House Ways And Means Member Says Trump’s Taxes Underscore The Fact That Our Tax Laws Are Often Inequitable And That Enforcement Of Them Is Often Unjust

Democratic Rep. Don Beyer, a member of the House Ways and Means Committee, released a statement on Friday after the release of the returns saying the materials were “lawfully obtained” by the committee through the “IRS tax enforcement, including the presidential audit program.” He also noted that the report released last week showed “this program was broken” and justified “our legislative purpose,” which he said led to the passage by the House of a bill to bolster the IRS mandatory presidential audit program last week.

“Despite promising to release his tax returns, Donald Trump refused to do so, and abused the power of his office to block basic transparency on his finances and conflicts of interest which no president since Nixon has foregone,” Beyer said. “Trump acted as though he had something to hide, a pattern consistent with the recent conviction of his family business for criminal tax fraud. As the public will now be able to see, Trump used questionable or poorly substantiated deductions and a number of other tax avoidance schemes as justification to pay little or no federal income tax in several of the years examined.”

Beyer went on to say that these findings “underscore the fact that our tax laws are often inequitable, and that enforcement of them is often unjust.”

What Tax Pros Will Be Looking For In Trump’s Returns

Trump’s finances are known to be complex, and the documents being released Friday only represent a portion of his business empire over a six-year period, so the financial picture will not be comprehensive.

CBS MoneyWatch asked two tax experts Bruce Dubinsky, a forensic accountant and founder of Dubinsky Consulting, and E. Martin Davidoff, founder and managing partner of Davidoff Tax Law some of the things they’d be looking for.

Among other things, the returns could reveal how much Trump continued to earn from the book and TV deals that helped make him a household name, and how much he donated to charity between 2015 and 2020.

The documents may also provide new insights into how his businesses took advantage of provisions in the tax code that benefit real estate developers.

Previously published excerpts of Trump’s returns, and testimony at the Trump Organization’s recent criminal trial, have focused on periods in which he reported large financial losses allowing him to pay little or nothing in federal income taxes some years.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Don’t Miss: When Are Federal Taxes Due 2020

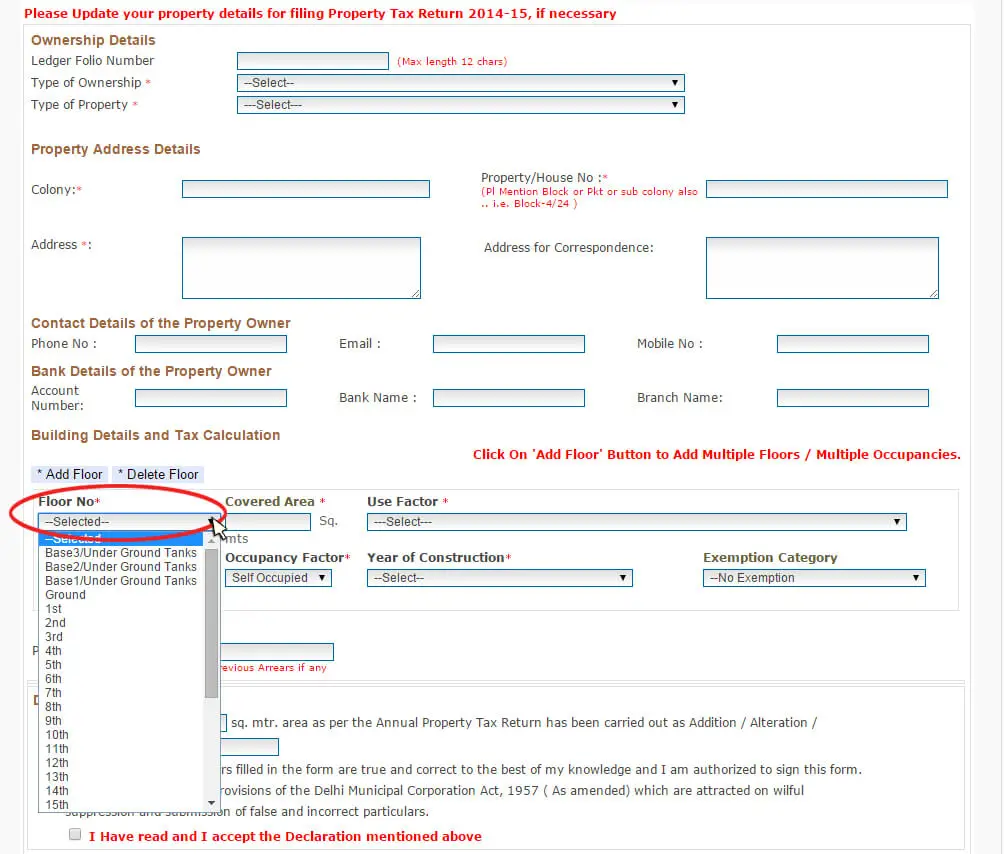

Last Years Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

Also Check: Turbo Tax 1099q

Those Who Have Filed Their Itr For Ay 2022

IMAGE: PTI

Now that the due date to file Income Tax Return is over and the tax payers have filed their returns, the other part of the process will begin, where the Income Tax Department will issue refunds that have been claimed by the taxpayers in their filings.

Those who have filed their ITR for Assessment year of 2022-23 on time will now wait for their income tax refunds, which is issued to taxpayers only when they pay higher taxes than the actual liabilities.

Income Tax assesses can check the status of their refund online.

You May Like: How Do I Check My Taxes

Also Check: Is Property Insurance Tax Deductible

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

General Questions About Property Taxes

In order for the amount of your taxes to be determined, the County Assessor must first assess the value of your property as of January 1. Generally, the assessed value is the cash or market value at the time of purchase. This value increases not more than 2% per year until the property is sold or any new construction is completed, at which time it must be reassessed.

For more information on how the assessed value is determined, see the County Assessors website.

After the Assessor has determined the property value, the County Controller applies the appropriate tax rates, which include the general tax levy, voter approved special taxes, and any city or district direct assessments.

For more information on the applied tax rates, see the County Controllers website.

The general tax levy is determined in accordance with State Law and is limited to 1% assessed value of your property. After applying tax rates, the County Controller calculates the total tax amount. Finally, the Tax Collector prepares property tax bills based on the County Controllers calculations, distributes the bills, and then collects the taxes. Neither the County Board of Supervisors nor the Tax Collector determines the amount of taxes.

The annual tax bill identifies the following:

If your bill bears the statementPrior Years Taxes Unpaid, this is an indication that there are delinquent taxes from prior years, which are not included in your bill. Please call 808-7900 for more information.

Don’t Miss: How Do I Pay Sales Tax In Texas

Once The Mortgage Is Paid

Paying off your mortgage is a huge accomplishment, but it also makes things slightly more complicated. Those property taxes that were previously being paid by your lender are now your responsibility, and youll be responsible for paying them even if your assessor doesnt send you a bill. Chances are, you can get the information you need and make your payments online, but if not, you can always contact your county assessor and get instructions on paying by mail.

Most county websites now have a portal designed to help residents pay their property taxes. Using only your property address or name, you should be able to get information on how much you owe and pay your bill directly. Thats a great one-time solution, but youll most likely want to set payments to happen automatically. Check to see if your county office has a debit option where the amount is taken from your account.

If youd prefer to be in control of how much you pay and when, you can set up these recurring payments to be made by your bank account on the due date. You may be able to set things up for monthly payments if this is easier on your budget, but you should also have the option to pay once or twice a year. Check in occasionally to make sure youre up to date on payments and pay close attention to any assessment notices that might change the amount you owe.

References

Real Estate Tax Payments

Tax Collector’s Public Service Office, located at 200 NW 2nd Avenue, Miami, Florida 33128, is open Monday through Thursday from 8:30 a.m. to 3:30 p.m. and Fridays from 8:30 a.m. to 12:30 p.m. We strongly recommend that you submit your payments online or by mail rather than visiting the Public Service Office. For additional information contact our office by calling 305-270-4916 or email .

The 2022 Annual Tax Notices were mailed on Monday, Oct. 31. The online payment button is activated as of Nov. 1, 2022, at 12:00 a.m. EST . Only current year taxes can be paid online.

Tax Roll Certification and AdvertisementsPursuant to Florida Statute 197.322, the property appraiser shall deliver to the tax collector the certified roll. The tax collector shall on Nov. 1, or as soon as the assessment roll is open for collection, publish a notice in a local newspaper that the roll is open for collection. The tax collector shall send to each taxpayer appearing on such rolls, whose address is known to him or her, a tax notice, within 20 working days after the receipt of the certified roll.

Real Estate TaxesReal estate property taxes also known as ad valorem taxes are collected annually. They are based on the assessed value of a property’s land, building and improvements, as determined by the Property Appraiser as of Jan. 1.

Pursuant to State Law , Tax Certificates will be sold for delinquent Real Estate Property Taxes on or before June 1.

Returned Payments

Value Adjustment Board Petitioners

You May Like: When Is The Due Date For Taxes

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

You May Like: Can You Pay Taxes Online

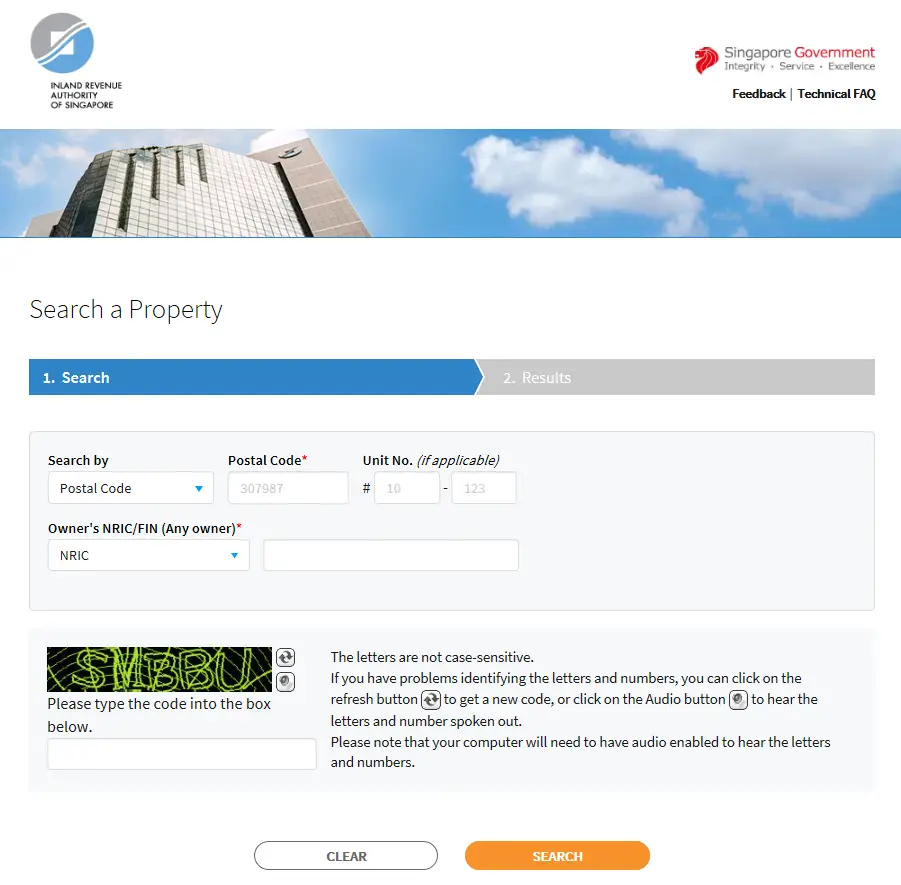

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

Don’t Miss: When Are We Getting Our Taxes

Trump Received Interest From His Adult Children On Loans He Made To Them

According to the former president’s tax returns, he made loans to his adult children Ivanka, Donald Trump Jr. and Eric, and reported receiving interest on those loans.

Trump declared a total of $50,715 in interest paid to him by his older children in 2017, 2018 and 2019, and $46,320 in 2020, according to his returns.

The staff of the Joint Committee on Taxation in their report last week said the interest income raised the “question of whether the loans were bona fide arm’s length transactions, or whether the transfers were disguised gifts that could trigger gift tax and disallowance of interest deductions by the related borrowers.”

Bruce Dubinsky, a forensic accountant and certified fraud examiner, said it could be an estate planning technique.

It’s the IRS’ position that as long as it is a bona fide loan, it is respected as a loan, Dubinsky said. So, each year, Trump is able to decide to forgive a certain amount of the loan tax-free, i.e., not expect it to be repaid. Dubinsky says that means the taxpayer, Trump, owes no gift taxes on the forgiven amount, and the recipients, his children, do not pay income taxes on it.

The gift limit before the giver can be taxed was $15,000 per year per person, so Trump and the first lady could have forgiven up to a total of $30,000 in loans to a child annually without gift or income tax implications, Dubinsky said.

Mandatory Audits Not Completed

The IRS policy manual requires the mandatory examination of the tax returns of the president and vice president each year. But according to the Ways and Means Committee’s report, no such audits were completed during the first two years of Trump’s presidency, as Trump had claimed.

The committee said the former president’s individual income tax returns filed in 2018, 2019, and 2020 were not examined until after he left office. Only the 2016 tax return was subject to a mandatory examination, and that audit was not completed while Trump was president.

The committee cited delaying tactics by Trump’s legal team, accusing them of “failing to provide all the facts needed to resolve certain issues, and stating, in some cases, that they ‘would likely have additional relevant facts to present in its protest or at appeal.'”

Recommended Reading: Do I File My Personal Taxes With My Business Taxes

How Can Donations To Charities Reduce My Taxes

Contributions to charities and non-profit organizations can be deducted from your adjusted gross income so you may pay less in taxes in a year. To qualify for tax-advantaged donations, nonprofits must be included in the IRS database of tax-exempt organizations.

Gifts to charity are considered income deductions, not tax credits. While charitable donations will reduce your taxable income, they don’t come directly off your tax bill. Depending on your income bracket, 10% to 37% of your donation will come back to you in money saved on taxes.

For example, a single tax filer in the middle tax bracket of 24% will save $24 in taxes for every $100 contributed to charity. At the upper tax bracket of 37% , a donation of $100 saves $37 on taxes.

If you are donating goods or services, you are allowed to deduct their “fair market value” on your tax return. Cash contributions above $250 and all non-cash donations require documentation of proof such as a receipt from the charity.

How To Get Your W2 Form Online

Online tax filing helps users to get their W2 form online quickly. They have a free W2 finder that you can use to search for yours.

After you get your W-2, you can start filing your taxes online, or you can download a copy so you can print it out and attach it to your tax return.

Its a much faster process than waiting for your W2 to come out in the mail. With over 150 million W2s available online, theres a good chance youll be able to find yours.

You May Like: How Do I Submit My Tax Return Online

Relationship Between Property Values & Taxes

- Prior to the economic downturn, property values were increasing annually, reaching a high of $58 billion in assessed value in fiscal year 2009.

- In addition, new construction was added to the rolls each year, also increasing the assessed value to be taxed.

- Both these helped keep the tax rate down.

When Do W2s Come Out

The IRS mandates that employers send out or make W2s available to their employees by January 31. Even if you switched jobs, they still have this deadline in place, yet sometimes you can expect to receive it earlier. Your former employer will also include your accumulated vacation, severance, and outstanding bonuses on your W-2 form.

To file your income taxes and get your tax refund, you have to have your W2. This form contains all of the vital information that you need for your annual income tax filing.

Confirm that your employer has your correct mailing address if you do not have your W-2 form by the end of January. If you dont receive the W-2 from your employer by Valentines Day, contact the IRS at 800-829-1040 and provide them with your details so they can find your information.

Before calling them, make sure you are prepared to provide them with your name, mailing address, phone number, social security number, employers name, address, and the dates you were employed.

The IRS will accept returns without W2s however, this could delay your refund. This is because the IRS has to make sure that your income is accurate and matches their records before issuing you a tax refund.

You May Like: How To Find Property Tax Records

Trump’s New Tax Accountant Prepared 2020 Tax Returns After Mazars Cut Ties With Trump

The former president’s 2020 tax returns were prepared by a different accountant than Mazars, which dropped Trump as a client and disavowed years of financial statements it had prepared for him.

The returns for the last year of his presidency were prepared by Timothy Horan, of BKM Sowan Horan LLP, on Mar. 25, 2022, according to the documents released by the House Ways and Means Committee.

A month earlier, in February 2022, the accounting firm that for years prepared Trump and the Trump Organization’s annual financial statements cut their ties with both and said a decade’s worth of the reports “should no longer be relied upon.” Mazars USA’s decision came as the New York attorney general’s office sought depositions of Donald Jr. and Ivanka Trump, as part of an ongoing fraud probe. The company said it could no longer stand by financial statements from June 30, 2011 to June 30, 2020.

Reporting by Graham Kates