What Is Irs Free File

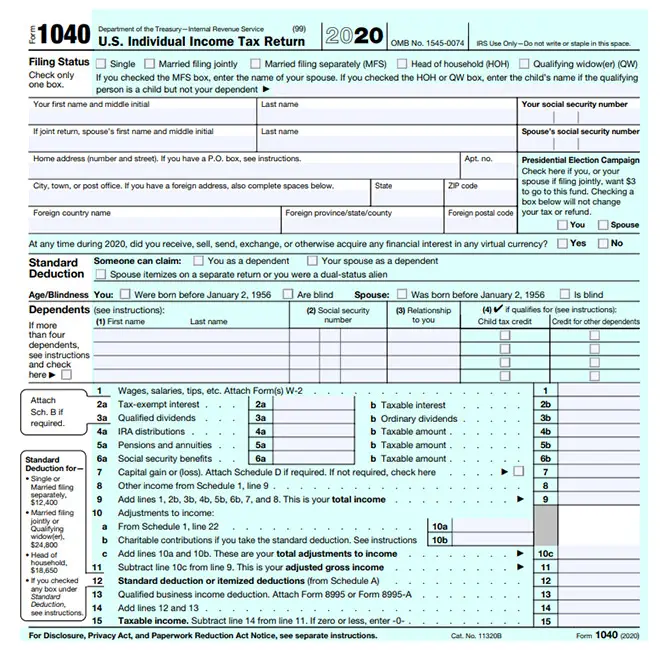

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

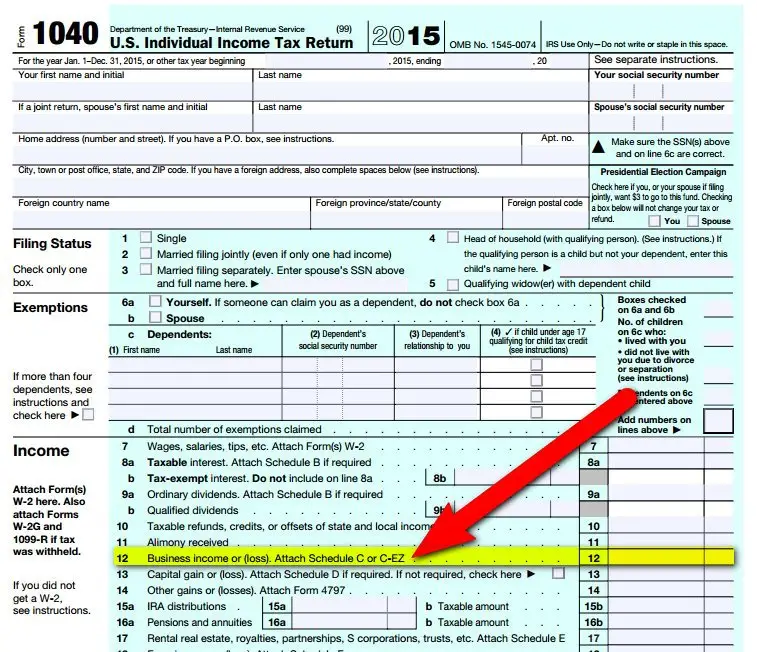

Other income

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

How Do You File Taxes If You Own Multiple Businesses

Whether you own one or multiple businesses, the steps for calculating your business income are usually the same. When you own one business, you only need to perform these steps once. When you own multiple businesses, you need to do this for each business, typically resulting in separate business tax returns. That means if you own three businesses taxed as S corporations at the federal level, youll need to file three separate tax returns for them , create three sets of Schedule K-1s, and then report the K-1 information on your personal tax return.

TurboTax Tip: Keeping separate bank accounts, credit cards and accounting records for each business can help you stay organized during tax time. Having these accounts listed under each business name makes it easier to keep track of your business performance.

Read Also: Are You Required To File Taxes

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

How Business Taxes Work

There are various forms of business structures. These are mostly organized at the state level, meaning each state may use different regulations, and some business structures are largely ignored at the federal level.

The IRS recognizes two main categories of business structures for business tax purposes pass-through entities and C corporations. The primary difference is that pass-through entities pass along all of their income to their owners to be taxed as the owners’ income, while C corporations pay taxes at the corporate level.

Pass-through entity structures include sole proprietorships, partnerships, and S corporations. In addition to these business types, there are Limited Liability Companies or LLCs, which are one of the most popular business structures. Despite their popularity, the IRS mostly ignores LLCs for tax purposes. The formation of business structures is controlled at the state level and the IRS has chosen not to create a separate tax structure for LLC taxes.

Instead, LLCs have choices on how they are to be taxed. These include being taxed as a Sole proprietorship , partnership , S corporation or C corporation .

You May Like: When Does Tax Return Start 2021

Irs Rules Regarding Your Age

As the table above indicates, individuals younger than age 65 must file if they make certain amounts. The earnings threshold amounts go up a bit for individuals 65 and up.

For married couples that file separate tax returns, the earnings target is based on the age of the older spouse.

In most situations, your age for tax purposes depends on how old you were on the last day of the year. But when it comes to determining whether you have to file a return, the IRS says that if you turned 65 on New Years Day, you are considered to be 65 at the end of the previous tax year. The one-day grace period allows you to use the higher-income thresholds to determine whether you must file a tax return.

How To File Business Taxes

When you file a federal income tax return for your small business, the way that you do it depends on how youve structured the business. If you run it as a sole proprietorship or single-member limited liability company , youll typically report all of your income and expenses on Schedule C or Schedule F if its for farming. If you run your business as a pass-through entity like a partnership or S corporation, or as a C corporation that pays its own taxes, youll need to use different tax forms to report your business income and expenses.

Pass-through entities use a tax form called Schedule K-1 to report a partners or shareholders share of the profits, losses, and other income of a partnership or S corporation. These are called pass-through entities because they pass these financial items through to the owners using Schedule K-1. They dont generally pay taxes themselves. Each partner or shareholder typically needs to receive a Schedule K-1 from the business to report their share of these items and then to include with their tax return. This is reported on Schedule E for an individuals tax return filed on Form 1040. An S corporation prepares Form 1120S, while a partnership prepares Form 1065 as their annual tax return.

C corporations aren’t pass-through entities because they pay taxes at the corporate level and typically don’t affect the owners tax return unless the corporation pays out dividends or interest to the owner.

Don’t Miss: How Much Is Capital Gains Tax In Pa

What Is An Ip Pin And Do You Need One

Identity theft has become a serious problem and fraudsters have used stolen identities to file false tax returns and claim refunds before the rightful filers can do so. Even childrens Social Security numbers are being targeted.

The Internal Revenue Service created an Identity Protection Personal Identification Number Opt-In Program to protect taxpayers whose identities had been stolen. Although the program was initially for victims of identity theft, it is being expanded in phases to all taxpayers. The IP PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. An IP PIN is used only on Forms 1040, 1040PR and 1040SS.

There are a number of reasons for signing up for an IP PIN, but also some drawbacks. Data breaches have become prevalent and most of us have our personal information stored somewhere online, which means we risk having that information leaked or stolen. The IP PIN offers a greater level of security when it comes to protecting people from tax-related crimes. The IP PIN is an important tool as it will thwart tax-related identity theft, preventing many of the problems that come with identity theft. If your identity is stolen, the IRS flags your account for the next three years, resulting in slower processing of your tax return and a delayed refund if one is due.

Recommended Reading: How Much Of Your Taxes Are Returned

Can I File My Taxes Online For Free

Yes, and yes. If your return is simple, TurboTax will connect you directly to the CRA through NETFILE, a system that lets you input your tax details and file your return digitally.

A simple return may include a number of common scenarios. Heres a list.

- Employment income

- Caregiver tax credit

- COVID-19 benefits & re-payments

As well, it can also involve additional benefits and credits like the age amount, social assistance, and disability amounts.

Maybe your return is more complicated. Items like claim donations, interest-based income, investment and employment expenses, or anything related to self-employment, may require more expertise.

The good news is you can use one of our other tailored products, like TurboTax Deluxe, Premier, and Self-Employed. Whatever your unique tax situation, we have the product to help you file to perfection.

This year, all of TurboTaxs product options are free for those 25 and under.

This includes all our product options at all levels of assistance, from doing your taxes yourself to using our Live Assist & Review and Full Service options. Well automatically direct you to the service that suits your level of tax complexity so you can file with accuracy and peace of mind.

You May Like: What To Do If State Taxes Rejected

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out what’s new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

Filing Taxes In Canada

Social Insurance Number in-person clinics

On Mon, Jan 9 and Thurs, Jan 12, 2023, from 9:30 am to 2:30 pm PT, Service Canada will be on campus to issue Social Insurance Numbers on the spot exclusively for UBC Vancouver students. This can save you a long commute to the nearest Service Canada office and is faster than the current 15-day processing time for online applications.

Read Also: Can I File Taxes If I Have No Income

The Best Time To File Your Tax Return

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Many things in life come down to timing, and tax returns are no exception. Wait too long, and you could miss the filing deadline, setting you up for interest charges or even penalties. Its always a good idea to file by the tax deadline, but you might be able to save money, beat crime or realize other advantages if you file during other parts of tax season. It all depends on your objective.

Also Check: How Much Do You Need To Donate For Tax Deduction

Filing Electronically And Choosing Direct Deposit Is The Fastest Way To Get Your Refund And Stimulus Payments

If I could give you one important piece of advice for filing your taxes, it would be to file electronically and choose direct deposit for your refund. The best way to file a complete and accurate return is to file electronically. The tax software asks questions about your income, credits and deductions and will help figure your Recovery Rebate Credit. If you want your refund as soon as possible, filing electronically and having your refund sent via direct deposit is the fastest and safest way to receive your money.

If you dont have a bank account, visit the FDIC website or the National Credit Union Association using their for information on where to find a bank or credit union that can open an account online and how to choose the right account for you. If you are a veteran, see the Veterans Benefits Banking Program for access to financial services at participating banks.

So, if you havent filed taxes recently because you thought you didnt have to, I hope Ive given you a closer look into why it might be a great idea to file in 2020. Its something that can be done electronically using a smartphone. Plus, with our helpful online resources and free filing assistance for certain taxpayers, its easier than ever to file electronically and see if youre due a refund. If youve already filed, thank you. Tell your friends and family so they dont lose the money theyre entitled to visit the filing information section of IRS.gov today!

You May Like: What Is The Tax Assessed Value Of My Home

Why You Should Consider Filing A Tax Return Even If Youre Not Required To File

Filing a tax return is probably not something most people enjoy doing. So why would anyone want to file a tax return if they don’t have to? Well, actually, there are some important reasons you might get a tax refund and you may be eligible for an additional stimulus payment. If youre eligible for future payments or credits, it helps if IRS has your 2020 tax return and direct deposit information on file.

While people with income under a certain amount aren’t required to file a tax return because they won’t owe any tax, if you qualify for certain tax credits or already paid some federal income tax, the IRS might owe you a refund that you can only get by filing a return. Some tax credits are “refundable” meaning that even if you dont owe income tax, the IRS will issue you a refund if youre eligible. Many people miss out on a tax refund simply because they dont file an IRS tax return.

There is usually no penalty for failure to file if you are due a refund, but why miss out on money thats rightfully yours? If, however, you wait too long to file your return and claim a refund, you risk losing it altogether. Thats because an original return claiming a refund must generally be filed within three years of its due date. If you havent filed a tax return for tax year 2017 and had any money withheld from your paychecks or are eligible for tax credits, you need to file by May 17, 2021. If you dont, the money is forfeited, by law, and becomes property of the U.S. Treasury.

Expense Receipts For Credits And Deductions

The CRA offers a variety of credits and deductions to those eligible, which help you reduce your tax owed. Throughout the year, make sure you keep all relevant receipts, bank records, and any other supporting documents as proof of your expenses.

Here are some of the common receipts you should have handy when you start filing your 2022 tax return:

Work-related Expenses

- Receipts for classroom/school supplies

Depending on your province of residence, you may also need a few other amounts for certain provincial credits such as rent receipts, property tax, or childrens fitness and arts expenses.

Does CRA need original receipts?

When filing a tax return its important to keep all your receipts and documents in case the CRA requests to see them at a later time. Also, note that the CRA requires that you keep the original copy of your paper documents.

Recommended Reading: What’s The Sales Tax In Florida

Why Should I File A Tax Return If I Don’t Have To Pay Tax

If you have to pay tax or have earnings on which CPP contributions must be paid, you must file a tax return. You must include your worldwide earnings in your taxable income. You will usually have to pay tax if your taxable income exceeds the amount of the basic personal exemption. See the tables of non-refundable tax credits for amounts for federal and provincial/territorial basic personal exemptions and other tax credits. If you have net self-employment income or pensionable employment income in excess of $3,500, you may have to remit CPP contributions.

There are other circumstances which may require a tax return to be filed:

You were requested by Canada Revenue Agency to file a return. You have disposed of during the tax year, or even your principal residence . You claimed a on your previous year’s tax return. You have withdrawn amounts from your RRSP under the or the Lifelong Learning Plan, and have not yet repaid the entire amount.

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

Don’t Miss: How Do You Have To Make To File Taxes