Who Qualifies To Make Ira Contributions

Anyone who earns income can put money in an IRA. Couples can also put money in an IRA for a non-working spouse.

Each person can put up to $5,500 in an IRA if you are age 49 or below and up to $6,500 if you are age 50 or above for the 2018 and 2019 tax years, so long as your contributions do not exceed your earned income. Each year, you have until the April 15 tax filing deadline to make your IRA payment for the previous tax year.

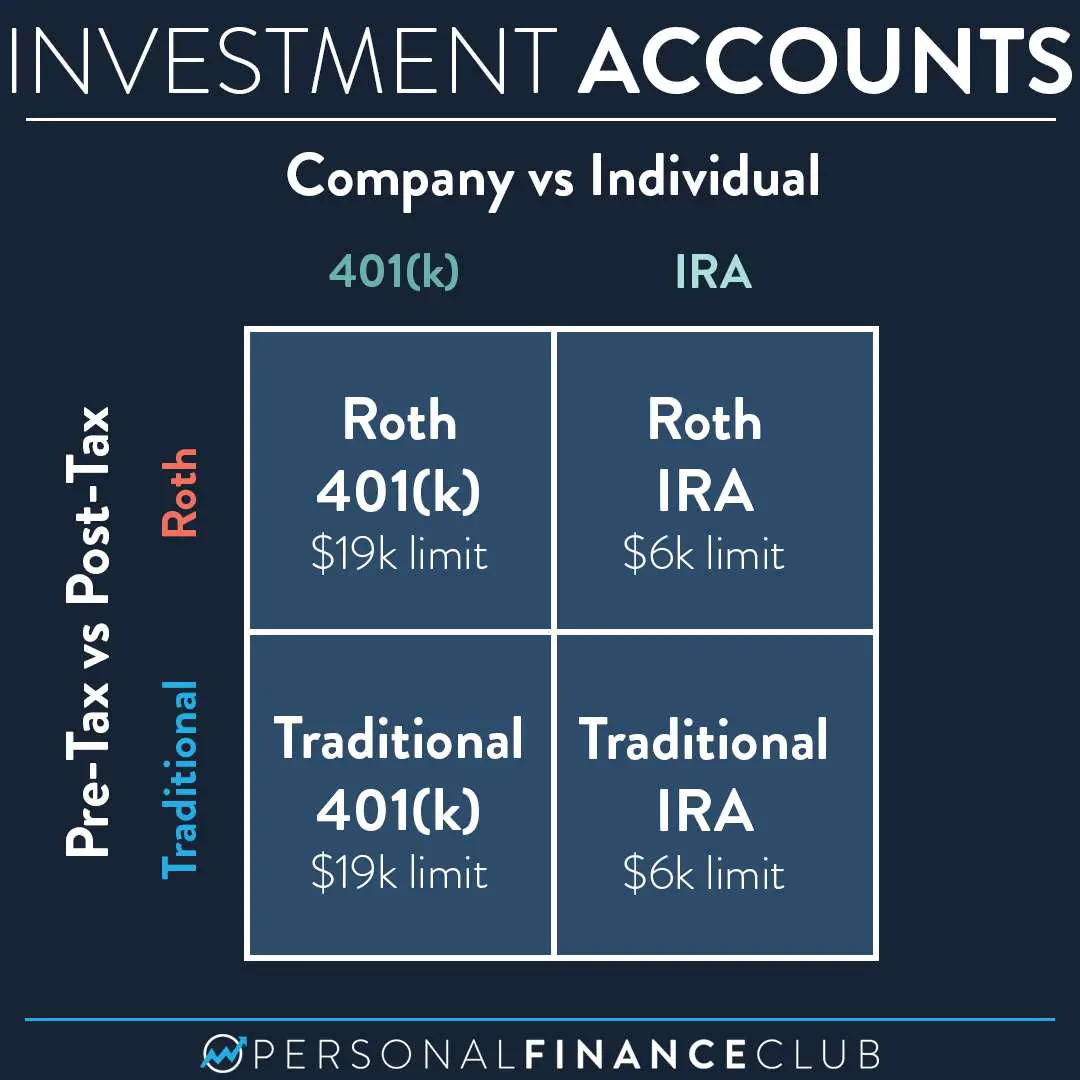

There are two main types of IRA traditional IRAs and Roth IRAs. In addition, those who are self-employed can put money in a SEP-IRA. Each has its own set of rules and offers different tax benefits. This article will deal with traditional and Roth IRAs.

Traditional IRAs are open to anyone up to the age of 70 1/2. Money in a traditional IRA grows tax-deferred. In other words, you wont have to pay taxes on any earnings until you take the money out. That allows your money to grow faster than it would if you had to pay income tax each year on those earnings.

What Are The Rules For Obtaining A Roth Ira Account

According to Troy Segal, single filers earning more than $144,000 cant be part of the Roth IRA.

Married couples earning more than $214,000 filing jointly, cant contribute to Roth IRA.

People who opened their Roth IRA accounts can deposit $6,000 annually.

If you are 50 or older, you may deposit a maximum of $7,000 a year.

Make sure your IRA account is different than a regular savings bank account.

Theres no robust coverage for IRA accounts. Nevertheless, you still have some options.

The Federal Deposit Insurance Corp. still offers insurance protection up to $250,000 for traditional or Roth IRA accounts, but account balances are combined rather than viewed individually, Troy Segal reported.

Tax Reporting When Making Non

When making after-tax contributions to an IRA, you must inform the IRS that you’ve already paid tax on those dollars. This is done using Form 8606. If you don’t report, track, and file the form, you’ll lose the ability to shield part of your IRA withdrawal from tax when you take the money out. In another words: you’ll pay federal income tax on the same dollar twice. This is the double tax trap.

Recommended Reading: Doordash State Id Number For Unemployment California

Income And Tax Deduction Limitations

The IRS limits the amount you can deduct each year, and this amount is subject to change each tax year. This maximum tax deduction may also be subject to a reduction when your MAGI is too high. The IRS provides a worksheet with your tax return instructions to help you calculate your deduction.

If you use tax software, such as TurboTax, you can avoid tedious calculations and let your computer calculate the deduction for you. TurboTax can help you determine whether your IRA contributions are deductible and will calculate exactly how much you can deduct.

Potential Advantages Of Pre

![Roth IRA Contribution Cheat Sheet [INFOGRAPHIC] Roth IRA Contribution Cheat Sheet [INFOGRAPHIC]](https://www.taxestalk.net/wp-content/uploads/roth-ira-contribution-cheat-sheet-infographic-inside-your-ira.jpeg)

- The account value may grow faster than a comparable taxable investment since the earnings in the account can grow tax-deferred.

- When you do pay taxes later, there’s a chance your investment and earnings will be taxed at a lower rate if your taxable income is taxed at lower rates than in your working years.

Read Also: How Much Are Taxes For Doordash

How To Calculate The Surrender Charge For An Ira

A traditional individual retirement account, or IRA, lets you make tax-deductible contributions. This means you can deduct the amount you contribute each year from your income taxes. In this way it differs from a Roth IRA, in which contributions are not tax deductive. With a traditional IRA, you pay tax on the amount, plus earnings, only when you begin to withdraw from the account. Since an IRA is an individual account that is not offered through an employer, you need to set up the contributions yourself.

Terminate A Payroll Deduction Ira

To terminate a Payroll Deduction IRA, notify your payroll organization that you will no longer be making this service available to your employees and that you want to terminate the contract or agreement with it. You should also notify your employees that the Payroll Deduction IRA has been discontinued.

You donot need to give notice to the IRS that you terminated your Payroll Deduction IRA. See Publication 3998 PDF or consult with your financial institution to determine if another type of retirement plan might better suit your needs.

Recommended Reading: 1040paytax.com Safe

A Traditional Ira Is An

A Traditional IRA is an Individual Retirement Account to which you can contribute pre-tax or after-tax dollars, giving you immediate tax benefits if your contributions are tax-deductible. With a Traditional IRA, your money can grow tax-deferred, but youll pay ordinary income tax on your withdrawals, and you must start taking distributions after age 72. Unlike with a Roth IRA, there are no income limitations to open a Traditional IRA. It may be a good option for those who expect to be in the same or lower tax bracket in the future.

Contributing To A Pretax Ira & 401 Plan In The Same Year

In general, if you have access to a 401 plan at work and want to make pretax IRA contributions in that year, the amount of income you earn will essentially govern your ability to make pretax IRA contributions.

| Single | |

| More than $10,000 | $6,000 + $1,000 more if youre 50+ |

In sum, if you earn more than $208,000 and are married and file jointly and have access to a 401 plan at work, you will not be able to make pretax IRA contributions. That number drops to $76,000 if you are single.

Even if you dont qualify for a deductible contribution, you can still benefit from the tax-deferred investment growth in an IRA by making a nondeductible contribution. If you do that, you will need to file IRS Form 8606 with your tax return for the year

Recommended Reading: How Do You Pay Taxes On Doordash

How Do You Report An Excess Ira Contribution

You dont have to report it to the government if you accidentally exceed your IRA contribution limit, and you catch your error before you file your tax return for that tax year. You can simply contact the financial institution that holds your IRA and ask them to withdraw the excess amount. But youll have to claim the income on your 1099 if your contributions were invested and gained value while in your IRA. This could come with a 10% penalty tax if youre younger than age 59 1/2.

Tips For Opening An Ira Before The Tax Deadline

Just because Tax Day might be on the horizon doesnt mean its too late to dig up some extra savings on your taxes. Contributing to a traditional IRA for the current tax year is an easy way to score an additional deduction or a credit, both of which can cut your tax bill or pump up your refund, while also increasing your retirement savings. If youre thinking of opening an IRA ahead of the filing deadline, there are a few things to keep in mind. For more help with retirement planning, consider working with a local financial advisor.

Don’t Miss: Payable.com Doordash

Examples Of How You Can Contribute To Both Plans

Lets look at an example of how you can combine the power of the 401ks and IRAs to speed up your retirement savings.

Example #1: Consider a 30-year-old earning $55,000 per year. Her first priority should be saving at least enough in her workplace retirement plan to earn the full employer match, which in her case is 50% of the first 6% saved .

In this case, shes saving nearly $5,000 in tax-deferred funds in her 401k . However, perhaps shes anticipating earning far more in the near future and wants to sock away some after-tax money while shes still in a relatively low tax bracket. She could save an additional $6,000 in a Roth IRA. That brings her total annual contributions to $10,500, all of it growing in tax-advantaged accounts.

Example #2: Next, consider a married 55-year-old woman earning $300,000 per year. Say shes maxing out her workplace 401k at her $19,500 yearly contribution limit. Because shes over 50, she also gets to make a catch-up contribution of $6,500 to her 401k. Luckily, her work matches contributions one-for-one up to 6% of her salary which means another $18,000 in her 401k, for a total of $44,000 that is pre-tax and will grow tax-deferred.

While she can also contribute $7,000 to a traditional IRA, her contributions will be nondeductible given her modified AGI level. The savings will still grow tax-deferred, so she decides its still a worthwhile retirement savings vehicle to pursue, despite the fact that its tied up for the next 4.5 years.*

Topic No 309 Roth Ira Contributions

A Roth individual retirement arrangement is a tax-favored account or annuity set up in the United States solely for the benefit of you and your beneficiaries. You can contribute to a Roth IRA if you have taxable compensation and your modified adjusted gross income is within certain limitations. Regardless of the amount of your adjusted gross income, you may be able to convert amounts from either a traditional, SEP, or SIMPLE IRA into a Roth IRA. You also may be able to roll over amounts from a qualified retirement plan to a Roth IRA. Contributions made to a Roth IRA may be able to be recharacterized as a contribution made directly to another type of IRA. However, conversions after 2017 from a traditional, SEP, or SIMPLE IRA to a Roth IRA may not be recharacterized. In addition, amounts rolled over after 2017 from a qualified retirement plan to a Roth IRA may not be recharacterized. Refer to Topic No. 413 for information about rollovers. A Roth IRA differs from a traditional IRA in that contributions arent deductible and qualified distributions arent included in income.

You May Like: Efstatus.taxact.xom

Ira Deduction Limits For 2021

If you save with both a 401k and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income. Contributions to a Roth are never deductible.

For instance, if you are covered by a retirement plan at work:

- You can deduct up to the contribution limit, if youre single and your modified AGI is $66,000 or less for 2021. You can take a partial deduction if your income is between $66,000 and $76,000 in 2021. Theres no deduction for people who earn more than $76,000 in 2021.

- If youre married and filing jointly, you can deduct the full amount if your modified AGI is $105,000 or less in 2021. You can take a partial deduction if your income is between $105,000 and $125,000 in 2021. Theres no deduction if you earn more than $125,000 in 2021.

Deducting your contributions is always an added bonus, but keep in mind even that if youre above the limit to make a contribution and reduce your taxes, there are alternative and potentially better strategies to explore than the nondeductible Traditional IRA.

Contributing To A Roth Ira & 401 Plan In The Same Year

With Roth IRAs, which provide no upfront tax benefit, it doesnt matter whether you have an employer plan. How much you can contribute, or whether you can contribute at all, is based on your tax-filing status and your income for the year.

This table shows the current income thresholds:

| Tax-filing status | |

| More than $208,000 | $6,000 each + $1,000 more if youre 50+ |

In sum, Roth IRA contributions are limited to those who earn less than $140,000 and are single or $208,000 and are married and file jointly in 2021. Although, there is a workaround known as the backdoor Roth IRA.

Also Check: How To Take Taxes Out Of Doordash

What Are The Contribution Rules

- Employees fund their own Payroll Deduction IRA through an after-tax deduction from their paycheck.

- After an employer forwards the payroll deduction to each employees IRA account at the financial institution, they have no further responsibility for the amounts contributed.

- Contributions to each employee’s IRA are limited.

Investments:

- Each employee chooses how to invest their IRA and can roll it over to another IRA.

- The financial institutions selected will manage the funds.

- Payroll Deduction IRA contributions can be invested in stocks, mutual funds, money market funds, savings accounts and other similar types of investments.

Create A Payroll Deduction Ira

Establish a relationship with a bank or brokerage to provide payroll deduction IRAs for your employees. You can decide to have just one provider or designate several IRA providers to give your employees more options. You must disclose the providers costs, such as annual fees, transfer fees and trading fees, so they can make an informed decision.

Recommended Reading: Does Doordash Take Taxes Out For You

Saving For Retirement And Securing A Healthy Financial Future Is One Of The Essential Components Of Personal Finance

When it comes to saving for retirements, the most popular vehicles are employer-sponsored retirement plans, like 401s, 403s and Individual Retirement Accounts .

For those who do not have access to a 401 or 403 account through their employer, IRAs seem like straightforward accounts where you contribute the yearly maximum, and you wait for the magic of compound interest to do its work and grow your investment over time.

There are two primary types of IRA, traditional and Roth , and the common conception is that you contribute to a Roth IRA when you are younger to take advantage of the tax savings. You switch to a traditional IRA later on as your income increases.

Today, we will describe how IRAs work and how combining traditional, Roth, and SEP-retirement accounts can provide the highest return on your savings.

IRAs

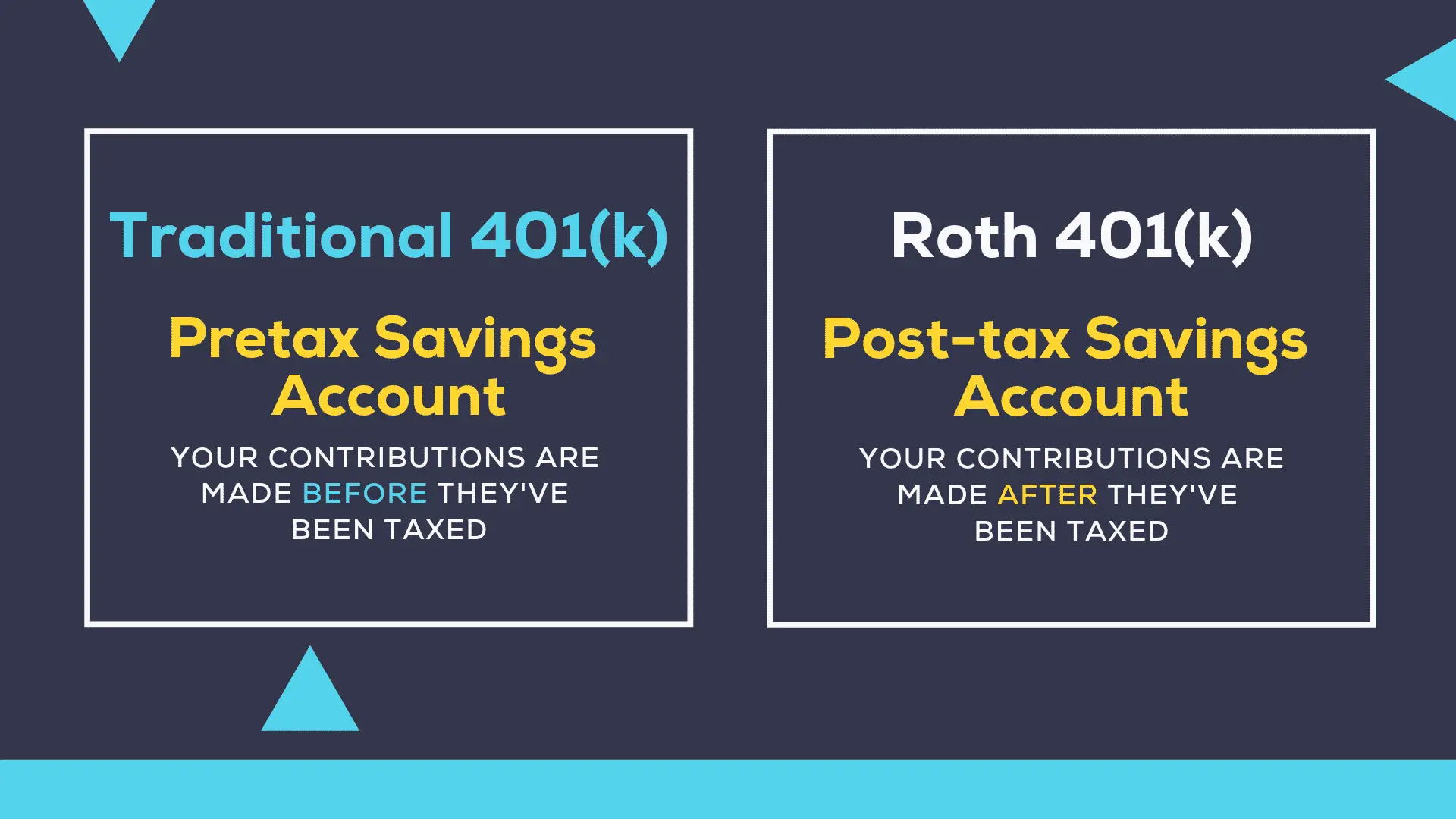

Traditional IRAs are considered pre-tax vehicles, which means your contributions and capital gains are not taxed until you begin withdrawing money from your account during retirement.

The advantage of deferring taxes until later is that you can initially contribute a more considerable amount of pre-tax dollars, leading to higher compounding.

Traditional IRAs have an annual contribution limit of $6,000 if you are under 50 years old and $7,000 if you are 50 or older to help you catch up.

Who should consider contributing to a Traditional IRA?

Roth

Who should consider contributing to a Roth IRA?

Simplified Employee Pension

Who should consider contributing to a SEP?

Additional Tax Traps To Consider Before Making Non

- State tax laws. The focus of this article is on the federal income tax, but it’s important to remember that states can have their own rules. Massachusetts, for example, does not follow the federal rules on tax deductible contributions or recovering âbasisâ on distributions. LeVangie says, “In Massachusetts, all IRA contributions are treated as after-tax additions, which gives you âbasisâ in your IRA that may be different than reported on the federal Form 8606, and your distributions will be completely tax free up until your âbasisâ is recovered for MA purposes . This is completely at odds with the federal reporting and can cause a lot of confusion and extra tax paid if not tracked and reported properly.”

- The same hazards apply to inherited IRAs. If your beneficiaries are unaware that you’ve made non-deductible IRA contributions, or can’t find the records, they have no way of excluding any of the distribution from tax.

Recommended Reading: Doordash Taxes Percentage

It’s About More Than Just Taxes

Instead of being funded with pre-tax contributions, Roth IRAs are retirement accounts that you fund with after-tax dollars in exchange for tax-free distributions. Distributions from pre-tax contribution plans, like a traditional IRA or 401k, are taxable.

The contribution type that works best for you depends on what plans your employer offers, how much you can contribute, and tax rates. Heres how you can compare the two options.

A Roth Ira Can Be A Great Way To Save For Retirement Since The Accounts Have No Required Minimum Distributions And You Withdraw The Money Tax

Tax-free income is a dream of every taxpayer. And if you save in a Roth account, its a reality. Roths are the youngsters of the retirement savings world. The Roth IRA, named after the late Delaware Sen. William Roth, became a savings option in 1998, followed by the Roth 401 in 2006. Creating a tax-free stream of income is a powerful retirement tool. These accounts offer big benefits, but the rules for Roths can be complex.

Here are 11 things you must know about utilizing a Roth IRA as part of your retirement planning.

Don’t Miss: Efstatus.taxact 2013

The Tax Advantages Of Ira Retirement Accounts

A traditional IRA and Roth IRA both have tax-advantages to help you reduce your taxable income. Here’s what you need to know about each:

Traditional IRA: Contributions you make today are made pre-tax, meaning that you’re deferring paying taxes on some of your income until you withdraw the money. Because you’re depositing money pre-tax, you will earn a tax deduction today. However, when you decide to withdraw the money , you’ll pay ordinary income tax. Be aware that while you can contribute to both a 401 and traditional IRA at the same time, you may not be able to take a tax deduction for contributions to IRA.

Roth IRA: Contributions you make today to a Roth IRA are post-tax, meaning that you’ve already paid taxes on the money you’re depositing. However, once you’ve had the account for five years and one of the below life events happen, you can withdraw all of the funds tax-free:

- You reach at least 59 ½ years old

- Are permanently disabled

- Use the money for a first-time home purchase.

And the best part of either a traditional or Roth IRA is the fact that your money can compound over time.

So if you decide to contribute to a traditional IRA, be sure to claim your contributions when you file your taxes with a service like TurboTax or H& R Block. These tax programs can help you maximize deductions and increase your refund.

-

Costs may vary depending on the plan selected

-

Free version

For simple tax returns only. See if you qualify.

-

Mobile app