Tips For Deducting Car Insurance From Your Taxes

If you plan to deduct car insurance on your taxes, it is important to keep good records in case the IRS questions you.

For example, Closely track how you use your vehicle, including a diligent vehicle log that records every mile the vehicle is driven for personal and business use.

If a vehicle isnt used solely for work, track the percentage of time the vehicle is used for both personal and business-related purposes, Shannonhouse says.

As a practical tip, record the starting mile and ending mile each time the vehicle is used, and make note of what the purpose of the drive was.

Finally, keep all receipts in a safe place.

Support for all business-related expenses is necessary for proper tax documentation, Shannonhouse says.

If you need more guidance, she suggests consulting the AICPAs Document Retention FAQs for Tax Practitioners.

Deducting Car Insurance And The Tax Cuts And Jobs Act

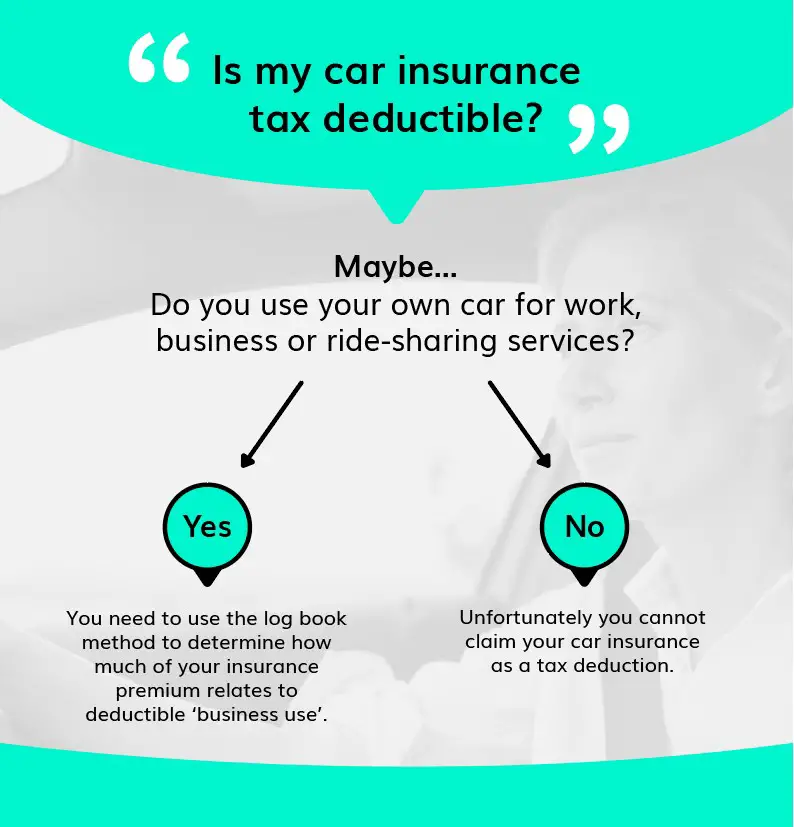

It is no longer possible to deduct car insurance from your personal tax return unless youre self-employed, you own a business or you qualify for an exception.

This is due to the Tax Cuts and Jobs Act of 2017, which significantly changed how millions of Americans file their taxes.

How has the TCJA specifically impacted the ability of people to write off auto insurance costs? According to Logan Allec, CPA and owner of the finance blog Money Done Right, it eliminated unreimbursed vehicle expense deductions, including auto insurance deductions, for W-2 employees for tax year 2018 through tax year 2025.

There are some very narrow exceptions for four specific fields: armed forces reservists, certain kinds of performing artists, fee-based government officials and employees with impairment-related work expenses, Allec added. But these are obviously few and far between.

Do I Need To Itemize My Car

Itemizing deductions may increase the cost of tax return preparation due to the number of forms involved. The good news is you don’t have to itemize to claim your auto insurance premiums or your mileage as business expenses. These deductions are generally claimed on Schedule C, Profit or Loss From Business.

When you itemize deductions, you break down your expenses that can be subtracted from your adjusted gross income, such as mortgage interest or charitable donations. That reduces your overall taxable income to reduce the final amount you owe. Itemized deductions are listed on Schedule A of Form 1040.

Also Check: How Can I Track My Tax Return

When Isn’t Car Insurance Tax Deductible

Your car insurance is never tax deductible if you never use your vehicle for any business purpose.

However, you can still lower your auto insurance premium, so look at different car insurance companies and compare prices and policies to get the lowest-priced coverage. The insurance industry is a competitive marketplacethey want your business!

Business Owners And Self

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. If a taxpayer uses the car for both business and personal purposes, the expenses must be split. The deduction is based on the portion of mileage used for business.

There are two methods for figuring car expenses:

There are recordkeeping requirements for both methods.

Also Check: How Much To Withhold For Taxes

When Car Insurance Can Be Tax Deductible:

There are a number of instances to claim your car insurance on your taxes. They include:

- If you use your car for business Whether youre self-employed and use your car for business purposes or your employer doesnt reimburse you for expenses related to business use of the car.

- If you suffered a vehicle loss or theft You may be able to claim loss deduction if your car was stolen or deemed a total loss. In order to qualify for this kind of deduction, you typically have to file a claim, ensure the accident wasnt a result of your negligence, your insurance company cannot completely reimburse you for the loss, and your costs must be greater than $100.

How To Calculate Auto Expense Deductions

tax payers figure their deduction both ways and take the deduction that gives them the biggest benefit

- Standard deduction: Claiming a standard deduction is the first, and probably easiest, way to claim a car insurance deduction on your taxes. While easier, this deduction only takes into account the mileage driven, multiplying the number of business miles by a certain rate. It does not allow you to claim any part of your car insurance as a deduction.

- Detailed deduction: Taking a detailed deduction allows you to deduct other expenses associated with your car, including insurance premiums. With this method, you would take the amount of business miles driven as a percentage of total use of your car for the year and apply that percentage to expenses, such as insurance premiums.

MORE

Havenât shopped for insurance in the last six months? There might be hundreds $$$ in savings waiting for you.

Recommended Reading: Do You Have To File Your Unemployment On Your Taxes

How To Deduct Your Car Insurance On Your Tax Forms

If you are self-employed, including as a rideshare driver, you will file a Schedule C tax form, which includes a section to include your deductible insurance expenses.

Below, see where to fill in car insurance expenses on your Schedule C.

Keep in mind that you can only write off insurance expenses if the total amount you’re eligible to deduct exceeds the standard deduction.

However, car insurance expenses rarely amount to more than a couple thousand dollars a year. As a result, you will usually need to have more deductions, such as business expenses, mortgage interest or certain education expenses, to be eligible for itemized deductions.

Exceptions To The Usual Rules

The business expense deduction for auto costs on Schedule C doesn’t cover vehicles that are considered equipment for tax purposes, such as those used for construction. There are also limits on depreciation claimed on certain vehicles, although theyre pretty generous: The maximum deduction for most passenger vehicles put into service after 2017 is $18,100 during the first year of ownership as of the 2020 tax year.

Read Also: What Info Do I Need To File Taxes

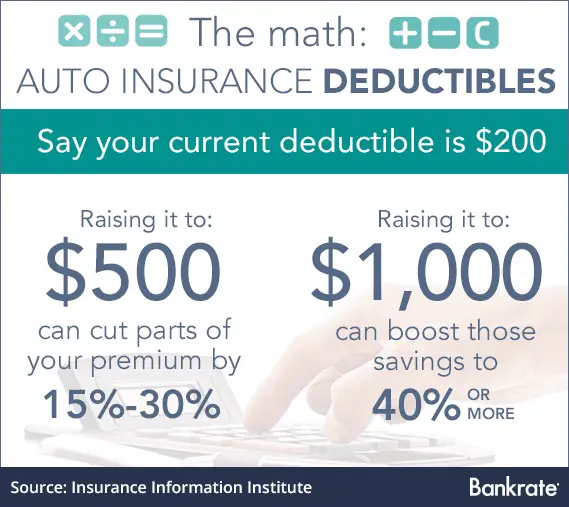

How Can I Deduct Car Insurance On My Taxes

If you qualify, you can either deduct all your business-related vehicle expenses, including your car insurance premium, or deduct an amount based on the actual miles you drove for your business using a cents-per-mile rate. These are known as the Actual Expenses method and Standard Mileage method, respectively.

You can choose either method and change from year to year without penalty. You can tally your expenses based on both methods and then choose the one that yields the higher deduction. Keep in mind that you can only use one method. If you do choose the Actual Expenses method, you can generally deduct the following from your taxes alongside your car insurance premium:

- Registration fees and licenses

- Tolls and parking fees

When it comes time to file your taxes, you’ll use one of two forms. Self-employed individuals will use Schedule C: Profit or Loss From Business to deduct car-related business expenses, including insurance. If you’re not self-employed and otherwise qualify for a deduction, you’ll use Form 2106 Employee Business Expenses to list relevant costs.

Pro tip:

If you aren’t sure if your auto insurance is tax deductible, consult a tax professional. They can also help you determine whether you’re better off taking the standard deduction versus itemizing your other deductions.

What Company Has The Best Car Insurance

The best car insurance company will vary based on your unique needs and circumstances. For example, one driver might be looking for a company that offers a certain specialty coverage while another driver might be looking for the cheapest rate. Understanding your needs is the first step to finding car insurance that fits your situation, and shopping around to compare companies can be a helpful strategy.

You May Like: What Form To Use To File Taxes

If You Consistently Use Your Car For Work

If youre a W2 employee in a handful of qualifying roles like an Armed Forces reservist or a qualified performing artist but you use your personal vehicle for any work-related purposes, or if you have to drive for work and dont already get reimbursed by your employer, you may be able to deduct at least some of your premiums .

Work-related uses for your personal car might include any extra trips to pick up supplies or attend meetings, or driving to visit clients or participate in a work-related event, like a conference. You can claim many of the seem auto-related expenses as car-owners who are self-employed, provided you document how and when you used your car for business purposes.

But if you got a speeding ticket while rushing to a work function, thats a no-go, traffic ticket fines are never tax deductible.

Preparing For Tax Season

Just remember the golden rule of getting ready for tax season keep great records. Consult a tax professional if you have specific questions about deducting your car insurance or other auto-related expenses from your taxable income, and read more about finding the right auto insurance for you here.

Senior Managing Editor & Auto Insurance Expert

Anna Swartz is a senior managing editor and auto insurance expert at Policygenius, where she oversees our car insurance coverage. Previously, she was a senior staff writer at Mic.com, as well as an associate writer at The Dodo.

Expert reviewer

Certified Public Accountant

Amy Northard, CPA, is a certified public accountant and a member of the Financial Review Council at Policygenius. Previously, she served as a certification administrator for the National Association of Mutual Insurance Companies .

Questions about this page? Email us at .

32 Old Slip, 30th Fl New York, NY 10005

Recommended Reading: When Are Tax Returns Due This Year

If You Use Your Car Strictly For Personal Use You Likely Cannot Deduct Your Car Insurance Costs On Your Tax Return

Unless you use your car for business-related purposes, you are likely ineligible to claim your auto insurance premium on your tax return. Business-related purposes may include using your car to pick up or deliver business supplies, driving to visit clients, or driving to a business conference. Simply commuting to and from work, however, does not count as a business-related purpose.

Other Groups Can Write Off Car Insurance

Self-employed professionals and small-business owners arent the only people whose car insurance premiums are tax deductible. If youre a reservist with the U.S. armed forces and need to travel more than 100 miles away from home, these travel expenses can be deducted.

Further, some performing artists and local officials are allowed to deduct car insurance costs. In short, make sure you do your research and speak with a tax pro if you think you might be able to write off your auto insurance premium.

Don’t Miss: Are Homeschool Expenses Tax Deductible

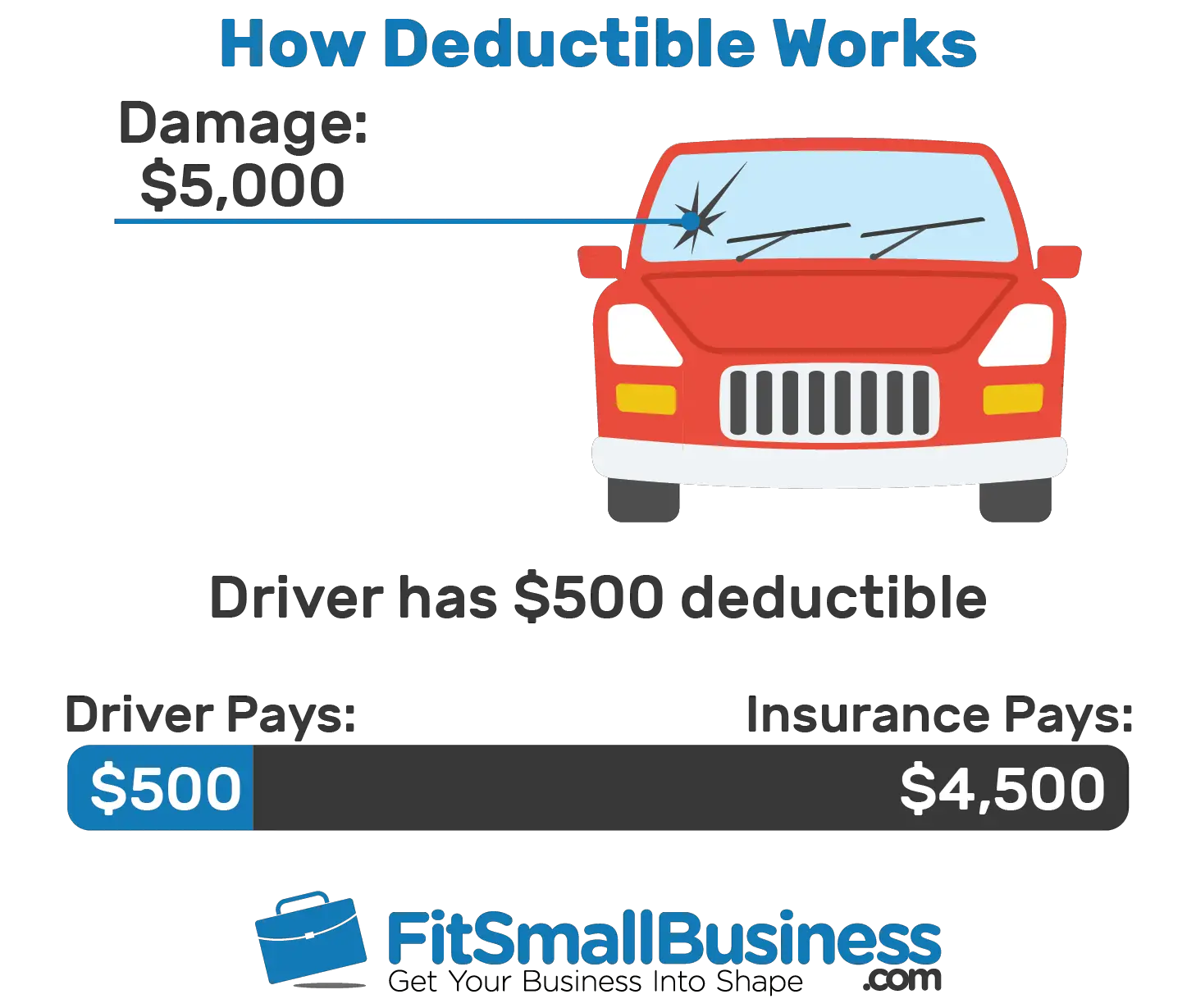

Subrogation And Deductible Recovery For Auto Claims

When another party is primarily at fault for your damages, State Farm may try to recover the amount of the claim paid for your loss. This is called subrogation. State Farm will try, to the extent that you’re not liable for the accident, to recover all or a portion of the deductible you paid. This is called deductible recovery.

Auto Subrogation Overview

Learn more about deductible recovery

Here’s the legal process for deductible recovery

We’ll attempt to promptly recover payments we’ve made from the party or parties responsible for your loss. The time needed for recovery varies with each claim and could take up to one year or longer.

Your claim handler will contact you if there’s any additional information we need from you.

Your deductible is due to the repair shop once repairs are completed. If the other party is found to be at fault for the accident, we’ll begin the deductible recovery process to reimburse you for the amount you paid for your loss.

Your deductible, if recovered, may be mailed as a check to you, or you can login for different payment options.

We work with other insurance companies on your behalf to do our best to get you back to normal. Contact your claim handler to get the specifics regarding your claim.

What Is A Tax Deduction

A tax deduction is an amount of money you subtract from your yearly taxable income when you file your taxes. But not everything can qualify for a deduction theres a wide variety of expenses that can be claimed as tax deductions, but when it comes to car insurance, claiming even part of your premiums as a deduction can be tricky.

Read Also: Can You File Your Taxes For Free With Turbotax

More Tcja Changescasualty And Theft Deductions

You might have potentially qualified for an itemized casualty and theft deduction if your auto sustained serious damage and you had to pay out of pocket for an insurance deductible for replacement or repairs. Claiming that part of your insurancethe deductiblewas subject to myriad rules and was included in the deduction for your loss. But its gone, too, for many taxpayers under the terms of the TCJA.

Beginning with tax year 2018 and thanks to the TCJA, you can only claim this itemized deduction if your vehicle was damaged or destroyed due to an event that is declared a disaster. Your deductible loss is limited to what you paid for the vehicle or what its worth after the disaster, whichever is less. You must subtract anything your insurer paid or compensated you for, thenyou must subtract an additional $100.

You would have a tax deduction if the resulting number exceeds 10% of your AGI.

Congress enacted special provisions for those affected by the 2020 hurricanes, as well as the California wildfires. Check with a tax professional if you suffered a loss due to one of these events to find out if you qualify.

Consult Your Accountant If You’re Unsure

It’s best to do your taxes correctly the first time: A few dollars saved is not worth the time and expense of a possible audit. If you’re unsure about whether you’re eligible to deduct your car insurance from your income taxes, consult an accountant or someone well-versed in tax law.

If you’re doing your taxes using services like TurboTax, the company will have on-call customer service with trained accountants ready to answer your questions. If you use your own personal accountant, be sure to consult with them.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Is Political Contribution Tax Deductible

Tax Forms: Deduct Your Car Insurance

You may be eligible to include some or all of the auto insurance costs in your taxes. You will need to complete a form for self-employed people and rideshare drivers like Uber and Lyft that reports auto insurance expenses. This form is called the schedule c form and can be found on the IRS website. If you are employed but still drive your own vehicle, you can fill out form 2106 to allow you to report business expenses.

The final thing to consider is whether your vehicle can be claimed for a tax deduction. Business use is not usually applicable to daily commutes between work and home. It is unlikely that your car will be eligible for tax deductions, even if it is used only to commute between work or home. You can only drive during business hours or for business purposes.

Is Auto Insurance Tax Deductible

When you use your auto for business purposes, you can deduct part of the total expense associated with running and maintaining the vehicle, including auto insurance expenses. Whether you can write off every expense depends on whether you use the vehicle for personal and professional purposes or you use it exclusively as a work vehicle.

For example, an Uber or Lyft driver will use their car for personal and business purposes. When they have the app on and are on call or driving a passenger, they are on business hours. The rest of the time, theyre using the car for personal purposes. When theres a split like this, the tax deduction will depend on the percentage of commercial usage versus personal usage. So if the Uber driver works only 40% of the time, they can deduct only up to 40% of their costs.

When using the mileage calculation, the driver can track mileage and take a standard mileage deduction only for miles traveled while working. The 2021 standard mileage deduction is 56 cents per mile tracked for business. While you can deduct taxes, insurance costs and other auto expenses, most people opt for the mileage deduction, as its easier and often yields a better deduction.

Bottom line: A business owner can deduct auto expenses, but the easiest and most cost-effective option may be to take a mileage deduction.

Read Also: Do You Need Bank Statements To File Taxes

Is Car Insurance Deductible For Self

If youre self-employed and use your car exclusively for business, then all costs associated with the vehicle, including the insurance, are deductible. Each insurance company defines business use differently, so if you are not sure how your provider will classify your vehicle, contact them to find out. It is important to do this because it determines if you qualify for the right deduction.

If you are self-employed and drive your car for both business and personal use, you can write off some of your insurance premiums. You can determine the exact amount by calculating the percentage. For example, if you use your vehicle 50% of the time for work and 50% of the time for business, you can deduct 50% of your annual insurance premium from your taxes.