Submit A Sponsored Guest Post: Technology Write For Us Technology Business Tips Ai Vr Ml Gadgets Managed Services Online Marketing Seo Health And Travel

Thanks for visiting on Dipolito One of the best guest blogging site with high-quality content and domain authority. At Dipolito, we provide an opportunity to write for us, for the people who are crazy about writing and has great writing skills.

Here are the details which you may find useful to collaborate with us for Guest Posting. Explore the guest posting requirements, the procedure to submit a guest post to us.

Types of Articles and Categories We Welcome

We appreciate your exploration and interest to Write for us technology as a Guest Blogger on the topics related Technology, Mobiles, Apps, Gadgets, Reviews & Ratings, Marketing, Business, Technology News & Updates and Digital Trends.

Vita And Tax Counseling For The Elderly

These twin programs offer free tax return preparation and counseling to qualified individuals.

VITA offers free tax help to people who generally make $58,000 or less, those who have disabilities, and people with limited English proficiency.

The TCE program offers help for those who are 60 years of age and older, and specializes in pensions and retirement-related issues, according to the IRS. Find a full list of the tax services these programs provide.

Important RemindersMake sure to bring these important documents: Photo ID, Social Security cards for you, your spouse, and dependents. Wage and earning statements from all employers. Interest and dividend statements from banks . Health insurance exemption certificate, if received. A copy of last years federal and state returns, if available. Proof of bank account routing and account numbers for direct deposit such as a blank check. Total paid for daycare provider and the daycare providers tax identifying number such as their Social Security number or business employer identification number. Forms 1095-A, B, and C, health coverage statements, and copies of income transcripts from IRS and state, if applicable, according to the IRS.

Both spouses must be present to sign the required forms when filing taxes electronically on a married-filing-jointly tax return.

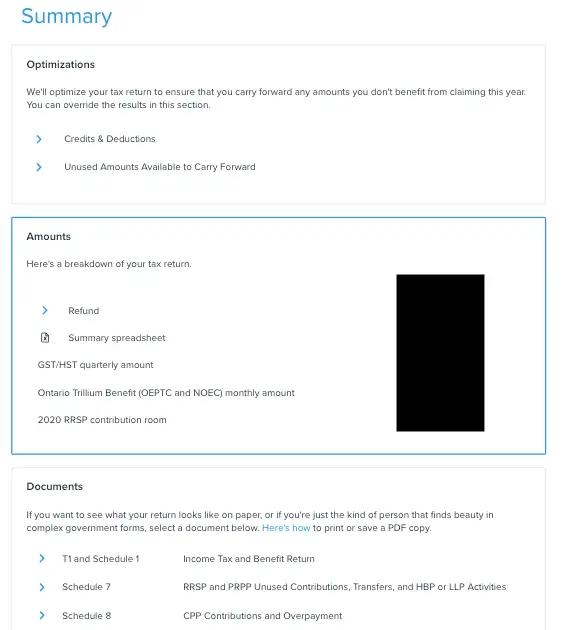

File A Digital Return Yourself For Free

Anyone who wants to file their own taxes digitally can do so for free using the IRS Free File System. If you earn $73,000 or more, it allows you to download a digital version of the 1040 tax form that you can fill out yourself and file digitally to the IRS, free of charge. No need to go to the Post Office to get the paper version.

But be prepared: Though the digital version performs some basic calculations, youll have to do the rest of the math yourself. And at this income level, youre not eligible for free tax help.

Also, check with your state tax office to see if it has any free digital services.

Important RemindersIts easiest for simple returns. While there are many free digital forms available to download, most taxpayers will only need a 1040, which is straightforward if youre reporting a simple tax return composed mainly of income, without itemized deductions.

Youll need to create a new Free File Fillable Forms account, even If you used the program in previous years. This account is separate from your irs.gov account, which you dont need to update.

How to Find ItGo to the Free File webpage on the irs.gov website and click the Use Free File Fillable Forms button. > > Review the information on the page and, when ready, click on the Start Free File Fillable Forms button. > > This will bring you to a page where youll be given even more important information to review.

You May Like: How To File State Taxes For Free

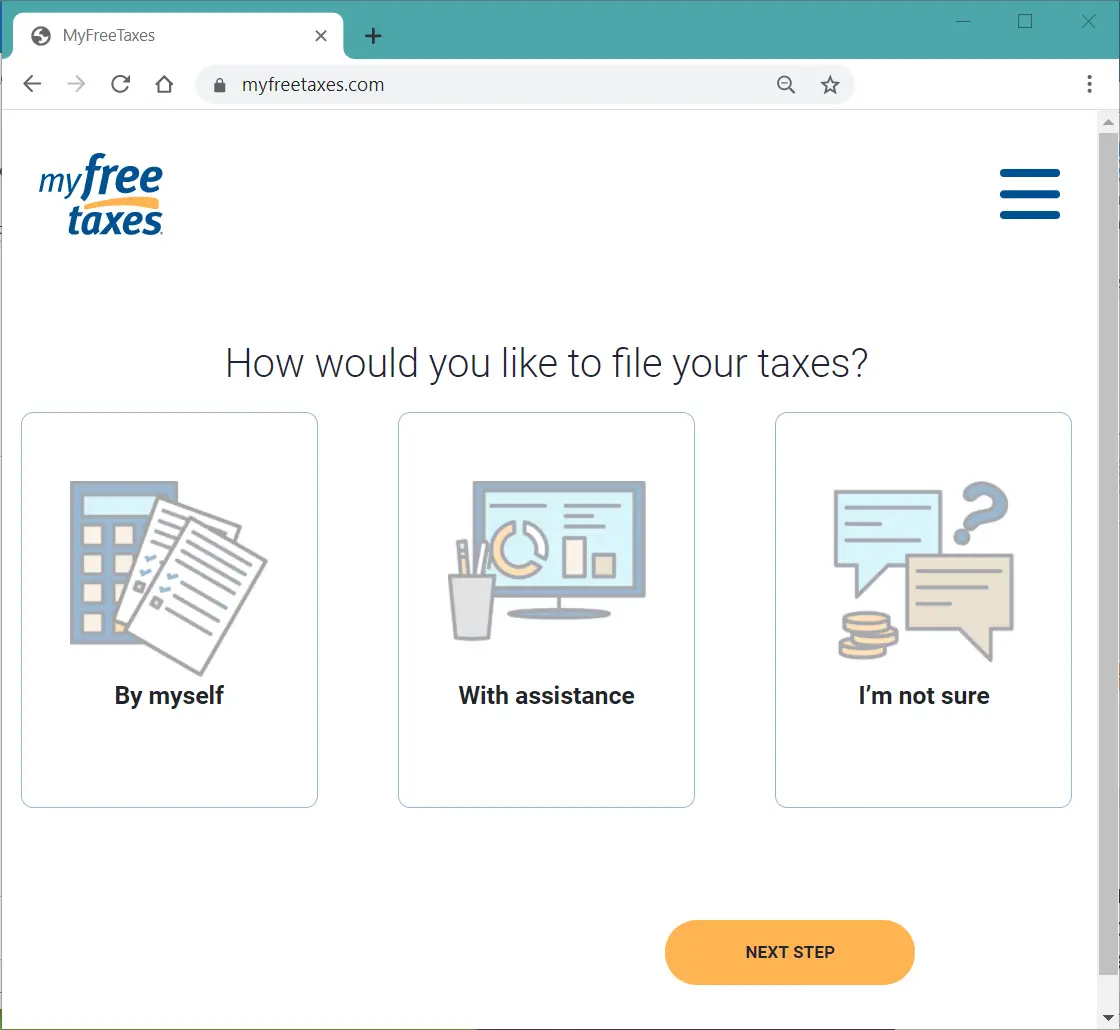

Consider A Free Online Tax

When doing your own taxes, you could do it by hand and mail in your return, or you could choose to e-file. For speed, accuracy and convenience, its hard to beat e-filing. Plus if you pair e-filing with direct deposit, youll probably get your refund faster than filing paper forms by mail.

Plenty of software providers and online services provide e-filing. Some may advertise free filing, but often theres a catch. Some allow you to file your federal return for free but then charge you for the state return. Some allow you to file for free if you take the standard deduction but charge you if you want to itemize. And some may even charge you if you have income reported on forms other than W-2s.

There can be many caveats to free filing software, so its important to understand what fees you might end up paying.

Also Check: Irs How To File Taxes

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Don’t Miss: What Is The Penalty For Filing Income Tax Late

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

Are There Other Factors That Will Complicate My Tax Return

Multiple streams of income arent the only things that can make your tax filing process more complex. If you own property, have investments, or can claim dependents, those things will all change your tax return.

Additionally, if any of the following situations apply to you, youll definitely want to work with a tax professional:

- You own your own business or are self-employed: If youre a business owner or self-employed individual, your taxes will automatically be much more complicated. There are also little known write-offs that could save you money if you work with a tax professional.

Plus, online filing services charge much higher rates for self-employed individuals and business owners, so its probably more cost effective to hire a tax accountant anyway.

Recommended Reading: What Is Wotc Tax Credit

Also Check: Where Can I Find My Tax Return From Last Year

What Should I Expect When Filing Taxes Online

Filing taxes online should be a quicker process than completing your return by hand. If you have a simple tax situation, you shouldnt expect to spend a long time preparing your tax return.

For example, if you only have W-2 income and claim the standard deduction, your tax return shouldnt take long to prepare, review, and e-file.

On the other hand, if you have a more complex tax situation, you may still need to enter a good amount of data manually, especially if you are itemizing your deductions or claiming certain tax credits.

For example, if you have several investment and bank accounts, work for yourself, have rental property, claim tax credits, or need to account for the Alternative Minimum Tax , your tax return may take a while longer to prepare.

Tax software can assist with handling these finer details and also provide objective explanations on the impacts of taking certain tax positions. Should you need help, several tax software packages offer to connect you with a qualified tax professional to answer questions, guide you through preparing your return, and check for any missed deductions or credits you might qualify for.

Documents You Need To File Your Taxes Online

Start by gathering all the required financial paperwork youll need to file. This includes any W-2 forms youve received from employers you worked for in the past year, as well as any Form 1099s you received for work with clients as a self-employed worker or for miscellaneous income you earned.

Other paperwork you may have and would need for your tax return includes interest you earned on bank accounts , investment income , student loan interest paid , mortgage statements of interest paid and information on contributions youve made to an IRA or a health savings account . While you can gather all the required paperwork for your tax return as you move through the e-filing process, collecting this information early can save you time later on.

Recommended Reading: Does Wyoming Have State Income Tax

What Are The Objectives Of The Free File Agreement

- Provide greater access to free, online tax filing options with trusted partners only through IRS.gov

- Make federal tax preparation and filing easier for and reduce burden on individual taxpayers, and

- Continue to focus free governmental services for those least able to pay for tax preparation services

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: What’s The Deadline For Filing Taxes

How To File Your Taxes

Whether you’re filing your taxes for the first or the 50th time, it’s always a good idea to gather your tax information early so you can prepare your return and file faster.

The IRS offers two methods for filing your taxes: electronically or through the mail. E-filing has grown to be the most popular method to file, representing over 90% of all returns received by the IRS for 2020 tax returns.

The IRS has stated that e-filed returns are more accurate and they avoid processing delays and speed up refund delivery. Despite this, roughly 10% of the population still chooses to file taxes the old-fashioned way: through the mail.

Regardless of your preference for filing your taxes, the basic process is the same:

Below breaks down each step necessary for filing taxes online, starting with the forms you need.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Don’t Miss: How To Find W2 Tax Return

File Early And Sign Up For Direct Deposit

If you think you may be getting a tax refund for 2021, theres more of an incentive to prepare your taxes and e-file early. The sooner you file, the sooner youll get your refund, and you know what this means more money in the bank. If you want your cash as fast as possible,make sure you choose direct deposit. Its the safest and easiest way to get your funds.

The IRS states that choosing to receive your tax refund through direct deposit gets you your refund in 21 days or less, while a check can take up to 2 months to arrive at your door. TheIRS pays out refundsbased on a schedule that actually prioritizes e-filed returns and direct deposit refunds. To be a part of that group, sign up with the IRS for a direct deposit payment straight into your bank account. You can do this when you file your tax return electronically.

Filing your taxes online is instant, unlike mailing in a paper tax return, which takes time to reach the IRS. After you file your taxes online, youll get a notification from the IRS saying that it was successfully received or that an error occurred. Again, if youre owed a tax refund, you will receive your money through direct deposit or a paper check. Remember, direct deposit is quicker and eliminates the risk of your money getting lost in the mail.

Did you know?

You can get your federal tax refund up to 5¹ days early when you direct deposit with Chime and file directly with the IRS. Learn More

What Is An Electronic Filing Identification Number

An electronic filing identification number is a number assigned by the IRS to preparers who are approved for the federal and state e-file program.

Once issued, an EFIN does not expire. However, if you change your Employer Identification Number or the name of your firm, you will have to either get a new one or update it through the online portal.

Its important to note: everybody who prepares taxes needs a PTIN. However, only your firm needs an EFIN. One per firm or per physical location is usually required.

To put even more simply: you need a PTIN to prepare and an EFIN to e-file.

Recommended Reading: How Much Is Tax In Alabama

Read Also: How To Pay Your Taxes Owed

What Our Client Says

Mr. Pargat Singh

Jas is straightforward, honest and polite guy and always cordial and willing to help with best of his knowledge. I enjoyed working with him from last 10 year.

Inderpreet

Best Accountant. Spectacularly Friendly .Takes Care of Our Personal and Bussiness Accounts. Gives the most helpful advice. I would defenitly recomend him as your accountant.

J. Jose

Very efficient and professional Person. Jas is very knowledgeable and has great experience in many areas of tax. Great customer service. He is just Awesome with his service. I highly recommend it.

What To Do If You Made More Than $72000

If your gross annual income was more than $72,000 in 2020, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option. You won’t be able to do much preparation in advance, however the program opens on Feb. 12.

Don’t Miss: How Much Is Sales Tax In Florida

Where To File Taxes For Free

If your tax situation is straightforward enough or if you qualify for free tax filing with guided preparation from the IRS, you should take advantage of it! Head to the IRS Free File site to get started.

Heres how it works for the 2022 tax year:

Note: The adjusted gross income threshold is $73,000 for the 2022 tax year, regardless of whether your filing status is single or married filing jointly.

File With Approved Tax Preparation Software

If you don’t qualify for free online filing options, you can still file your return electronically with the help of commercial tax preparation software. View approved software options.

To file on paper, see Forms and Paper Filing below. If you do choose to file on paper, please note that, due to COVID-19 workplace protocols and mail delays, it will take longer for us to process your return.

Also Check: How To Submit Payroll Taxes

Can I Import Tax Forms

Online tax software has streamlined the ability to prepare your tax return by having you input your unique tax information through intuitive question and answer prompts, on-screen guidance, access to a tax professional, and convenient e-filing with the IRS.

Tax software allows you to import your tax information directly onto your return without needing to handle physical forms or manually enter the data.

You can import tax forms like:

- W-2 from your employer

- 1099-B, 1099-DIV, 1099-OID, 1099-INT or 1099-R forms from brokerages where you invest or institutions where you bank

- 1099-NEC forms from companies you work for as a self-employed person

- 1099-MISC forms for non-employment related payments or income

TurboTax Tip: When selecting the financial institution for importing your tax forms, be sure to select the right company from the list. For example, several participating partners’ names may start with First National Bank. Select your specific bank to ensure your details can be found.