Will Unemployment Benefits Come With A Tax Break In 2022

Unlike last year, a special tax break doesn’t exist for up to $10,200 of unemployment benefits. The temporary tax break applied only for those with modified adjusted gross incomes of less than $150,000 in 2020 and those who also received unemployment benefits last year.

This year, jobless benefits received in 2021 will be taxable on the 2021 federal income tax return.

Contributing: Susan Tompor, Detroit Free Press Russ Wiles, Arizona Republic Associated Press

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko. For shopping news, tips and deals, join us on .

Congressman Schiff Calls For Extension Of The Expanded Child Tax Credit By Years End

Today, Congressman Adam Schiff sent a letter to House Speaker Nancy Pelosi and House Majority Leader Steny Hoyer urging the House to extend the expanded Child Tax Credit which has the ability to lift millions of Californias most economically-marginalized children out of poverty before Republicans take control of the House in January.

The Child Tax Credits monthly payments are used by millions of families in California and across the country to pay for necessities including food, rent, educational expenses, and child care. The American Rescue Plan of 2021 critically expanded its reach and benefits, increasing monthly payments and the number of eligible recipients by removing an earnings requirement that kept the lowest-income families from claiming the full credit. Between July and December 2021, child poverty was slashed by nearly 40 percent to reach a record low of 5.2 percent, and 3 million children were lifted out of poverty in a single month.

However, the expansion expired in December 2021 due to Republican opposition, putting nearly 10 million children nationwide at risk of falling deeper into poverty disproportionately children of color and children in the lowest-income families, like single-parent households. As House Democrats put forth their biggest legislative priorities over the next four weeks, Schiff is urging that an extension of the expanded Child Tax Credit is included in any year-end package.

Specifically, the Child Tax Credit expansion:

Tax Day For Individuals Extended To May 1: Treasury Irs Extend Filing And Payment Deadline

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

Also Check: How To File Llc Taxes On Turbotax

The Irs Just Released New 2021 Tax Brackets Here’s What They Mean

Money, Home and Living Reporter, HuffPost

You might still be focused on surviving 2020, but when it comes to taxes, it doesnt hurt to plan ahead.

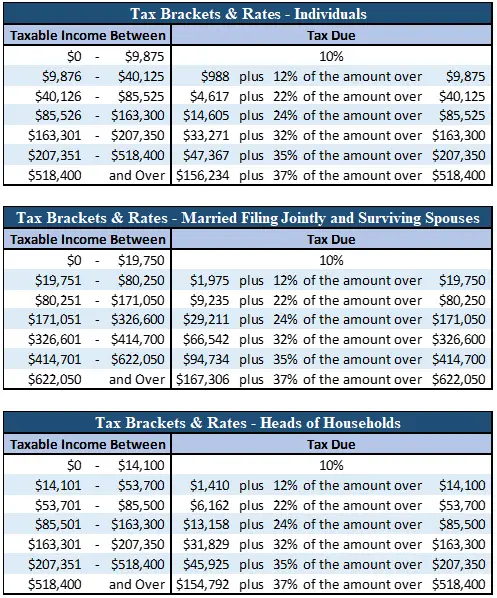

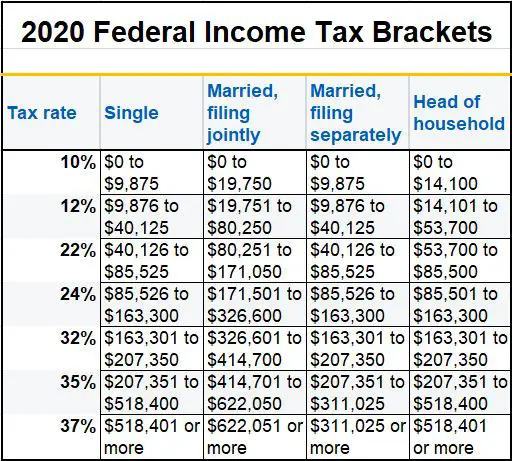

This month, the IRS released updates to the tax code for tax year 2021. Though actual tax brackets remained the same , income limits for each bracket were increased to account for inflation. The standard deduction for 2021 was also increased.

These changes will affect how much you pay when you file income taxes in 2022. Heres a look at the 2021 tax brackets and other changes to personal taxes next year.

How Are Individuals Affected By The Tax Deadline Extension

The tax extension deadline generally applies to all calendar year tax-paying entities, including individuals, self-employed persons, and trusts and estates. The Treasury and IRS announced the deferment of filing your federal tax return as well as specific federal tax payments. This delay in payment comes interest- and penalty-free, for 90 days, until July 15, regardless of the amount owed.

Furthermore, anyone who needs to make quarterly estimated tax payments also has until July 15 to submit these payments. This means your 2020 tax year first and second quarter estimated tax payments, previously due on April 15 and June 15, are now both deferred until July 15.

Recommended Reading: What Qualifies You To Be Tax Exempt

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Free File Available January 14

IRS Free File will open January 14 when participating providers will accept completed returns and hold them until they can be filed electronically with the IRS. Many commercial tax preparation software companies and tax professionals will also be accepting and preparing tax returns before January 24 to submit the returns when the IRS systems open.

The IRS strongly encourages people to file their tax returns electronically to minimize errors and for faster refunds as well having all the information they need to file an accurate return to avoid delays. The IRS’s Free File program allows taxpayers who made $73,000 or less in 2021 to file their taxes electronically for free using software provided by commercial tax filing companies. More information will be available on Free File later this week.

Read Also: Do I Have To Give My Ex My Tax Returns

When Can You File Taxes

Most taxpayers know that January marks the start of return filing, but theyre not exactly sure of when. So, what naturally follows is the question When is tax season? and When can I file my taxes?

Read on for the answer to When will I get my tax return? and more details about the IRS refund process.

Federal Tax Deadline Extensions

The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021. Due to severe winter storms, the IRS has also extended the tax deadline for residents of Texas, Oklahoma and Louisiana to June 15, 2021.

This extension also applies to 2020 tax payments. Individual taxpayers may defer tax payments until the new filing deadline, interest and penalty free. The new federal tax filing deadline is automatic, so you don’t need to file for an extension unless you need more time to file after May 17, 2021.

If you file for an extension, you’ll have until October 15, 2021 to file your taxes. But, you’ll still need to pay any taxes you owe by May 17.

The new federal tax filing deadline doesn’t apply to 2021 estimated tax payments. First and second quarter estimated tax payment deadlines are still April 15, 2021 and June 15, 2021.

Also Check: Is It Hard To Do My Own Taxes

Dont Be Surprised By Delays

While every tax season is busy for the IRS, pandemic-induced backlogs from the past two years coupled with limited fundingwill make the current tax season even more so.

Treasury officials said in a briefing call Monday that at the start of a normal tax season, the IRS might have 1 million returns backlogged, but the number this year is several times more.

Last week, IRS Commissioner Charles Rettig noted that return processing and tax assistance delays arose as the agency was administering several Covid-19 relief efforts passed by Congress. Those included issuing three rounds of Economic Impact Payments, creating a system to send out advance monthly payments of the Child Tax Credit and making changes to the Earned Income Tax Credit.

One example: Last year, the agency was unable to answer more than two-thirds of the calls it received. Thats why tax filers are encouraged to first use the online tools provided on IRS.gov to get answers to their questions before reaching out to the agency directly.

This year is likely to be just as frustrating. Thats why tax filers are encouraged to first use the online tools provided on IRS.gov to get answers to their questions before reaching out to the agency directly.

Expect phones lines to be jammed up for the forseeable future, Rettig said.

Tax Forms Instructions & Booklets

The resident tax booklets contain both the tax forms and the instructions for each major form. The tax forms on the Web site are available separately from the resident and nonresident instruction booklets.

All of our tax forms have been reformatted to ensure enhanced readability when paper forms are filed. This format has increased the number of pages of some of the tax returns. Make sure that you attach all pages of your return to ensure that your return is processed correctly.

- Tax Forms and Instructions Online – Tax forms and instructions for Individual and Business taxpayers are available here online at Maryland Tax Forms and Instructions .

- Tax Booklets at Libraries – We have provided a limited supply of tax booklets to a number of libraries throughout the State that have requested them.

- Tax Booklets at Comptroller’s Taxpayer Service Offices – Tax booklets are available at all of our local taxpayer service offices.

- Request a Tax Booklet – Taxpayers may request a resident or nonresident tax booklet by calling 260-7951, or by e-mail at .

Also Check: Can You File State Taxes Without Filing Federal

How Can I Make Sure I Get My Refund As Fast As Possible

Each tax filing is as unique as the individual it represents. To help expedite the tax refund process, consider one or more of the following tips:

- Visit us at any H& R Block office to ensure your return is ready to file when e-file opens.

- Consider e-filing versus traditional paper filing.

- Complete a tax return that is free of any errors or miscalculations. This means carefully reviewing personal information such as your name, social security number, home address and bank information, if applicable.

How Should You Request To Receive Your Refund

The IRS gives you three options for receiving your refund:

- Deposit into U.S. Savings Bonds

You can also apply a refund to any future taxes owed. This is a popular choice among some small business owners who are required to pay estimated taxes.

Of the three refund options available to you, direct deposit is the fastest and safest option. You can receive your refund via an ACH bank transaction in as little as a few days. Paper checks, however, can take over a week to process, several days to travel via the postal system, and several days to clear your bank.

*Note:Some tax software companies also offer the option of receiving a tax refund on a prepaid debit card. Im not particularly fond of this option, but it is available to some tax filers. In this case, the refund is first sent to the tax preparation company, then they issue you the prepaid debit card.

Recommended Reading: What All Do I Need To Do My Taxes

Smuggling In India Report 2021

The Directorate of Revenue Intelligence , the apex anti-smuggling intelligence and investigation agency functioning under the aegis of the Central Board of Indirect Taxes and Customs , celebrated its 65th Foundation Day at New Delhi.

The celebration commenced with Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman inaugurating the function here today, in the presence of Union Minister of State for Finance Shri Pankaj Chaudhary. Revenue Secretary, Shri Sanjay Malhotra Chairman-CBIC, Shri Vivek Johri and Members of the Board were present during the occasion along with Director General, DRI, Shri Mohan Kumar Singh. The function was attended by former Chairpersons and Members of CBIC, senior officers including ex-DGs of DRI. The event was physically attended by about 400 participants and was also streamed live through a digital platform with participation of hundreds of attendees from DRI, CBIC, International Organisations and other officers of Government of India.

The Union Minister for Finance also released the Smuggling in India Report 2021-22 which analyses trends such as Smuggling of Gold, Narcotics Drugs and Psychotropic Substances, wildlife etc., Commercial Frauds and International enforcement operations & cooperation. DG DRI, Shri M K Singh welcomed the dignitaries and presented a report on DRIs performance in the previous financial year.

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

You May Like: How To Get S Tax Id Number

Some Who Don’t Normally File Returns Need To File

Like last year, the IRS said, some individuals will need to file tax returns even though they are not required to file because of a low income. They would need to file to claim a “Recovery Rebate Credit” to receive the tax credit from the 2021 stimulus payments or reconcile advance payments of the child tax credit.

More:Special tax break for charitable donations packs extra incentive for giving

Many tax preparation software sites and offices are already up and running even though the IRS won’t accept e-filed returns until later in January. The prepared returns will be electronically submitted to the IRS when filing season officially begins.

The deadline for federal income tax returns is April 18.

Last year, the average income tax refund was $2,827 as of May 21, according to IRS data.

The IRS issued 95.6 million refunds and a total refund amount of $270.3 billion. The tax deadline was extended last year to May 17.

What Should You Do With Your Refund

Consider your financial goals if you dont already have plans for your refund. Think about how you can use it for paying off debts, meeting your savings goals, or building your emergency fund.

You may want to put it in a high-interest savings account. These are the safest options for preserving and growing your savings fund.

You May Like: What Is The Tax Rate On Unemployment

Other Factors That Could Affect The Timing Of Your Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

Taxpayers who claim the earned income tax credit or the additional child tax credit may see additional delays because of special rules that require the IRS to hold their refunds until Feb. 27. You should also expect to wait longer for your refund if the IRS determines that your tax return needs further review.

Refunds for returns that have errors or that need special handling could take up to four months, according to the IRS. Tax returns that need special handling include those that have an incorrect amount for the Recovery Rebate Credit and some that claim the EITC or the ACTC. Delays also occur when the IRS suspects identity theft or fraud with any return.

Respond quickly if the IRS contacts you by mail for more information or to verify a return. A delay in responding will increase the wait time for your refund.

If you submitted an amended tax form, it may take more than 20 weeks to receive a refund due to processing delays related to the pandemic.

How To Qualify For The Child Tax Credit

Whether a household qualifies for the CTC depends on one main factor: income.

Single taxpayers, heads of households and married couples will only qualify for the maximum $3,600 or $3,000 credit if their incomes are below $75,000, $112,500 and $150,000, respectively. After that, single and head of household filers have to make under $200,000 annually to qualify for the $2,000 payment, while married filers incomes must not surpass $400,000 a year.

The CTC is then phased out by $50 per every $1,000 over the income threshold.

Eligibility for the Child Tax Credit| Filing status |

|---|

Don’t Miss: Is The Tax Assessment The Value Of The Property

Tax Filing Season Begins Feb 12 Irs Outlines Steps To Speed Refunds During Pandemic

IR-2021-16, January 15, 2021

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Friday, February 12, 2021, when the tax agency will begin accepting and processing 2020 tax year returns.

The February 12 start date for individual tax return filers allows the IRS time to do additional programming and testing of IRS systems following the December 27 tax law changes that provided a second round of Economic Impact Payments and other benefits.

This programming work is critical to ensuring IRS systems run smoothly. If filing season were opened without the correct programming in place, then there could be a delay in issuing refunds to taxpayers. These changes ensure that eligible people will receive any remaining stimulus money as a Recovery Rebate Credit when they file their 2020 tax return.

To speed refunds during the pandemic, the IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. People can begin filing their tax returns immediately with tax software companies, including IRS Free File partners. These groups are starting to accept tax returns now, and the returns will be transmitted to the IRS starting February 12.

Last year’s average tax refund was more than $2,500. More than 150 million tax returns are expected to be filed this year, with the vast majority before the Thursday, April 15 deadline.