Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

Can I File For An Extension To File My 2020 Return

Yes. You may get an automatic five-month extension to file your 2020 federal income taxes, meaning they wont be due until October 15. To do so, submit your request to the IRS by May 17.

But note that an extension to file is not an extension to pay what you owe. You still must pay any remaining federal taxes owed on your 2020 income by May 17, if you want to avoid a potential late payment penalty.

And if youre owed a refund, taking longer to file your taxes means you will wait longer to get your refund.

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

Also Check: How To Pay State Income Tax

Filing And Payment Deadline Extended To July 15 2020

The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The filing deadline for tax returns has been extended from April 15 to July 15, 2020. The IRS urges taxpayers who are owed a refund to file as quickly as possible. For those who can’t file by the July 15, 2020 deadline, the IRS reminds individual taxpayers that everyone is eligible to request an extension to file their return.

What’s The Fastest Way To File My Tax Return

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Read Also: When Is Filing Tax Deadline

Prepare And File Your State Tax Return Quickly And Easily

Our tax software carries over all the information from your federal tax return to save you time. Preparation of your state return is fast, easy, and convenient. E-filing is included at no extra cost.

- Prepare and file your state tax return for only $14.99 – Lowest price to prepare and file your state tax return.

- Save Time – Our tax software carries over all the information from your federal tax return to save you time.

- E-filing is included at no extra cost – FreeTaxUSA provides the fastest way to get your refund when you use e-file and direct deposit and there is no extra cost.

- Amend your state tax return – If you ever need to amend your state tax return in the future, FreeTaxUSA will help you with easy to understand instructions. The interview style process helps you make the corrections you need.

- Free customer support – Get help wherever you are in your tax return. Contact our customer support at any time free of charge for help.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: Can You File State Taxes Without Filing Federal

File As Early As Possible

Filing early is almost always best, and e-filing is quicker and safer than filing a paper return.

You can also avoid identity theft by filing early. New Jersey-based CPA Gail Rosen said, The IRS will only allow one tax return per Social Security number each year. Therefore, the best protection against identity theft is to file your taxes early.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Dont Miss: How To Calculate Tax Expense

Read Also: How To Find Tax Amount

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or use Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline.

More From Financial Empowerment

Unless you choose to file for an extension you must file and pay any remaining federal income taxes you owe for 2020 by May 17.

That way, you will avoid being hit with any potential late filing or late payment penalties.

But if you do miss your filing or payment deadlines, you may be eligible for first-time penalty relief.

There are two exceptions to the new extended federal deadline.

The first applies to anyone who pays estimated taxes, including many small businesses. Your usual April 15 payment was still due on April 15.

The second applies to anyone living in Texas, Oklahoma and Louisiana, who were hit hard by the February storms. The IRS extendedthe federal tax deadline for residents in those states to June 15.

Read Also: How To File Taxes From Last Year

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

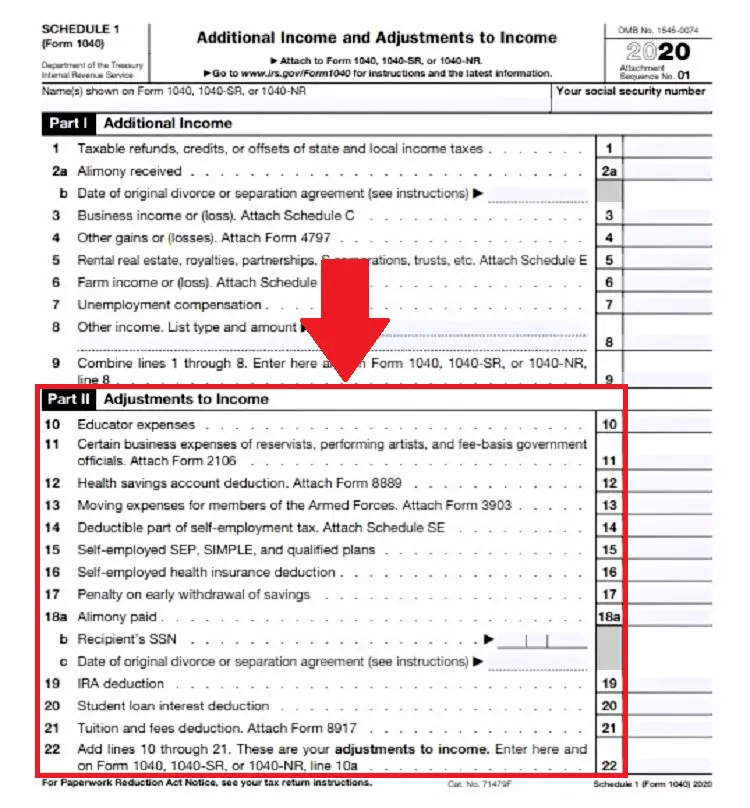

What If I Made A Mistake And Need To Re

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after youve already filed your original Form 1040. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Read Also: How Much Do Charitable Donations Reduce Taxes 2020

Irs Backlog Of Unprocessed 2020 Returns

Meet Ken Corbin:

Ken Corbin has two roles: he’s the IRSâ first Chief Taxpayer Experience Officer, and also, Commissioner of the Wage and Investment Division, with responsibility for 36,000 employees, located in over 375 sites nationwide, who are administering tax laws governing individual U.S. wage earners.

He recently said: “Out of the nearly 168 million 2020 tax returns we received, as of December 4, 2021, we had 6.7 million unprocessed individual returns and 2.6 million unprocessed Forms 1040-X.”

That’s 9.3 million individual returns in the hopper from last year’s tax season. How long it will take for people to get their refund this tax season is any body’s guess.

Commissioner Corbin blames the processing delays on the large inventory of tax returns waiting to be processed due to several factors, including the pandemic. He goes on to say, “…the IRS is correcting significantly more errors on 2020 tax returns than in previous years. More than 10 million electronically filed returns contained errors requiring a manual review of the return information.”

Corbin also stated that, “accurate returns filed electronically” with refunds due were “out the door within 21 days for those using direct deposit.”

Steps to Make Tax Filing Easier:

Each fall, the IRS launches a âGet Ready for Taxesâ campaign that encourages taxpayers to prepare to file, including what actions to take and what to know before filing season begins, and how to get help.

Things to Consider:

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Also Check: Can Home Improvement Be Tax Deductible

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

Who Should File A Tax Return

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year.

You may want to file even if you make less than that amount, because you may get money back if you file. This could apply to you if you:

- Have had federal income tax withheld from your pay

- Made estimated tax payments

- Qualify to claim tax credits such as the Earned Income Tax Credit and Child Tax Credit

Recommended Reading: What Taxes Do You Pay In Texas

How To File A Return

To electronically file a taxpayer’s return using the EFILE web service:

As stated in section 150.1 of the Income Tax Act:”For the purposes of section 150, where a return of income of a taxpayer for a taxation year is filed by way of electronic filing, it shall be deemed to be a return of income filed with the Minister in prescribed form on the day the Minister acknowledges acceptance of it.”

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Whats The Fastest Way To Receive My Refund

Step 1: E-file your taxes. That gets the information into the IRS system a lot faster than paper filings. Also, if you were eligible for an economic impact payment but didnt receive it youll have to file a tax return to claim the recovery rebate credit, even if you arent normally required to file.

Step 2: Make sure youve signed up for direct deposit, as the IRS says that can significantly speed up your refund. It also adds more flexibility. Your refund can be split into up to three separate accounts, including individual retirement accounts.

Don’t Miss: How Much To Do Tax Return

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

Do I Also Get More Time To File My State Taxes Then

In most instances.

Even though the IRS extended the federal filing deadline, it was up to individual states to set their own tax deadlines.

And most have extended their filing deadlines to May 17 to align with the federal schedule. They include Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Georgia, Idaho, Illinois, Indiana,Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Vermont, Virginia, West Virginia and Wisconsin.

Some states filing dates differ. They are Hawaii, April 20 Iowa, June 1 Maryland, July 15 and Oklahoma June 15, although technically that only applies to tax payments, whereas returns still had to be filed by April 15.

In Louisiana, the deadline is May 17, although residents living in federally declared disaster areas due to the February winter storm have until June 15.

Recommended Reading: Do You Pay Taxes On Roth Ira Withdrawals