How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

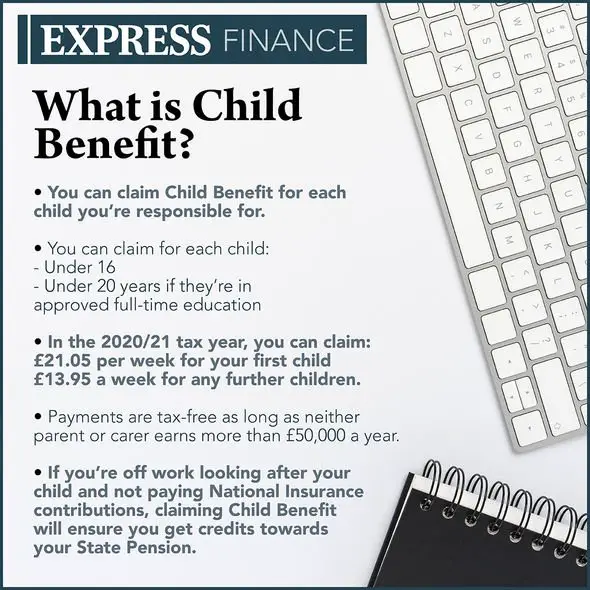

Universal Credit And Child Tax Credit

Child Tax Credit is one of six benefits being replaced by Universal Credit.

Unless youre currently getting Working Tax Credit, you can no longer make a new claim for Child Tax Credit and must apply for the child element of Universal Credit instead.

On Universal Credit, you might be able to claim back up to 85% of eligible childcare costs. In 2022/23 this is up to a maximum of £646.35 for one child, or £1,108.04 for two or more children.

This is compared with the 70% you could claim for childcare costs on Child Tax Credit.

To get the childcare costs element, you must:

- be in paid work, or

- have an offer of paid work thats due to start before the end of your next Universal Credit monthly assessment period.

If youre in a couple, your partner must also be in paid work. This is unless they cant provide childcare because of a limited capability for work, or theyre caring for a severely disabled person.

You can claim the child element of Universal Credit for all qualifying children born before 6 April 2017.

If your children were born on or after 6 April 2017, youll only be able to claim for the first two. This is unless you had a multiple birth or there are other limited exceptions.

The Earned Income Tax Credit Puts Thousands Of Dollars In Workers Pockets

The Earned Income Tax Credit is a tax credit that provides a tax break for low-income workers and families based on their wages, salaries, tips, and other pay, as well as earnings from self-employment.

The EITC has existed for decades but the IRS estimates that 1 out of 5 eligible Americans do not claim the credit. This year, thanks to President Bidens American Rescue plan, the credit is more generous and open to more workers than ever.

You May Like: How Do I File Unemployment On My Taxes

Make Sure You Get Your Checks

The IRS will send advance payments based on an estimate from 2020 tax returns, or 2019 returns if the 2020 return has not been filed and processed. Payments will come automatically most people do not need to do anything.

But certain individuals must take action to receive the advance payments. Historically, people needed to have at least a base amount of earned income, such as wages or self-employment, to qualify for the child tax credit. But in 2021, there is no earned income requirement, so people with other income, such as social security, supplemental security income, pensions or IRAs, who have a dependent child or grandchild could qualify. If somebody is in that category and they don’t normally file a return, they may want to file and I’d say file pretty soon so that we have something to base the payment on, says Smith.

One exception would be people who, though not required to file a return because their income was too low or it was non-taxable social security or supplemental security income, used the IRS non-filer tool to claim stimulus payments. When people did that, that was actually considered to be a basic return, says Smith. If they did that, then we’ve got that record. If their situation is still comparable or similar in 2021, they’d be able to get payments on that basis.”

What Is The Other Dependent Tax Credit

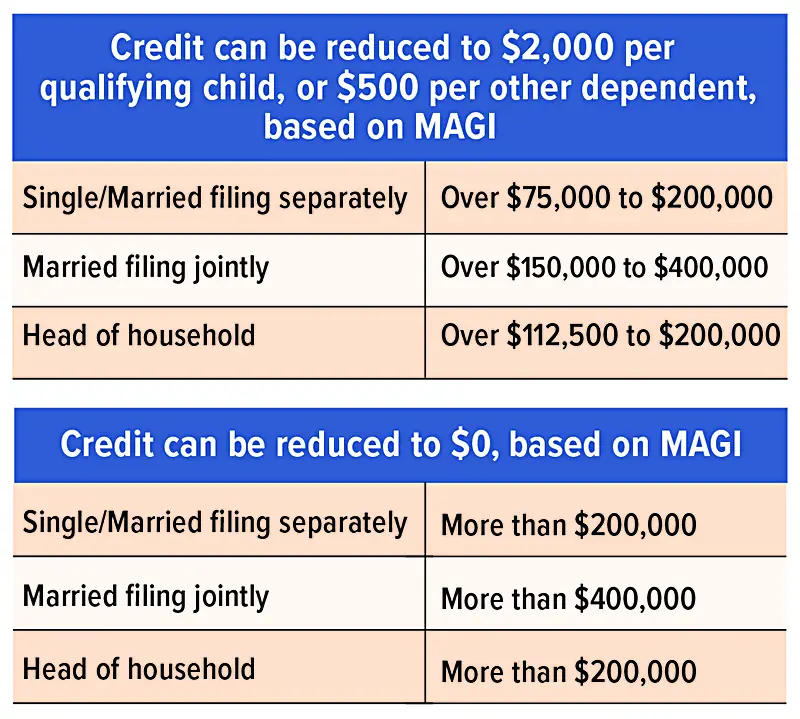

If you dont qualify for the Child Tax Credit and your dependent child is beyond the age of 17, or you assist a friend or family, you may be eligible to claim the Other Dependent Tax Credit of up to $500 per qualified individual.

If your adjusted gross income exceeds $200,000 , the credit will begin to taper down.

Also Check: How To Report Someone For Tax Fraud

Why You Havent Received The Full Amount Of Your Child Tax Credit

You need to file your 2021 tax return to get all of the Child Tax Credit for which you are eligible.

Filing a tax return is how you can tell the government about your family and the number of qualifying children you are claiming. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return.

Any remaining Child Tax Credit benefits will be paid when eligible parents and guardians file their tax returns for 2021 and claim the Child Tax Credit.

To get free assistance filing for the Child Tax Credit, go here.

If you had any life events such as an income change or the birth of a child during 2021, this may have an impact on the remaining amount of Child Tax Credit that you can properly claim.

Parents Who Live Outside The United States

If you and your spouse, if you are married and filing a joint return do not have your main home in one of the 50 states or the District of Columbia for more than half the year, you can still qualify for up to $3,000 or $3,600 for each qualifying child, but the refundability of your Child Tax Credit will be limited.

Recommended Reading: What Date Is Income Tax Due

How To Create An Idme Account

When the IRS determines your eligibility, it will calculate your child tax credit amount and process your advance payments automatically. To be proactive and inform yourself about your status, you must have an ID.me account.

An ID.me account provides a way to access your IRS information register if you are a non-filer and manage banking information, eligibility, or opt out of monthly payments if you prefer to receive one payment next year.

You do not need to create an ID.me account if you already have one from a state government or federal agency, or if you have an existing IRS account with a Secure Access username and password.

To create an ID.me account, start at the Child Tax Credit Update Portal. From there:

In February 2022, the IRS announced a new security-enhanced method for creating an online account without requiring biometric data. For those that choose to use ID.me or have registered with it in the past, any uploaded images will be permanently deleted.

This Year More Workers Without Dependent Children Can Claim The Credit And Can Receive Up To Three Times More Money Than In 2020

Before the American Rescue Plan, people with no dependent children were eligible for the Earned Income Tax Credit only if they were age 25 to 64 and they could receive only up to $538. The maximum amount of Earned Income Tax Credit is nearly tripled for these taxpayers up to $1,502.

In addition, the American Rescue Plan made new workers eligible for the Earned Income Tax Credit:

- If you are 19 or older, you could be eligible to claim the Earned Income Tax Credit.

- If you are 18 years old and were formerly in foster care or are experiencing homelessness, you could be eligible for the credit.

- Certain full-time students age 24 and older can qualify.

- There is no upper age limit for claiming the credit if you have earned income.

- Singles and couples who have Social Security numbers can claim the credit, even if their children dont have SSNs.

- More workers and working families who have income from retirement accounts or other investments can still get the credit. The limit on investment income is now $10,000 and will now rise every year with inflation.

Read Also: What Happens If You Forget To File Your Taxes

Claim Your Child Tax Credit

GetCTC is closed for 2022. Already filed? Check the status of your refund at Where’s My Refund. If you want to learn more about the Child Tax Credit, the Earned Income Tax Credit, and missing stimulus payments you can check out our Frequently Asked Questions and get ready to file your taxes in 2023.

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

Also Check: How To Get Tax Papers From Last Year

If You Have A Change In Circumstances

You must tell HMRC within 30 days if you have a change of circumstances that could affect your Child Tax Credit. For example:

- losing or getting a job

- a partner moving in or out.

This might mean youll have to make a new claim for Universal Credit. HMRC will tell you what you need to do.

Find out more in our guide How will moving to Universal Credit affect me?

How To Tell If Someone Is A Qualifying Child

To be a qualifying child for the purpose of claiming them under the Earned Income Tax Credit, your child must:

- Be your own child, adopted child, stepchild, or foster child. You can also claim a sibling, step-sibling, half-sibling, or a descendent of any of them and

- Have lived with you for more than half of 2021.

- Any age and permanently and totally disabled at any time during 2021

The IRS provides detailed information on other, less common factors that may impact whether a child is a qualifying child for the Earned Income Tax Credit.

You May Like: Did The Irs Get My Tax Return

People Who Are Eligible For The Full Credit Amount

These people are eligible for the full 2021 Child Tax Credit for each qualifying child:

- Families with a single parent with income of $112,500 or less.

- Everyone else with income of $75,000 or less.

For the 2021 Child Tax Credit, the age of each qualifying child whether they were older or younger than 6 years old at the end of 2021 will determine the Child Tax Credit amount that their parents or guardians are eligible to receive.

I Just Had A Baby Am I Eligible For The Ctc

In a nutshell, sure. The child tax credit is available to parents of infants in 2021. The hitch is that you must notify the IRS.

Because the government department does not have information for your baby on file, you will need to use the CTC portal to update your number of qualified children.

Dont worry if you decide not to participate in the upfront payments. You may still claim the credit when you submit your tax return.

Also Check: How Much Tax Do You Pay On Cryptocurrency

It Says I Don’t Have A Refund Due Will I Still Get My Child Tax Credit

The child tax credit for 2022 is not the same as it was for 2021. If you do not have taxable income and money earned from working you will not be eligible for the refundable child tax credit. The child tax credit was a larger amount for 2021 and you did not even have to work to qualify to get it. That is not true for 2022. The maximum amount of the child tax credit for 2022 is $2000, and only $1500 is the refundable “additional child tax credit” amount that can be added to your refund. But that additional child tax credit amount is based on how much you earned by working. You have to earn at least $2500 and then you get 15% of the amount above $2500, up to the maximum of $1500.

Who Can Access The Colorado Child Tax Credit

The Colorado Child Tax Credit will be available to Colorado residents with incomes of $75,000 or less with children under age six as of December 31, 2022 who qualify for the federal Child Tax Credit. Children under age six who would qualify for the federal Child Tax Credit if they had a social security number will qualify for the Colorado Child Tax Credit.

Don’t Miss: How To Save Money On Taxes

How Much Money You Could Be Getting From Child Tax Credit And Stimulus Payments

Enhanced child tax credit: Up to $3,600 per child, or up to $1,800 per child if you received monthly payments in 2021.

First stimulus check: $1,200, sent in April 2020

Second stimulus check: $600, sent in December 2020

Third stimulus check: $1,400, sent in March 2021

Note that if you filed your taxes in 2021, you should’ve already received your money from the first two stimulus checks.

Children Born Or Newly Added To Your Family In 2021

Last years monthly Child Tax Credit payments were based on your 2019 or 2020 tax returns, which did not include any children born or newly added to your family in 2021.

However, a child born or added to your family in 2021 can be a qualifying child for the full 2021 Child Tax Credit, even if you did not receive monthly Child Tax Credit payments in 2021. You will receive the full amount of the Child Tax Credit that you are eligible for when you file your 2021 tax return.

You May Like: How Much Is Income Tax In California

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

Child Tax Credit: Impact On Policy And Poverty

The expansion of the Child Tax Credit for 2021 has important policy and economic implications. When the Child Tax Credit was first enacted, it was intended to benefit low- and moderate-income families. Since its enactment in 1997, it has benefited these taxpayers. At higher income levels, the credit is phased out gradually. However, the Child Tax Credit had been criticized regularly for providing little or no benefit to the poorest families, many of whom are not taxpayers and do not file tax returns.

Over the years, frequent amendments increased the Child Tax Credit amount and provided refunds that were limited in amount and scope at one time, refunds were restricted to taxpayers with three or more children. High-income phaseouts continued, and credit disallowance rules addressed fraudulent, reckless, or improper claims. But, for years, the Child Tax Credit did not reach the poorest families.

In 2021, for the first time, the significant increase in the credit amount and the provision of total refundability extended benefits to the neediest families. According to the Center on Poverty & Social Policy at Columbia University, “…the sixth Child Tax Credit payment kept 3.7 million children from poverty in December . On its own, the Child Tax Credit reduced monthly child poverty by close to 30%.”

Read Also: Can You Pay Property Taxes Online

Families Get Up To $3600 From The Child Tax Credit Learn How To Get Yours

The Child Tax Credit is now available to the families, offering up to $3,600 per child under 6 years old and $3,000 per child between 6 and 17 years old from the IRS. The credit is not a loan!

Since the American Rescue Plan increased the amount of the tax credit for children and expanded its eligibility, almost all families qualify. Even families who havent filed a tax return or dont have recent income are eligible for the full Child Tax Credit, and anyone who has a child with a Social Security number can get it, even if they dont have one themselves.

If you already filed taxes this year, just sit tight. Even if you did not explicitly claim the Child Tax Credit, you will soon start receiving your money in the form of paper checks or direct deposit. You can check on your payments and manage them through the IRS CTC Update Portal.

If you were not required to file taxes this year, you can use the IRS Non-Filer portal to get your tax credit and start receiving payments.