Whos Eligible For Social Security Disability Insurance

In addition to meeting the disability requirements, you must have worked long enough and recently enough to qualify for Social Security Disability Insurance.

First, you must meet the work test. This test is based on Social Security work credits and requires you to earn at least a minimum amount of income in wages or self-employment income per calendar year. For each $1,510 in wages or self-employment income that you earn per year you earn one credit. You can earn up to four credit per year. When youâve earned $6,040 in 2022, youâve earned your four credits for 2022.

Typically, you need at least 40 credits with 20 of these earned in the last 10 year period ending with the year of your disability. However, meeting the work test requirement can also depend on your age. It requires different amounts of Social Security credits since younger workers typically have not had enough time in the workforce to earn the full 40 credits. For those:

- Under age 24: You meet the work test if you earned 6 credits in the 3-year period when your disability began.

- Age 24 to 31: In general, you may qualify if you have credits equivalent to working half the time between age 21 and becoming disabled.

- Age 31 or older: Youâll need to have earned at least 20 credits in the 10-year period immediately before becoming disabled.

Second, review the Social Security Administrationâs table to determine if you meet the duration of work test based on your age and when your disability began.

High Credit Utilization Rate

Paying taxes with a credit card can also potentially have a negative impact on your credit score. Charging high tax payments to a credit card can cause a spike in your credit utilization rate, which is the total percentage of your credit you use.

To calculate your utilization rate, simply divide your total credit card balance by your total available credit. So if you have two credit cards with a combined $3,000 balance and a total $10,000 credit limit, your utilization would be 30%. Adding a $2,000 tax payment to that would increase your utilization rate to 50%, which is high.

Credit score calculations weigh your credit utilization rate and it’s ideal to keep it as low as possible. FICO found that “high-achievers” maintain utilization rates below 15%.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Find: 5 Things You Must Do When Your Savings Reach $50,000

For that, they can thank an 8.7% cost-of-living adjustment designed to help seniors and other beneficiaries deal with a soaring inflation rate that is also the highest in 41 years. Heres a roundup of the latest announcements and other information you should know.

Also Check: How Do You Pay Taxes You Owe

When Are Quarterly Taxes Due For 2022 And 2023

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2022:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2023, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

Get Our Top Investigations

Heres what happened when we went looking.

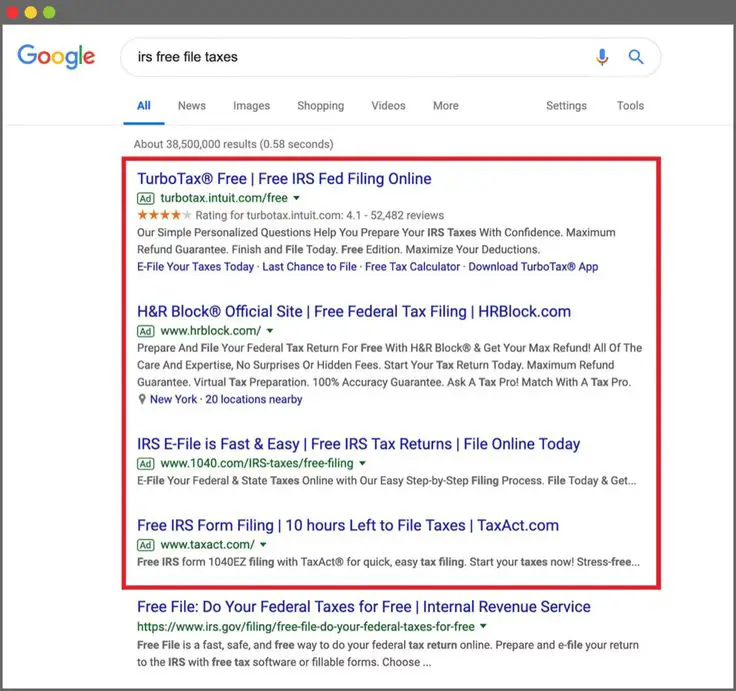

Our first stop was Google. We searched for irs free file taxes.

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word free five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasnt going to be free at all. Turns out the house cleaner didnt qualify because he is a independent contractor. The charge? $119.99.

Then we tried with a second scenario. We went back to TurboTax.com and clicked on FREE Guaranteed. This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay this time because theres an extra form if you dont have insurance. The charge? $59.99.

But wait. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? No! According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free.

You May Like: How To Calculate Federal Tax

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast-growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 398,200 electronic payments in 2020. The Department also received more than 2.8 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

What Is The Turbotax Free File Program

The TurboTax Free File program is required as part of the IRS Free File program.

To qualify for the TurboTax Free File, you must make under $34,000 per year.

You are eligible if you make less than $34,000 and:

Click here to access the TurboTax Free File program.

Important: If you make under $66,000 per year, you are eligible to file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, .

Recommended Reading: Where Do I Report 1099 Q On My Tax Return

Electronic Federal Tax Payment System

You can also pay your tax bill using the government’s Electronic Federal Tax Payment System . You’ll use your Social Security number or Individual Taxpayer Identification Number , a personal identification number , an internet password, and a secure browser to make a payment through this system. It can take up to five days to process your enrollment in this service, and you can complete the initial paperwork online or over the phone. With EFTPS, you can schedule payments up to 365 days in advance, and you’ll receive an immediate confirmation upon payment.

How To File For Your Alaska Permanent Fund Dividend Using Turbotax

If youre looking to get your Alaska Permanent Fund Dividend , you may be wondering if you can file for it using TurboTax. The answer is yes! Heres what you need to know about how to file for your PFD using TurboTax. The Alaska Permanent Fund Dividend is a yearly cash payment made to eligible residents of Alaska. The amount of the dividend is based on the earnings of the Alaska Permanent Fund, which is a state-owned investment fund. To be eligible for the Alaska Permanent Fund Dividend, you must have lived in Alaska for at least one calendar year as a resident. You must also be a U.S. citizen or a qualified alien. If you meet these requirements, you can file for your Alaska Permanent Fund Dividend using TurboTax. To do so, youll need to enter your PFD information in the Alaska PFD section of the TurboTax software. When youre ready to file your taxes, TurboTax will ask you if you want to file for your Alaska Permanent Fund Dividend. Simply select Yes and enter the required information. Once youve entered your PFD information, TurboTax will calculate your dividend and file your taxes accordingly. You should receive your dividend check in the mail within a few weeks. Thats all there is to it! Filing for your Alaska Permanent Fund Dividend using TurboTax is quick and easy. So if youre a resident of Alaska, be sure to take advantage of this great benefit.

Read Also: Is Heloc Interest Tax Deductible

Social Security And Medicare Taxes

During any calendar year in which your employer pays you more than a specified amount $2,300 in 2021 and $2,400 in 2022 they must collect and pay the employer portion of Social Security and Medicare taxes on your behalf. The same is true if your household employer pays you $1,000 or more during one calendar quarter.

As an employee, you’re responsible for paying half of the tax , and your employer must pay the other half. Some employers might voluntarily cover both portions and not withhold any of it from your pay.

If you think a family hired you as an employee but your household employer thought you were a self-employed person, you may need to attach Form 8919 for Uncollected Social Security and Medicare Tax on Wages. By filing this form, your Social Security earnings will be credited to your Social Security record.

How To Pay Quarterly Taxes

Once you’ve calculated your quarterly payments,

- You can submit them online through the Electronic Federal Tax Payment System.

- You can also pay using paper forms supplied by the IRS.

- When you file your annual tax return, you’ll pay the balance of taxes that weren’t covered by your quarterly payments.

You have other options as well when you show an overpayment of tax after completing Form 1040 or 1040-SR. You can apply all or part of your overpayment to go toward your estimated tax for the current tax year rather than be refunded.

Consider this amount when estimating your tax payments for the current tax year. You can treat the overpayment credited toward your estimated taxes as a payment made on the April deadline for the first quarter of the current tax year.

You can use your new total annual income to estimate your quarterly payments for the next tax year. You can also use software like QuickBooks Self-Employed to track your income, expenses, and deductions throughout the year, which will help with estimating your quarterly payments.

Read Also: Do You Have To Do Taxes For Doordash

States That Tax Social Security Benefits

You may have dreamed of a tax-free retirement, but if you live in one of the states that tax social security, your benefits could take a hit.

Are Social Security benefits taxable? You can bet your bottom dollar they are at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But do states tax Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

States have different ways of taxing Social Security, too. It can be age-based, such as in Colorado where people under 65 may owe taxes on Social Security benefits but older people generally donât. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then thereâs Utah, which includes Social Security benefits in taxable income, but allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

The state-by-state guide to taxes on retirees is updated annually based on information from state tax departments, the Tax Foundation, and the U.S. Census Bureau. Income tax rates and related thresholds are for the 2022 tax year unless otherwise noted.

Recommended Reading: Age Of Full Social Security Benefits

How To Report Your Alaska Permanent Fund Dividend On Your Taxes

Dividends of the Alaska Permanent Fund are paid out from the Alaska Permanent Fund, a trust fund established in 1976 to provide a steady income stream for Alaskans. Federal income tax exemptions for charitable contributions do not apply to dividends however, those who receive dividends are required to file federal income tax returns for the year. Form 1040 should contain these amounts, as well as lines 8f and 8j of Schedule 1. In 2018, you must report all dividends as taxable income if you received a Permanent Fund Dividend . In 2021, the dividend will be $1,114. Taxation of the funds is imposed, but no federal income taxes are withheld. You must report all income received by you and your minor child to the IRS in order to pay all associated taxes.

Also Check: When Is The Tax Filing Deadline For 2021

Pay Some Of The Tax You Owe

If you can afford to pay some, send it by April 18. The penalty for not paying your taxes depends on the total tax you owe. If you pay some now, the penalty will be smaller later.

You can make a partial payment with TurboTax. In the File section, select I will mail a check. If you choose to pay with your bank account or credit card, TurboTax will charge the total tax due.

Guide To The Nanny Tax For Babysitters And Employers

OVERVIEW

When it comes to working in people’s homes, the working arrangements are often casual and wages are paid out in cash. This grey area can lead to confusion for both parties, but determining if a nanny or home-care giver is considered a household employee can make tax filing simpler for everyone involved.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Recommended Reading: What Is The Penalty For Late Taxes

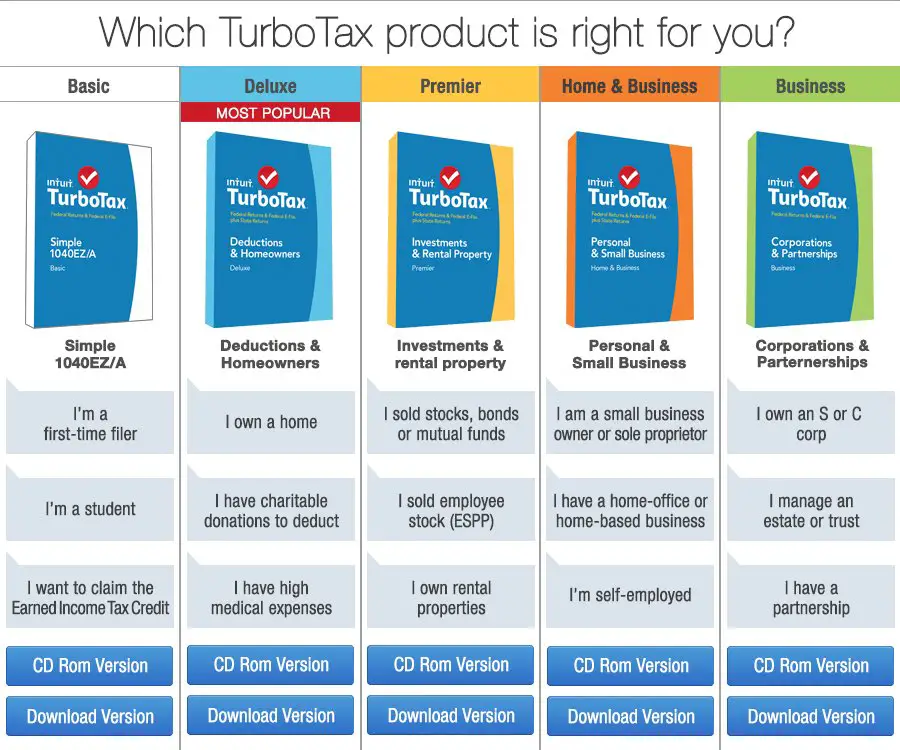

Who Qualifies For Turbotax Free Edition

If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industrys deal with the IRS. You can access the TurboTax Free File program here.

TurboTax also offers a Free Edition for people who are filing very simple returns. Warning: The Free Edition puts many people on track to pay is not part of the IRS Free File program.

Remember: If you make under $66,000 per year, you are still eligible to prepare and file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, to find another free tax preparation offer from IRS Free File.

Rep Frank Ryan Introduced The 314

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

A state lawmaker has come up with a revised version of a plan he first introduced three years ago that would not only eliminate school property taxes but would make it illegal for a Pennsylvania school district to impose one.

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

Of course, the plan calls for some tax shifting to generate the $16 billion needed to replace the lost property tax revenue for schools. It also includes new taxes on certain retirement income and food and clothing.

Rep. Frank Ryan, R-Lebanon County, on Thursday unveiled his a 314-page House Bill 13 that is the product of five years of work and pulls in the expertise of a bipartisan working group of property tax elimination advocates.

Everybody wants to get rid of property taxes as long as the other person is the one who is going to pay the replacement tax, Ryan said at a Capitol news conference flanked by members of his working group. It is clear that any solution will require sacrifice on the part of all Pennsylvanians.

His plan tries to spread that burden around. It would:

Ryan acknowledges applying the tax on retirement income makes the sales pitch for his plan a tough pill to swallow, but said he believes Pennsylvanians will face that eventuality anyway.

Read Also: Ssa Retirement Benefits Application Form

Don’t Miss: Is Ein Same As Sales Tax Number

Social Security And State Taxes

Some of the confusion over the tax status of Social Security payments likely comes from the fact that each state treats Social Security differently. Many states treat Social Security the same way the federal government does, taxing every dollar of it based on the bracket you slot into with your full retirement income. This means that your Social Security check will be taxed twice once by the federal government and once by your state.

Other states only partially tax Social Security. They might only tax 50% of it, or have some other formula for determining exactly how much of your monthly check is subject to state taxes.

Finally, some states dont tax Social Security at all. For some of these states it is a special carveout, and for others it is simply because there is no state income tax, so none of your retirement income will be subject to any state tax.