What Is Backup Withholding

Backup withholding is a tax deduction that occurs when independent contractors provide the wrong TIN or incorrectly report their income on a tax return. In this event, employers may be required to withhold a percentage of any future payments made to the contractor and deposit it directly with the IRS.

What Is A 1099

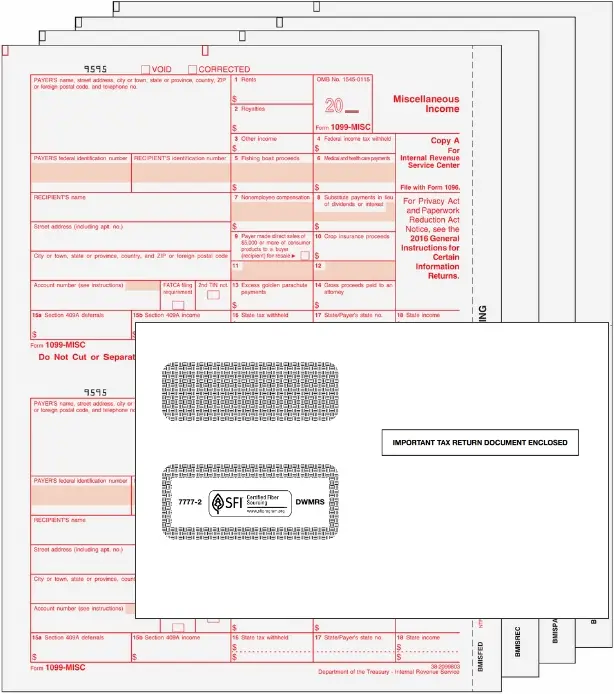

All self-employed individuals or 1099-MISC income earners are required to pay tax every quarter to the IRS. Each January, you should receive a 1099 MISC form in the mail from each company you did work for in the previous year. If you worked for more than one organization in a year, you can expect multiple 1099 MISC forms.Each form will reflect an amount in Box 7. This should be the total amount you were remunerated by an employer, meaning you need to pay tax on this amount. Remember, it is your responsibility to stay on top of your credit responsibilities if you fall in the 1099-MISC income bracket. If you earned more than $3,000 in a year, you will need to pay tax on this amount.

Who Should Get A 1099

The 1099-MISC is a common type of IRS Form 1099, which is a record that an entity or person not your employer gave or paid you money.

-

You might have received a 1099-MISC tax form from a client in the past if you’re a freelancer, independent contractor or self-employed. However, starting in 2020, those payments are now reported on the 1099-NEC instead .

-

A Form 1099-MISC will have your Social Security number or taxpayer identification number on it, which means the IRS will know youve received interest and it will know if you dont report that income on your tax return.

You May Like: Do I Pay Taxes On Roth Ira Gains

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Quarterly Taxes For The Self

Earn more than $1,000? You need to pay taxes quarterly, in April, June, September, and January.

If you also work for someone as an employee, theyâll withhold taxes from your pay. But the money you make on the side is also taxed. And those taxes, in the form of a portion of your income, need to be withheld by you.

You can calculate your estimated tax payments based on last yearâs income, or on your estimated income for the present year.

Recommended Reading: What Day Are Income Taxes Due

Entering Multiple 1099 Forms

if you received 1099-MISC forms from several payers, you will need to enter each one separately in your tax software. If you have just one business, all 1099-MISC forms are collected and added to your business tax schedule for that business. If you have several businesses, be sure each 1099 form is connected to the right business.

Your New York State Form 1099

Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2021 New York State Form 1099-G statement is the same as the 2020 New York State income tax refund they actually received.

If you do not have a New York State Form 1099-G statement, even though you received a refund, or your New York State Form 1099-G statement amount is different from your refund amount, see More information about 1099-G.

Don’t Miss: How Much Do You Make To Have To File Taxes

How Do I Pay Self

Determine your net income . You owe self-employment taxes if you earn a net profit of $400 or more. For up to $142,800 of earned income in 2021 the self-employment tax rate is 15.3%. You can calculate your self-employment tax using Schedule SE on IRS Form 1040. Follow Form 1040 instructions to calculate what you owe after the tax year.

How To Pay Estimated Taxes Online

You also pay your estimated taxes online through the IRS website. The IRS receives your payment almost immediately when you pay online. Plus, you dont have to worry about your payment getting lost in the mail. The system provides a confirmation number for all payments so you have proof if you run into any problems. Best of all, you can easily make payments from the comfort of your own home. No stamps required!

To learn more about paying estimated taxes online, check out our detailed blog post on the topic.

Don’t Miss: What Is The Sales Tax For Texas

Irs Says Tax Day Will Be Different This Year Put These Important Tax Dates On Your Calendar

Its not too early to start thinking about your 2022 income-tax return, if you can bear the thought.

Thats because the tax-filing season is scheduled to start on Monday, Jan. 23, the Internal Revenue Service announced Thursday. Thats less than two weeks away.

The IRS is expecting more than 168 million individual tax returns this year, it said.

Most households come away with a refund, making for a major financial event during the year. Two-thirds of individual taxpayers came away with a refund last year averaging around $3,200, according to IRS data through late October.

This year, refunds will be arriving in a time of high inflation and potential recession worries and experts caution theres a good chance many refunds could be smaller, now that pandemic-era increases to certain tax credits have vanished.

Maximizing an income-tax refund starts by staying organized and knowing when to be on the lookout for the tax forms that pour in from employers, banks, brokers, mortgage lenders and others.

Hurrying too soon, a person might overlook a credit, deduction or piece of paperwork to back a claim. The same goes if theyre rushing at the last minute. An error could snag a refund and hold up a return inside the IRS, as it runs another tax season while cutting a backlog.

While much work remains after several difficult years, we expect people to experience improvements this tax season, he said in a statement.

How To Pay Your 1099 Taxes

If you think you might owe more than $1,000 in federal income taxes, you should be making payments throughout the year â not just when you file your return. These additional payments are referred to as âquarterlyâ or âestimatedâ tax payments. You pay your quarterly taxes on the 15th day following the end of the quarter. For example, letâs say you expect to owe $2,000 in taxes. You would divide that amount by four and make your quarterly tax payments on the following schedule:

| Quarter |

|---|

| $500 |

We havenât gotten into all the nitty-gritty here â like the forms that are involved in the filing process. If youâre interested in more details, check out our blog post on how to pay self-employment taxes step by step.

Don’t Miss: How To Find Out How Much Property Tax I Paid

If You Have Income But No 1099

All income must be reported to the IRS and taxes must be paid on all income. The payee may have forgotten to prepare and submit a 1099-MISC form for the income paid to you. Most likely, the payee may not have paid you $600 or more in a calendar year, in which case, no 1099-MISC must be filed with the IRS and provided to the worker.

Internet And Phone Expenses

Everyone does business online or by phone these days, making for a perfect tax deduction for those who are self-employed.

All youâll have to do is determine what percentage of time you use your phone and internet for business purposes. Then, figure out how much youâre paying for that amount of time. This number is your internet and cell phone deduction.

Example: You log 2,000 hours of computer use in a year. 500 of these hours were used for your business. This means ¼ of your internet expenses are deductible.

If you spend $50 each month on internet service , you can take $600 and multiply it by .25. After calculating, youâll discover that you can write off $150 of your internet expenses for the year.

Also Check: Will I Get My Tax Refund And Stimulus Check Together

What Should I Do If I Don’t Get My W

First, make sure that your employer hasn’t emailed you instructions on how to access your W-2 form online. According to IRS Publication 15A, employers can provide electronic versions of W-2 forms if employees opt in. There might be an email with instructions that’s been filtered to your spam or junk folders.

Next, contact your human resources or payroll department to ask if your W-2 form has been sent and, if so, to request that they send you another.

If your employer cannot or does not help you, you can also contact the IRS directly for your W-2 information. You can call the agency at 800-829-1040, and the IRS will contact your employer or payer and request your missing W-2 form for you.

When you call the IRS for help with a missing W-2 form, you’ll need to have several pieces of information to verify your identity:

- Legal name, address, Social Security number and phone number

- Employer name, address and phone number

- Dates you worked for the employer

- Estimates of your wages and income tax withheld in 2022

For the last item in the list, your last paycheck of the year is a good way to find an estimate of your total wages and taxes paid.

If you still don’t receive or can’t access your W-2 form by April 18 — when taxes are due this year — you have a few options for filing your 2022 tax return.

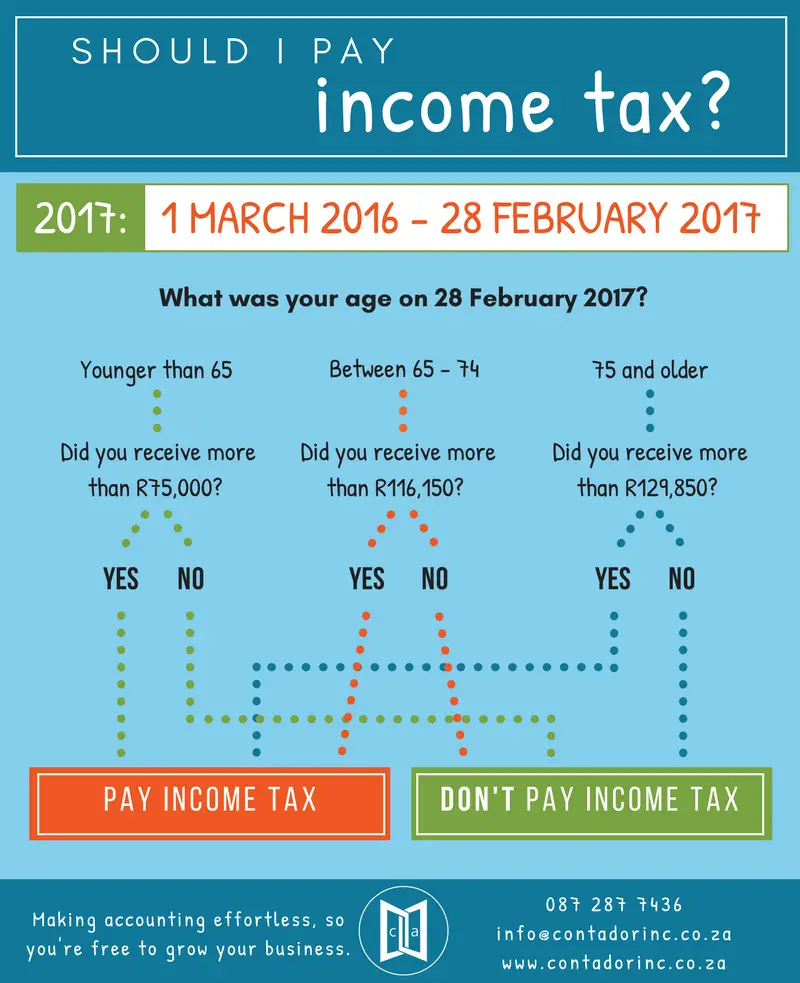

How Do I Know If I Need To Pay Estimated Taxes

You must pay estimated taxes if:

- The amount of income tax withheld from your salary or pension is not enough.

- You acquire income from interest and dividends, alimony, self-employment income, capital gains, prizes, and awards. While not a requirement, they may be a reason you might underpaid your payments.

- You expect to owe at least $1,000 or more in taxes after you file your return.

Read Also: Where Can I Get State Tax Forms

How To File Taxes With Irs Form 1099

OVERVIEW

If you receive tax form 1099-NEC for services you provide to a client as an independent contractor and the annual payments you receive total $400 or more, you’ll need to file your taxes a little differently than a taxpayer who only receives regular employment income reported on a W-2.

Apple Podcasts | Spotify | iHeartRadio

|

Key Takeaways When you provide $600 or more in services to a business, that client is usually required to report your earnings by issuing Form 1099-NEC. When you receive form 1099-NEC, it typically means you are self-employed and claim your income and deductions on your Schedule C, which you use to calculate your net profits from self-employment. As a self-employed person, you’re required to report all of your self-employment income. If the amount you receive from your self-employed work totals $400 or more, you will likely need to pay self-employment taxes using Schedule SE. |

One of the most common reasons youd receive tax form 1099-NEC is if you’re self-employed and did work as an independent contractor during the previous year. The IRS refers to this as nonemployee compensation.

The process of filing your taxes with Form 1099-NEC is a little different than if you only had income reported on a W-2. Here’s some tips to help you file.

Calculating The Federal Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called ,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

You May Like: How Much Tax On Gambling Winnings

Tax Tips For 1099 Workers

From how and when to pay taxes to types of deductions you can take, its important to understand whats different when youre an independent worker.

1. Self-employment taxes. In general, most workers must pay Social Security and Medicare taxes, in the form of self-employment taxes. If you work as a company employee, your employer typically withholds this from your paycheck as part of payroll taxes. By contrast, 1099 workers need to account for these taxes on their own.

The self-employment tax rate for 2021 is 15.3% of your net earnings . While the Medicare portion of the tax applies no matter how much you earn, the Social Security portion applies to earnings up to $142,800 in 2021 and $147,000 in 2022. You should also know that you can deduct half of this tax as a deductible expense.

2. Quarterly estimated tax payments. The US is a pay-as-you-go tax system, which means you’re required to pay taxes on your income periodically throughout the year. When youre a company employee, employers withhold income tax from your paycheck automatically. On the other hand, 1099 workers need to make estimated tax payments to the IRS and applicable state revenue departments on their own on a quarterly basis. How much will you need to pay? That depends on how much you expect to earn and whether or not you also have a W-2 job that withholds taxes from your paychecks.

Whether you receive the form or not, you should report your independent contractor income to the IRS on a Schedule C.

How To Lower Your Self

If you are self-employed or a small business owner, you understand first-hand how awful your tax bill can be, especially with the giant 15.3% self-employment tax added on .

When youâre not an employee, you donât have anySocial Security and Medicare taxes withheld from your income.

And since thereâs no state and federal income taxes, health insurance, or social security and medicare taxes, are taken out of your paycheck, you are the one who is solely responsible to pay self-employment tax. Most individuals working a full-time job would expect a tax refund, but you’ll need to pay taxes on 1099 income.

Thankfully, there are plenty of things you can do to avoid outrageous quarterly tax payments and yearly tax payments.

Here are a few ways you can keep some extra money in your pocket when you receive a 1099.

You May Like: Do Social Security Benefits Get Taxed

How To File An Independent Contractor 1099 Form

If youre an independent contractor, you may be required to file a 1099 form. Heres what you need to know about how to file an Independent Contractor 1099 form.

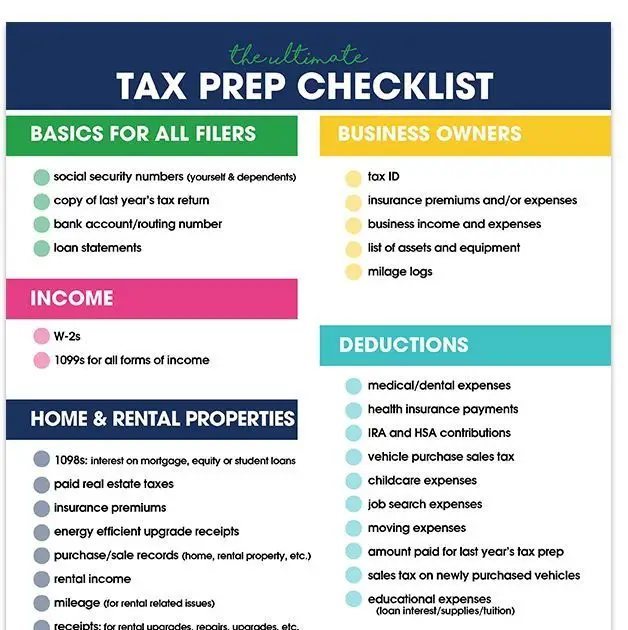

To file a 1099 form, you will need the following information:

- Your name, address, and Social Security number or taxpayer identification number

- The name, address, and taxpayer identification number of the company or individual you worked for

- The amount of money you earned from the company or individual

- The date you received the payment

Once you have gathered all of the required information, you can file your 1099 form online or by mail. If you choose to file online, you will need to create an account with the IRS. State income tax filings by mail are simple just print out the form and send it to the IRS.

If you earn $600 or more from a company in a year, that company is required to send you a 1099 form by January 31 of the following year. The 1099 form will show the total amount of money you earned from the company in the previous year.

You should receive your 1099 forms by early February. If you dont receive them by then, contact the companies that should have sent them to you.

Exploring The Many Types Of 1099s

You may have received non-employment income from a bank account that paid you interest. Or from a brokerage account with dividend-paying stocks. Or maybe you did some freelance work as an independent contractor. Or perhaps, you received unemployment benefits. Each type of non-employment income requires a different version of the 1099 form to report that income to the IRS for tax purposes.

For example, independent contractors and freelancers who earn $600 or more in non-employment income should receive a 1099-NEC and report that on their tax returns. Dividend income is reported via 1099-DIV, and interest on a 1099-INT.

Although taxpayers may not like receiving different tax documents, and businesses probably like issuing them even less, 1099s are essential to keep track of income that isn’t recorded in a person’s wages or salary found in a W-2. Indeed, the Internal Revenue Service matches nearly all 1099s and W-2 forms against your Form 1040 tax returns or other tax forms. If they don’t match, the IRS may tell you that you owe more money.

Here are 10 things you should know about your 1099s, including a review of the various types and what to do if you don’t receive your 1099 or it’s inaccurate.

You May Like: Is Fein Same As Tax Id