Tax Refund: What Are The Tax Changes If You Expect A Refund

You can receive a reduced refund or possibly a tax charge as a result of some tax benefits that were previously increased returning to normal

- CalWorks Benefits.How much does CalWORKs cash aid pay?

You’ll be able to submit your federal tax return in a few weeks. Even if you hate tax season, now is a wonderful time to plan yourself so that the filing process goes as smoothly as possible.

Reviewing this year’s major tax changes that will probably affect the size of your tax refund is a good place to start.

Who Qualifies For A Stimulus Check And How Much Will I Receive

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Also Check: Direct Express Pending Deposit Stimulus Check

Alberta Child And Family Benefit

This benefit is a non-taxable amount paid to families that have children under 18 years of age. The quarterly amounts are issued in August 2022, November 2022, February 2023, and May 2023.

The benefit includes both a base component and a working component, with combined benefits to a maximum of $5,120.

The maximum base component ranges from $1,330 to $3,325 depending on the number of children. You may be entitled to:

- $1,330 for the first qualified dependant

- $665 for the second qualified dependant

- $665 for the third qualified dependant

- $665 for the fourth qualified dependant

The base component of the benefit is reduced if your adjusted family net income is more than $24,467.

Families may be eligible for the working component once their family employment income exceeds $2,760. The maximum working component will range from $681 to $1,795 depending on the number of children. You may be entitled to:

- $681 for the first qualified dependant

- $620 for the second qualified dependant

- $371 for the third qualified dependant

- $123 for the fourth qualified dependant

The working component of the benefit is reduced once your adjusted family net income is more than $41,000.

This program is fully funded by the Alberta provincial government.

Don’t Miss: Do Social Security Recipients Have To File Taxes

Young Child Tax Credit

Provide more for what matters most.

Do you have a child under the age of 6?*

If you qualify for CalEITC and have a child under the age of 6, you may also qualify for a refundable tax credit of up to $1000 through the Young Child Tax Credit ! If you qualify, you may see a reduced tax bill or a bigger refund.

Use this calculator to see if you qualify and estimate the amount of your credit!

Filing your state tax return is required to claim both the CalEITC and the YCTC. Tax filers with an ITIN Individual Tax Identification Number including undocumented workers, may now qualify for the CalEITC and the Young Child Tax Credit .

*Qualifying children must be under 6 years of age as of December 31, 2021.

For more information about the Young Child Tax Credit , visit the Franchise Tax Board YCTC page.

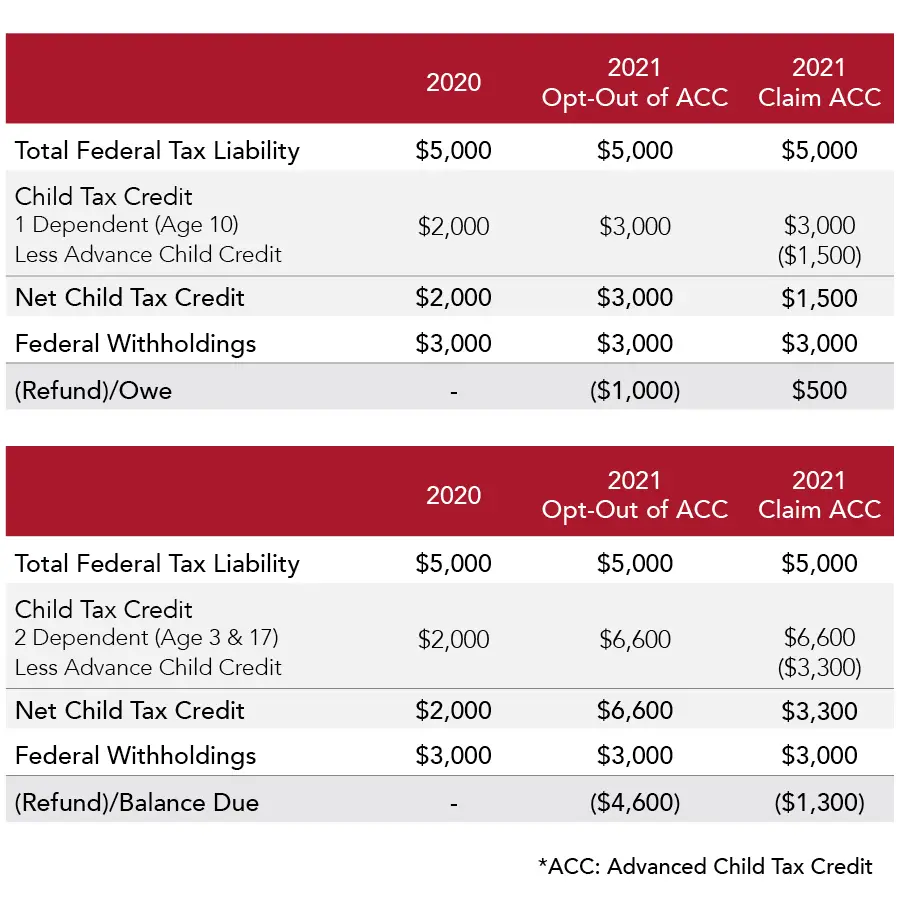

Why Life Changes Affect Child Tax Credit Payments

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Changes in income, filing status, the birth or death of a child, or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax return.

This section will help you understand how certain life events will impact your Child Tax Credit eligibility.

Read Also: Do You Have To File Bitcoin On Taxes

What Is The Child Tax Credit And How Do You Qualify In 2020

Some of Americaâs most effective social support policies work through the tax code. Programs like the Earned Income Tax Credit and the mortgage interest deduction have made life easier for millions of taxpayers, while the polite fiction of the payroll tax helped ensure political survival of Social Security and Medicare.

Among those success stories is the child tax credit, a policy that helps families with the costs of raising children.

And those costs are not small. According to the Department of Agriculture the average American family will pay more than a quarter of a million dollars raising a single child to age 18, a price tag that does not include college tuition. Finding child care and juggling employment can add even more to this number, putting a traditional family further and further out of reach for precisely the same young adult population already struggling with weak job opportunities and historic debt due to student loans.

A simple tax credit canât fix all of the problems of the cost of college and rising rents. But it can help at least a little bit. Hereâs how it works.

Read Also: How Much Will I Get Taxed

How To Claim The Credit

You can claim the child tax credit on your Form 1040 or 1040-SR. Youll also need to fill out Schedule 8812 , which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS Free File.

A word of warning: In the eyes of the IRS, youre ultimately responsible for all information you submit, even if someone else prepares your return.

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

» Curious about what other credits you may qualify for? Here’s a list of 20 common tax deductions and breaks

Read Also: Will The Stimulus Checks Be Taxed

Get This Year’s Expanded Child Tax Credit

File your taxes to get your full Child Tax Credit now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U.S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their childrens development and health and educational attainment.

learn more about the expanded child tax credit

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

Recommended Reading: How To Get Last Year’s Tax Return

If You’re A Foster Carer

You cant claim child tax credits for a foster child if you get a fostering allowance, or the childs maintenance or accommodation is paid for by someone other than yourself.

If you arent sure, call the tax credits helpline to check.

HM Revenue and Customs tax credits helpline

Telephone: 0345 300 3900

Relay UK – if you can’t hear or speak on the phone, you can type what you want to say: 18001 then 0345 300 3900

You can use Relay UK with an app or a textphone. Theres no extra charge to use it. Find out how to use Relay UK on the Relay UK website.

If you’re calling outside of the UK: +44 2890 538 192

Monday to Friday, 8am to 6pm

Telephone : 0300 200 1900

Monday to Friday, 8.30am to 5pm

Your call is likely to be free of charge if you have a phone deal that includes free calls to landlines – find out more about calling 0345 numbers.

Child Care Tax Credit Calculator

Child Care Tax Credit Calculator. The child tax credit is a credit that can reduce your federal tax bill by up to $3,600 for every qualifying child. For the 2020 tax year, the child tax credit was $2,000 per qualifying child.

To calculate your childcare tax credit, multiply your expenses by the rate of your family income tax credit. Since july, millions of families have received monthly child tax credit payments of up to $300 per child. Free childcare for children aged between 2 and 4 help with childcare costs if your child is under 16.

Source: sebsauvage.net

The letter that went out to qualifying families from the whitehouse earlier this year explains, for 2021, most families with kids will get a tax relief payment of up to $3,000 for each child between 6 and 17 years old and up to $3, 600 for every child under 6 years old. receiving the payment: The advance child tax credit calculator will provide you with the estimated credit amount you can expect as your child tax credit for 2021.

Source: taxcredits.healthreformquotes.com

Calculating the child and dependent care credit until 2020. The new child tax credit will provide $3,000 for children ages 6 to 17 and $3,600 for those under age 6.

Source: www.eitcoutreach.orgSource: sebsauvage.netSource: templatearchive.com

Its combined with a dependents calculator, so you. There are also maximum amounts you must consider.

Source: edinburgincometax.com

Also Check: What States Have The Lowest Sales Tax

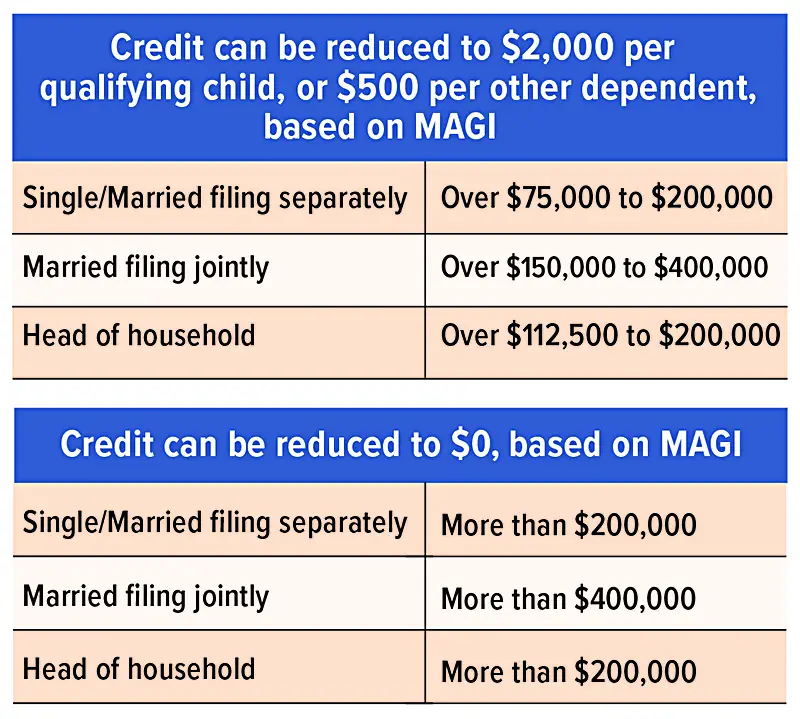

Worksheet For Calculating How Much Child Tax Credit You Can Claim

The IRS provides a Child Tax Credit worksheet to help calculate the amount of credit available to take on your tax return. This worksheet and additional information about the Child Tax Credit can be found in IRS Publication 972.

The calculation for this credit can also be done free of charge,using online software.

- Based on the six tests mentioned above, you must determine how many qualifying children you can claim.

- Multiply the number of dependent children you can claim by $3,600 (maximum amount of the Child Tax Credit.

- Determine your modified adjusted gross income . This amount can be found on Form 1040, line 38 Form 1040A, line 22 or Form 1040NR, line 37.

- Subtract your MAGI by the following amounts below depending on your filing status:

- Single, head of household, or qualifying widow: $200,000

Example:

A single taxpayer with 2 qualifying children and modified adjusted gross income of $80,000 can claim a Child Tax Credit of $1,750.

Step 1: Number of Children x $2,000 Maximum Credit.

2 Children x $2,000 = $4,000

Step 2: Determine the modified adjusted gross income calculated on your Form 1040.

MAGI = $80,000

Step 3: Subtract the MAGI based on your filing status by the limitation mentioned above. If your MAGI is less than the limitation, you are eligible for the full credit of $2,000.

$80,000 $75,000 = $5,000.

What If I Dont Have A Bank Account

If you dont have a bank account, checks will be mailed to your address.

If you wish to open a bank account, visit the Federal Deposit Insurance Corporation for information on opening an account online.

Reloadable prepaid debit cards or mobile payment apps with routing and account numbers may also be an option.

You May Like: How To File An Amended Tax Return Turbotax

Wheres My Stimulus Check

There is, however, at least one benefit related to this thats already guaranteed for 2022.

If you add up all six child tax credit check amounts you got last year? You should have also gotten a tax credit for that same amount this year when you filed your federal taxes. That will represent the second half of your child tax credit. And, for now, that will be the end of the enhanced credit.

Theres always a chance the Senate could revisit the legislation supporting an extension of these checks. For the moment, though, that possibility seems highly unlikely.

Children Born Or Newly Added To Your Family In 2021

Last years monthly Child Tax Credit payments were based on your 2019 or 2020 tax returns, which did not include any children born or newly added to your family in 2021.

However, a child born or added to your family in 2021 can be a qualifying child for the full 2021 Child Tax Credit, even if you did not receive monthly Child Tax Credit payments in 2021. You will receive the full amount of the Child Tax Credit that you are eligible for when you file your 2021 tax return.

Recommended Reading: Who Qualifies For The Premium Tax Credit

Residents Of American Samoa The Commonwealth Of The Northern Mariana Islands Guam And The Us Virgin Islands

Residents of American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, or the U.S. Virgin Islands may be eligible for advance Child Tax Credit payments and the Child Tax Credit. The credit is being administered by the tax agencies of each U.S. territory, not the IRS. Please contact your local U.S. territory tax agency regarding your eligibility, and for additional information about any other changes to the Child Tax Credit.

Work Out How Many Children You Can Claim Tax Credits For

If your children were all born before 6 April 2017, you can claim child tax credits for each child.

If your first or second child was born on or after 6 April 2017, you can claim child tax credits for them.

If your third child or any later child was born on or after 6 April 2017, you can’t usually get child tax credits for them. You should still let HMRC know about them. If they’re disabled, you might still get a payment if one of these applies:

- they get Disability Living Allowance

- they get Personal Independence Payment

- they’re certified blind

There are some exceptions – you might still get a payment for 3 or more children if:

-

you have a multiple birth – if you have other children born before 6 April 2017 you won’t get a payment for the first child in a multiple birth

-

youve adopted a child from the UK

-

youre caring for someone else’s child in a formal care arrangement

-

youre caring for someone elses child in an informal arrangement where otherwise theyd be in care

Check the exceptions and how to apply for them on GOV.UK.

Philip has 3 children who were all born before 6 April 2017. He gets child tax credits for all of them. He’ll keep getting the same amount because they were all born before 6 April 2017.

Yasmin has 2 children who were both born before 6 April 2017 and she gets child tax credits for both of them. She’s expecting another baby, due after 6 April 2017. She won’t get child tax credits for her baby because it’s her third child.

Recommended Reading: Are Tax Attorneys Worth It

Reconcile Your Advance Payments Total On Your 2021 Tax Return

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount youre eligible to claim.To reconcile advance payments on your 2021 return:

- Get your advance payments total and number of qualifying children in your online account.

- Enter your information on Schedule 8812 .

You can also refer to Letter 6419.

If Married Filing Jointly

If you received advance payments based on a joint return, each spouse is treated as having received half of the payments, unless one of you unenrolled.

To reconcile your advance payments on your 2021 tax return, add your advance payments total to your spouses advance payments total.

Each of you can find your advance payments total in your online account.

If Letter 6419 Has a Different Advance Payments Total

For the majority of taxpayers, the advance payments total in Letter 6419 will match the total in online account.

If the advance payments total differs between your Letter 6419 and your online account, rely on the total in your online account.

Your online account has the most current advance payment information. Do not rely on Tax Transcripts for the advance payments total.

Keep Letter 6419 for your tax records.

Frequently Asked Questions: Reconciling Your Advance Payments

People Who Are Eligible For The Full Credit Amount

These people are eligible for the full 2021 Child Tax Credit for each qualifying child:

- Families with a single parent with income of $112,500 or less.

- Everyone else with income of $75,000 or less.

For the 2021 Child Tax Credit, the age of each qualifying child whether they were older or younger than 6 years old at the end of 2021 will determine the Child Tax Credit amount that their parents or guardians are eligible to receive.

You May Like: How To Check Federal Tax Refund

You Can Still Owe State Taxes If Your Student Loans Were Forgiven

You may have earned student loan forgiveness under the Public Service Loan Forgiveness program or another comparable initiative, even while widespread federal student loan relief is still on hold.

You won’t be responsible for paying federal taxes on any balances that were cancelled in 2022 if you have any. This is due to a clause in the 2021 American Rescue Plan that delays federal taxation of forgiven post-secondary education loans until 2025.