Can I Claim Mortgage Interest On My Taxes

The mortgage interest deduction allows you to reduce your taxable income by the amount of money you’ve paid in mortgage interest during the year. … As noted, in general you can deduct the mortgage interest you paid during the tax year on the first $1 million of your mortgage debt for your primary home or a second home.

Understanding Refinance Mortgage Tax Deductions In 2022

Most people who buy a home or refinance an existing mortgage pay closing costs. So, you may wonder if you can tax deduct some of your closing costs on a refinance mortgage in 2022. The good news is you can deduct some of these costs on your taxes on your refinance mortgage!

Some of the closing costs you can tax deduct on a refinance mortgage in the year you pay them are:

- Points paid on a cash-out refinance for home improvements. If you do a cash-out refinance to lower your interest rate and pull-out cash, the refinance points may be deductible on your taxes. However, you must prove that the cash was used for capital improvements on the home, not simply home repairs. If you use the cash for another purpose besides capital improvements, you cannot deduct the points.

- FHA mortgage insurance and VA funding costs: Loans that are backed by the US government such as FHA and VA loans usually reduce the risk of the loans by charging you mortgage insurance or funding fees. You may be able to tax deduct upfront mortgage insurance premiums and mortgage insurance premiums paid on a loan backed by FHA.

- Funding fees you pay for a refinance loan backed by the VA.

- Guarantee fees charged for a refinance loan backed by the USDA.

Note: If you are using some of the refinance money for a purpose other than a home improvement, any additional points you paid can be deducted throughout the rest of the loan term.

Are Refinance Costs Tax Deductible On Rental Property

Refinancing a mortgage is when a property owner replaces their existing loan with a new one. Unlike owner-occupier homeowners, property investors can benefit from many refinance costs tax deductions. Some of the fees an investor can expect to claim are:

- loan establishment fees such as the application fee

- early discharge fees

- fixed rate loan break fees

- any title search fees charged by your lender

- valuation fees charged by your lender

- mortgage broker fees

- lenders mortgage insurance billed to the borrower

The average cost of refinancing fees can change, so its always a good idea to discuss these with your lender to get a full picture.

Recommended Reading: Where Do I Send My Tax Return From Florida

State And Local Property Taxes

You cant ever get away from taxes, and the tax man will take his cut at your closing too. Depending on where you live, youll usually have to pay some state or local property taxes. This could be a portion of the current years taxes or the full amount .

Whether youre closing on a house this year or not, you can always deduct property taxes. However, the State and Local Tax Deduction is limited to $10,000 per year for single filers and married couples.3

About Deductible Closing Costs

As per IRS publication 530, homebuyers may deduct certain closing costs when they file federal tax returns. These include the points, or loan origination fees, you paid, as well as property taxes and mortgage interest. The IRS considers points as prepaid interest, thereby permitting deductibility. You can deduct all the points you paid in the year you paid them, rather than over the life of the loan, if the mortgage is for your primary residence and you didnt pay more in points than the usual amount in your area.

Points are worth 1 percent of the entire mortgage loan, so if you have $350,000 mortgage, each point is worth $3,500. Typically, homebuyers pay two to three points at closing, not higher amounts which limit deductibility.

Recommended Reading: Do I Need To Report Roth Ira On Taxes

What Closing Costs Are Added To Basis

Basis in a rental property is the price that you paid for the home. For example, if you purchased a single-family rental for $140,000 on a subdivided lot with a value of $10,000 your initial basis would be:

- Home value = $140,000

- Lot value = $10,000

- Initial basis = $150,000

Of course, it costs more to buy a rental property than just the price of the home and the lot. Extra expenses and closing costs that can be added to the basis include:

- Real estate commission if paid by the buyer, such as a buyer-broker fee.

- Inspection fees and surveys.

- Legal fees paid for preparing the purchase contract and deed.

- Title fees such as abstract, title search, and recording fees.

- Owners title insurance and transfer taxes, which is a tax paid to the state or local government where the real property is located.

- Real estate taxes that the seller owed but the buyer paid for, a situation sometimes found when buying distressed property that the seller can not afford to own.

- Existing mortgage assumed by the buyer, as when a property is purchased subject to the existing loan.

- Other debt owed by the seller that is paid by the buyer, such as money owed to a contractor for previous work done on the property or unpaid property management fees.

After adding these additional closing costs to your initial basis, you now have an increased adjusted basis.

Adding costs to your initial basis provides a couple of big benefits:

1. Increase depreciation expense

- $143,750 x 3.636% = $5,227 per year

If You’re Unsure Seek Support

If youre unsure whether your expenses are tax deductible, its critical that you consult your accountant or call the IRS TeleTax line at 1-800-829-4477 to listen to recordings covering various tax-related topics. If you make an error when filing your taxes and pay the IRS less than you owe, you can be charged a late penalty on the outstanding amount.

Another Way To Own Investment Properties

Read Also: What Can Be Itemized On Taxes

Is There A Tax Break For Buying A House In 2021

The First-Time Homebuyer Act of 2021 is a federal tax credit for first-time home buyers. It’s not a loan to be repaid, and it’s not a cash grant like the Downpayment Toward Equity Act. The tax credit is equal to 10% of your home’s purchase price and may not exceed $15,000 in 2021 inflation-adjusted dollars.

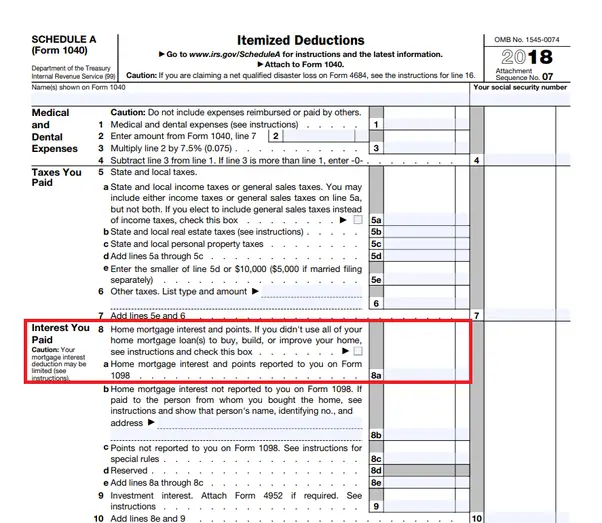

Which Particular Closing Costs Can You Deduct

You cant completely deduct all the costs of closing on your house. Only a few eligible ones make the cut. The IRS denotes the following as deductible costs:

- Sales tax issued at closing

- Real estate taxes charged to you when you closed

- Mortgage interest paid when cost was settled

- Real estate taxes that were paid for by the mortgage lender

- The interest you paid at the time of the home purchase

- Loan origination fees . These would be written as a percentage of the borrowed money.

Variation exists among these costs, and each house purchase carries different rules. Be sure to double check whether your needs fit with these, and reach out to your lender or advisor if youre not sure.

You May Like: What Are Taxes Used For

Discount Fee Or Points

When you pay points toward your mortgage loan, it is also known as buying down the loan. These fees, paid to your lender, lower the interest rate of your loan. One point equals 1% of the loan amount. In our example of a $250,000 loan, you would pay $2,500 to buy the loan down one point. The amount the one percent buy down would impact your interest rate varies by lender, type of loan, and current mortgage rates.

Read Also: Do You Have To Report Roth Ira On Taxes

How Does Buying A Home Affect Tax Return

The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed. It is a form of income that is not taxed. Homeowners may deduct both mortgage interest and property tax payments as well as certain other expenses from their federal income tax if they itemize their deductions.

Read Also: How To Find Annual Income Before Taxes

Three Upfront Tax Deductible Closing Costs

There are three closing costs on rental property that can be deducted right away:

1. Mortgage interest

The interest part of the mortgage payment can be deducted as a closing cost, but not the principal payment because that is an offset to the loan liability on your balance sheet.

For example, if your mortgage is $481 per month principal and interest, only the interest portion of the payment is tax deductible. Other mortgage-related costs such as mortgage broker commission and recording fees are added to the basis.

2. Mortgage points

Also known as discount points, mortgage points are fees paid to the lender in exchange for buying down the rate or reducing the interest rate. One point costs 1% of your mortgage, so one point on a $112,500 mortgage would be $1,125. Points also typically include expenses such as credit check fees and paperwork preparation.

Generally speaking, you will spread the deduction for points over the period of the loan rather than deducting this expense in the first year. But, always check with your tax professional for guidance, because every investors situation is different.

3. Real estate property taxes

Property taxes paid at closing can also be deducted as a rental tax expense. Real estate taxes are prorated between the buyer and seller, with the day of closing belonging to the buyer.

Are Refinancing Fees Or Closing Costs Tax Deductible

This depends. If you are refinancing the home in which you live, you cant deduct any closing costs or fees on your taxes. If you are refinancing a home that you rent out, though, you can deduct some refinancing fees. Thats because homes you rent out earn you income, and the money you spend to earn that income is considered tax deductible.

Also Check: How Much Does Employer Pay In Taxes For Employee

Closing Costs That Increase Your Basis

Other closing costs on a rental property need to be added to the property basis and then recovered over time with depreciation. Your initial cost basis when you buy a rental property is the price paid for the property. After that, certain closing costs are added to the initial basis to arrive at an adjusted basis.

Settlement fees and closing costs that become additions to your basis include:

Refinance Tax Deductions You May Qualify For

You may qualify for several deductions in the year you refinance the mortgage on your rental property and beyond. Talk to an accountant about your eligibility for the following deductions if you are unsure:

- Mortgage interest deduction

- Discount points deduction

The closing costs that are tax deductible on your rental property may include your attorney fees, state-required inspection fees, other legal fees, appraisal fees, and even your refinance application fee where applicable. Insurance and repair costs for the rental property are also typically tax deductible.

Also Check: When Are 2020 Taxes Due

Which Closing Costs Are Not Tax Deductible

Typically, the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Other closing costs are not. These include:

- Owners title insurance

There is one tax benefit to these costs, though. You can add these closing fees to the cost basis of your home when you sell it. This lowers the amount of profit that you make. This can help reduce any capital gains tax you might have to pay on your home.

When you sell a home, you wont have to pay capital gains taxes on the first $250,000 of your sale if you are single or $500,000 if you are married. If you are married and sell your home for $300,000, then, you wont have to pay any capital gains taxes on it.

You will have to pay capital gains taxes on any profits over those figures. If you are married and sell your home for $600,000, youd have to pay capital gains taxes on $100,000 of your home sale. You can, though, reduce this tax burden by adding your cost basis thats where your loan closing costs come in and the costs of any improvements that you made to the home.

Closing Costs On Primary Residence Are Not Tax Deductible

One of the most common questions we get is, Are closing costs tax deductible? Unfortunately, you cannot tax deduct your closing costs on your refinance mortgage for your personal residence. In the past borrowers were able to deduct refinance costs for tax purposes. If you are looking for safe refinance tax deductions then keep reading. Common closing cost expenses include:

- Title insurance fees

- Attorney and notary fees

However, one exception is if your property that is being refinanced is an investment property. In that case, you may be able to tax deduct some of your closing costs it is important to consult with your CPA to ensure that what you want to do is allowable under IRS laws.

Recommended Reading: When Are 2020 Business Taxes Due

Simple Question: Are Closing Costs Tax

Simple answer: it depends. Homeowner tax deductions can be very difficult to calculate, given all the varying factors that go into the equation. So to find out whether the closing costs on your particular home purchase make the cut, check out what the IRS says in its tax deduction breakdown in Form 1040 and on its website.

As with all possible tax deductions, beyond just home-related ones, it is the responsibility of the taxpayer to report each of the taxes and fees related to the purchase as itemized deductions. Also with all possible tax deductions, your first priority is most likely to save money and earn tax advantages. For this purpose, do the groundwork: research whether taking a standard deduction versus deducting your closing costs would save you the most. The standard deduction for tax year 2021 is $12,550 for single filers an d $25,100 for married couples filing jointly. It will increase in tax year 2022 to $12,950 for single filers and $25,900 for married couples filing jointly.

In The Year Of Closing

If you itemize your taxes, you can usually deduct your closing costs in the year in which you closed on your home. If you close on your home in 2021, you can deduct these costs on your 2021 taxes.

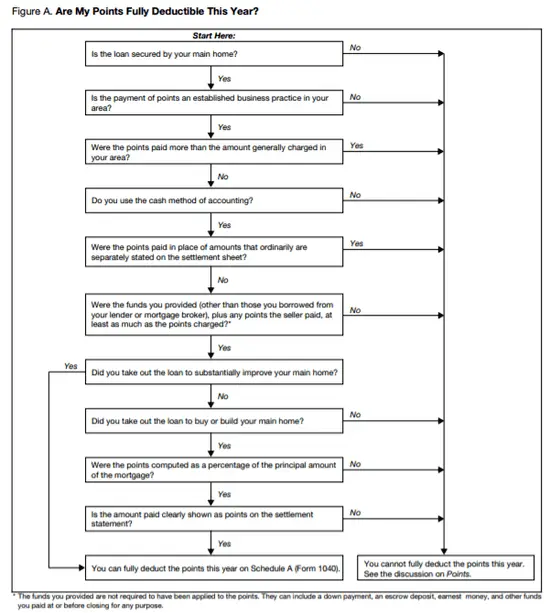

If you purchased mortgage points, though, things can get more complicated. You can deduct the cost of mortgage points in the tax year in which you purchased them if you meet the following rules laid out by the IRS:

- The mortgage loan must be used to buy or build the borrowers primary residence.

- Paying points must be a long-standing business practice in the area where the loan The amount you paid for the points must be average for the area.

- Either the buyers or sellers must pay for the points, and those payments must be documented.

- Youre not allowed to borrow the funds used to pay for points.

- The amount you paid must be clearly shown and itemized on your loans closing disclosure or settlement statement.

Also Check: What Happens If You Forget To File Your Taxes

What Closing Costs Are Deductible When Buying A Home

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes. Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including: Abstract fees.

What Deductions Can A Small Business Claim

Read Also: How To Get Past Tax Returns

Do You Have To Own A Home For 5 Years To Avoid Capital Gains

To get around the capital gains tax, you need to live in your primary residence at least two of the five years before you sell it. Note that this does not mean you have to own the property for a minimum of 5 years, however. Once you’ve lived in the property for at least 2 years, you’d reach capital gains tax exemption.

What Changes The Cost Basis

The basis of a property can be adjusted by closing costs and other acquisition expenses The refinance costs noted above are added to the cost basis and included in the depreciation. If you take that same $100,000 value property and add $5,000 in refinance closing costs, the new cost basis is $95,000, beginning in the tax year that you complete the refinance and incur the costs.

You May Like: When Can I File 2021 Taxes

How Much Are Closing Costs

Most lenders and industry watchers will tell you that your closing costs, on average, will cost you somewhere between 2% and 5% of the amount borrowed.

The national average closing costs for a single-family property were $5,749 including taxes and $3,339 excluding taxes in 2019, according toClosingCorp, which analyzes closing cost data for the industry.

For a more specific estimate, we used a closing cost calculator from banking service BBVA to show what these fees might look like for a $250,000 loan. After entering a 20% down payment, 30 years for the term and a 4% interest rate, the total amount of closing costs was calculated at $7,042.

Recommended Reading: Where Is My State Refund Ga