Is Aarp Doing Taxes This Year 2022

AARP Foundation Tax-Aide sites are currently open for the 2022 tax season. This year, tax assistance is available by appointment only. AARP Foundation Tax-Aide provides free tax preparation in different ways in-person, low-contact, or contact-free depending on what service is available in your area.Feb 8, 2022

Supercharge Your Rewards Earnings

Loyalty programs from airlines, credit card issuers, and retailers are a great way to live large and get more for your money. AARP offers several ways to maximize your rewards. You also can link your AARP membership card to your Walgreens Balance Rewards account to earn 50 points for every $1 you spend in the store.

Dont Ignore Your Mail

In a digital world of paying bills online and taming overflowing email inboxes, envelopes in the mailbox may get put in a pile to sort later. January and February is a bad time to do that.

Here are some of the tax documents that will begin arriving in January and February:

- W-2 shows employment income if you are still working

- 1099-NEC stands for non-employee compensation paid to independent contractors

- 1099-INT documents interest received from a financial institution

- 1099-B reports gains and losses from stocks, bonds and other securities sold through a broker

- 1099-R shows distributions made from pensions, annuities, IRAs and other retirement plans

Some envelopes will be marked, important tax return document enclosed, but sometimes an important piece of paper could be included with a regular monthly statement, such as a mortgage statement.

To get a sense of whats coming when, you can find clues in your mail. Brokerage firms often tuck a slip of paper into December quarterly statements showing a timeline of when the company will send 1099s and other tax documents.

They need to open the mail, first of all, and check those extra slips of paper that are included with their statements because theres probably some important tax information in it, says Downey.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

You May Like: How Much Do I Owe In Property Taxes

Save More Money When You Shop

Members also can get an array of other AARP benefits and discounts to keep more money in their wallets. For example, show your AARP card at Tanger Shopper Services and get a free coupon book with over $1,000 in discounts that can be redeemed at a variety of outlet stores. You can also get free printable coupons good at grocery stores, drug stores and other retailers from Coupons.com.

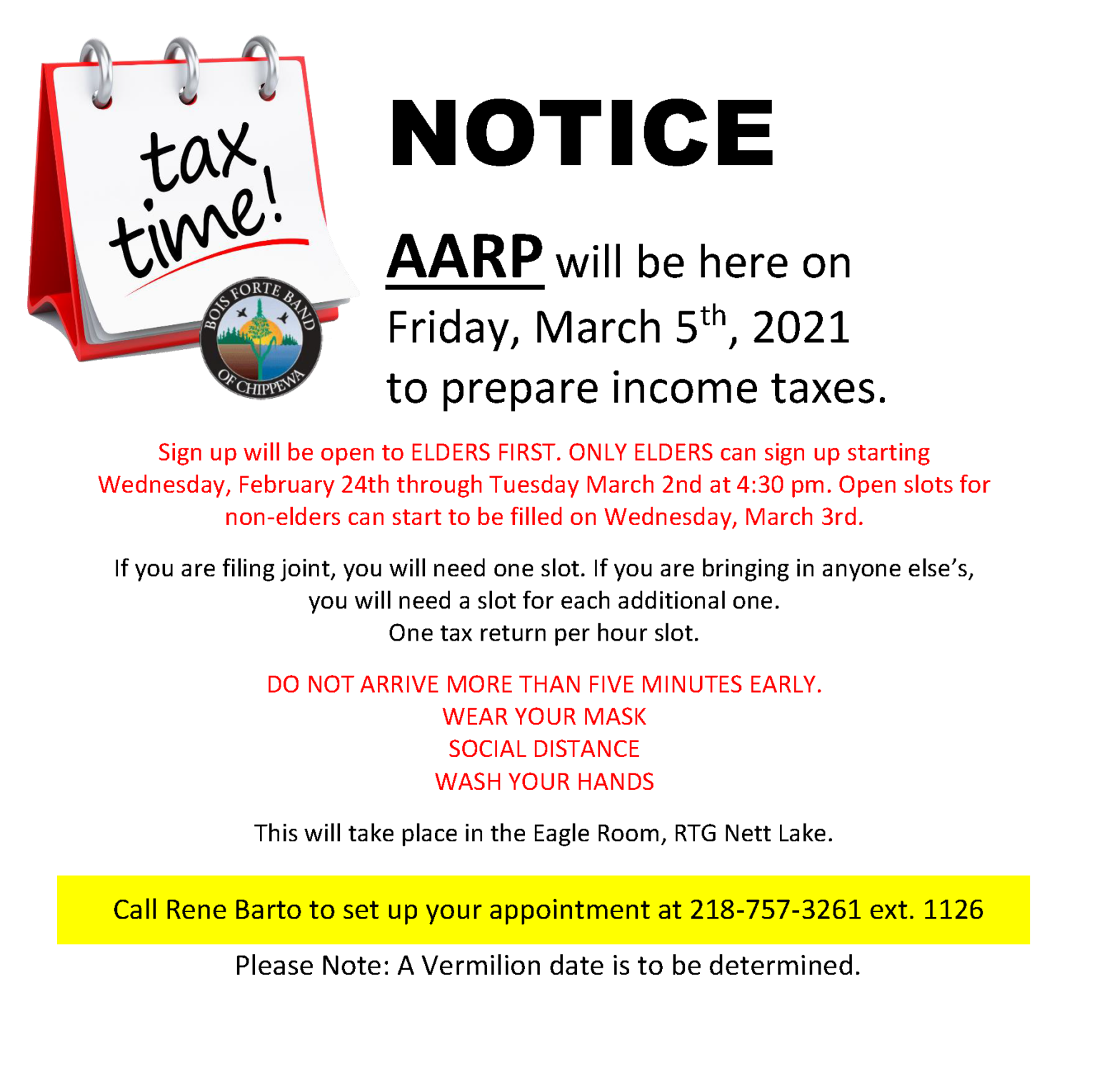

Where Is Aarp Doing Free Taxes This Year

AARP Foundation Tax-Aide started in 1968 and is the nations largest volunteer-run free tax preparation service.Get Your Taxes Done for Free.Day/Date/ ScheduleTuesday, March 3rd 9 AM to 5 PMLocation/AddressDavis Senior Center 646 A. St, Davis, CA 95616CountyYoloAppointment Phone #503-661-20017 more columnsJan 29, 2020

Also Check: Efstatus Taxact Com Return

Read Also: How Is The Earned Income Tax Credit Calculated

Icipants Must Bring The Following Materials:

- Blank check if you want to direct deposit any refund.

- Social Security Card for all individuals to be listed on the tax return as dependents.

- Wage and earnings statement such as W-2 from all employers.

- Any other financial information and/or documents relating to income, expenses, and banking.

- Please know how much stimulus and/or Child Tax Credit received in 2021.

Area Agencies On Aging

There are Area Agencies on Aging serving seniors in communities across the United States. AAAs offer an array of services, benefits and information to help support seniors and family caregivers. Since IRS and AARP tax help appointments are filling up quickly at sites across the country, you may need to look into alternate sources of assistance. Try contacting your AAA to see if there are other free or low-cost tax preparation resources available in your local community.

Before showing up to any free tax preparation location, check if you need to make an appointment first. Typically, some sites offer assistance on a walk-in basis, but many are requiring pre-set appointments this year to ensure social distancing and other COVID-19 safety protocols are enforced. Be sure to bring all necessary tax documents and information for the volunteers to help you. The IRS publishes a checklist of things taxpayers should bring to their income tax return preparation sites here.

Recommended Reading: Can I Get My Tax Refund On Cash App

The Aarp Foundation Provides Free Help

The AARP Foundation is AARP’s charitable organization that serves members and nonmembers alike. The foundation services vulnerable people age 50 and older. One of its services is the AARP Foundation Tax-Aide program, which provides free in-person and virtual tax assistance.

While the AARP Foundation Tax-Aide provides help to anyone free of charge, the organization puts a particular focus on helping taxpayers who are over 50 years old or who have low to moderate income. Program volunteers are located throughout the country, and all volunteers are IRS-certified each year to ensure they’re up to date on current tax codes.

Take Advantage Of Free Tax Preparation And Assistance

Phoenix, AZThe Arizona Department of Revenue presents a variety of free filing services for taxpayers this tax filing season. Taxpayers are strongly encouraged to e-file and direct deposit their refund for a more accurate and secure return which delivers refunds six times faster.

- AARP Foundation Tax-Aide If a taxpayer is 50 and older and cannot afford a tax preparation service to file federal and Arizona returns, they can obtain assistance at www.aarp.org/money/taxes/aarp_taxaide.

- Free File Alliance Individuals with a federal adjusted gross income in 2021 of $73,000 or less may qualify to receive free e-file preparation from a certified software vendor. Through the Free File Alliance, a taxpayers 2021 federal and state income tax returns can be filed at no cost to them. Visit page for vendors.

- To ensure no fee is charged, taxpayers must go to the Departments website to complete the return. This saves on preparation fees, prevents costly errors, and ensures that the taxpayer receives any refund directly in the most efficient way possible.

- Nearly 88,000 Arizona taxpayers used the Free File software last year, saving themselves approximately $9.6 million.

For individuals also needing assistance but do not qualify for free electronic filing services, ADOR suggests:

Recommended Reading: How To File Income Tax Return Online

Know Your Standard Deduction

If you are confident you will take the standard deduction, which is $12,550 for single filers and $25,100 for joint filers this year, that will reduce some of your paperwork. It doesnt make sense to go through the time and effort to itemize if your itemized deductions are less than the standard deduction.

The standard deduction was a huge game-changer as far as documentation and the amount of time and stress on people to pull things together, says Downey. She says taxpayers can look at their return last year, consider what changed this year and make a rough calculation if they are anywhere close to exceeding the standard deduction a difficult feat if they have no mortgage and dont have high medical bills.

If you plan to itemize deductions, you will need to comb through your checkbook, credit card statements and receipts if you havent been tracking items like charitable contributions during the year. That takes time, but the effort may be worth it, particularly if youve taken out a mortgage or incurred large medical expenses. Also, states have different limitations on itemized deductions, so some expenses may be deductible on your state return even if you take the standard deduction on your federal filing, Ford notes.

Nj Free Tax Assistance Locations

*COVID-19 Announcement: Due to COVID-19 restrictions, please follow directions listed and/or call agency prior to visiting.

This year you may find that VITA tax preparation programs around the state have COVID-19 restrictions.Many VITA volunteers are either working remotely, limiting their in-person availability, or opting for drop-off services.

AARP Foundation Tax-Aide provides free tax preparation in different ways in-person, low-contact, or contact-free depending on what service is available in your area. Some sites can provide service in one or two visits, or you may not need to visit a site at all, with all interactions taking place online.

For the most current listing of AARP locations, visit the 2022 AARP Foundation Tax-Aide Service.

VITA sites listed below are actively helping clients this year. Look for the location in your area and follow the instructions provided for that site or call the site for further instructions. The VITA programs goal is to complete your tax return in a timely manner. Submitting ALL the information and documentation required to complete the tax return will hasten the process.

Use the drop-down menu to filter the list by county.

Also Check: How Much Money Will Taxes Take Out Of My Paycheck

Irs Tax Information For Elders

For those who are simply looking for information on what types of retirement income are taxable or the eligibility requirements for certain tax deductions and credits, the IRS has your back. Visit the IRS Tax Information for Seniors & Retirees site for tax answers that apply specifically to older adults and retired individuals.

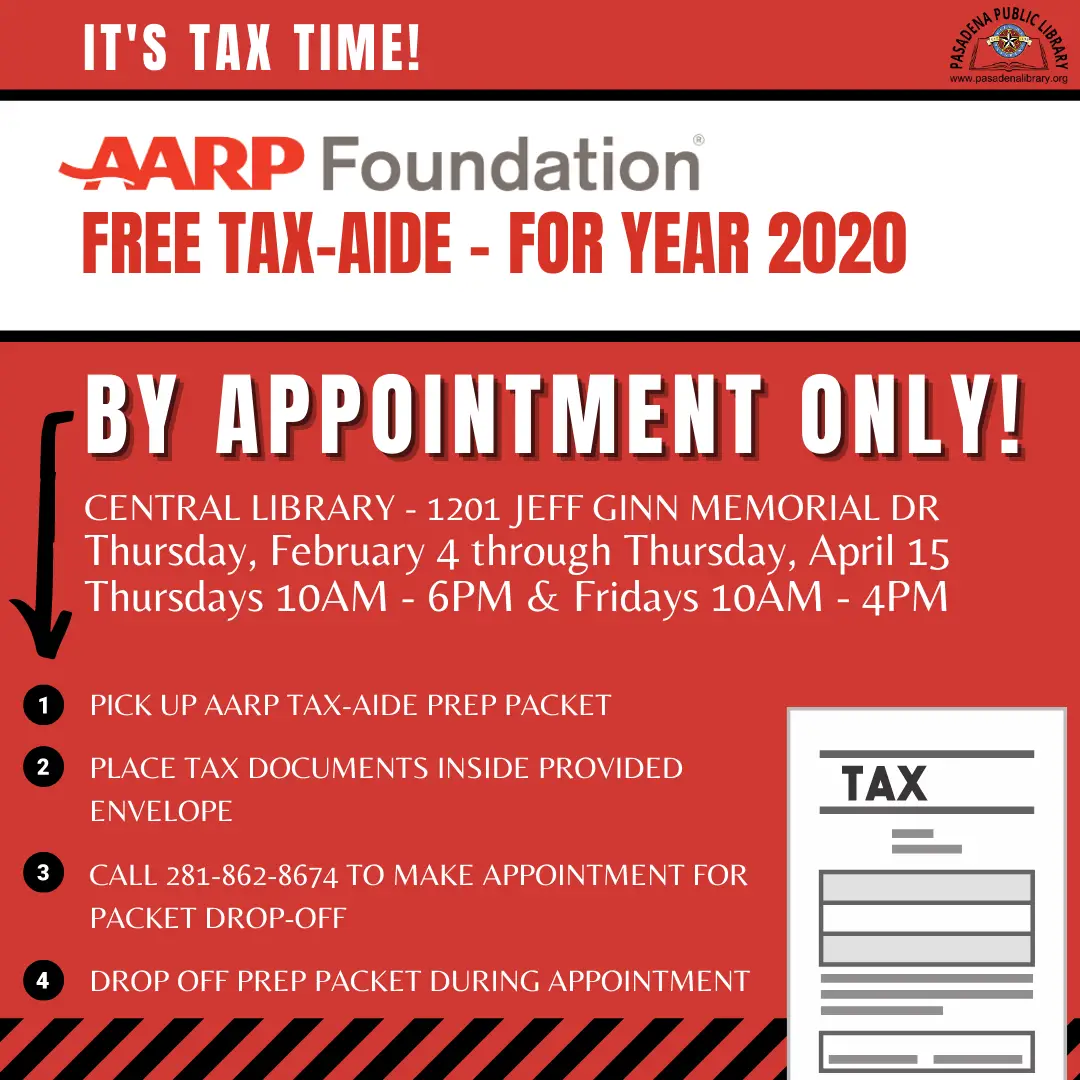

Appointments Are Required And May Be Made After Jan 15 2022

To Make an Appointment HERE

Guidelines

Intake and other forms will be available outside the building, during tax preparation hours. Please pick up an intake form , envelopes and other forms on days we are open beginning Jan 31, 2022. These will be located in plastic bins outside the entrance of the HEC. You may also download these forms below.Please complete the intake form prior to your appointment. If you cannot pick them up prior to your appointment, then please arrive at least 20 minutes early to complete the forms in your vehicle. When you arrive for your appointment please call the phone number posted at the entrance and a volunteer give you instructions for the appointment. Please have your cell phone available on the day of your appointment and prepare to wait in your vehicle while we review and scan your documents. For taxpayers, who are married and filing jointly, both individuals must be present to sign documents. Exceptions may be made only when a spouse is unable to be present due to health issues.NOTE: Individual appointments must be made for each member of a household or group that is filing a return!

What you should bring

The AARP Foundation Tax Aide Program cannot prepare returns that include :

- Self-employment returns with expenses of more than $35,000 or more, home office deduction, employees, inventory or operating loss

- Royalty income with associated expenses

- Out-of-state or multi-state returns, except for states with no state income tax

Don’t Miss: How To File Taxes If Married But Living Separately

Pay Less For Prescriptions

About 70% of Americans take at least one prescription drug, and 20% take five or more. The cost of these medications adds up, so why not save? The AARP® Prescription Discounts offers savings to AARP members and their spouses and dependents on drugs not covered by your current prescription insurance or Medicare Part D. The savings average up to 61%.

How To Get Free Tax Help

Free tax is available through the AARP Foundation Tax-Aide from Feb. 1, 2022, to April 18, 2022. Hours and dates may vary by location throughout the pandemic.

AARP Foundation Tax-Aide volunteers can help prepare many types of returns. However, not all tax returns can be prepared. If a taxpayer has a unique or complex tax situation, help may be unavailable. You can review which types of tax situations qualify.

Also Check: How To File Back Taxes Without W2

Irs Tax Help Programs

The IRS Volunteer Income Tax Assistance program is available to taxpayers who generally make $57,000 or less, persons with disabilities, and taxpayers who speak limited English. The IRS also offers a free Tax Counseling for the Elderly Program for all taxpayers, particularly those who are age 60 and older. VITA and TCE volunteers are IRS-certified and these sites are open from February through April.

It is worth noting that there is some crossover between the TCE program and the AARP Tax-Aide program. Nonprofit organizations receive grants from the IRS to provide free tax counseling to their local community members.

Unfortunately, during the 2021 tax filing season, some VITA and TCE tax sites are operating at limited capacity while others are not opening at all. The IRS offers many other online resources and tax help tools, including IRS Free File.

To learn more about VITA and TCE, find an open site near you, or explore other IRS tools and publications, visit the IRS website.

You May Like: Michigan.gov/collectionseservice

Volunteer Income Tax Assistance And Tax Counseling For The Elderly Programs

The IRS sponsors the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs. The VITA Program generally offers free tax help to people who generally make $56,000 or less, persons with disabilities, the elderly, and taxpayers with limited English who need assistance in preparing their tax returns. The TCE program gives priority to seniors age 60 years and older.

To learn about these programs and eligibility, visit the IRS website. Locate VITA and TCE assistance sites near you.

Interested In Becoming A Volunteer?These tax assistance programs are only successful with the help of volunteers willing to give their time and expertise to help taxpayers eligible for these free services. If you are interested in volunteering, please contact the program that interests you.AARP Tax-Aide Program

You May Like: When Do We Get Tax Refund

Figure Out Your Cost Basis

If you sold stocks, bonds or other securities in 2021, you will need to know the cost basis, or what you paid, to calculate any gain or loss on the sale. Before 2011, brokers were not required to report cost basis to the IRS so they may not have records of what you paid, requiring you to collect this information. If you dont use a broker, you are responsible for figuring out your cost basis.

If you sold a home, you want to compute your purchase price and any improvements to determine if you need to report a capital gain. Up to $250,000 of the gain on a home sale can be excluded for single filers and up to $500,000 for those filing joint returns. Even if the home sale falls below those amounts, the sales transaction needs to be reported to the IRS, Ford notes. People dont always realize that, she says.

Tax Prep 202: Aarp Offers Free Assistance What Documents Will You Need To Provide

The AARP Foundation Tax-Aide program gives help each year to assist taxpayers with their form preparations, and has resumed the service with the onset of the 2022 tax season. Tax-Aide sites will begin taking appointments for free tax preparation and e-filing services beginning in early February, AARP said.

Find: 6 Top Tips for How To Turn $1,000 Into $10,000

Tax-Aide will offer the same options as last year for tax preparations, including:

-

Low contact models, which allow taxpayers to drop off their papers and return to review

-

Fully virtual service

-

Virtual coaching service

Tax-Aide sites might be affected by the ongoing COVID-19 pandemic, but AARP ensures that each site is run in a way that keeps everyone safe, complies with state and local laws, and takes into account the number of available volunteers.

They list the below as general documents needed for tax filing and recommend bringing them to your meeting:

-

Previous two years tax return

-

All correspondence received from the IRS and your state/local taxing authority

-

Social Security cards and/or ITIN notices/cards or other official documentation showing taxpayer identification numbers for every individual on your return

-

Government-issued photo ID for each taxpayer

-

Checking or savings account information if you want to direct deposit any refund or direct debit any amounts due

-

Identity Protection PIN for each individual

Recommended Reading: How To File Taxes With Retirement Income

Do Seniors Need To File Taxes To Get Stimulus Check

People who are considered nonfilers dont need to do anything to receive a third stimulus check, according to the IRS.

However, if youre claiming missing stimulus money in a Recovery Rebate Credit, even nonfilers will have to file a tax return this year.

You may be able to use a special form and file for free..

United Way Aarp Offer Free Income Tax Help

Donna RenfroeFeb 26, 2021 at 7:13 am

For people who need help with personal income tax filing, the annual ritual has been complicated this year, as preparers have to follow COVID-19 guidelines on social distancing. Fortunately for Lakeland residents, free help is available with safety protocols in place for those who, while cautious, prefer human contact.

United Way of Central Florida underwrites a program, Voluntary Income Tax Assistance, with offices in Lakeland, Mulberry, Bartow, and Haines City. Transactions, handled through the Personal Finance Center of Polk County, are open to those earning less than $66,000 a year.

You can expect limited person-to-person communication, said Jennifer Olivas, a financial coach with the finance center in Mulberry. Communication and document handling takes place with an IRS-certified volunteer using a bubble system that includes a drop-off and pick-up.

This year, families and individuals will bring tax paperwork to their preferred location using a drop-off system, Olivas said. Your tax information and required documents are accepted at the drop-off and will go to a tax volunteer. The volunteer prepares your tax return and in about seven days calls you to schedule a pick-up appointment.

Locations and contact information are:

A complete list of all Polk County locations is at www.financepolk.com/taxprep.

In addition to protection against infection, the system also provides a secure information-gathering process, Olivas said.

You May Like: How To Contact Irs About Tax Return