Vita And Tax Counseling For The Elderly

These twin programs offer free tax return preparation and counseling to qualified individuals.

VITA offers free tax help to people who generally make $58,000 or less, those who have disabilities, and people with limited English proficiency.

The TCE program offers help for those who are 60 years of age and older, and specializes in pensions and retirement-related issues, according to the IRS. Find a full list of the tax services these programs provide.

Important RemindersMake sure to bring these important documents: Photo ID, Social Security cards for you, your spouse, and dependents. Wage and earning statements from all employers. Interest and dividend statements from banks . Health insurance exemption certificate, if received. A copy of last years federal and state returns, if available. Proof of bank account routing and account numbers for direct deposit such as a blank check. Total paid for daycare provider and the daycare providers tax identifying number such as their Social Security number or business employer identification number. Forms 1095-A, B, and C, health coverage statements, and copies of income transcripts from IRS and state, if applicable, according to the IRS.

Both spouses must be present to sign the required forms when filing taxes electronically on a married-filing-jointly tax return.

Personal Experience And Recommendations

Ive been doing my own taxes for years now. Over the years Ive used Turbo Tax, H& R Block and Tax Slayer to do my taxes from home. Ive found them all accurate, easy to use and most importantly they dont charge you a ton to file your tax return. Which one you prefer will probably boil down to which interface you feel most comfortable working with.

Its important to remember that whether you do your own taxes or you hire an accountant to do your taxes for you. YOU are still legally responsible for the accuracy and timeliness of your tax return. The risk of being audited by the IRS is actually very slim but if it does happen it can be a very uncomfortable experience. So if you choose to hire someone else to do your taxes, be sure theyre qualified. The ever helpful IRS even gives a list of points to keep in mind when choosing a tax preparer.

Personally I think that just about everyone reading this can handle preparing their own taxes. The software available now makes it 100 times easier than the days of doing taxes by paper and pencil. If you choose to file your taxes by yourself this year I recommend using Turbo Tax or H& R Block. Ive used them both in the past and will probably be using Turbo Tax to file my return this year as well. You can check out what they have to offer using the buttons below. Whatever you choose, Good luck!

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have $73,000 or less of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Recommended Reading: What Is The Easiest Online Tax Service To Use

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

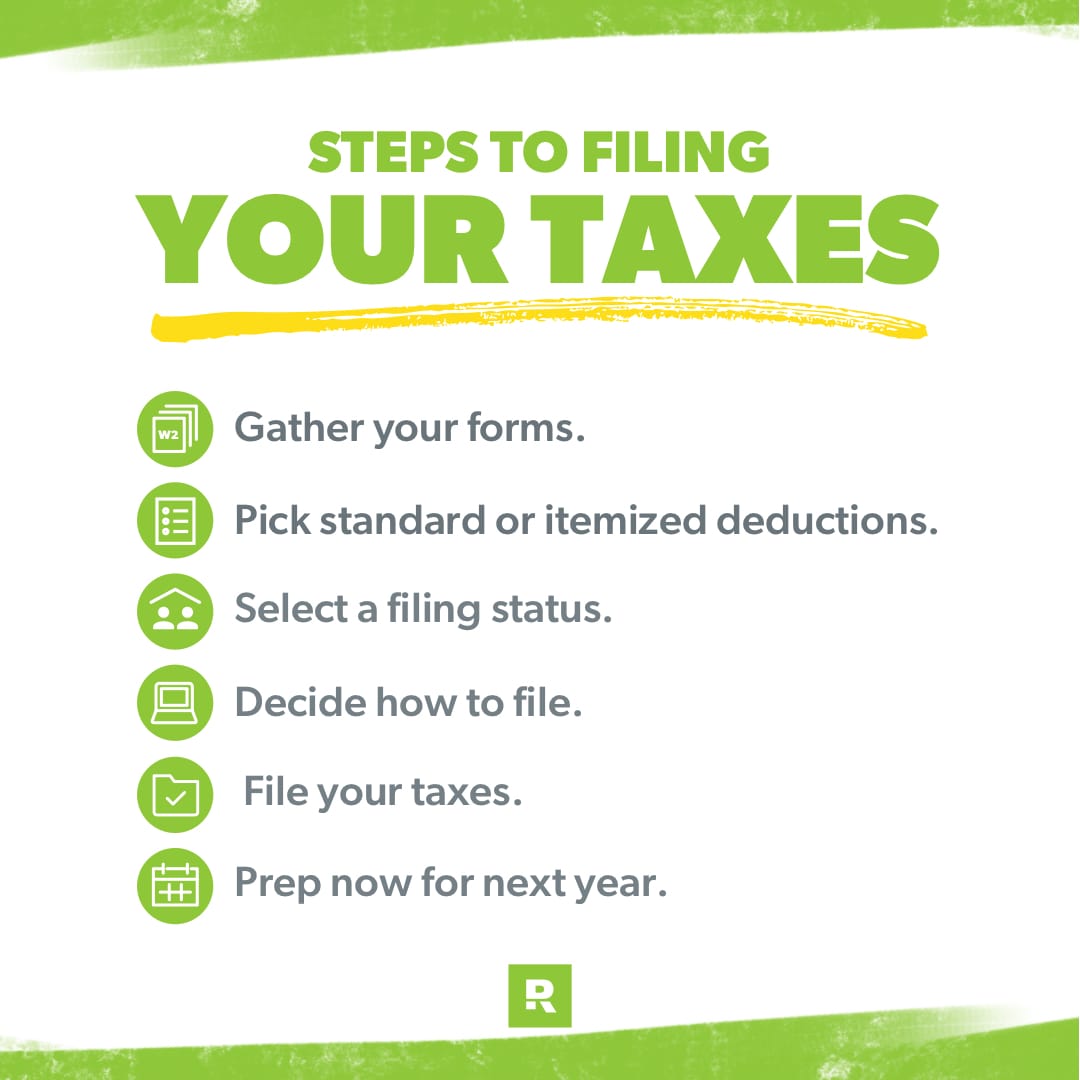

Put It All Together And See If You Owe Tax Or Are Due A Refund

If you’re using a website or tax-preparation software, it will take you through the process step-by-step, asking a wide range of questions about everything from your income to your marital status and dependents that it uses to find deductions and credits applicable to your situation. Some also offer live tax advisors online for an additional fee.

If you’ve chosen to hire a professional, they will return to your completed return to you for review before filing. If you’ve prepared your own returns on paper, double and triple-check the math and make sure you haven’t missed any deductions or credits.Once you’ve finished, be it on your own or through a professional, you’ll discover whether you owe the IRS money or if you overpaid and are due a refund.

Read Also: How To File An Oregon Tax Extension

Get Organized For Next Year

If you end up with a big tax refund or a large tax bill, you probably want to go ahead and adjust your withholdings so that youre not taking too much or too little out of your paycheck for taxes.

And one more thing: Once your taxes are signed, sealed and delivered to the IRS, you might be tempted to celebrate by starting a bonfire and burning all those receipts and tax forms in a blaze of glory dont do that.

Instead, promptly file any tax documents and important receipts when you receive them so you dont have to search the house for them next spring. Buy a few manila folders, an accordion file or a filing systemthat will hold your tax documents and save those documents for at least three years. You might need them if the IRS comes knocking.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Also Check: How To Report Stock Sales On Tax Return

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic filing season opens. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Free Online Tax Software

Online free tax preparation offers a convenient and reliable way to file your taxes.

If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software.

MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through an online chat. Tax filing is free for both federal and state tax filing.

MyFreeTaxes offers a broader range of tax forms than most VITA sites. However, you cannot use this site if you have self-employment income. If youre not comfortable using the website on your own, ask someone you trust to help you.

Another free online option is Free File Alliance, a suite of programs in partnership with IRS. You can find Free File programs on the IRS website. If you choose to use one of these programs, read the fine print carefully. Each program has slightly different criteria for their software. In addition, some companies offer free state tax returns, while others dont.

Don’t Miss: How To Fill W 9 Tax Form

How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

How To File Federal Income Taxes For Small Businesses

OVERVIEW

Depending on your business type, there are different ways to prepare and file your taxes.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Before filling out any tax form to report your business income, gather all your recordspaper or electronicthat pertain to your business earnings and expenses. If you run your business as a sole proprietorship, or as an LLC and you are the sole owner, you can report your business income and expenses on Schedule C along with your personal income tax return. If you run your business as a corporation, or decide to treat your LLC as one, then you need to prepare a separate corporate tax return on Form 1120 or Form 1120S if you are an S-Corp, or Form 1065 for a partnership and/or multi-member LLC. |

When its time to file a federal income tax return for your small business, there are various ways you can do it, depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation.

Different types of business entities can require a different set of tax forms for reporting your business income and expenses. Regardless of the form you use, you generally calculate your taxable business income in similar ways.

Also Check: Can You File Taxes Before Feb 12

File A Digital Return With Free Tax Help

If you earn $73,000 or less, youre eligible for free tax help from companies that have partnered with the IRS.

A tax prep service walks you through the filing process and makes sure you have the right information and documents. But it also performs important calculations on your return. Some services even include a free state tax return.

Important RemindersYou must access the services through the IRS website. If you go to the providers directly, any account you create there will not work on the Free File system.

The tax prep service is a public/private partnership between the IRS and third-party providers. This years partners are: 1040Now.NET, ezTaxReturn.com, FreeTaxReturn.com INC, FileYourTaxes.com, On-Line Taxes at OLT.com, TaxAct, FreeTaxUSA, and TaxSlayer.

Two of the third-party services offer their tool in Spanish: ezTaxReturn.com and TaxSlayer. None of the remaining services offer any language other than English.

How to Find ItGo to the Free File webpage on the irs.gov website and click the Choose an IRS Free File Offer button. > > From this page you can choose to browse the offerings or to use the finder tool which pinpoints the service best suited for you.

For the browse tool, click the Browse All button. > > Here youll see each of the services, along with important information to help you decide which is the right one for you.

Electronically File Your Arizona 2021 Income Tax Returns For Free

Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services. Free File is the fast, safe and free way to do your tax return online.

Individuals who meet certain criteria can get assistance with income tax filing. Taxpayers can file for free if they meet the following criteria:

Also Check: Where Do I File My Federal Tax Return

File With A Free Netfile

The CRA doesnt let just anyone file online through NETFILE. For your own protection, make sure youre using a certified tax software like TurboTax. This ensures your information is secure.

The CRA thoroughly vets any organization that offers tax filing services and software. And rightly so. Certified software is the trusted way to file with accuracy and confidentiality.

Youll also want to take advantage of the CRAs Auto-fill my return service, which lets you automatically fill in details from your CRA account into your return. This greatly reduces the time youll spend filling out forms manually no thanks and helps you import your information correctly.

With TurboTax, you can seamlessly and securely auto-fill your info from the CRA and more. As well as easily add claims and deductions to your return with our step-by-step process.

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

You May Like: Can I Not File Taxes For One Year

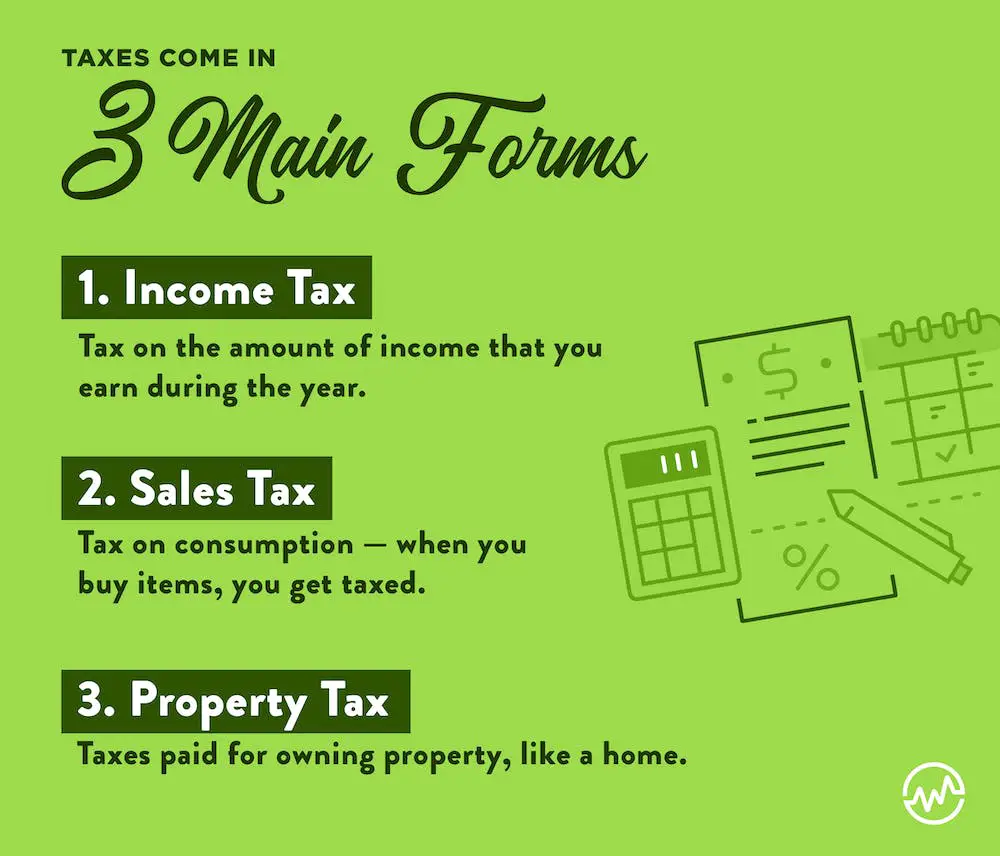

Everything You Need To File Your Taxes

Youre almost certainly paying taxes if you work for a regular paycheck. As a refresher, here’s how it works: Your employer withholds the taxes you owe from your earnings each pay period and sends them to the appropriate federal and state governments on your behalf. But that’s just the first step of the process. A great deal more is involved in filing your taxes correctly and in making sure you’re not paying more than you have to.

In this guide, learn why and how you have to file a tax return, as well as other important aspects of the filing process you need to know.

Who Should Hire A Tax Professional

- Anyone With A Complicated Return If you have a complex financial situation due to getting married/divorced, having a child, selling a property, starting a business or being a frequent trader in your investment accounts. You might be better off hiring a professional to do your taxes.

- Anyone Who Struggles Managing Their Finances If you struggle managing your day-to-day finances be honest with yourself. Doing your own taxes just isnt for you. Its better to pay a little extra to be sure they get done right than to make a bunch of mistakes and end up getting audited or missing out on important deductions.

- Anyone Who Doesnt Have The Time Depending on the complexity of your return and how many tax forms you have to enter information from doing your own taxes can get to be time-consuming. While you might have to wait for a professional to get around to doing your return, it could still be a time saver over sitting in front of a computer and doing it yourself. If you dont want to commit the time, you dont have to.

Also Check: What To Do When Taxes Are Late

How To File Your Taxes Online For Free

Anyone with simple tax returns can file their taxes for free. Here are some optionsand how to use them.

For the past six years, Milagros Melendez, a 72-year-old retired home-care worker, has filed her taxes digitally with the help of volunteer tax professionals in an immigrant-assistance program.

The program, called the Volunteer Income Tax Assistance , is just one of many free tax filing options available to consumers.

For Melendez, who lives in a predominantly Latino neighborhood in Northern Manhattan, the free service offers peace of mind. Her tax preparation is performed by volunteers who speak Spanish and who must take and pass tax-law training that meets or exceeds Internal Revenue Service standards.

Ive never dedicated myself to learning about taxes, it just wasnt my area of expertise, she says.

Plus, now that shes retired and on a fixed income, using the free tax prep service eliminates a financial burden. Before, she would go to her neighborhood tax preparation service, a travel agency, which, she says, charged her around $125.

And since the service files her taxes digitally, the time for processing and delivery of any refund is expedited.

With that in mind, here are some options to consider.