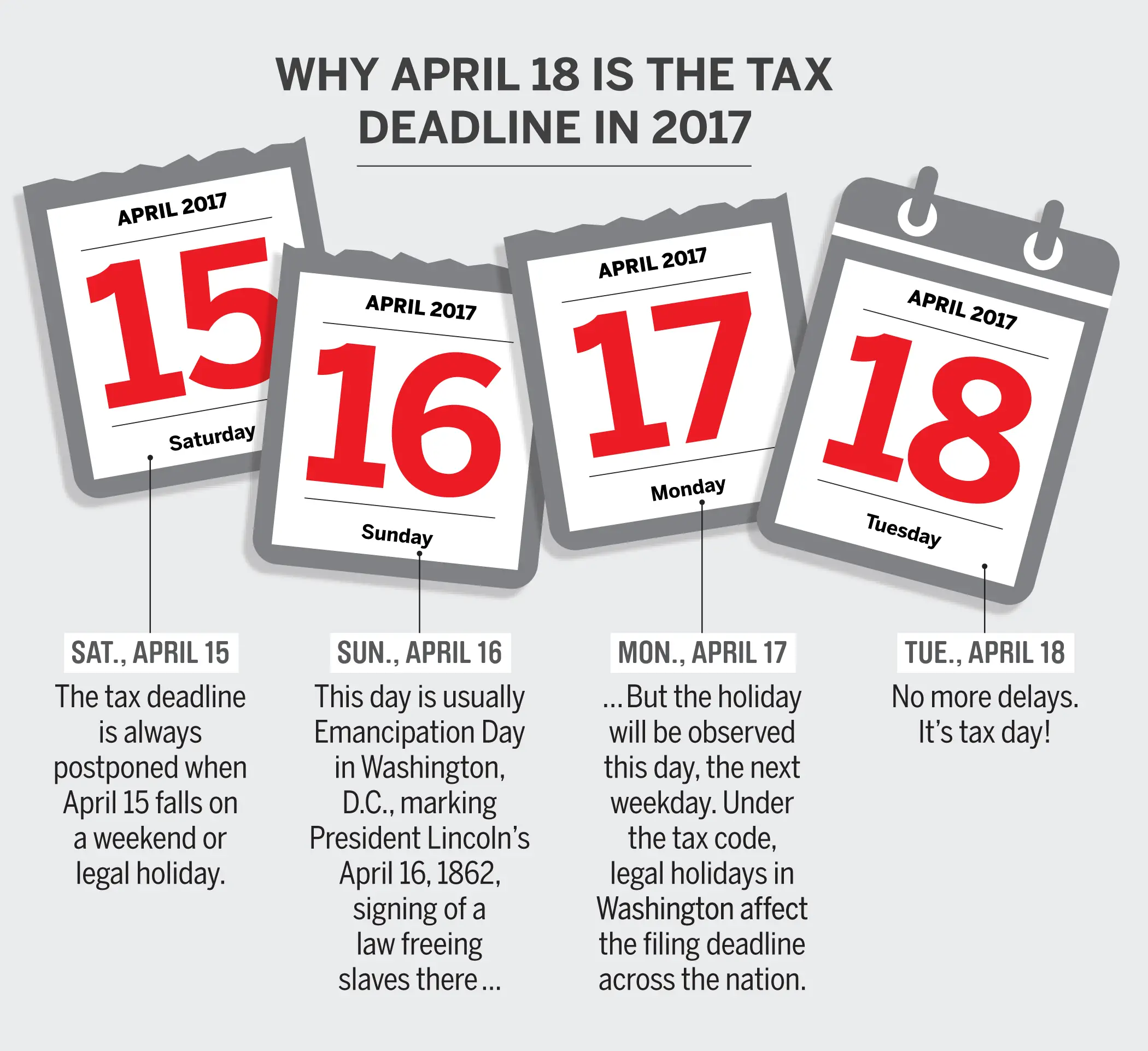

Circle April 18, 2022, on your calendar because thats the one general date by which most filers need to get returns into the IRS. While taxes are typically due on April 15, this years Tax Day falls on Emancipation Day, a legal holiday observed in Washington, D.C. As a result, most filers will have until the next business day, April 18, to submit their tax returns.

However, you may have a different deadline if you filed for an extension or if you are a corporation. Heres a rundown of all the deadlines you need to keep track of.

Given fluid tax filing rules its important to ensure your investments are protected. A financial advisor can help you make sure your tax filings dont unnecessarily hurt your assets.

Paid Family And Medical Leave Contributions

Employers, other business entities and self-employed individuals electing PFML coverage are required to file Quarterly Returns through MassTaxConnect.

The first required quarterly return will cover the period from October 1, 2019 to December 31, 2019 and must be filed on or before January 31, 2020. All subsequent return filings will be due on or before the last day of the month following a calendar quarters close.

For more PFML information visit:

What You Need To Know For The 2022 Tax

Ottawa, Ontario

Canada Revenue Agency

Last year, Canadians filed almost 31 million income tax and benefit returns. Having the information you need on hand to file your return makes the filing process that much easier. We want to help you get ready, so you are in good shape when it comes time to file your return this year.

Here you will find information on filing options, COVID-19 benefits, and whats new for this tax-filing season.

Also Check: How Much Medicare Tax Is Withheld

Note: The Hsa Contribution Deadline And Ira Contribution Deadline Are The Same As The Tax Deadline

Note that the HSA contribution deadline and IRA contribution deadline also fall on the same day as the tax deadline. This means you have a few additional months to contribute for the tax and calendar year, beyond the actual tax and calendar year end. You can also open new accounts to contribute to up until the same date, which is great news for savers.

When Can You File Taxes For 2021

Even though some of the taxes owed will have to be paid by April 18, 2022, you can e-file them sooner. During the next few months, the IRS will likely start accepting electronic returns. The 15th and the 15th of February, respectively. When taxpayers should have received their last paycheck in fiscal 2021, that is 2022.

Don’t Miss: When Do I Have To Do Taxes

Requirements For Federal Excise Tax

Pay special attention to which types of excise tax forms you may be required to file.

- File Form 720 if you are required to pay quarterly Federal excise tax returns

- File Form 11-C if you need to file for wagering income

- File Form 2290 if your business uses heavy highway vehicles

Furthermore, you must file these forms each quarter of the calendar year, with due dates as follows:

- for first quarter

- for second quarter

- for third quarter

- for fourth quarter of the previous year

How To Make An Estimated Tax Payment

The fastest and easiest way to make an estimated tax payment is to do so electronically using IRS Direct Pay. Taxpayers can schedule a payment in advance of the January deadline.

Taxpayers can now also make a payment through their IRS Online Account. There they can see their payment history, any pending or recent payments and other useful tax information. The Electronic Filing Tax Payment System, or EFTPS, is an excellent choice as well.

The IRS does not charge a fee for these services. Plus, using these or other electronic payment options ensures that a payment gets credited promptly. More information on other payment options is available at Pay Online.

Don’t Miss: When Can I Expect My Unemployment Tax Refund

Time Is Running Out To Claim Your Stimulus And Child Tax Credit Payments

Last month, the IRS reported that millions of eligible people have yet to properly claim their COVID relief payments. The IRS uses tax returns to determine eligibility for both pandemic stimulus checks and child tax credits, and unfortunately, those who need the relief mostsuch as people with lower incomes, limited internet access, or who are experiencing homelessnessare often the least likely to have filed their taxes. Heres what you can do to take action before this weeks deadline for claiming your stimulus and/or child tax credit payments.

Seek Out Tax Deductions You Can Still Claim

If you find that you owe taxes, all might not be lost. As long as the April 15th tax-filing deadline has not yet passed, you can still add money to an IRA, lowering your taxable income in the process. As long as you meet the income guidelines for a deductible IRA, this step alone could lower the amount you owe or even entitle you to a refund.

Read Also: When Do You File Taxes This Year

Tax Extension Application Filing Deadline

If, for one reason or another, you are unable to file your tax return by the April 18, 2022 tax deadline, you can file for an IRS tax extension. Note that the extension must be postmarked by the April 18 deadline also.

Also, a key disclaimer an extension of time to file is not an extension of time to pay. Any taxes due are still due on the normal filing deadline date, in order to avoid penalty.

Whats The Deadline For Filing An Extension

You still have to submit your request for an extension by April 18 . But you will have until Oct. 17, 2022, to file a completed 2021 tax return.

Keep in mind that filing an extension doesnt push back when you need to pay the IRS: To avoid late penalties, you still need to submit an estimate of what you owe. An extension just gives you more time to complete your return.

Your state may have a different tax deadline than the IRS does.

Read Also: How Long Does Tax Return Take

Tax Deadlines: April To June

- :Deadline for employees who earned more than $20 in tip income in March to report this income to their employers.

- : Deadline for household employers who paid $2,300 or more in wages in 2021 to file Schedule H for Form 1040.

- : All individuals must file their 2021 personal tax returns, or Form 1040 or Form 1040-SR by this date. This is also the deadline to request an automatic extension for an extra six months to file your return, and for payment of any tax due.

- : Deadline for filing 2021 personal tax returns if you live in Maine or Massachusetts.

- May 10, 2022: Deadline for employees who earned more than $20 in tip income in April to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in May to report this income to their employers.

- :Deadline for second-quarter estimated tax payments for the 2021 tax year.

- :Deadline for U.S. citizens living abroad to file individual tax returns or file Form 4868 for an automatic four-month extension.

Claim Your Renewable Energy Credits

You might not be able to deduct your mortgage interest payments in any meaningful way, but you can still claim renewable energy credits. You should file Form 5695 if you have qualified costs for residential energy across any of these areas:

Youll also use this form to deduct any energy-efficient home improvements youve made to your property.

These nonrefundable credits can help lower your tax bill to $0, but they wont put any money back in your pocket.

Read Also: How To File 2016 Taxes

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- Electronically filing and choosing direct deposit is the fastest way to get your refund. When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.

- If you already have an account with a bank or credit union, make sure you have your information ready â including the account and routing number â when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

- You can learn more about choosing the right prepaid card here.

How To File Your Tax Return Electronically

You might want to e-file your late return if you haven’t missed that deadline as well. Many taxpayers can e-file at IRS Free File if their AGIs were under $73,000 in 2021. Some other rules can apply as well, imposed by the individual software providers that participate in the Free File Alliance.

The IRS will accept e-filed returns until November. It will announce the exact November cutoff date sometime in October 2022.

Also Check: How To Request An Extension On Your Taxes

How Do You Get A Tax Deadline Extension

Taxpayers who know they will be unable to make the April 18, 2022, deadline for filing their income tax can request a six-month tax deadline extension by filing Form 4868 before the deadline. Once the IRS receives your extension request, the deadline for filing your taxes is pushed back to Oct. 17, 2022.

Military extensions may extend beyond Oct. 17. While most U.S. taxpayers are required to file by the Oct. 17 deadline, some military members may be eligible for an automatic extension if they were deployed to a tax-free combat zone for part of the previous or current tax year. This extension has several rules, so visit the IRS website for specific information.

Note: According to the IRS, this extension may also apply to individuals serving in the combat zone in support of the U.S. Armed Forces, such as merchant marines serving aboard vessels under the operational control of the Department of Defense, Red Cross personnel, accredited correspondents, and civilian personnel acting under the direction of the U.S. Armed Forces in support of those forces.

Also Check: Us Individual Income Tax Return

What Do I Do About Missing Tax Forms

If you don’t receive your income forms, you should first contact the employer and request a copy or ask that it be re-sent. If that doesn’t work, you can then contact the IRS at 1-800-829-1040 . You’ll need to provide the following information:

- Name, address, Social Security number, and phone number

- Your employer’s name, address, and phone number

- Dates you worked for your employer

- An estimate of your paid wages and federal income tax withheld during 2021

You May Like: How Much Do Charitable Donations Reduce Taxes

Tax Filing Postmark & E

The April 18 tax deadline does not refer to when the IRS receives your tax return. Instead, it refers to the date that the tax return is postmarked. So if you mail out your tax return on April 18 by USPS mail and the IRS receives your tax return after that date, your return wont be considered late. The same rule applies for e-filing your taxes. If you e-file your taxes, you must do so by April 18 as well.

Estimated Tax Filing Deadlines For 2022

While the regular filing deadline is what will be needed for most employees, if you have self-employment income, then you’ll also want to be sure that you’re taking care of paying your estimated taxes for the year. There are 4 deadlines throughout the year to pay your estimated tax for each quarter, and generally speaking, they always fall in the middle of April, June, September, and January. For 2022, the estimated tax payment dates are:

Recommended Reading: When Is An Ira Taxed

W2s And 1099s Due By January 31

For business owners, another important deadline to remember is that forms W2 and 1099 must be filed by January 31, 2023.

-=====-

See an estimated chart of when taxpayers may anticipate their 2023 income tax refunds:

See more federal tax deadline dates at

Irs Tax Stimulus Checks For 2022 Perhaps With Recovery Rebate Credit

Some people might want to file returns even though theyre not required to do so to claim a Recovery Rebate Credit or the 2021 stimulus payments.

According to the IRS, individuals who didnt qualify for a third Economic Impact Payment or got less than the full amount may be eligible to claim the Recovery Rebate Credit. For those who got some money, the IRS says youll need to know the total received to calculate the correct rebate credit to avoid processing delays.

The IRS will send Letter 6475 starting in late January with the total amount of the third Economic Impact Payment received. Economic impact payment amounts also can be viewed on IRS online accounts.

Read Also: How Much Should I Put Aside For Taxes 1099

When Can I Expect My Refund

If you file electronically and choose direct deposit, the IRS says you can expect your refund within 21 days, assuming there are no problems with your return.

The IRS has already processed more than 70 million returns for fiscal 2021 and issued nearly 52 million refunds. But the agency has also warned about delays in processing returns, especially as the 2022 tax season involved complications like stimulus payments and an expanded child tax credit.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement.

Experts agree direct deposit is the fastest way to get your refund from the IRS.

Irs Reminds Taxpayers Of Upcoming Filing Extension Deadline Free File Remains Open Until Nov 17

IR-2022-179, October 14, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is Monday, October 17. IRS Free File remains open until November 17 for those who still need to file their 2021 tax returns. This includes those who qualify for the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 tax return to claim them.

IRS Free File is a public-private partnership between the IRS and tax preparation software industry leaders who provide their brand-name products for free. There are eight Free File products available in English and two in Spanish.

IRS Free File provides two ways for taxpayers to prepare and file their 2021 federal income tax return online for free:

- IRS Partner Sites. Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Individual taxpayers whose adjusted gross income is $73,000 or less qualify for any IRS Free File partner offers. Free File lets individuals electronically prepare and file their federal income tax online using guided tax preparation.

Recommended Reading: How Many Years Do I Have To File My Taxes

The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

Recommended Reading: When Are Taxes Due By

How Much Is The Real Property Tax

The following rates form the basis of real property tax computation, according to the Local Government Code of 1991:

- 1% of the propertys provincially assessed value

- 2% of the propertys assessed value in Metro Manila

To determine real property tax assessments, use this formula: Real Property Tax = Rate x Assessed Value

For example, your real property tax would be 20,000 if your property is in Metro Manila and its assessed value is 1,000,000. However, your real property tax obligation will be 10,000 if your property of the same value is situated in the province.

Also Check: Will Irs Extend Tax Deadline

What This Means For You

We understand that each taxpayers situation is unique, and in order to help you during these difficult days, our recommendation is to continue working toward the tax deadline as if it was still April 15. This will enable us to more quickly evaluate your tax position in order to determine what is most beneficial for you. For those who will receive a refund, we can file your return so you receive the payment as soon as possible. For those who will owe tax, you can proactively determine the amount and then plan to delay the payment until closer to the deadline.

Undoubtedly, circumstances may make it difficult to proceed as you once intended, but we remain committed to working with you even more so during these difficult times. If you have any questions, please contact your KSM advisor.