For Simple Tax Returns With Student Loan Interest Or College Tuition: H& R Block Free Online

Also great

H& R Block Free Online supports two common forms for students that TurboTax Free Edition doesnt: the student loan interest deduction and the tuition and fees statement . These are valuable above the line deductions that can reduce the amount of taxes you owe or increase your refund even if you take the standard deduction. If you have a simple return and you paid interest on a student loan or paid for college tuition, H& R Block Free Online is the best way to file for free.

H& R Blocks interview process and guidance are nearly as good as TurboTaxs. The software points out when some selections are uncommon to help you avoid checking the wrong boxes for example, when we entered a dependent, H& R Block told us its uncommon to report that the child has an individual taxpayer identification number. After each major section, the program provides a summary of what youve entered so far. And at any time, you can click the shopping cart icon to see if youll need to pay for the program.

We contacted support over chat, but as we found in 2019s testing, the automated help was not helpful. It misunderstood our issue and then refused to transfer us to a live agent.

Like TurboTax, H& R Block is also now asking for permission to use the specific information in your tax return to target you with personalized ads. Since H& R Block will still file your taxes even if you dont agree to provide these permissions, we strongly suggest you decline.

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Get A Free Copy Of A Prior Year Return

Print your completed tax returns for free! If you prepared a tax return from 2015-2021 using FreeTaxUSA, here’s how to print a copy of your return:

- Returning users:

- Step 2) Click on Prior Years at the top of the screen

- Step 3) Choose the year in the Prior Year Returns section

- Step 4) View or download the return you want to print

Read Also: How Much Tax Do You Pay On Social Security

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: When Do You Have To Do Your Taxes

Here Is What’s Visible On Transcripts:

- Last four digits of any EIN: XX-XXX4321

- Last four digits of any account or telephone number

- First four characters of the first and last name for any individual

- First four characters of any name on the business name line

- First six characters of the street address, including spaces

- All money amounts, including wage and income, balance due, interest and penalties

The IRS will provide unmasked Wage and Income transcripts when needed for preparing and filing tax returns. Unmasked Wage and Income transcripts fully display personally identifiable information such as the taxpayer’s name, address, and Social Security number along with the employer’s name, address, and Employer Identification number.

Information Requested From The Irs

Information requested from the IRS is social security sensitive one social cannot obtain information about another social which includes married couples. If you need transcripts and you are married, you each need to request your own wage and income transcript for that year. You tax return transcript if filed jointly can be retrieved by either of you, as you both have a copy attached to your social.

The IRS electronic copies only go back so many years. 3 years is always available and often up to 7 years is obtainable, however 10 years or more and you are out of luck as far as IRS transcripts are concerned.

Let us know if you have any questions while obtaining any transcripts.

Charles Steinmetz

Read Also: How Much Tax Do We Pay

Ein Lookup: Finding Your Ein Is Simple And Easy

How do I find my EIN number?! Its so hard!

It can be frustrating to attempt to open a new business account or apply for financing, be asked for your EIN, and proceed to find out that youve lost it and all relevant paperwork with your EIN or Tax ID number on it .

However, there are several simple and easy ways to obtain your EIN even if you dont have a single tax return or your confirmation letter.

If you cant find your EIN or Tax ID number, look around for your confirmation letter, and if you cant find it, look through your relevant tax and business documents. If that doesnt work, simply give the IRS a call and provide the necessary information.

No matter what, obtaining your EIN should be easy. So, if youve lost it, and not having it is holding you back from moving forward with something important, dont sweat it.

How Do I Find My Old W2

TurboTax does not have a copy of the W-2. It would have a Wage and Tax Statement worksheet that included the information from the W-2 and emulates a W-2. The worksheet would be included in the PDF of the tax return if you downloaded the PDF to include All forms and worksheets in the tax year the return was completed.

If you cannot obtain the W-2 from your employer, then for a fee of $37 you can get a complete copy of a W-2 from the Social Security Administration

You can get a free Wage and Income transcript from the IRS by completing a Form 4506-T

See this IRS website for transcripts

For a fee of $50 you can get a complete federal tax return to include copies of W-2s from the IRS by completing Form 4506

See this IRS Tax Topic

Recommended Reading: How Much Does H & R Block Charge For Taxes

Read Also: How Do I File Previous Years Taxes

What Is A Sa302 Calculation

This is a much more detailed breakdown of your tax return. Itspecifies the tax rate youre on, the total income on which youve been chargedtax, the amount of income tax you owe, along with any Class2 and Class4 National Insurance contributions. It will also tell you about deductions,balancing payments, and any other income you may have received from othersources.

Self-employed workers can use SA302 documents to provideevidence of their income. So if youre applying for a mortgage, for example,and the bank or building society asks you to prove your income for a givenperiod, you can follow the steps above to access your SA302 documents.

If you didnt submit your tax return online, or if yourestruggling to locate certain older paper documents, then you can try contactingHMRC. Youll need your Unique Taxpayer Reference number to hand, aswell as your National Insurance Number. You should also ensure that all of yourpersonal details are up to date in your personal tax account, sothat HMRC can properly identify you with their screening questions.

If You Need To Change Your Return

You can make a change to your tax return 72 hours after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2023 for the 2020 to 2021 tax year

- 31 January 2024 for the 2021 to 2022 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Don’t Miss: When Is The Extended Tax Deadline

How To Request Old Tax Returns

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How do you access old tax returns?

- Accessing a Transcript of Old Tax Returns Determine which type of transcript you need. Register online with the IRS. Request a transcript of your old tax returns online. View the transcript online or receive it by mail.

Masking Of Personal Information On Transcripts

The IRS is fighting a war against identity theft and tax fraud. Thieves attempt to gain access to IRS transcript data to file fraudulent tax returns or engage in other crimes. To help prevent this, transcripts only display partial personal information, such as the last four digits of your social security number. Full financial and tax information, such as wages and taxable income, is shown on the transcript. You can see a sample of a redacted transcript on the IRS website.

You may request an unmasked transcript for tax preparation. The IRS mails unmasked transcripts to your address in its records. Tax professionals can also obtain copies of their clients unmasked transcripts.

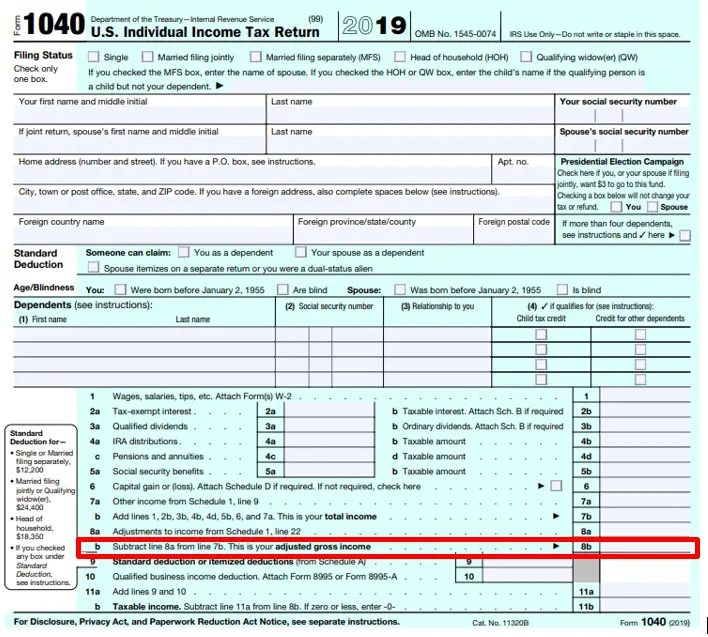

You May Like: What Does Agi Mean For Taxes

Recommended Reading: When Can I File Taxes 2021

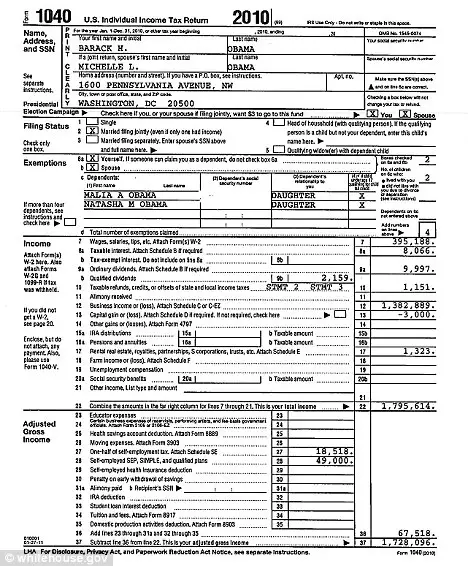

Irs: Statistics Of Income National Sample Data

- Corporate Source Book Files, compiled 1965-1990National Archives Identifier:646618

- Online Access:

This series includes information from a sample of filed income tax returns, excluding returns with an adjusted gross income of $200,000 or more, recorded on IRS Forms 1040 and 1040A and the associated schedules. Certain personal data have been deleted to prevent identification of individual taxpayers, although these records include a state of residence identifier. These files are an augmented version of the 1977 and 1978 files from the series Individual Income Tax Model Files . These files have been preserved as EBCDIC fixed-length records with packed decimal fields and can be made available as exact copies only.

Dont Miss: What Does H& r Block Charge

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Recommended Reading: How Do I Pay My Payroll Taxes

Copies Of Old Returns

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

If You Dont Expect To Get A Tax Slip

You have 2 options:

- Option 2:

- Estimate your income without tax slips

If you cant get a slip in time to file your taxes, you can estimate your income manually. Add up your pay stubs or financial statements to estimate the income to report, and any related deductions and credits you can claim.

Include a note with your return stating the name and address of the issuer of the slip, the type of income, and what you are doing to get the slip.

- If you file electronically: Keep all of your documents in case the CRA asks to see them later.

- If you file by paper: Attach a copy of the pay stubs or statements and your note to your paper return. Keep the original documents.

Read Also: How To Reduce Federal Taxes

Register If You Havent Already To Use The Canada Revenue Agency To Find Your Old T4 Slips

Click here to register. For this, youll need your social insurance number, your date of birth, your postal code, and your tax returns from the previous two years. Once youve registered, youll be sent, via snail mail, a security code to verify your account. It should only take a couple of days to get your security code, and once youve entered that in, you can move on to step two.

Can You Get Prior Year Tax Information From The Irs

There are a few times where you may run into a situation where you need to provide a copy of your prior year tax return. For instance, you could be applying for a home mortgage loan and need proof of income or maybe you misplaced it and would just sleep better at night knowing you have a copy in your filing cabinet. Either way, in most circumstances, a paper transcript of this information will do. Before venturing to the IRS website, be sure to have the following information ready:

- social security number

- street address currently on file with the IRS

- zip code currently on file with the IRS

- type of transcript needed

Happy hunting!

Tags: amended tax return, contact the IRS, progress of tax return, tax refund, wheres my refund tool

This entry was postedon Thursday, October 20th, 2016 at 3:22 pmand is filed under Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

You May Like: How To Buy Tax Forfeited Land

Read Also: How To Stop Unemployment From Taking Tax Return

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Why Does Gethuman Write How

GetHuman has been working for over 10 years on sourcing information about big organizations like Turbo Tax in order to help customers resolve customer service issues faster. We started with contact information and fastest ways to reach a human at big companies. Particularly ones with slow or complicated IVR or phone menu systems. Or companies that have self-serve help forums instead of a customer service department. From there, we realized that consumers still needed more detailed help solving the most common problems, so we expanded to this set of guides, which grows every day. And if you spot any issues with our How Do I Obtain Copies of My Previous Tax Returns on Turbo Tax? guide, please let us know by sending us feedback. We want to be as helpful as possible. If you appreciated this guide, please share it with your favorite people. Our free information and tools is powered by you, the customer. The more people that use it, the better it gets.

Turbo Tax

What customers are saying about this and similar problems

Was this page helpful? If so, please share!

Don’t Miss: What Do I Need To Bring To Tax Preparer