Chapter : Tax Fairness And Effective Government

An economy that works for everyone is an economy where everyone plays by the same set of rules. Since 2015, the federal government has worked to ensure that the wealthiest people and businesses pay their fair share that sophisticated tax planning does not allow anyone to avoid paying the taxes they owe and that tax measures disproportionately benefiting the wealthiest at the expense of everyone else are eliminated.

At the same time, Canadians expect their tax dollars to be put to good use by an efficient and responsible federal government.

Budget 2022 proposes additional measures that will make the tax system more fair, and new steps to ensure that the federal government is delivering the effective programs and services that Canadians deserve.

Does Gifting Reduce Taxable Income

Unfortunately, you canât reduce your taxable income by gifting. What constitutes as a âgiftâ? According to the IRS, itâs âany transfer to an individual, either directly or indirectly, where full consideration is not received in return.â

While gifts are not tax-deductibleâyou cannot deduct the value of gifts you makeâyou can take advantage of the annual gift exclusion, which is the amount you can gift before you have to pay a gift tax on it. As of 2018, that amount is $15,000.

Strengthening The General Anti

The general anti-avoidance rule is intended to prevent abusive tax avoidance transactions, while not interfering with legitimate commercial and family transactions. If abusive tax avoidance is established, the GAAR applies to deny the tax benefit that was unfairly created.

- Budget 2022 proposes to amend the Income Tax Act to provide that the GAAR can apply to transactions that affect tax attributes that have not yet been used to reduce taxes.

- The government intends to release in the near future a broader consultation paper on modernizing the GAAR, with a consultation period running through the summer of 2022, and with legislative proposals to be tabled by the end of 2022.

Also Check: How Much Taxes Come Out Of Paycheck

Reducing Tax Rates By Reducing Tax Bias

Editors note: This post originally appeared in Real Clear Markets on June 23, 2015.

Tax experts from around the world gathered two weeks ago in Washington DC to push forward a Euro-led project for the prevention of BEPS base erosion and profit shifting. This project is aimed at getting multinational companies to locate facilities and jobs in real countries, instead of post office boxes in tax havens.

The corporate tax rates in Europe are already 10% to 15% lower than the 35% rate in the U.S. If Europe moves forward with BEPS, that will put more pressure on US large companies to move people and plants abroad unless Congress substantially reduces the U.S. corporate tax rate.

While almost everyone wants to reduce the U.S. corporate tax from 35% to 25%, almost no industry is willing to give up its current tax preferences to achieve this rate reduction on a revenue neutral basis. This means that the national debt would not rise because revenues lost by rate reduction would be offset by revenues gained by restricting existing tax preferences.

This tax bias for debt has major negative implications for the US economy. To begin with, this bias strongly encourages financial institutions and other firms to maximize their leverage their debt relative to their equity. High leverage increases the risk of bankruptcy and magnifies any financial crisis because a business under pressure has little equity cushion to absorb losses.

Donate Money Goods Or Stock To Charity

As mentioned earlier, you can take a tax deduction for donations to qualifying charitable organizations — and that includes donations made in the form of cash, stocks, goods, and even miles driven.

There are a bunch of rules regarding charitable donations you need to know about, though, such as:

Image source: Getty Images.

You May Like: When Will Child Tax Credit Start

Use A Flexible Spending Account

Many employers will let you set up a Flexible Spending Account , which lets you sock away funds for qualifying healthcare expenses on a pre-tax basis, shrinking your tax bill. For example, you might contribute the maximum of $2,750 to your FSA and then spend it on, say, prescription drugs, braces for your kid, therapist visits, and some doctor visits. That $2,750 will not show up as taxable income, meaning that if you’re in the 24% tax bracket, you’ll avoid paying $660 in taxes on it.

There’s a little catch, though — that’s use-it-or-lose-it money. If you don’t use those funds during the year, they go up in smoke.

There are also Dependent Care FSAs, which help people pay for dependent-care expenses with pre-tax money, and those have a $5,000 annual contribution limit for most folks.

Time Your Gains Or Losses

Effective tax strategies for high-income earners should include managing the timing of large gains so you arent subject to the Medicare surtax or pushed into the 20% capital gains bracket.

Here are some techniques to manage your gains:

Establish and contribute appreciated positions to a charitable remainder trust. Charitable remainder trusts disperse income to beneficiaries for an established period of time before the remainder is donated to charity. By contributing a long-term, appreciated asset, you avoid incurring tax on the gains and get a deduction based on the current value of the gift.

Invest in a Qualified Opportunity Fund . These were created in the Tax Cuts and Jobs Act and allow you to defer taxes on capital gains until 2026 by investing them in a QOF within 180 days of the sale. Taxes can be reduced by holding onto the investment for at least five years.

Harvest unrealized losses on your investments. When stock markets fall, you may consider selling investments in taxable accounts that have losses. A strategy known as tax-loss harvesting allows you to sell your investments to capture your losses on paper. In 2022, the IRS allows taxpayers to deduct up to $3,000 in losses against regular income and allows you to offset losses with current and future year capital gains. Losses not used in the current year can be carried forward to subsequent years.

Don’t Miss: How To Get Income Tax Return Copy

The Real Tax Rate Vs The Official Rate

The difference between the 21% statutory corporate income tax rate and the effective rate based on the cash taxes companies actually pay is the result of generous tax breaks doled out by U.S. Congress.

The 379 profitable Fortune 500 companies paid an average effective federal income tax rate of 11.3% on their 2018 income.

One of the rationales for lowering the corporate income tax rate in the debate over the TCJA was that the cut would be offset by the elimination of tax breaks and loopholes for large companies. While the new law dropped some tax subsidies, it introduced many new ones.

The Inflation Reduction Act of 2022 imposed a 15% minimum income tax on corporations earning at least $1 billion annually. The 2017 TCJA eliminated the prior version of the corporate alternative minimum tax.

Effectsof Tax Rate On Value

In valuing a firm, should you use themarginal or the effective tax rates? If the same tax rate has to be applied toearnings every period, the safer choice is the marginal tax rate because noneof the reasons noted above can be sustained in perpetuity. As new capital expenditurestaper off, the difference between reported and tax income will narrow taxcredits are seldom perpetual and firms eventually do have to pay theirdeferred taxes. There is no reason, however, why the tax rates used to computethe after-tax cash flows cannot change over time. Thus, in valuing a firm withan effective tax rate of 24% in the current period anda marginal tax rate of 35%, you can estimate the first years cash flows usingthe effective tax rate of 24% and then increase the tax rate to 35% over time.It is critical that the tax rate used in perpetuity to compute the terminalvalue be the marginal tax rate.

Whenvaluing equity, we often start with net income or earnings per share, which areafter-tax earnings. While it looks like we can avoid dealing with theestimating of tax rates when using after-tax earnings, appearances aredeceptive. The current after-tax earnings of a firm reflect the taxes paid thisyear. To the extent that tax planning or deferral caused this payment to bevery low or very high , werun the risk of assuming that the firm can continue to do this in the future ifwe do not adjust the net income for changes in the tax rates in future years.

You May Like: What Is The Best Tax Relief Company

Change The Character Of Your Income

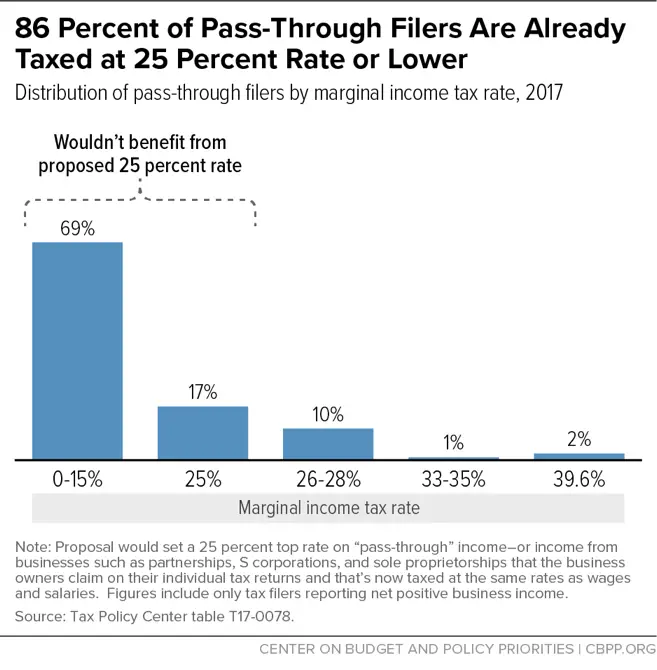

You can adjust the assets in your portfolio to change the way your income is taxed. If you own a business, changing your business structure can be a very effective tax reduction strategy for high-income earners.

Here are some options:

Convert your traditional, SEP, or SIMPLE IRA to a Roth. After age 59-½ , Roth distributions are generally tax-free. In addition, they arent considered investment income, so they wont increase your MAGI for the 3.8% Medicare surtax. Youll need to analyze your federal tax brackets, but Roth conversions can be a powerful tool to reduce the taxation of your future income.

Buy tax-exempt bonds. Interest income from tax-exempt bonds is excluded from Medicare surtax calculations and not subject to federal income tax. Even better, municipal bond interest on bonds purchased in your state of residence are state and federal income tax free.

Restructure your business entity. Incorporating your business lets you choose the tax structure that works best for you financially. A C-corp, for example, has a lower top tax rate than an S-corp or sole proprietorship. In addition, earnings from a pass-through entity may also qualify for a new deduction of up to 20% of business income. Switching to a sole proprietorship lets you hire your minor children without having to withhold or match payroll taxes. Childrens earnings are also taxed at a lower rate.

Reinforcing The Canada Revenue Agency

Canadians understand the importance of everyone paying their fair share. The federal government has invested in strengthening the ability of the Canada Revenue Agency to target a full spectrum of compliance work, including initial verification, uncovering aggressive planning schemes, and prosecuting criminal tax evasion.

- Building on recent investments, Budget 2022 proposes to provide $1.2 billion over five years, starting in 2022-23, for the CRA to expand audits of larger entities and non-residents engaged in aggressive tax planning increase both the investigation and prosecution of those engaged in criminal tax evasion and to expand its educational outreach.

These measures are expected to recover $3.4 billion in revenues over five years, with additional benefits to be realized by provinces and territories whose tax revenues will also increase as a result of these initiatives.

This investment builds on the previous $2.2 billion in resources provided to the CRA since Budget 2016 which has yielded a return of five dollars to each dollar invested until 2020-21.

Also Check: How Many Undocumented Immigrants Pay Taxes

Corporate Tax Loopholes In The Us

Clearly, corporations have become extremely savvy at finding ways to pay less in taxes. For example, when Congress passed the CARES Act in response to the COVID-19 pandemic in 2020, payments to families under the legislation stole the headlines. The restoration of the carryback provision for corporations’ net operating losses not just for 2020 but also for 2018 and 2019, on even more generous terms than those that prevailed before elimination in the TCJA, received considerably less notice.

Listed below are several key corporate tax-avoidance strategies. The Business Roundtable, a lobbying group representing the CEOs of the largest corporations, notes many of the tax breaks that can leave some companies owing no federal income tax for some years continue to enjoy strong bipartisan support.

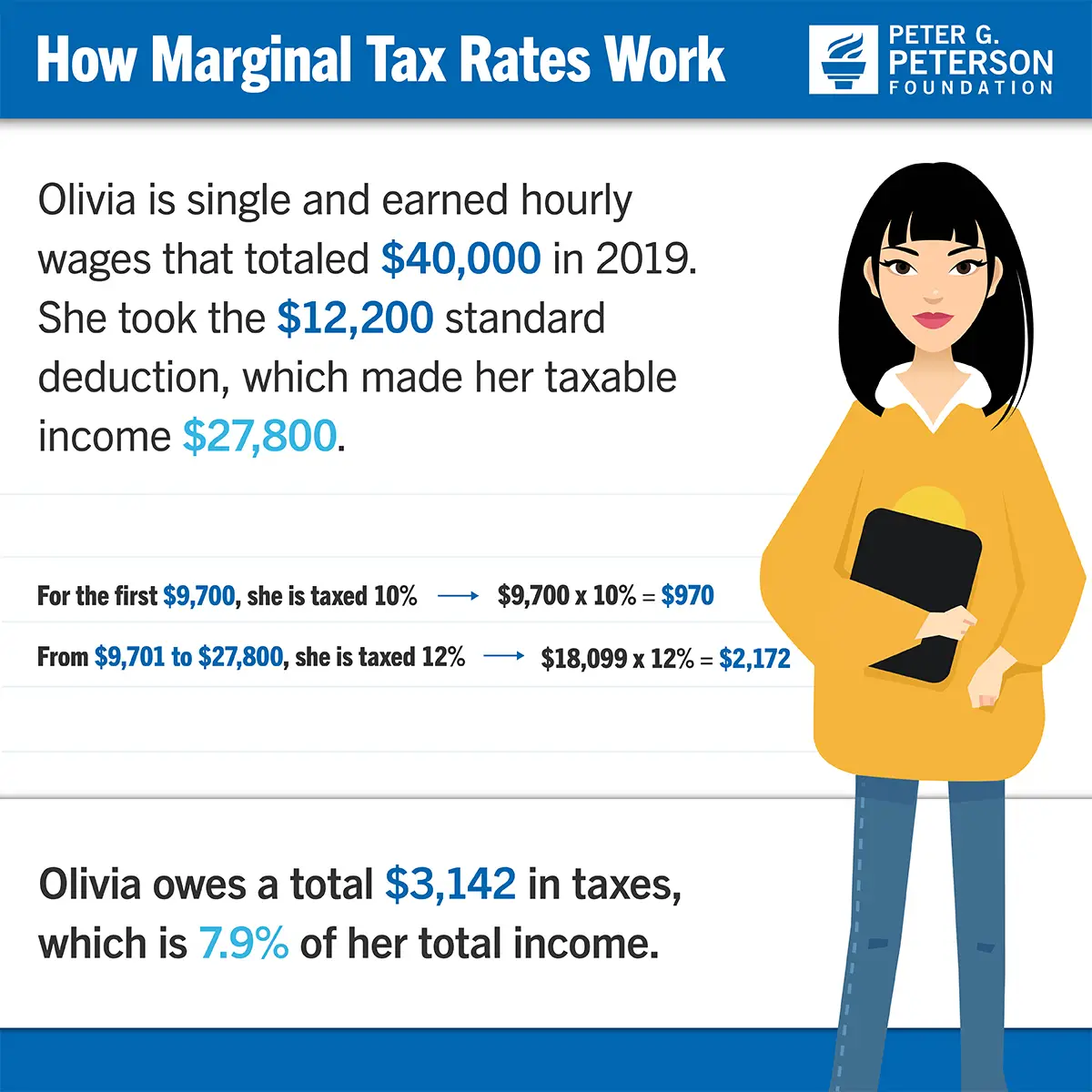

The Progressive Taxation System

Under this system, the more you earn, the more you will owe in taxes. However, if you find yourself in one of the higher tax brackets it doesnt mean that you will pay that tax rate on your entire income. Lets assume that you earned $100,000 last year. This means that you would pay 10% of your income up to $9,875 or $988. Then you would pay 12% on your income from $9,876 to $40,125 which totals $3,630.

As you can see, our tax bracket system is essentially a hybrid of the flat tax and the progressive taxation system. Although there are flat rates for each tier, its likely that you will pay multiple flat rates as your income spans across multiple tiers. Therefore, portions of your income will be subject to progressive taxation. Every tax-paying American pays the same amount on their first $9,700 of income regardless of whether they make $50,000 or $50 million.

RELATED READING: How To Calculate Your Effective Tax Rate

Read Also: How To Evade Taxes Legally

And 2021 Bc Basic Tax Credits

2022 and 2021 B.C. basic tax credits|

Personal Credits |

||

|---|---|---|

|

Reduce when spousal income exceeds |

$9,678 |

|

|

Reduced when dependant income exceeds |

$9,678 |

|

|

Reduced when dependant income exceeds |

$4,946 |

|

|

Age Reduced when income exceeds |

||

|

Actual |

Actual |

|

|

Volunteer firefighters and search and rescue volunteers |

$3,000 |

|

|

Charitable and other giftsLowest tax rate on first $200 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and 16.8% on the remaining amount |

Actual |

|

|

Reduced by lesser of 3% of net income or$2,350 or $2,302 |

Actual |

|

|

$8,477 |

||

|

Reduced by attendant care and child care expenses in excess of |

$4,946 |

|

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Apply For Income Tax Extension

Evolution Of The Canadian Metr And Its Components

Chart 1 – Canadian METR by year

Between 2000 and 2012, the average Canadian METR declined significantly and is now about a third of its 2000 level. Throughout the period from 2012 to the present, Canada has had either the lowest or second-lowest rate in the G7.8

Chart 1 illustrates the overall downward trend in the Canadian METR since 2000. It also shows the components of the Canadian METR by type of tax at different points in time:

- In 2000, the national average METR in Canada was estimated to be 44.1 per cent.

- The Canadian METR now stands at 13.7 per cent, which is the lowest in the G7. The reduction from the 2012 METR was primarily the result of tax changes announced in the 2018 Fall Economic Statement.

In addition, actions implemented by provincial government have also contributed to the decline of Canada’s METR, including:

- The elimination of general capital taxes in all provinces by 2012.

- The harmonization of retail sales taxes with the GST .

- The gradual reductions in corporate income tax rates in the provinces of New Brunswick, Ontario, Manitoba, Saskatchewan, Alberta, British Columbia and the three territories between 2000 and 2019.

- The introduction of various investment tax credits, in particular in the provinces of Quebec and Manitoba.

Want To Pay Less Tax Going Forward Here’s How To Do It

Though taxes are an inevitable part of life, most of us would rather pay less of them. If you’re looking to lower your tax bill, it’s important to understand how our tax system works.

The U.S. utilizes a progressive federal tax system, where the tax rate increases as earnings increase. As such, the more money you earn, the more money you pay — but only on your highest dollars of income. In fact, while your marginal tax rate — the rate at which your highest dollars of income are taxed — might reach a certain threshold, your effective tax rate will typically be lower than your marginal rate.

Image source: Getty Images.

Your effective tax rate is the overall rate at which your earned income is taxed. If you’re unhappy with your effective tax rate, there are things you can do to lower that number and keep more of your money out of the IRS’s hands.

Recommended Reading: How To Check Last Year Tax Return

Below The Line Deductions

Below the line deductions, also known as standard deductions or itemized deductions, are determined after calculating your AGI. Unfortunately, not all below the line deductions will lower your taxable income. According to estimates, nearly 90% of taxpayers will end up taking the standard deduction rather than itemizing deductions. In 2022, the standard deduction is $12,950 for individuals, $25,900 for married filing jointly, and higher for the blind and individuals age 65 plus.

Itemizing deductions is much harder for high-income earners than in years past. If you plan ahead, there is serious potential to reduce your tax further by itemizing your deductions. Tax reduction strategies may include:

Charitable contributions. There are many strategies to help you maximize your charitable contributions and reduce your income tax. High-income earners should consider donating low cost basis stock, contributing to a donor advised fund, or stacking future charitable donations in a single year to maximize tax deductions.

Mortgage interest expenses. If you currently rent or have a lot of consumer credit card debt, you may consider purchasing a home or doing a cash-out refinance to take advantage of deducting mortgage interest. In 2022, up to $750,000 in principal financed may be tax deductible.