Overview Of Tennessee Taxes

Tennessee has no income tax on salaries and wages. And beginning with the 2021 tax year, the state repealed all taxes levied on income earned from interest and dividends. Tennessee also has the highest overall average sales tax in the country, while homeowners in the state pay some of the lowest property taxes in the nation.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Getting Your Tennessee Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Tennessee, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Tennessee tax refund, you can visit the Tennessee Income Tax Refund page.

Tennessee Sales Tax Nexus

A sales tax nexus is a legal way of stating that a small business has a significant enough presence within a state that the state can require them to collect and remit sales tax on behalf of their customers. Traditionally this has been only a physical presence, but it now consists of any corporate presence. Within Tennessee, this corporate presence means:

- Having an office, warehouse, or another place of business in Tennessee

- Having an employee, contractor, salesperson, or other solicitors who operate physically within the state

- Furnishing property, or providing services that are subject to sales or use tax while in the state

Read Also: Do You Have To Claim Plasma Donation On Taxes

How Do I Register For A Tennessee Resale Certificate

Registration for in-state tax filing is done through the departments Tennessee Taxpayer Access Point . The website uses a wizard-based questionnaire to guide you through the process of registering. For out-of-state retailers who meet the requirements, you must also register to collect and remit Tennessee sales tax. This is also done through TNTAP.

Visit the Department of Revenue for:

Payees may only file and pay online. Payments may be done via:

- ACH payments, either via taxpayer bank account or their 3rd party vendor, Global Payment Systems.

Note that taxpayers with a block or restriction on their account who use ACH must provide the information as required by the state.

How Your Tennessee Paycheck Works

As is the case in all U.S. states, you have to pay federal income and FICA taxes in Tennessee. FICA taxes are Social Security and Medicare taxes. Youll pay 6.2% and 1.45% of your income for these taxes, respectively. Your employer typically matches these percentages for a total of 12.4% received for Social Security and 2.9% for Medicare. If you earn wages in excess of $200,000 , $250,000 or $125,000 , that money is subject to a 0.9% Medicare surtax, which employers do not match.

While your employer typically covers 50% of your FICA taxes, this is not the case if you are a self-employed worker or an independent contractor. In this case, you are responsible for ensuring that 100% of your FICA taxes are paid and will likely need to cover the entirety of them yourself. However, you may be eligible to take a deduction during tax season to get back some of the employer portion of your FICA taxes.

As mentioned above, Tennessee employers withhold federal income tax from your paycheck each pay period. This goes to the IRS, where it is counted toward your annual income taxes and funds a range of expenses.

Read Also: Doordash Taces

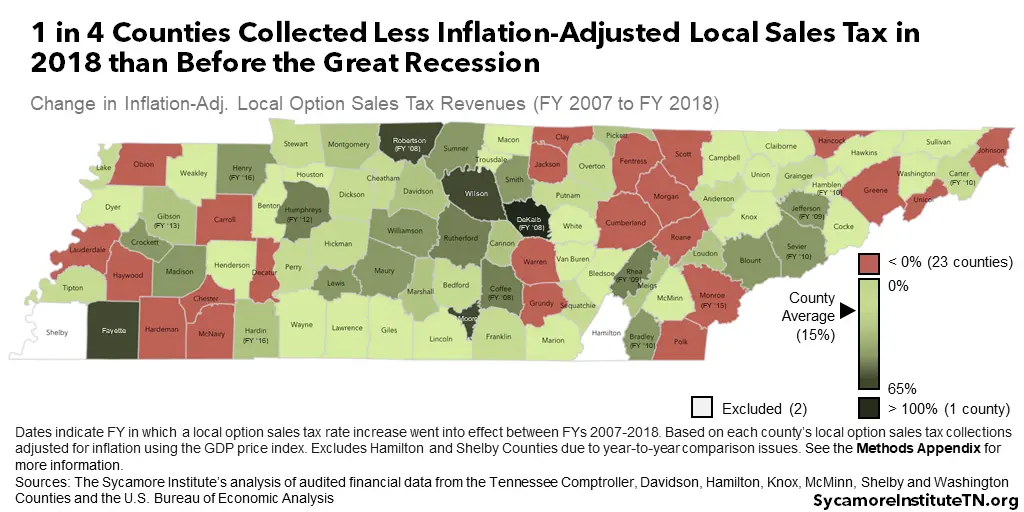

Certified Tax Rates By County

Below is a list and schedule of the certified tax rates submitted and reviewed by the State Board of Equalization. The below is for informational purposes only and persons should compare any rates below with the rate adopted by each jurisdicition’s governing body. For questions regarding the below rates or about the certified tax rate process, please contact the offices of the State Board of Equalization.

| Counties/Jurisdictions | 2019 CTR | 2020 CTR |

|---|

Tennessee Sales And Use Taxes

Any retail sales, rentals or leases on goods and services in Tennessee are levied by sales and use taxes. Tennessees sales and use tax rate is seven percent in 2017. Use taxes are levied on products, both tangible and digital, that are imported and used in Tennessee. For example, if you bought something online from a California retailer and had it shipped to Tennessee, you would pay the Tennessee use tax on the transaction.

Local governments may charge additional sales and use tax rates. Local tax rates can range from 1.5 to 2.75 percent. Tennessee also charges a single article sales tax rate of 2.75 percent for single items priced between $1,600 and $3,200.

Don’t Miss: How Do I Pay Taxes For Doordash

Filing Your Tennessee Sales Tax Return

Tennessee requires all sales and use tax returns and payments to be filed and paid electronically. This is done through the Tennessee Taxpayer Access Point . First-time filers must register for an account to file their return and make payments. After that, filers log in with their username and password to file future taxes.

A helpful video about filing your sales and use tax return through TNTAP can be found here.

Tennessee Franchise And Excise Tax

Some states levy a tax on certain legal entities for the right to exist and do business in the state. Though some states call it a transaction privilege tax or simply a privilege tax, this state calls it the Tennessee franchise and excise tax. Despite its name, this is not a tax on franchises, but an essential part of filing taxes for your LLC.

Don’t Miss: Ein Look Up Number

More Help With Taxes In Tennessee

Understanding your tax obligation is important. Whats even more important is how to deduct Tennessee tax from your federal taxes as an itemized deduction.

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with Tennessee tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your TN taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Tennessee state tax expertise with all of our ways to file taxes.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Tennessee Sales Tax Exemptions

What is Exempt From Sales Tax In Tennessee?

The state of Tennessee levies a 7% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1% and 2.75%. The range of total sales tax rates within the state of Tennessee is between 8.5% and 9.75%.

Use tax is also collected on the consumption, use or storage of goods in Tennessee if sales tax was not paid on the purchase of the goods. The use tax rate is the same as the sales tax rate. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made. For example, purchases made in the month of January should be reported to the state of Tennessee on or before the 20th day of February.

Also Check: Does Doordash Give You A 1099

Davidson Countys Different Tax Rate Districts

Davidson County has two primary tax rate districts, the General Service District and the Urban Service District . The USD tax covers the more extensive services provided to property owners, such as garbage pick-up, street lights and sidewalks provision not provided to those in the GSD. The GSD, which are the areas outside of the USD boundary, a property owner would pay individually for these additional services.

There are several other smaller tax districts as a result of satellite cities located within the GSD . Taxable properties in these small incorporated municipalities are subject to the GSD tax rate plus the satellite citys rate, if any, as adopted by the legislative bodies of those cities. Services provided by the satellite cities may differ from jurisdiction to jurisdiction.

Your assessment notice has a Tax Jurisdiction box which indicates your taxing district as GSD, USD or satellite city. After you have determined which taxing jurisdiction in which your property is located, select the calculator below.

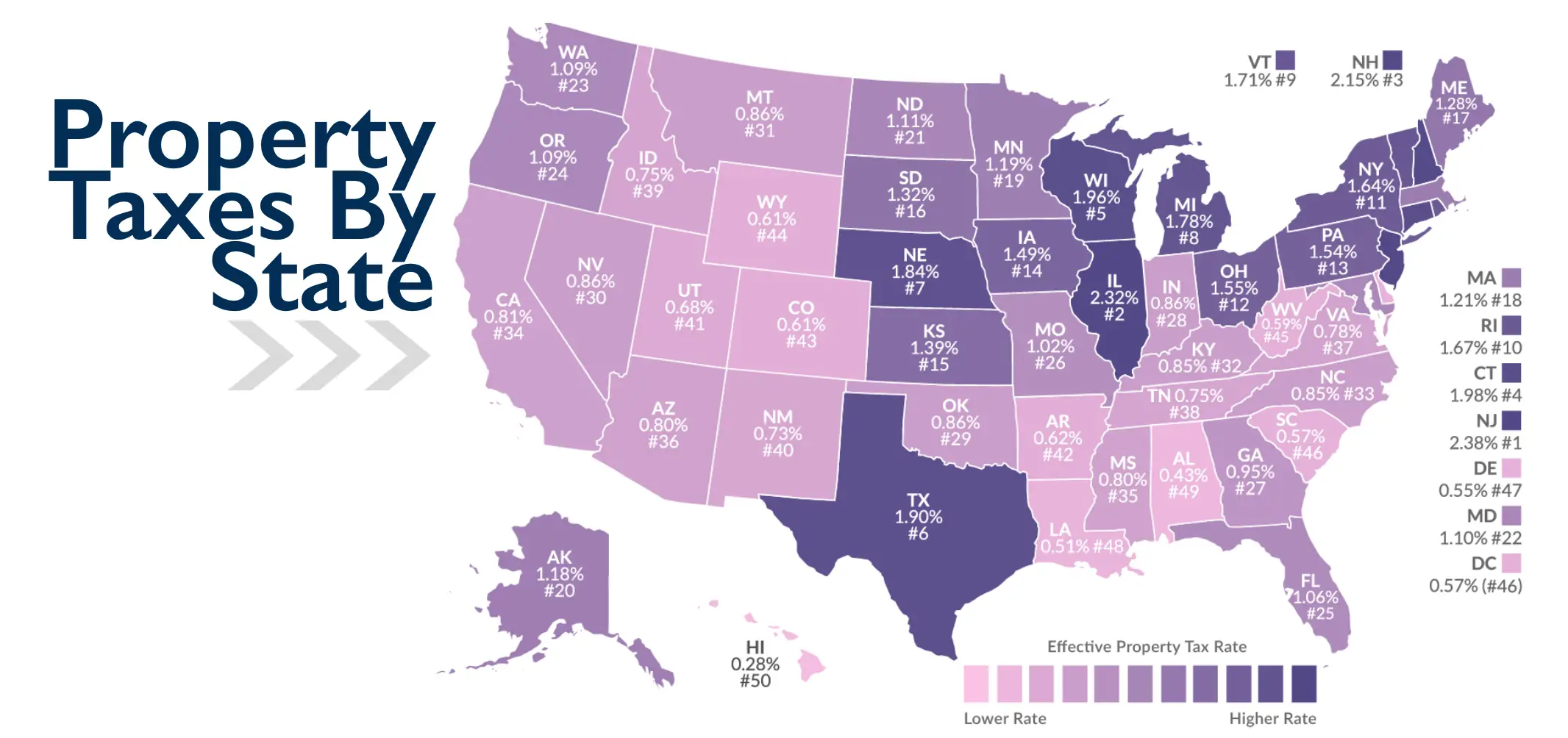

Tennessee Property Tax Rules

County officials are responsible for administering the property tax in Tennessee, starting with the county assessor. The county assessor in each county is responsible for assigning a value to each property, on which taxes are based.

This is done through a regular reappraisal. Assessors reappraise property in Tennessee in four to six year cycles. The purpose of the reappraisal is to determine the current market value, on which taxes will be based until the next reappraisal in four, five or six years.

Homeowners who believe their property has been over-appraised should first contact their assessor for an informal discussion. If that discussion is not fruitful, an official appeal can be filed with the County Board of Equalization.

Taxes are not applied to that full market value, rather to the assessed value. For residential property, assessed value is equal to 25% of market value. Thus, if your county assessor appraises your property at $100,000, your assessed value will be $25,000. Your tax rate applies to that amount.

Recommended Reading: Doordash Quarterly Taxes

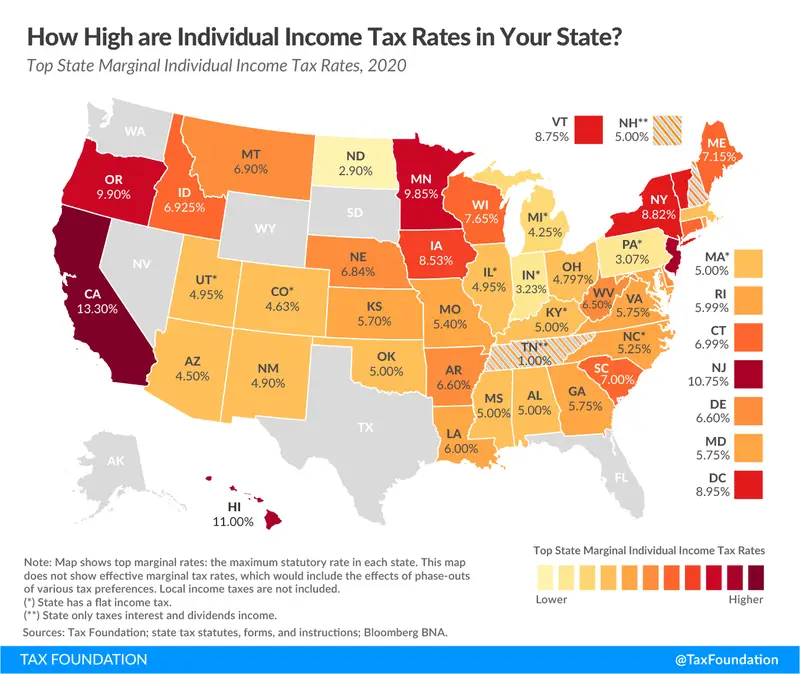

The Tennessee Income Tax

Tennessee collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Unlike the Federal Income Tax, Tennessee’s state income tax does not provide couples filing jointly with expanded income tax brackets.

Notably, Tennessee has the highest maximum marginal tax bracket in the United States. You can learn more about how the Tennessee income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Tennessee does not collect an income tax on tax normal wage income. A special 6% income tax called the Hall income tax applies only to taxable interest and divident income over $1,250 for individuals and $2,500 for married couples filing jointly. Taxpayers over 65 with total income less than $16,200 for a single filer or $27,000 for a couple filing jointly are exempt from this tax.

The Hall income tax, named after the state senator who sponsored it, has been around since 1929 and hasn’t been raised since 1937. Only dividend or interest income from investments like stocks, mutual funds, and corporate dividends is subject to this tax. Interest from bank or credit union accounts, the type of interest earned by most Tennessee residents, is exempt from the Hall income tax.

For more information on the Hall income tax, call the tennessee Department of Revenue’s tax help hotline at 532-6439.

Tennessee Sales Tax Software

While calculating sales tax in Tennessee is easier than in many destination-based states, retailers may find that sales tax software helps them streamline the process and avoid the kinds of mistakes that lead to audits. Our TaxTools software is the answer. It pinpoints the right sales tax for every US address, and applies the appropriate sales tax to each order placed on your site. Then when youre ready to file your return, our reports make the process simple. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of AccurateTaxs TaxTools software.

You can also use our free sales tax calculator to look up the rate for any Tennessee address.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Also Check: Do You Claim Plasma Donation On Taxes

How Much Is Payroll Tax In Tennessee

Tennessee State Payroll Taxes Tennessees income tax is simple with a flat rate of 1%. For the calendar year 2021, Tennessee unemployment insurance rates range from 0.1% to 10%, with a taxable wage base of up to $7,000 per employee per year. New employers pay a flat rate of 2.7%.

- Tennessee State Payroll Taxes Tennessees income tax is simple with a flat rate of 1%. For the calendar year 2021, Tennessee unemployment insurance rates range from 0.1% to 10%, with a taxable wage base of up to $7,000 per employee per year.

Contents

How To Figure Your Property Tax Bill

Property taxes in Tennessee are calculated utilizing the following four components:

The APPRAISED VALUE for each taxable property in a county is determined by the county property assessor.

The ASSESSMENT RATIO for the different classes of property is established by state law .

The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

The TAX RATE for Davidson County is set by the Metro Council based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the countys tax base. The tax rates are not final until certified by the State Board of Equalization.

To calculate the tax on your property, assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 , and the TAX RATE has been set by the Metro Council at $3.288 or $2.953 per hundred of assessed value. To figure the tax simply multiply the assessed value by the tax rate of $3.288 or $2.953 per hundred dollars assessed.

Recommended Reading: Doordash 1099 Nec

Does Tennessee Have A Sales Tax Holiday

Like certain other states, Tennessee also has a sales tax holiday that exempts the tax for clothing and school supplies that cost $100 or less and for computers and tablets that cost $1500 or less. The tax holiday fell on the last weekend of July 2021 . Additional sales tax holidays were implemented in 2021 for food and ingredients and gun safety equipment. Neither has been renewed yet for 2022.

Suta Tax Rates And Wage Base Limit

- Each state has its own SUTA tax rates and taxable wage base limit. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover.

- SUTA tax rates will vary for each state. Each state has a range of SUTA tax rates ranging from . Employers will receive an assessment or tax rate for which they have to pay.

- Some states have their own SUTA wage base limit. The wage base limit is the maximum threshold for which the SUTA taxes can be withheld.

- In case the employer starts a new business, the states provide a standard new employer SUTA rate. This rate will again change as the business grows, depending on the number of unemployment claims made to the state by workers who lose their jobs.

Read Also: Appeal Cook County Property Taxes

Tennessee Hall Income Taxes

While it is not one of the seven states that dont impose a personal income tax, Tennessees income tax isnt imposed on typical income sources like wages and salaries. Rather, Tennessees Hall income tax is imposed on income from interest and dividends only.

The Hall income tax rate of five percent on stock dividends, promissory note interest and bond interest income. The tax applies to individuals and entities who receive income from these sources.

There is a general exemption on the first $1,250 of individual income returns and the first $2,500 of joint income returns. There are other exemptions for age and disability.

How Much Is Sales Tax For A Car In Tennessee

Sales tax for a car in Tennessee includes a state sales tax, a county or city sales tax, and a single article tax. Your sales tax total depends on if you have a car to trade in, where you buy the car, and if you qualify for any tax exceptions. Car sales tax in Tennessee applies to all road vehicles, whether bought new or used from a private party or a licensed dealer.

There are two ways to calculate the vehicle purchase price in order to apply the 7 percent state sales tax. If you don’t have a trade-in, then the purchase price is the amount you agree to pay prior to any rebates or incentives. If you have a trade-in, then the purchase price is the amount remaining after applying your old car’s trade-in value to your new car’s price. As confirmed by the SalesTaxHandbook, Tennessee doesn’t tax the value of your trade-in vehicle.

Local sales tax varies by location. The maximum charge for county or city sales tax in Tennessee is $36 on the first $1600 of a car’s purchase price. A single article tax is another state tax to consider when purchasing a car. It’s a 2.75 percent sales tax that’s applied to the car’s purchase price when it’s over $1600 but not more than $3200. Single article taxes for purchases over $3200 are capped off at $44 according to the Knox County Clerk’s office.

You May Like: Taxes On Doordash