Work Out When Youll Pay

In general, the IRS will only allow you to pay quarterly taxes once each month and no less than two days after that months end.

If your quarterly tax payments dont cover all four periods, youll have to make up the difference with a payment for the annual return. If this is still not enough, it wont be an issue as long as youve paid enough in each quarter.

Youll need to make sure that your bank account is registered for direct debit or set up EFTPS before you can pay your quarterly tax.

Also Check: Are Debt Settlement Fees Tax Deductible

Balance Of $10000 Or Below

If you owe less than $10,000 to the IRS, your installment plan will generally be automatically approved as a “guaranteed” installment agreement.

- Under this type of plan, as long as you pledge to pay off your balance within three years, there is no specific minimum payment required.

- For balances above $10,000, you may have to provide additional information in order to qualify.

How Can I Make Calculating And Paying Quarterly Estimated Taxes Easy

Although most taxpayers dont find the tax process enjoyable, there are a few things you can do to improve your experience with paying quarterly estimated taxes.

The most effective step for ensuring a smooth process is keeping good, clean books. These serve as your basis for all of your tax calculations, and as documentation should the IRS have any questions.

Talking to a professional can also ensure youre paying the right amount of taxes every quarter and will help avoid underpayment penalties.

If youre curious about straightening out your quarterly estimated taxes, Founders can help. Contact us to get started!

Read Also: How To Pay My Federal Taxes Online

Recommended Reading: Can I Pay Property Tax Online

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,â meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Recommended Reading: Do You Pay Taxes On Court Settlements

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

A Note On The Alternative Method

If you owe any âCommunications and Air Transportation Taxesâ and calculate those taxes based on amounts billed or tickets sold, rather than on amounts actually collected, those taxes are considered collected during the first week of the second following semimonthly period.

This is called the âAlternative methodâ of determining excise tax deposits. For more on how it works, check out page 11 of the instructions to Form 720.

Donât Miss: Does Doordash Give You A 1099

Also Check: What Are Payroll Taxes Used For

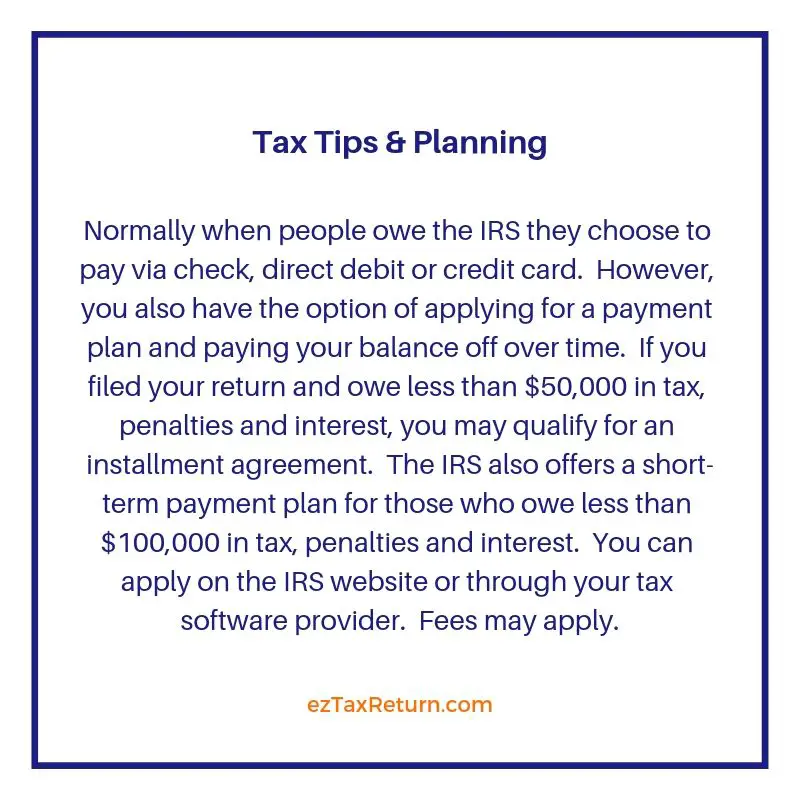

Set Up A Payment Plan

The IRS offers payment plans if you can’t pay all or even anything you owe right away. The important thing is that you don’t ignore your plight, hoping that it will go away, because it won’t.

You can set up a monthly installment agreement with the IRS, allowing you to pay what you owe over time. You can even decide how much you want to pay per month, at least to some extent. The entire balance has to be paid off within 72 months, so your minimum payment would be what you owe divided by 72. Leave some room for interest and penalties when you’re making your calculations.

You’re not prohibited from paying more than the amount you’ve committed to in any month. You can retire the debt sooner and minimize interest charges by doing so.

The IRS will still charge the late-payment penalty as well as interest, but it’s reduced to 0.25% a month. There’s a one-time setup fee of $130 as of 2022, increasing to $225 if you don’t apply online. But if you do apply online and if you agree to have the monthly payments taken from your bank account by direct debit, this one-time processing fee drops to $31. And the IRS offers a low-income setup fee option of $43 if you qualify. Direct debit is required if you owe more than $25,000.

You don’t have to qualify for the installment agreement by submitting a collection information statement to prove your assets and income, at least not if you owe less than $50,000. You can apply online using the Online Payment Agreement Application on the IRS website.

Will I Owe Penalties For Back Taxes

Generally, penalties accrue when a taxpayer fails to file and/or pay taxes on time. The IRS will sometimes abate the penalties if the taxpayer can meet a legal standard known as reasonable case. Usually, reasonable case means that the taxpayer was a victim of crime, substance abuse, mental disease or natural disaster. The taxpayer must have some sort of documentation to prove the event.

Recommended Reading: When Do We Get Our Tax Returns

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule CPDF to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C InstructionsPDF may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must fileSchedule SE , Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions for Schedule SEPDF may be helpful in filing out the form.

If Your Loans Are In Default Will Next Year’s Tax Return Be Garnished

Normally, if you have federal student loans in default , your tax refunds can be taken to help cover the balance owed. Since federal student loans were on pause during the 2022 tax season, your federal tax refund was not eligible to be garnished by the government.

It’s unclear if this will remain in place for 2023, though with the new payment pause set to expire at the end of 2022, this benefit may expire.

Don’t Miss: How To File An Oregon Tax Extension

Do You Owe Money To The Irs But Cant Pay Try This

Do you owe back taxes and cant afford to make any payments? Then it may be time for a special tax status known as currently not collectible. This means that your debt is still considered valid even though theres no chance at recovery right now. When youre approved for currently not collectible status, the IRS can no longer garnish your wages or seize any property.

Now, dont forget about these debts because the IRS is still looking for payment.

What is Currently Not Collectible Status?

The IRS will place your account in currently not collectible status if you cant pay both back taxes and reasonable living expenses. You may request this by submitting the proper form with documentation that proves how much income you have left over that is available to make a payment, along with any assets that have been sold recently to cover mounting debts like homes!

To qualify for the currently not collectible status, you will need to put together a case that you will present to the IRS. Gather copies of your bills, proof of your income , and your investments. It is important to document your inability to pay so that if the IRS determines you cannot afford your necessary expenses, it can grant you status.

Temporary Solution

Statute of Limitations

Fill Out Your Tax Return

You can file your estimated taxes online by filling out Schedule C-EZ, E, and/or F if you own a sole ownership LLC. If youre part of a multi-member LLC, then youll be filing on Form 1065.

If you did not conduct any business and your net profit or loss is only $400 or less, youll need to file Schedule C-EZ. Otherwise, its 1065 time! Dont forget to fill out the IRS Form 1040-ES every quarter!

You May Like: How Much Federal Income Tax Do I Pay

Back Taxes What Are They

Back taxes refers to delinquent taxes which are overdue. Your record is researched to determine where you stand with the IRS, what you owe, what years are unfiled, what years are necessary to file and to acquire documentation to do those returns. Back taxes come into existence a few different ways.

- If a taxpayer fails to file returns for a number of years, the IRS will file returns for the taxpayer and thereby assess a tax.

- If a taxpayer is audited and the IRS determines more tax is due, a back tax is then also assessed against the taxpayer.

- When a taxpayer files returns but is unable to pay the tax due, then a back tax is assessed against the taxpayer.

What Are Quarterly Estimated Tax Payments

The American tax system works on a pay-as-you-earn system. In other words, as you earn money throughout the year, you need to receive income for it. This way, the government will also receive a steady income.

For this reason, taxes are paid in two ways. W-2 employees will pay their taxes through withholding, whereas taxpayers that get their money through freelancing will pay through quarterly taxes.

If you are self-employed, theres no way to have your tax payments withheld from your paycheck. For this reason, the IRS requires that the individuals make these payments themselves, by their due date.

Quarterly tax payments are usually a better alternative to paying the taxes all in one lump sum. The IRS allows you to do that as well, but this might cause you to be overwhelmed by the larger sum. By paying quarterly, you pay in smaller increments, and the penalty will not be as big.

Recommended Reading: What Is The Tax Rate For Federal Income Tax

Do You Owe Money To The Irs But Cant Pay

Nationally Recognized Tax Resolution Attorney – Providing Innovative Solutions to IRS Tax Dilemmas

Try This.

When you owe back taxes and cant afford to make any payments, then it may be time for a special tax status known as currently not collectible. This means that your debt is still considered valid even though there’s no chance at recovery right now. When youre approved for currently not collectible status, the IRS can no longer garnish your wages or seize any property.

Now, don’t forget about these debts because the IRS is still looking for payment.

Ask For An Abatement Of Penalties

The IRS often reduces or removes penalties and interest on the penalties if a taxpayer writes a letter explaining the situation.

For example, if you had an unusual tax event, you made an honest mistake, or you or your spouse had a serious illness, the IRS may waive the penalties.

Be sure to ask for an abatement in your letter.

Also Check: What Happens If I Forgot To File Taxes

What Is A Violated Installment Agreement

The Department can cancel a payment plan after it begins, if it has been violated. A payment plan is considered violated if you do not:

- Sign and return the waiver that was included with your paperwork

- Make the full monthly payment on time

- File and pay any tax return due

- Provide a completed Statement of Income and Expenses when requested

If your payment plan is in violation and is subject to being canceled, the Department will notify you in writing.

What Happens If My Income Changes During The Year

If your income changes during the year and you realize that your previous estimates may have been inaccurate, you can simply adjust your estimate accordingly in your next quarterly filing. For instance, if you underreported in the first quarter, you can increase your estimate in the second quarter to make up for the initial shortfall. At the end of the day, estimated taxes will always deviate at least somewhat from your actual tax liability, so it is normal for these kinds of adjustments to be made.

Don’t Miss: What Tax Return Does An Llc File

Why Do I Owe Taxes This Year 2022

If you’ve moved to a new job, what you wrote in your Form W-4 might account for a higher tax bill. This form can change the amount of tax being withheld on each paycheck. If you opt for less tax withholding, you might end up with a bigger bill owed to the government when tax season rolls around again.

Can I Reduce The Amount Of Back Taxes That I Owe

Yes. Back taxes can be reduced by a variety of actions :

It is a very rare event when the IRS prosecutes a person for back taxes. Generally, the IRS and Justice Department seek to prosecute individuals for back taxes when the amounts are very large and the taxpayer has committed some sort of fraud upon the government. If you have concerns regarding your conduct, be sure to consult with an experienced tax attorney.

Read Also: How To Find Tax Id

Credit And Debit Cards

You can use your debit or credit card to pay your tax bill online or over the phone. The IRS doesn’t charge a fee for this service, but the service providers charge a fee for processing the payment. The three providers PayUSAtax, Pay1040, and ACI Payments, Inc. charge a fee. Debit card transactions are often between $2 and $4. For credit transactions, the fee is based upon a percentage of the payment amount. For instance, for a credit transaction of $1,000, the taxpayer may be charged a fee of $19.90 while a credit transaction of $10,000 would cost the taxpayer a fee of $199. The IRS accepts Visa, Discover, American Express, Mastercard, STAR, Pulse, NYCE, Accel, PayPal, and PayNearMe

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Read Also: What Is The Sales Tax In Colorado