How To Calculate Your Crypto Taxes

Calculating your crypto taxes – especially if you trade at volume – is time consuming. You can do it all manually, or you can use a crypto tax calculator like Koinly to save you hours.

If you want to calculate your crypto taxes manually, follow these steps:

You’ll then need to report all taxable crypto disposals, the proceeds from your disposal and the subsequent capital gain or loss to the IRS , as well as any income from crypto.

It’s enough to exhaust even the most enthusiastic of mathematicians. But there is an alternative – use Koinly and save hours.

How Capital Gains Taxes Work On Bitcoin

Suppose you purchased one bitcoin for $30,000. You then sell it for $50,000, so you have a $20,000 capital gain. This would be a short-term gain if you held the Bitcoin for one year or less, and it would be taxed as ordinary income according to your tax bracket. It’s a long-term gain taxed at a rate of either 0%, 15%, 20%, depending on your overall income, if you owned the Bitcoin for longer than one year.

Do I Owe Crypto Taxes

In the U.S., crypto is considered a digital asset, and the IRS treats it generally like stocks, bonds, and other capital assets. Like these assets, the money you gain from crypto is taxed at different rates, either as capital gains or as income, depending on how you got your crypto and how long you held on to it.

To understand if you owe taxes, its important to look at how you used your crypto in 2021. Transactions that result in a tax are called taxable events. Those that dont are called non-taxable events. Lets break them down:

Not taxable

Taxable as capital gains

-

Selling crypto for cash: Did you sell your crypto for U.S. dollars? Youll owe taxes if you sell your assets for more than you paid for them. If you sell at a loss, you may be able to deduct that loss on your taxes.

-

Converting one crypto to another: When you use bitcoin to buy ether, for example, you technically have to sell your bitcoin before you buy a new asset. Because this is a sale, the IRS considers it taxable. Youll owe taxes if you sold your bitcoin for more than you paid for it.

-

Spending crypto on goods and services: If you use bitcoin to buy a pizza, for example, youll likely owe taxes on the transaction. To the IRS, spending crypto isnt that much different from selling it. You need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes.

Taxable as income

Good news for hodlers

Recommended Reading: How Much Are Taxes At H& r Block

How To File Crypto Taxes

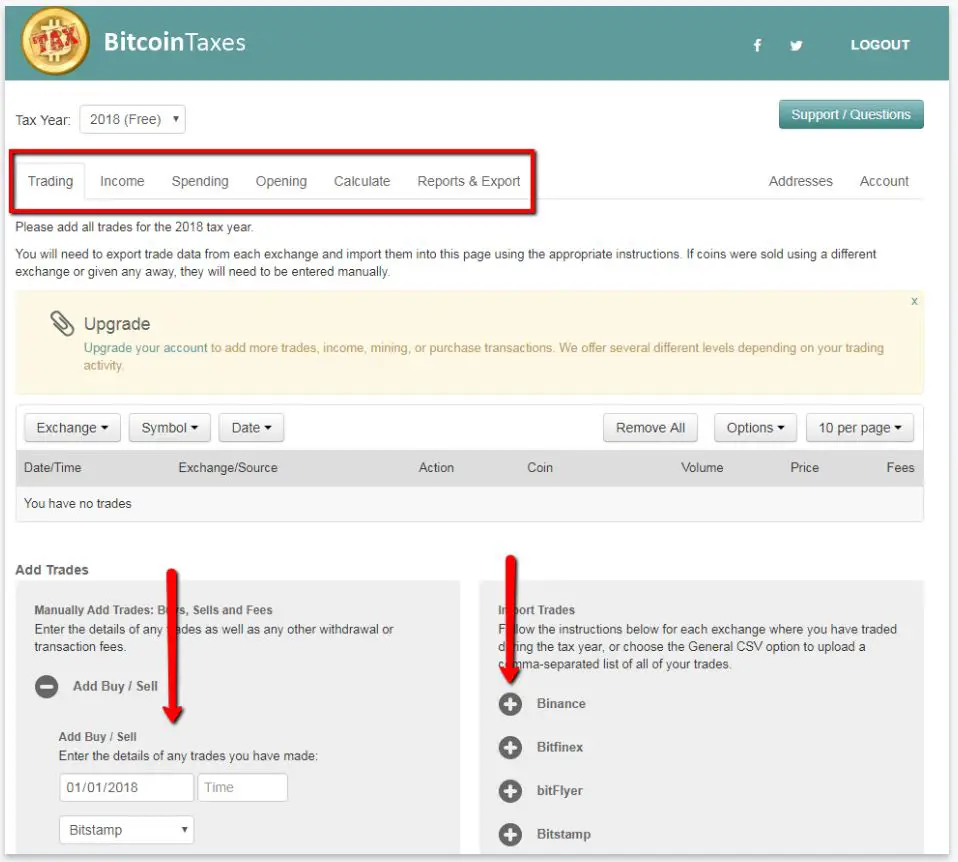

Once youve calculated any taxes you may owe on bitcoin or other virtual currency, its time to file them along with your federal income tax return. Several crypto-focused tax software programs exist to help taxpayers make sense of their cryptocurrency tax requirements. CoinTracker even integrates with TurboTax to simplify that process, and other crypto tax software may integrate with other regular tax software.

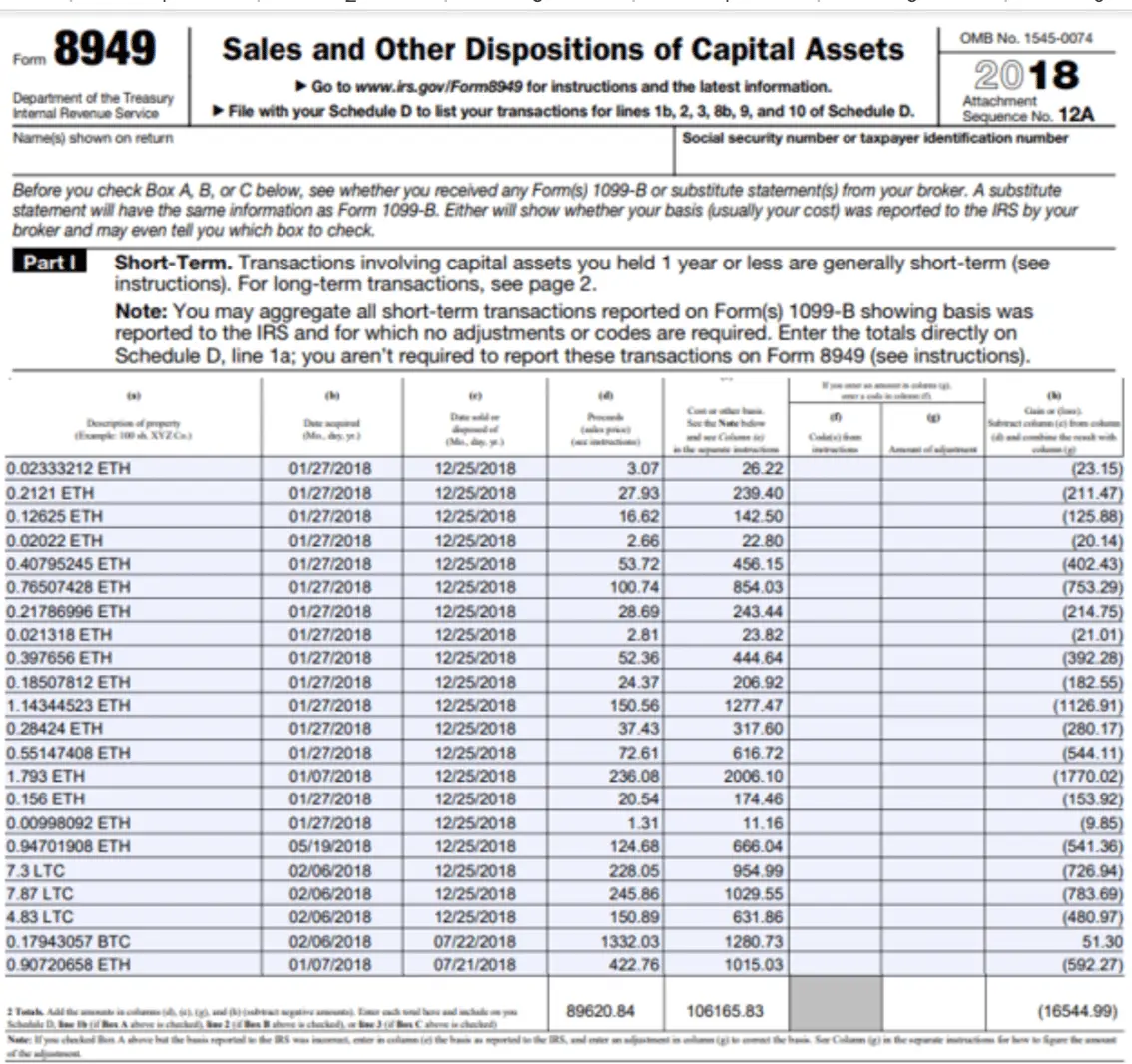

Once youve used Form 8949 to reconcile capital gains and losses for the year, simply report them on your IRS Form 1040 using Schedule D.

Our Cpas Can Help You Report Crypto Gains On Form 8938

When you need help understanding how to report your crypto gains and other foreign financial assets using Form 8938, our team can help. To learn more about how the United States Tax Code affects expats, visit us online or call the CPAs for American expatriates at US Tax Help today 362-9127.

*Pricing Quotes Are Provided After Document Review

Let Us Tackle Your U.S. Tax Issues

Also Check: How Far Back Can You File Taxes

What Is Specific Identification

Taxpayers can also elect to use Specific Identification. Specific Identification allows a taxpayer to select which particular cryptocurrency unit is being disposed of in a transaction. This allows a taxpayer to optimize the tax calculation in order to minimize any gains or obtain losses.

In the example above, the taxpayer is able to identify theyre disposing of assets acquired on July 1 and September 1. Using Specific Identification would result in a $2,000 net capital loss as opposed to a $7,000 net capital gain under FIFO as shown above. Here, its preferable to use Specific Identification to dispose of assets with the highest cost basis first, an approach known as highest in first out .

Continued Failure To File

If, after the deadline to report and any extensions have passed, you still have not properly reported your crypto gains on Form 8938, you can face additional fines and penalties. After an initial failure to file, the IRS will notify any taxpayer who hasnt completed their annual return or reports. If, after 90 days, you still havent included your crypto gains on Form 8938, you could face a fine of up to $50,000. Additionally, for every 30 days after youve been notified about your failure to file, you could face another $10,000 in fines.

Omitting your crypto gains from Form 8938 isnt worth it. On top of financial penalties, you might face criminal ones as well. That is, of course, if you cannot prove reasonable cause for not reporting cryptocurrency on Form 8938. Reasonable cause means that you can show that you didnt intentionally misfile or fail to file completely you made a mistake. You can avoid the fines and penalties for not reporting your crypto gains on Form 8938 by consulting with an experienced accountant, like the CPAs for American expatriates at US Tax Help. If you live abroad, you might not receive notice about your failure to file for a long time, allowing fines to build up.

Also Check: Where Can I Find Tax Forms

What Is A Disposition

This refers to the way you get rid of something, such as by giving, selling or transferring it. In general, possessing or holding a cryptocurrency is not taxable. But there could be tax consequences when you do any of the following:

- sell or make a gift of cryptocurrency

- trade or exchange cryptocurrency, including disposing of one cryptocurrency to get another cryptocurrency

- convert cryptocurrency to government-issued currency, such as Canadian dollars

- use cryptocurrency to buy goods or services

Look Out For Irs Warning Letters

The IRS has confirmed they’ve been sending out more letters to crypto investors they believe are underreporting, evading tax, or owing tax. This letter may come in the form of three possible types: 6173, 6174 or 6174-A.

The 6174 and 6174-Aletters are no action warnings, and are considered to be educational – they are designed to remind the taxpayer of their obligations to report and file their taxes on crypto transactions. If you have appropriately filed your taxes you do not have to do anything.

Letter 6173 does require action. Failure to respond to this letter will result in an audit of your tax account by the IRS.

Crypto investors who intentionally underreport their investments can face fines starting from $25,000 and can even face criminal charges with up to 5 years in prison.

The information on this website is for general information only. It should not be taken as constituting professional advice from Koinly. Koinly is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances. Koinly is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website.

You May Like: How To Pay Virginia State Taxes

How To Report Crypto On Taxes

You file your crypto taxes with your annual tax return – but you’ll need a few other forms to do so. You can see our complete guide on filing your crypto taxes with the IRS, but in short:

Report crypto disposals, capital gains and losses on: Form Schedule D and Form 8949.

Report crypto income on: Form Schedule 1 or Form Schedule C .

You can do this with paper forms or through a tax app like TurboTax or TaxAct. We’ll walk you through both.

Purchasing Crypto With Dollars

Simply buying virtual currency with U.S. dollars and keeping it within the exchange where you made the purchase or transferring it to your personal wallet does not mean youll owe taxes on it at the end of the year.

If your only crypto-related activity this year was purchasing a virtual currency with U.S. dollars, you dont have to report that to the IRS, based on guidance listed on your Form 1040 tax return.

You May Like: How Much Is Sales Tax In New Mexico

Bitcoin Miners Are Required To Report Receipt Of The Virtual Currency As Income

Some people “mine” Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger.

According to the IRS, when a taxpayer successfully mines Bitcoin and has earnings from that activity whether in the form of Bitcoin or any other form, they have to include it in gross income after determining the fair market dollar value of the virtual currency as of the day it is received. If a bitcoin miner is self-employed, gross earnings minus allowable tax deductions are also subject to the self-employment tax.

Let a tax expert do your investment taxes for you, start to finish. With TurboTax Live Full Service Premier, our specialized tax experts are here to help with anything from stocks to crypto to rental income. Backed by our Full Service Guarantee.You can also file your own taxes with TurboTax Premier. Your investment tax situation, covered. File confidently with Americas #1 tax prep provider.

How To Calculate Crypto Taxes

Lets take a peek at a few key phrases related to cryptocurrency and taxes:

- Taxable events: Transactions or uses of virtual currency that result in gains

- Capital gains: Any money gained through transactions

- Form 8949:IRS form for reconciling amounts of capital gains and losses

- Form 1099-MISC:IRS form for reporting rewards/fees income from staking

- Cost basis: The fair market value of a cryptocurrency when you acquired it

When you sit down to figure out your crypto taxes, youll want to have a grasp on what the IRS considers a taxable event regarding cryptocurrency. Here are a few activities with your virtual currency that would likely be taxable events:

- Selling cryptocurrency for cash

- Using mined or purchased cryptocurrency to pay for goods or services

- Converting cryptocurrency

- Receiving mined cryptocurrency

- Receiving virtual currency as payment

- Receiving crypto rewards

The general rule of thumb is that if you realize any gains from your cryptocurrency, you could owe taxes on them . So, if you simply have Bitcoin or other virtual currency sitting in your investing count or cryptocurrency wallet, but dont sell or use it, you havent realized any gains.

Some other non-taxable events include donating cryptocurrency to charity and transferring cryptocurrency between your own crypto wallets.

As with other property, losses on your crypto can be used to offset gains, up to $3,000 per year. Plus, you can carry over additional losses to future years.

You May Like: What Percent Is Sales Tax

Buying Or Selling Cryptocurrency As An Investment

Buying cryptocurrency isnt a taxable event by itself. You can choose to buy and hold cryptocurrency for as long as youd like without paying taxes on it, even if the value of your position increases.

Taxes are due when you sell, trade or dispose of your cryptocurrency investments in any way that causes you to recognize a gain in your taxable accounts. This doesnt apply if you trade cryptocurrency in a tax-deferred or tax-free account like an individual retirement account .

For example, if you buy $1,000 worth of Bitcoin and later sell it for $1,200, you’d need to report this $200 gain on your taxes. The gain, whether its a short-term or long-term capital gain, will depend on how long youve held the cryptocurrency.

If you instead sold the same $1,000 worth of Bitcoin for $800, youd recognize a loss that can offset other gains and up to $3,000 of your taxable income if your total losses are greater than your total gains. Any unused loss can roll forward to future years as an offset to future gains or up to $3,000 of your taxable income per year.

Give Crypto As A Gift

Giving cryptocurrency as a gift could save you money on taxes on your crypto gains. Also exempt from gift taxes is the recipient. As of right now, you are permitted to make gifts of up to $15,000 per person per year without having to fill out a gift tax return or pay any gift taxes. Even if you go over the $15,000 threshold, you wont be subject to gift taxes until your $11.7 million lifetime estate exemption has been exhausted.

To calculate the tax they must pay when they consider selling the cryptocurrency, the recipient will have to understand your basis in it. They will be required to pay tax on the entire gain over your basis, but it might be less than you would have to if you did it yourself.

For example, a mature person in their 50s with a successful career is probably in a higher tax bracket than a young person just out of college and starting their first job. So, if you give your cryptocurrency to a younger member of your family, your overall tax burden may be reduced.

The same goes for donating crypto where donating assets such as property and cryptocurrencies could result in advantageous tax treatment. Normally, you can write off the fair market value of your cryptocurrency without having to pay capital gains taxes.

There are restrictions on the deduction amount, so consult a tax expert to learn how a donation might improve your tax situation.

Read Also: How To File Income Tax With No Income

Do I Have To File Nc State Tax As An Expat

It depends.

If you were a nonresident, you would only need to report the interest income if the income is derived from a “business, trade, profession, or occupation carried on in North Carolina”.

If the income is strictly from investment income, you would not have a filing requirement.

Please see the attached link for more information on whether you have a filing requirement or not. North Carolina bases the requirement to file based upon whether you had to file a federal return and the amount of your federal gross income as well as the source of your North Carolina income.

Tax Treatment Of Cryptocurrency For Income Tax Purposes

Cryptocurrency is a digital representation of value that is not legal tender. It is a digital asset, sometimes also referred to as a crypto asset or altcoin that works as a medium of exchange for goods and services between the parties who agree to use it. Strong encryption techniques are used to control how units of cryptocurrency are created and to verify transactions. Cryptocurrencies generally operate independently of a central bank, central authority or government.

The following pages outline the income tax implications of common transactions involving cryptocurrency. When we refer to cryptocurrency in this publication, we are talking about Bitcoin or other similar virtual currencies.

You May Like: Where To Find Adjusted Gross Income On Tax Return

What Happens If You Don’t Report Taxes On Bitcoin To The Irs

Tax evasion occurs when taxpayers knowingly do not remit taxes on any source of income, whether it be related to cryptocurrency, wages, salaries, stocks, real estate, or other investments. If the IRS has reason to believe you have engaged in tax fraud, they may audit you. Be mindful that trading platforms may issue tax statements, notifying the IRS that you have engaged in cryptocurrency transactions.

How Do I Calculate Cryptocurrency Capital Gains And Losses

For each trade, partial or complete, you’ll need to know the following details:

1. When you bought the coins.

2. How much you paid for them .

3. When you sold the coins.

4. How much you received for them.

The more sophisticated exchanges may have a reporting mechanism to help you collect this kind of information. Otherwise, unless you’ve kept detailed records of your own, you may need to root through your email, bank account or wallet receipts.

Once you have that information in hand, there are several options available for doing the math. For example, some investors use the “first in, first out” methodology, wherein the first coins you buy are also the first coins you sell. We won’t cover all of the methods and math here. You can do a web search to learn more about the options for calculating capital gains.

You May Like: How Much Do Rich People Pay In Taxes

Cryptocurrency Tax Free Countries

Even in 2021, there are still countries that do not oblige you to pay cryptocurrency and BTC taxes. These are:

As of now, the country doesnt have any strict policy regarding cryptocurrency. However, cryptocurrency is gaining momentum, and the crypto treatment may soon be changed.

Cryptocurrency investments, trading, and hodling are not subject to taxation in Malaysia. Yet, the authorities intend to change the situation around crypto assets and Bitcoin taxation and want to introduce updated guidelines this year.

Portugal can be considered a crypto paradise. The country does not make you pay taxes on Bitcoin and other crypto assets even if you are a trader .

There are no specific cryptocurrency tax laws in Slovenia. One can sell BTC and other crypto without a necessity to pay capital gain tax. Yet, businesses that receive payments in BTC and other decentralized digital assets must pay tax at the corporate rate . Also, a company cannot use cryptocurrency as the only method of payment.