How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits can reduce your tax bill on a dollar-for-dollar basis they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

What Is A Marginal Tax Rate

The term “marginal tax rate” refers to the tax rate paid on your last dollar of taxable income. This typically equates to your highest tax bracket.

For example, if you’re a single filer with $35,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $46,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would then be 22%.

Refundable Vs Nonrefundable Tax Credits

Some Federal tax credits are nonrefundable, meaning once they reduce your tax liability to $0, a taxpayer may not receive additional benefit nor receive a refund due to an unused portion of the credit. An example of a nonrefundable tax credit is the Adoption Tax Credit once the credit reduces a taxpayers tax liability to $0, the taxpayer will simply not pay tax.

On the other hand, other credits may be refundable, Not only can refundable tax credits reduce a taxpayers liability to $0, it may flip the taxpayer into receiving a tax refund. If you owe $750 in taxes but qualify for a $1,000 refundable tax credit, you would ultimately receive a $250 tax refund.

Be mindful that some credits are partially refundable. For example, the Child Tax Credit of $2,000 is partially refundable in 2023, up to $1,600 is refundable.

Recommended Reading: What Is Futa Payroll Tax

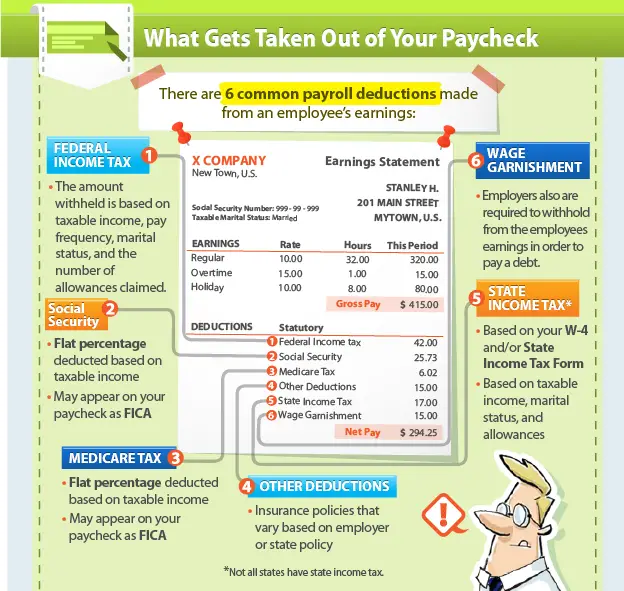

How Do Payroll Deductions Work

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time.

The amount you withhold for each employee depends upon the individuals Form W-4 Employees Withholding Certificate, state and local withholding certificates, benefit selections and other details. For instance, has the employee enrolled in your health insurance plan or is there a court-ordered garnishment to comply with?

Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax.

Where Does All That Money Go

Federal income tax is the governments biggest source of revenue. It is used to pay the countrys ongoing expenses, such as national defense, infrastructure needs, social assistance programs, and paying interest on the national debt.

Many people are surprised to learn that all of the income you make is not taxed at one rate. Lets say you are the single filer in the example above, earning $41,600 per year. Your income falls into the 22% tax bracket. But, if you paid a flat 22% tax rate, you’d owe $9,152. Yikes. What gives?

Federal income taxes are paid in tiers. For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn–the amount from $9,876 to $40,125–is taxed at 15%. Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

Don’t Miss: What State Has The Cheapest Taxes

Eligibility Requirements For Child Tax Credit In The 2022 Tax Year

To be eligible for the CTC in 2023, first and foremost, you must have dependent children under 17. In addition, you must meet specific requirements related to your income level and filing status.

The CTC offers families considerable financial relief each year, helping them save money or reduce debt. Here are the qualifications you need to meet to get it:

- For 2022, adjusted gross income must be of or under $200,000 for single fillers or at $400,000 for married filing jointly to fully claim the credit.

- All children must be under 17 on December 31st of the year in question.

- All persons claiming the credit must have a valid Social Security Number or an Individual Tax Identification Number associated with their tax return.

Once you have established your eligibility for the Child Tax Credit, its time to start the process of claiming it and unlocking $2,000 per qualifying child quickly and easily.

What Are Federal Taxes

Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and . Federal Unemployment Tax Act is another type of tax withheld however, FUTA is paid solely by employers.

For employees, there isnt a one-size-fits-all answer to, How much federal tax is taken out of my paycheck? However, free online tax and learning how payroll taxes work helps understand what take-home pay may look like.

Don’t Miss: When To File Tax Return 2020

Four: Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Don’t Miss: How To Become Tax Exempt

How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

Related

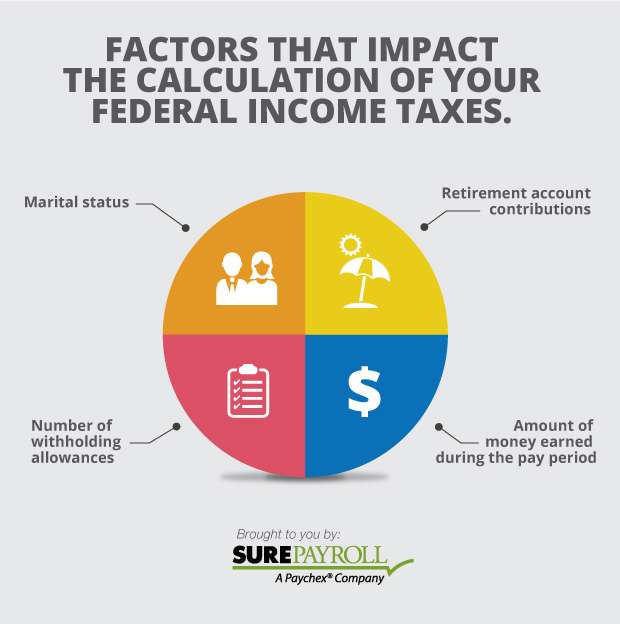

The percentage of taxes withheld from a workers paycheck varies based on the withholding allowances the worker reported on IRS Form W-4. To determine the exact tally requires access to state and federal tax brackets and gross wage information. You must also incorporate Social Security and Medicare withholdings into the calculations.

Preparing For Employer Payroll Taxes When Hiring Employees

Before new hires start working, they typically fill out Form W-4 so that their employers can withhold the correct amount of federal income tax from their pay. They may also have to complete a separate withholding certificate for state income tax depending on the state. Some simply use the federal Form W-4 for this purpose and others dont collect income tax at all.

Read Also: How Much Do You Get Back In Tax Returns

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Take Care Of Deductions

In addition to withholding for payroll taxes, calculating your employees paycheck also means taking out any applicable deductions.

There are voluntary pre and post-tax deductions like health insurance premiums, 401 plans, or health savings account contributions. Some employees also have involuntary deductions that may need to be considered for items like child support or wage garnishments .

Be careful here, because pre-tax deductions like 401 are taken out of gross income in Step 1, which means that the tax withholding calculation in Step 2 will be lower. Post-tax deductions are taken out after Step 2. Pre-tax deductions will save the employee more taxes.

Recommended Reading: How To Calculate Taxes On Stocks

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Why Do I Have To Pay Fica Tax

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible.

Some people are exempt workers, which means they elect not to have federal income tax withheld from their paychecks. Social Security and Medicare taxes will still come out of their checks, though.

Typically, you become exempt from withholding only if two things are true:

-

You got a refund of all your federal income tax withheld last year because you had no tax liability.

-

You expect the same thing to happen this year.

Read Also: What Address Do I Send My Federal Taxes To

How Your Indiana Paycheck Works

Employers will withhold federal and FICA taxes from your paycheck. Medicare and Social Security taxes together make up FICA taxes. Employers withhold 1.45% in Medicare taxes and 6.2% in Social Security taxes per paycheck. Employers also match this amount for a total FICA contribution of 2.9% for Medicare and 12.4% for Social Security. Note that if you are self-employed, you need to pay that total yourself. However, there are some deductions to help self-employed workers recoup some of those taxes. Additionally, wages that exceed $200,000 are subject to a 0.9% Medicare surtax.

The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. The amount of federal taxes taken out depends on the information you provided on your W-4 form. Remember that whenever you start a new job or want to make changes, youll need to fill out a new W-4. Withholding affects how much you will pay in taxes each pay period.

In recent years, the IRS has made multiple changes to the W-4. The updated form doesnt let you to list total allowances anymore. Instead, it requires you to enter annual dollar amounts for things like non-wage income, income tax credits, total annual taxable wages and itemized and other deductions. The form also includes a five-step process that asks filers to enter personal information, claim dependents and indicate any additional income or jobs.

Calculating Employer Payroll Taxes

In addition to the taxes you withhold from an employees pay, you as the employer are responsible for paying certain payroll taxes as well:

- FICA Matching: You are required to match the employees FICA tax withholding, which means your company will pay 6.2% tax for Social Security and 1.45% tax for Medicare. Using our example employee, you as the employer would pay a matching $129.17 for Social Security and $30.21 in Medicare, resulting in a $159.38 FICA obligation.

- Unemployment Taxes: You will also have to pay federal and state unemployment tax. Unemployment taxes are paid only by the employer, not the employee.

- Federal Unemployment Tax is 6.0% of the first $7,000 in wages you pay each employee each year. If your company is subject to state unemployment, you can receive a federal tax rate credit of up to 5.4%, which makes the effective tax rate 0.6%. Once an employee earns more than $7,000 in a calendar year, you stop paying FUTA for that employee in that tax year. Federal Unemployment: $2,083.33 x 0.6% = $12.50

- State Unemployment Tax varies by state. Consult with your states Department of Labor or Unemployment Revenue for tax rates, wage bases, and filing requirements. For this example, we will assume the employee has not yet been paid $7,000 year-to-date. We will use Floridas unemployment tax rate of 2.7%. State Unemployment: $2,083.33 x 2.7% = $56.25

Rinda Myers, Kurb to Kitchen LLC

Read Also: How Much Is Sales Tax In Illinois

Why Is My Check So Small After Taxes

OVERVIEW

You may wonder why so much money comes out of your pay, where it goes, and what can be done to change the deducted amount. The good news is that you usually have some control over your deductions.

Payroll deductions perform a valuable service: Without them, taxpayers would be responsible for figuring out how much of their paycheck is withheld for federal taxes and then sending the correct amount to various agencies as they earn their income throughout the year. This isnt considered ideal for the government or taxpayers.

- Those who have no money deducted from their income for taxes such as the self-employed can encounter problems when its time to file their income tax returns.

- One common problem when youre filing taxes as self-employed is a surprising and substantial tax bill at tax time, especially if youre unprepared and unable to pay the amount in full.

The government established the system of payroll withholding to help prevent these kinds of surprises to lower the likelihood of unpaid tax liabilities, and to ensure a steady flow of money to the U.S. Treasury

Heres an overview of the percentage of your paycheck withheld for federal taxes, why so much comes out of your pay, where that money goes, and what can be done to change the deducted amount.

Dont Miss: Wheres My Tax Refund Ga

How Is Federal Income Tax Calculated

The more taxable income you have, the higher tax rate you are subject to. This calculation process can be complex, so PaycheckCityâs free calculators can do it for you!

The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

For each payroll, federal income tax is calculated based on the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication 15-T. The current tax rates are 0%, 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Again, the percentage chosen is based on the paycheck amount and your W4 answers.

Also Check: What Happens If I File My Taxes Wrong

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.