Subtract Taxes You’ve Already Paid

You must pay taxes as you earn or receive income by making tax withholding payments or making quarterly estimated payments.

How Often Can You Change Your Payroll Exemptions

Americans don’t agree on much, but try to find one who argues against getting a tax refund. The funny thing is, a tax refund is just the government giving you back money you earned in the previous year. It’s just what you overpaid to them in taxes that year. Just how much comes back to you is based on several factors, but the biggest reason is how much your employer takes out of your checks all year.

Exceptions To Getting A Refund Or Owing Taxes

Some individuals and couples dont have to file a tax return. To determine whether you need to file, check the standard deduction for the appropriate tax year for your filing status. If your income is below the standard deduction, you dont need to file a tax return. If youre not sure whether you need to file, you can also visit the IRS website and use their interactive tool called Do I Need to File a Tax Return? to find out if you need to file. You can use the tool without creating an IRS.gov account.

Even if you dont have to file, though, you may still want to if youre entitled to a refundable tax credit. The Earned Income Tax Credit and the Child Tax Credit are both refundable, so if you qualify for them, you may receive a refund. You can only get the refund if you file taxes, though.

You May Like: Is Doordash Taxable Income

What People Get Wrong About Tax Refunds

I have a confession to make: I actually love the kooky weirdo financial experts you see on TV or on their online soapbox who lecture you about taxes. Because 99.99% of the time they are DEAD WRONG about money.

One of their favorite go-to buzz phrases:

If youre getting a tax refund, youre giving the government free money!

TRANSLATION: If you get a refund, that means the government took your money and earned interest on it for an entire year!!

Then these experts are typically out of breath because of their own brilliance.

Let me break this down for you.

The average tax refund is about $3,000. Lets assume that money would have been sitting in a savings account with a 1.45% APY .

How much interest did you lose through your tax withholdings? $3.62 a month.

OMG!! The government is stealing the equivalent of a latte each month! Time to dump a bunch of tea in Boston Harbor.

Heres a hard truth: If you had that money, you probably would have spent it. Thats not a slight against you thats just human psychology. We as humans have an incredibly finite amount of willpower. Thats why cost-saving measures like cutting out lattes or lunch at your favorite sandwich spot arent realistic.

And yes, technically, theyre right. You could have been earning interest on the money. I live in a world of reality, however, which means that technically isnt always correct.

What To Know About The 2022 Tax

Even in 2022, the unprecedented nature of this years tax-filing season all comes down to the COVID pandemic. The federal government tasked the IRS with delivering most of the direct aid approved for 2021 in President Joe Bidens American Rescue Plan, whether that was the child tax credit or stimulus checks.

We urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year, Rettig said. People should make sure they report the correct amount on their tax return to avoid delays.

Those features can cause delays because they leave more room for error either because the IRS didnt tally Americans stimulus totals correctly or because taxpayers made a math error.

Taxpayers are not submitting their tax returns as normal this year, says Garrett Watson, senior policy analyst at the Tax Foundation. Theres going to be wide variations in peoples experiences during this years tax season some are going to see disruptions.

You May Like: Do Doordash Drivers Pay Taxes

Interest On Delayed Income Tax Refund

Under Section 244A of the Income Tax Act, in case the refund payment is delayed, the Income Tax Department is liable to pay interest at 6%. The interest applicable to your refund amount shall be computed from the date on which the tax was paid to the date on which the refund was made. For example, if you claim a refund of Rs.10,000 for AY 2017-18 and you received the refund in March 2018, the interest applicable to your refund will be computed from April 2017 to March 2018.

How To Estimate How Much I Will Get Back In Taxes

Receiving a tax refund is like coming upon found money, but a refund has actually been your money all along, which you overpaid through payroll deductions or quarterly tax payments returned to you. When you complete your tax return, youll be able to estimate the amount of taxes you overpaid, which means any surplus will be headed back your way. So sharpen your pencil, turn on the calculator and tackle that tax return or you may avail yourself to an online tax return estimator that does the math for you.

Tips

-

You can estimate your tax refund by comparing your yearly tax contributions to your income tax bracket while simultaneously factoring in the various credits and deductions you have taken.

Don’t Miss: Www 1040paytax

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Child Tax Credit: Will You Need To Pay Money Back To The Irs Check Here

Here’s a quick and easy way to see if you were eligible for payments last year and the remainder of the credit this year.

Katie Teague

Associate Writer

Katie is an Associate Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

If you’re not eligible for child tax credit payments you received in 2021, you might need to repay the money back.

Millions of families last year received six advance child tax credit payments. But while most were eligible to receive the payments, there are some who didn’t qualify. If you weren’t eligible and still received those payments, or if you received a higher amount than you’re eligible for, it’s possible you’ll have to pay back a portion to the IRS when you file your taxes. You can use the IRS Eligibility Assistant Tool to check by answering a few questions. More on that below.

The IRS online tool is the best way to check your eligibility online without the hassle of calling the IRS. You’ll need some personal information and an account with the IRS which will require a bit of time to set up using ID.me. We’ve updated this story recently.

Recommended Reading: Can You File Taxes With Doordash

How Do I Get My Tax Refund

Luckily for you, the IRS is very good about getting your tax refund to you.

In fact, you can check out the IRSs Wheres my refund? tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, its going to take considerably longer to get your refund back. In fact, youre going to have to wait four to six weeks before youre even able to check your status on their Wheres my refund? tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit . Its secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use:

So you know how much youre getting back and how to get your money. Now lets get into what you might be getting WRONG about your tax refund.

Why Use A Paycheck Calculator

Use one of the calculators listed below to estimate how much money will be in your pay. Paycheck calculators can also be helpful even before you’ve accepted a job offer, or when you’re offered a raise.

What may seem like a large salary or a reasonable hourly rate, may seem different when you use a paycheck calculator and see the amount that you receive.

Paycheck calculators can also help determine if you are deducting the correct amount of money from your check for taxes:

- If you deduct too little, you will need to pay back the amount you underpaid throughout the year at tax time.

- If you deduct too much, you’ll receive money back at tax timewhile unexpected money is always nice, having the money throughout the year may be more beneficial.

Learn how to fill out a W4 form before you begin a new job, so you can make sure the correct amount of money is deducted from each paycheck.

There are paycheck calculators to help you determine how much your paycheck will be after deductions and to help you decide how much you should have deducted to cover taxes.

Don’t Miss: Doordash Deductions

How Do I Check My Child Tax Credit Eligibility Online

Before you begin, make sure you’ve got a copy of your most recent tax return. If you don’t have a tax return on hand, you can use your filing status and the number of children you claimed, along with an estimate of your total income for 2021.

Use the IRS Eligibility Assistant tool to answer a few quick questions to see if you qualify. Here’s how.

1. Go to the Advance Child Tax Credit Eligibility Assistant tool page on the IRS website.

2. Tap or click Check Your Eligibility.

3. You’ll then need to answer a few questions about yourself and your taxes. For instance, the form will ask if you claimed the child tax credit on a previous tax return.

4. You may need to provide additional information, depending on how you answered the questions. Here’s where you fill in your filing status, adjusted gross income and the number of children you claimed on your tax return .

5. After you hit Next, the tool will let you know whether you qualify based on the answers you provided. It’ll tell you the amount each kid under 6 qualifies you for, and how much each kid 6 and older qualifies you for. It’ll also show you the income phaseout details.

6. From here, tap or click Manage your advance child tax credit payments, which will take you to the child tax credit portal.

Keep in mind that the Eligibility Assistant tool and Child Tax Credit Update Portal do not tell you how much you are eligible for. The tool also doesn’t tell you:

Withholding: How Its Calculated

At this point you may be thinking, OK. Well Im in the __% tax bracket, and its obvious that my employer is withholding way more than that!

Youre probably right. Thats because your employer isnt just withholding for federal income tax. Theyre also withholding for Social Security tax, Medicare tax, and state income tax.

The Social Security tax is calculated as 6.2% of your earnings, and the Medicare tax is calculated as 1.45% of your earnings. Before youve even begun to pay your income taxes, 7.65% of your income has been withheld.

Your refund is determined by comparing your total income tax to the amount that was withheld for federal income tax. Assuming that the amount withheld for federal income tax was greater than your income tax for the year, you will receive a refund for the difference.

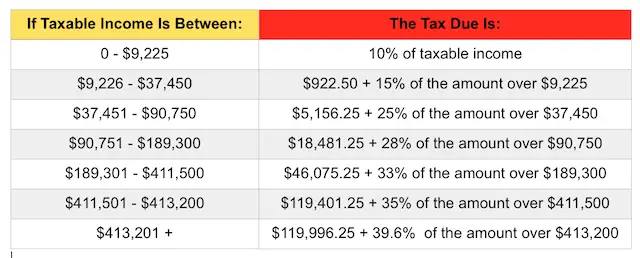

EXAMPLE: Nicks total taxable income is $32,000. He is single. Using the tax table for single taxpayers, we can determine that his federal income tax is $3,641.

Over the course of the year, Nicks employer withheld a total of $8,500 from his pay, of which $4,000 went toward federal income tax. His refund will be $359 .

Read Also: Csl Plasma Taxes

The $8000 Child Tax Credit That Many Parents May Not Know About

Most U.S. families with children are familiar with the federal Child Tax Credit, given that parents of more than 60 million kids received enhanced payments in 2021. But there’s another tax benefit geared to parents that may be less well known than the CTC but that can be far more generous, providing up to $8,000 in tax credits this year.

The Child and Dependent Care Credit was supercharged through the 2021 American Rescue Plan, with the pandemic aid bill boosting how much parents can claim on their tax returns for child care expenses as well as making it fully refundable. The latter is important because if the tax credit exceeds what you owe the IRS, you’ll get the difference in your tax refund.

The Child and Dependent Care Credit isn’t new it’s been around since the 1970s, and was designed to help working parents offset the cost of daycare, after school programs and summer camps. But the credit hadn’t kept up with the pace of child care costs, with the child advocacy group First Five Years Fund noting in 2018 that it only covered about 10% of the typical annual cost of care for two children in the U.S. at the time.

The expanded Child Tax Credit, by comparison, provides $3,600 for each child under six and $3,000 for children between 6 to 17.

That means tax credits like the Child and Dependent Care Credit are more valuable for taxpayers than deductions and become even more so when they are fully refundable.

Looking For Help With Self Assessment Tax Returns Instead

Our tax rebate calculator is for people looking to claim tax back for essential work expenses. If you’re looking to claim specifically for travel you can use our . If you’re self-employed or using the for other reasons, we can help with that too! See our page to see how we take all the stress and guesswork out of Self Assessment.

HMRC Timescales

Recommended Reading: 1040paytax Com Legitimate

How Do I Know If I Owe The Irs Back Taxes And How Much

There are four ways to know if you owe the IRS money.

If you owe back taxes, ignoring letters doesn’t make the IRS, or your tax debt go away. In fact, it can make things worse. Just like any other collections agency, expect letters and additional fees until the issue is resolved. As a government entity, the IRS can also garnish wages, put a lien on your property, and keep future refunds.

Don’t expect to wait them out: The IRS rarely forgives debts and has 10 years to collect them before they are written off. This is known as a Collection Statute Expiration Date . Usually, once that date is passed, the IRS has no choice but to forgo your debt. But beware, there are exceptions: The CSED can be extended through various means, such as entering into an installment agreement, having property seized, or entering a period of non-collectability.

Nearing your CSED date? You may qualify for a partial reduction of your debt by either submitting partial payment installment agreement or an offer in compromise.

Withholding And Estimated Taxes

Your employer withholds money from your check for taxes, but the amount of the withholding is somewhat within your control. When you start a job, you complete a W-4 form which has a box for allowances, typically based on the number of family members in your household. The more allowances you claim, the less money will come out of your check. You can even claim exemption from taxes if you have valid grounds to do so.

Alternatively, you can also claim zero allowances for maximum withholding or ask that additional money be withheld from the check, if you expect to owe taxes on other income. For example, if your spouse is self-employed, you can arrange for additional withholding from your own paycheck to avoid the inconvenience of your spouse making quarterly estimated tax payments. You can also adjust withholding for example, if you have a new baby and want to claim another allowance by filing another W-4.

Read Also: Ein Free Lookup