What Are Taxes And Why Are They Important

The average American family paid $15,748 dollars in federal, state and local taxes in 2018. That was based on an average $51,666 household income, according to USAFacts. Taxes are not only important because of how much of your income they take, but also because of what you get in return.

Governments use taxes to fund public programs, works and services. They provide the money necessary to maintain your local and national infrastructure.

Different levels of government federal, state and local pay for different public services. But sometimes they may overlap. For example, all three levels of government pay for different costs associated with roads, education and some other services.

S For Filing Your Taxes

Once you have your forms and records from the previous year compiled, most people can file their taxes in five basic steps.

Youll have to make decisions each step of the way that can affect the amount of your tax bill or refund. Some decisions can mean it will take you longer to get a refund that you are due.

This guide will help you decide which choices for filing your taxes are best for you.

Child Tax Credit Confusion

The Child Tax Credit and confusion surrounding advance payments of the credit that were distributed in 2021 may be the biggest surprise for a lot of tax filers.

The Child Tax Credit is not income, but if you got the money for the credit ahead of time, you cant turn around and claim the credit for your children on your tax return, Williamson said.

If your adjusted gross income was under $400,000 and you qualified for the CTC, you may have received $1,400 in advance payments. Youll have to report this. But if you didnt receive the advance and were entitled to it you can claim it on your tax return.

Theres going to be a bunch of people that are going to claim this credit, but who already got the money, Williamson said, adding that this could lead to a computational nightmare when people do their taxes.

Don’t Miss: How Much Income Need To File Tax Return

How Are State And Local Taxes Used

State spending varies depending on a lot of different factors, from population to overall wealth to the amount of taxes they collect. But education is the single biggest expense for every state in the union.

State and local taxes often go to the same service public schools are a good example. The state may fund part of the costs and local counties, cities or school districts spend local taxes on them as well.

Combined spending on elementary, secondary and higher education accounts, on average, for nearly a third of state and local expenditures, according to the nonprofit Urban Institute.

Public welfare costs include most Medicaid costs while police spending also includes money spent on courts and correctional facilities in the Urban Institute analysis.

The remaining 22 percent went to direct expenditures money paid to current employees, retirees and private sector entities outside of government such as contractors.

State and local governments spent $3.2 trillion dollars in 2018. Thats a 183 percent increase after you adjust for inflation since 1977, according to the analysis.

What Types Of Taxes Are There In The Usa

There are separate taxes at the federal, state, and local levels in the USA, each of which is added together and paid or withheld as a total amount. However, not all US states have the same taxes. The differences can be enormous from state to state.

Taxes are due in the USA on all income, such as salaries, estates, gifts, dividends, and profits from sales, capital, and imports.

Don’t Miss: How Much Does H& r Block Charge To Do Your Taxes

Energy Environment And Natural Resources

Next time you ask the question what are taxes used for, make sure you take a hard look at the state of the natural resources of the country, its environment and the energy requirements. These are all aspects that are funded for through the use of our tax generated income. 2% of the tax revenue is spent on ensuring environmental protection, protection of the energy assets and conservation efforts for the natural resources of the country.

What Taxes Are Added Back To Ebitda

When you already know the answer to What is EBITDA, its time to look at the taxes included in the equation. As a refresher, here is the EBITDA calculation:

EBITDA = Earnings + Interest + Taxes + Depreciation + Amortization

Business owners pay a number of taxes, including:

And the list goes on. So when it comes to knowing which taxes to include, its easy to confuse which taxes you should use in EBITDA.

EBITDA taxes are specifically income taxes, including:

Keep in mind that the income taxes in the EBITDA calculation are corporate income taxes, not the payroll incomes taxes for employees.

Also Check: Do I Pay Tax On Selling My House

The Role Of Taxes In Ebitda

So, why do you add taxes back in EBITDA, and what is the role of taxes in the equation? You add the income taxes back so your EBITDA equation can reflect how much you pay in taxes more accurately. The more you pay in taxes, the higher your EBITDA.

The role of taxes in the equation is to align your companys EBITDA ratio more closely with other companies in your businesss tax bracket.

But, there is a catch to adding these taxes back to the equation. That catch is your business structure.

Are Us Taxes Low

Generally speaking, U.S. taxes are lower than in other developed nations. In 2018, total U.S. tax revenue represented 24% of gross domestic product according to the Tax Policy Center, whereas the average among the other 35 member countries of the Organisation for Economic Co-operation and Development was 34%.

Read Also: When Are Property Taxes Due

Tangible Personal Property Taxes

Tangible personal property is property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

Taxes on TPP make up a small share of total state and local tax collections, but are complex, creating high compliance costs are nonneutral, favoring some industries over others and distort investment decisions.

TPP taxes place a burden on many of the assets businesses use to grow and become more productive, such as machinery and equipment. By making ownership of these assets more expensive, TPP taxes discourage new investment and have a negative impact on economic growth overall. As of 2019, 43 states taxed tangible personal property.

Paying For Social Programs And Benefits

The taxes you pay also help:

- families with low or modest incomes

- adults 65 years and older

- persons with disabilities

If you are an employee, through the contributions deducted directly from the money you earn, you also contribute towards social programs, like:

- employment insurance

- the Canada Pension Plan

- the Quebec Pension Plan

- the Quebec parental insurance plan

Your employer will deduct these contributions automatically and will also make contributions to these programs in your name.

Note: If you are self-employed, you pay both the employee and employer contributions when you do your taxes.

Your taxes and contributions help pay for social programs and benefits like:

Example: Receiving payments when you need them most

Emmanuel has worked at his office job for many years. He qualifies for the GST/HST credit and receives payments four times a year. His child will be born next month, and Emmanuel plans to take EI parental leave. His wife will also receive CCB payments once their child is born. Without these programs, Emmanuel and his wife would probably have fewer options. This experience helped them understand the benefits of paying taxes.

Resources are available

After you finish this lesson, these resource links will be available:

- Child and family benefits

- Quebec Parental Insurance Plan

Also Check: Do You Have To Pay Taxes On Insurance Settlements

How Do I Pay My Property Taxes

When you borrow money to buy a house, your property taxes are collected as part of your monthly mortgage payment. They are then deposited into an escrow account. That money is used to pay the property taxes, along with everything else. After you pay off your mortgage, you will be responsible to pay property taxes on your home to your county tax collector directly.

Why Are Not All Taxes Included In Ebitda

So, why must you only include income taxes and not other taxes in your EBITDA formula? Income taxes are not a part of your companys overhead or general operating expenses. The other taxes are expenses you must pay regardless of business income or structure.

Another reason you do not include these types of taxes in EBITDA is that most businesses pay these taxes.

For example, you must pay payroll taxes if you have employees. The cost of having employees is an expense that you account for each year. These expenses may fluctuate depending on the number of employees, raises, and other factors. But, the expense of payroll taxes is an overhead cost. Because the taxes are not linked directly to profits, do not include payroll taxes in EBITDA.

On the other hand, corporate profits can vary. As a result, so do the corporate income taxes you must pay. Because of the fluctuation in the amount of income tax your business pays, include the cost of these income taxes in your EBITDA calculation.

The bottom line: The taxes linked directly to profits are EBITDA taxes.

Recommended Reading: Do You Pay Taxes On Unemployment

How Do Taxes Work

In the U.S., federal income tax is a progressive tax system. Effectively, the more you make, the larger the percentage of your income you pay in taxes. Your income level puts you into one of seven tax brackets. The percentage at which your income is taxed is called your tax rate.

Each year, new tax laws change how much you have to pay. They also offer new tax breaks, including tax deductions, tax credits and tax exemptions.

Since 2020, many changes to the federal tax code have been made in response to the COVID-19 pandemic and the economic turmoil it has fueled.

Other issues affecting the 2022 income tax season are underfunding and short staffing at the Internal Revenue Service, the federal agency that collects and processes income taxes.

I would recommend people file electronically, absolutely file electronically if youre expecting a refund, Donald Williamson, CPA and director of the masters in taxation program at American Universitys Kogod School of Business, told Annuity.org. The IRS has 24 million pieces of mail to open and, if you file a paper return, youre in for a long wait.

According to Williamson, the backlog of paper returns is so great in 2022 that there are still people waiting on refunds from their 2020 income tax returns.

What You Need To File Your 2021 Tax Return

Maintaining tax records is a cornerstone personal finance skill. You should receive the forms and tax documents youll need to file your tax return ahead of tax season, between December and the end of January. Youll need to save the paperwork until youve received all that you are expecting before beginning your tax return.

Many of these forms or documents are new this year.

Whether you have been a gig worker who had never received a 1099 Form before or are new to the industry, almost every gig worker will be receiving a 1099-K starting with tax year 2022, Phillips said in a statement.

Common Documents Needed To File Tax Returns

- Form W-2

Additionally, Letters 6419 and 6475 are new for your 2021 taxes. Both can affect your refund or tax liability if you were eligible for or received certain COVID-19 tax relief.

New COVID-19 Relief Forms

- Letter 6419

- Titled Your 2021 Economic Impact Payment and used to reconcile advance CTC payments, Letter 6419 can help you get the rest of your 2021 CTC payments if you havent already received them. The letter lists the total amount of advance CTC payments you received in 2021, along with the number of qualifying children used to calculate the advance payments.

- Letter 6475

- Titled Your 2021 Economic Impact Payment and used to determine your eligibility for the Recovery Rebate credit, Letter 6475 only applies to the third round of Economic Impact Payments issued between March and Dec. 2021.

You May Like: Is It Too Late To File Your Taxes

Claim Standard Deduction And Charitable Contributions

Youll be able to claim charitable contributions on your 2021 federal income tax return, even if you take the standard deduction. In the past, you could only claim a deduction for charitable contributions if you itemized your deductions.

Now, even if youre claiming the standard deduction, youre also able to claim up to $300 for a charitable cash contribution, and if youre married filing jointly, its up to $600, Lisa Greene-Lewis, CPA and tax expert for TurboTax, explained.

This big change could cut the tax bill for up to 90% of taxpayers who currently take the standard deduction if they donated to charity in 2021.

Now, even if youre claiming the standard deduction, youre also able to claim up to $300 for a charitable cash contribution, and if you’re married filing jointly, it’s up to $600. Lisa Greene-LewisCPA and Tax Expert, TurboTax

Cash contributions include donations made by cash, check and credit or debit cards, as well as any out-of-pocket expenses you were not reimbursed for while volunteering for a qualifying charity. It does not include the value of your volunteer services, securities or other property.

What Is The Alternative Minimum Tax

The alternative minimum tax is a tax designed to ensure that taxpayers who earn above a certain threshold pay their fair share of taxes. The AMT places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits they may claim.

The IRS exempts income up to a certain level from the AMT, and this amount automatically adjusts with inflation. In 2021, the AMT exemption amount is:

- $114,600 for married individuals filing jointly and surviving spouses

- $73,600 for single individuals and heads of households

- $57,300 for married individuals filing separately

Don’t Miss: What Is Income Tax In New York

Taxes Based On Wealth

Taxes based on wealth are taxes imposed on things people own. For example, property taxessuch as those imposed based on the assessed value of real estate or other propertyare the main source of revenue for many local governments.

Other examples of taxes based on wealth are inheritance, estate, and gift taxes.

A Brief History Of Taxes In The Us

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

You know the sayingnothing is certain except death and taxes. Though that may be true, taxes tend to be more complicated and very inconsistent. And they didn’t always exist as they do today. In fact, America’s first citizens enjoyed very few taxes.

But as time went on, more levies were added: federal income tax, the alternative minimum tax, corporate tax, estate tax, the Federal Insurance Contributions Act , and so on. Some were increased, while others were repealedonly to be added again. Below is our analysis of the origins of some of the more common taxes we face today.

Also Check: Who Qualifies For The Earned Income Tax Credit

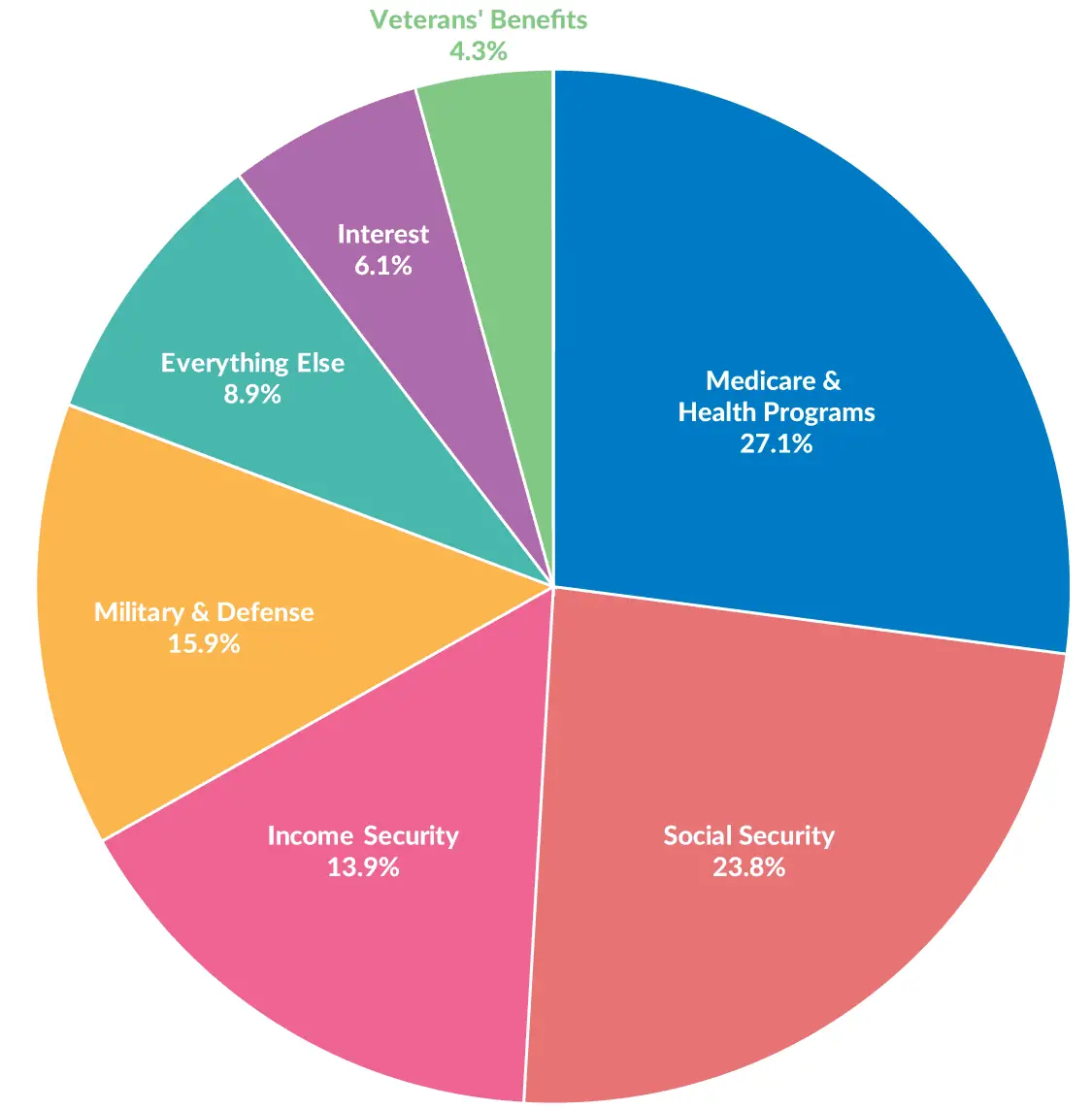

How Are Federal Taxes Used

Most of the taxes collected by the federal government go to national defense, Social Security, Medicare and other health or social programs.

The federal government routinely spends more money than it collects from taxes and other forms of revenue. As of late 2021, the national debt the amount of money the federal government owes was more than $28.4 trillion, according to the U.S. Treasury Department.

What Are Property Taxes

A property tax is what it sounds like a tax paid on a residential or commercial property owned by individuals like you or a legal entity. The rate is determined by your local government and is based on many factors. Well talk more about how to calculate property tax later. Since the tax rate is determined based on your local government, it varies across states and even across zip codes!

Take a state like New Jersey where homeowners pay an average property tax rate of 2.47% for 2021. On a $327,700 house that means $675 per month and $8,108 per year in property taxes.

On the other end of the spectrum, there are states like Alabama where average property tax on homeowners is 0.42%. With median property value at $137,200, this means Alabamians pay an average annual property tax of $572. A relative bargain.

Despite the many dissimilarities between New Jersey and Alabama, its still somewhat shocking to see a difference in annual property taxes to the tune of $7,500. It makes you think: What exactly goes into determining property taxes and where does the money you pay ultimately go? You may be surprised to learn how your property taxes benefit your community in a variety of ways.

Recommended Reading: What Are The Tax Brackets For 2021

Are Property Taxes Included In Mortgage

While not all types of loans require lenders to include property taxes in your monthly mortgage payments, there are some types that do. One example is the FHA mortgage. This type of loan lumps property tax payments into the mortgage payments you pay each month. Some lenders do often charge you more than the expected property tax, just in case you end up owing more than originally calculated. Of course, if you overpay, the lender will refund you. However, if you underpay, you will have to make additional payments.

How does it work if your property taxes are included in your mortgage? Well, the lender deposits any property taxes into escrow. This is an account that your lender uses to collect and store your taxes. Then, when the county requires payment, your lender pays your property taxes out of the escrow account.

Dont think this removes the responsibility from you completely. You should still be checking every month for a notice of receipt of payment from your local tax collectors. If youre missing this, you need to take action and speak with the tax authority and your lender. While having property taxes included in your mortgage payment can be easier, it is still your responsibility to make sure your taxes are paid on time.