File Electronically And Opt For Direct Deposit For Your Refund

The IRS is encouraging taxpayers and tax professionals to file electronically once they have all the information they need to complete an accurate return. That will avoid delays in the processing and issuing of refunds, child tax credits and recovery rebate credits, the agency said.

“Going online ensures you get the full amount of credit and refunds you’re due,” Burhmann told CNET.

Using direct deposit is the fastest way to get any refund or credits due to you, according to Rettig. Individuals can use a bank account, prepaid debit card or mobile app and will need to provide routing and account numbers.

You can open an account at an FDIC-Insured bank or through the National Credit Union Locator Tool.

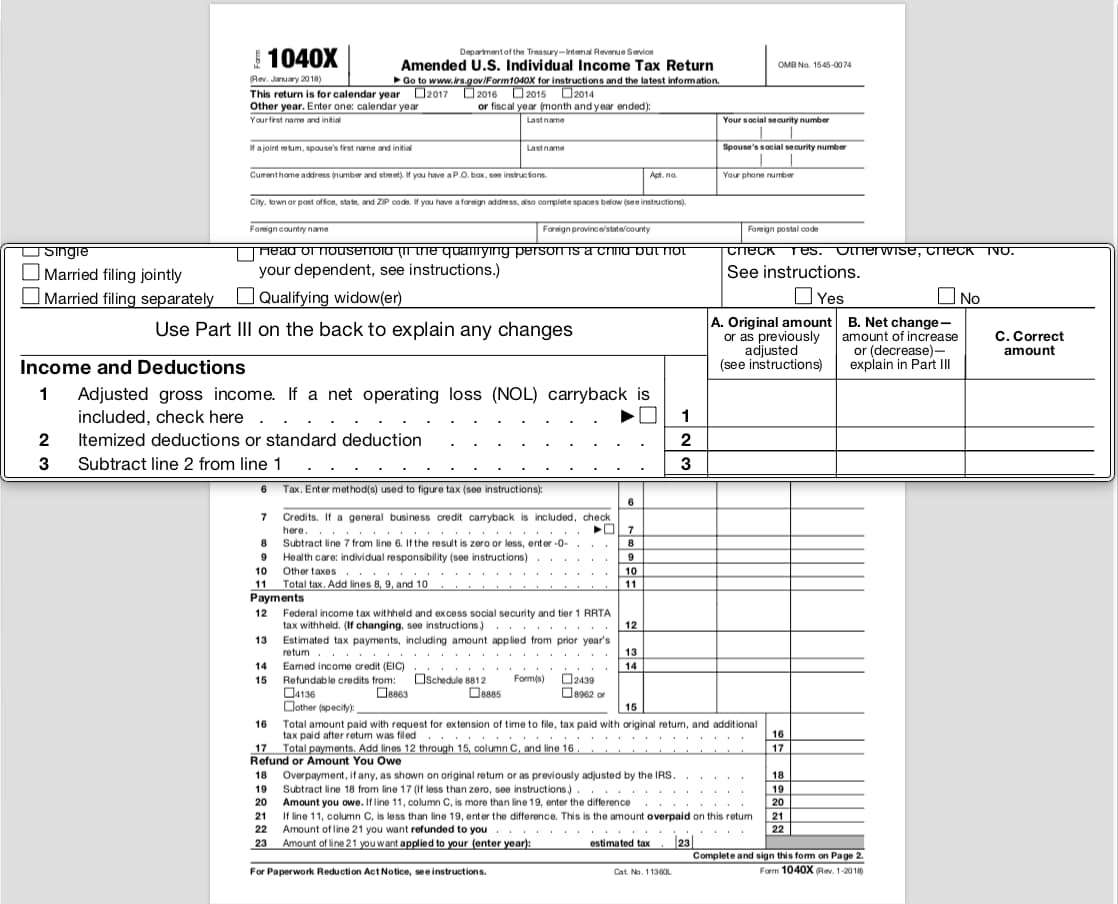

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

When Should I Receive My 2021 W

W-2’s are due to be mailed no later than Jan. 31. According to the IRS, a 2015 law made it a permanent requirement that employers file copies of their Form W-2, Wage and Tax Statements, and Form W-3, Transmittal of Wage and Tax Statements, with the Social Security Administration by Jan. 31.

FREE COVID TEST KITS:How do you get free COVID tests from the government? You can order online or with new hotline.

Don’t Miss: How Much Taxes Do You Pay For Doordash

If You Preparedyour Taxes Online

Youll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, its a simple matter of clicking on the Documents tab, then on the tax year you want, then finally on Download PDF.

TurboTax suggests using the Account Recovery tool if you cant find the return youre looking for. Its possible that youre not signed in under the same account you used to prepare it.

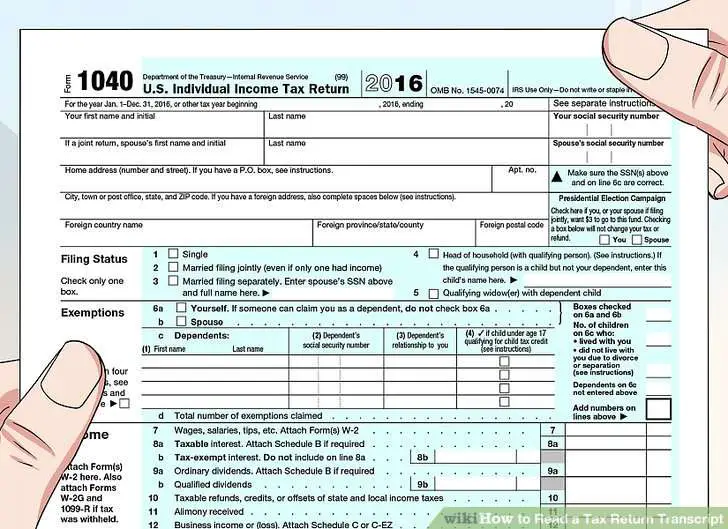

Request Federal Return From Irs

To get a photocopy of your federal tax return, download and print Form 4506 from the IRS website. Fill in the information requested about yourself and the tax return year requested and then sign the form.

You’ll need to include a money order or check for $50. However, there’s an exception if you’re eligible for a fee waiver for disaster assistance and emergency relief. The IRS notes that you’ll need to use the memo or note field to write “Form 4506 request” along with your Social Security number or tax ID.

The second page of Form 4506 will list IRS offices sorted by location. Find your local office’s address and mail the form and payment to that location. The IRS will mail the photocopied tax return within 75 days.

You May Like: Do You Get A 1099 From Doordash

How Do I Know If The Amount Listed On My 1099

If you have access to your HIRE account, you may want to look at your Claim Summary page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, , and Federal Pandemic Unemployment Compensation, , are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

Can I Check My 2018 Tax Return Online

The IRS offers IRS etools at IRS for taxpayers who have already filed their 2018 taxes to check on their refund status. Through the IRS2Go app on iPad, or at IRS.gov. When a taxpayer files an electronic return, or four weeks after he mails in a paper return, he or she is provided with refund information.

Read Also: Door Dash And Taxes

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

When Are State Tax Returns Due

Of the 41 states that collect income tax, most are adhering to the April 18 deadline, though there are some exceptions.The deadline to file 2021 state income taxes in Delaware and Iowa, for example, is April 30, 2022. In Virginia, the due date is May 1 and in Louisiana, it’s May 15.Check with your state department of revenue for the most current information and deadlines.

Your state may have a different tax deadline than the IRS does.

Don’t Miss: Does Doordash Give You A 1099

How Do I Get My Original Agi If I Cannot Locate My Last Year’s Return

To retrieve your original AGI from your previous year’s tax return you may do one of the following:

- Use the IRS Get Transcript Online tool to immediately view your Prior Year AGI. You must pass the IRS Secure Access identity verification process. Select the Tax Return Transcript option and use only the “Adjusted Gross Income” line entry.

- Contact the IRS toll free at 1-800-829-1040

- Complete Form 4506-T Transcript of Electronic Filing at no cost

- Complete Form 4506 Copy of Income tax Return

Filing Back Tax Returns

You may be able to fill out past-due tax returns through online software or with an accountant, but youll need to print the forms and mail them to the IRS.

Mail your back tax returns to the IRS in separate envelopes and send them by certified mail so that you have proof that the IRS received each individual tax return. Mailing them in separate envelopes will also help prevent the IRS from making any clerical errors in processing them. It takes about six weeks for the IRS to process accurately completed back tax returns.

Remember, you can file back taxes with the IRS at any time, but if you want to claim a refund for one of those years, you should file within three years. If you want to stay in good standing with the IRS, you should file back taxes within six years.

You May Like: Is Plasma Donation Money Taxable

Advance Child Tax Credit Payments

The American Rescue Plan, signed by President Joe Biden in March, boosted the 2021 child tax credit to $3,000 from $2,000 per child age 17 and under, with an extra $600 for children under age 6.

Millions of families received half up front, through $250 or $300 monthly payments, from July through December, meaning they will have a smaller write-off at tax time.

“Working families are not expecting this,” said Tommy Lucus, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida. “And it’s going to be a shock to them.”

For example, if you qualified for a $3,000 tax credit and received payments for $1,500 in advance, you will claim the $1,500 balance when filing a tax return.

When Can I Expect My Refund

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> If you file electronically and choose direct deposit, the IRS says you can expect it within 21 days, assuming there are no problems with your return.By law, the agency cannot issue refunds involving the earned income tax credit or additional child tax credit before mid-February, in order to help prevent fraudulent refunds from being issued. But individuals who are eligible for those credits can still begin filing on Jan 24.

Read Also: Pastyeartax Com Reviews

Dont Count On That Tax Refund Yet Why It May Be Smaller This Year

- If youre banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

- The advance child tax credit, paused student loan payments and year-end mutual fund payouts may cause higher taxable income for 2021.

If you’re banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

Typically, you get a federal tax refund when you’ve paid or withheld more than the amount you owe, based on taxable income.

The IRS subtracts the greater of the standard or itemized deductions from adjusted gross income to reach taxable income, and there are a few reasons why it may be higher in 2021.

Pay Social Security Taxes To Qualify For Benefits

Self-employed individuals have to pay Social Security taxes through their estimated tax payments and individual income tax returns. By filing a return and paying the associated taxes, you report your income so that you may qualify for Social Security retirement and disability benefits when you need them.

Read Also: Where Can I File An Amended Tax Return For Free

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the softwares instructions to e-file the

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

What Is Free File

Yet a simple way to cut down on costs which many people oddly dont tap into remains using the IRS Free File system, if you qualify. Why pay $40 or $50 or more for online software if you dont have to do so?

The Free File program at IRS.gov gives eligible taxpayers free access to brand name software programs offered by rival tax-prep companies. Those who qualify can use online software that prompts filers with key tax questions, does the math and allows you to file returns electronically for free. E-filing helps the IRS process returns and issue refunds more quickly than a return filed by paper.

TurboTax was but one partner in Free File. Those who selected TurboTax last year are able to opt for another online tax preparation service in the Free File program. Last year, there were nine tax software products available via Free File in English and two in Spanish.

Read Also: Do You Have To Pay Taxes Working For Doordash

Can I Deduct $300 Of Charitable Contributions In 2021 Without Itemizing Like Last Year

Yes. If you are single, you can deduct up to $300 of cash contributions to qualified charities and still take the standard deduction. If you are married and filing a joint return for 2021, you can claim the standard deduction and also deduct up to $600 of cash contributions to qualified charities. Remember that gifts to some charitable organizationsfor example, those to private, non-operating foundations and donor-advised fundsare deductible only as itemized deductions. In addition, if you made substantial cash contributions in 2021, you may claim itemized deductions for cash contributions in an amount equal to 100% of your adjusted gross income.

Consider Irs Transcript Vs Return

If you can’t access your H& R Block tax records for some reason, you can fill out IRS Form 4506, Request for Copy of Tax Return, and pay a fee to have the IRS send you a photocopy of your federal tax return. This method will let you get a past return as far back as six years ago. The downside is that you may have wait as long as 75 days to have the IRS mail you the documents, and this can be a problem if you need them quickly for an application you’re filling out.

If you only need to know specific information from your last tax return and don’t need the actual document, then requesting an IRS tax transcript can be a free and quick alternative. The IRS makes transcripts available for the last three tax years, and you can get yours as soon as five to 10 days from when you order.

You have a few transcript options that may work for you. If you need your adjusted gross income, taxable income and other basic items from your tax return, you can request a tax account transcript. You can also request a tax return transcript that has much of the information from your tax return and related forms but doesn’t account for any changes made after the original filing date. Credit Karma notes that banks and other organizations will often accept tax transcripts as part of their verification process, so check to find out which they prefer.

Read Also: Highest Paying Plasma Donation Center Near Me

First Time Signing In This Year

How Long Can The Irs Collect Back Taxes

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> There is a 10-year statute of limitations on the IRS for collecting taxes. This means that the IRS has 10 years after assessment to collect any taxes you owe. This is a general rule, however, and the collection period can be suspended for various reasons, thus extending how long the IRS has to collect your debt.

Recommended Reading: What Tax Form Does Doordash Use

Where Do I Find My 1099

Also Check: What Is The Unemployment Percentage In The United States

Here’s How Long It Will Take To Get Your Tax Refund In 2022

Three in four Americans receive an annual tax refund from the IRS, which often is a family’s biggest check of the year. But with this tax season now in progress, taxpayers could see a repeat of last year’s snarls in processing, when more than 30 million taxpayers had their returns and refunds held up by the IRS.

Treasury Department officials warned in January that this year’s tax season will be a challenge with the IRS starting to process returns on January 24. That’s largely due to the IRS’ sizable backlog of returns from 2021. As of December 31, the agency had 6 million unprocessed individual returns a significant reduction from a backlog of 30 million in May, but far higher than the 1 million unprocessed returns that is more typical around the start of tax season.

That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. And some taxpayers are already reporting receiving their refunds, according to posts on social media.

However, so far, the typical refund is about $2,300 less than the average refund check of about $2,800 received last year. That could change as the tax season progresses, given that tens of millions of Americans have yet to file. But it could signal that taxpayers could get smaller checks this year, an issue for households already struggling with high inflation.

Read Also: Does Doordash Do Taxes