What To Expect For The 2020 Tax Year

This is the last year youll be able to take the residential energy credit. You may be able to get a tax credit equal to 22% to 30% of the improvement costs toward eco-friendly improvements like installing solar panels or energy-efficient appliances. The incentive expires on Dec. 31, 2021.

Also, remember that you cant deduct your home equity loan interest if you take the standard deductions, which are slightly higher in 2021 versus 2020. If you arent sure whether to itemize or take the standard deduction, contact a tax professional for guidance.

What Forms Do You Need For This Interest Tax Deduction

Your lender should send you a Form 1098, a Mortgage Interest Statement, by the end of January each year.

Itll tell you how much interest you paid during the year, and then it gives you other information, too, like the balance of the loan, Schwartz explains.

Only interest of $600 or more is reported on this form. If your interest is less than that, you might not receive a 1098. But you can still report the interest on your tax return.

Is A Heloc Worth It If The Interest Isnt Deductible

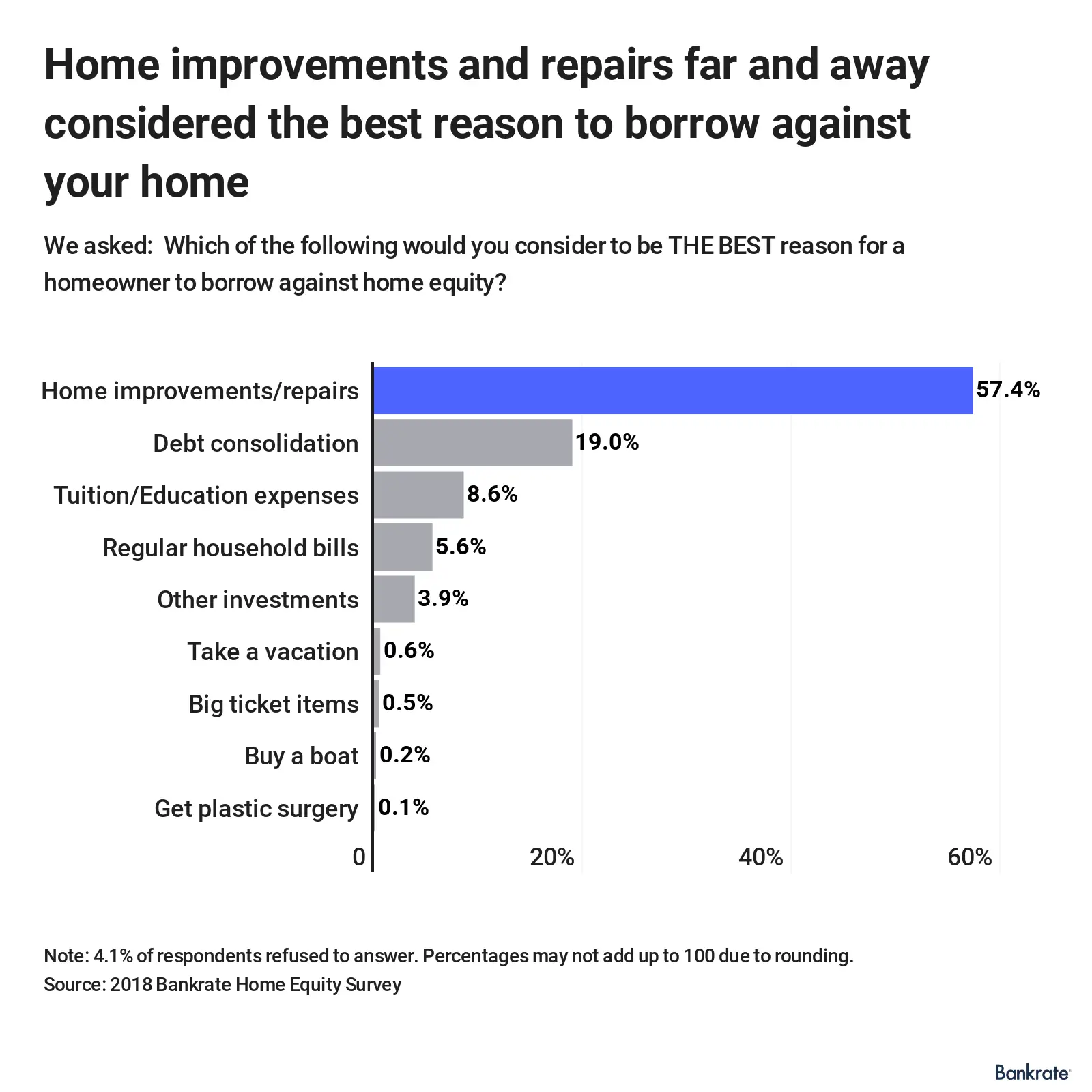

Taking out a home equity line of credit may still be worth it even if the interest is not deductible to you, depending on how you plan to use the money. If youre interested in consolidating credit card debt, for example, and if you can get a much lower rate with a HELOC, then you could save money this way. Of course, this strategy assumes that youll pay the HELOC down as quickly as possible to minimize interest charges and that you wont run up new debt on the cards that youve paid off.

Recommended Reading: Where Can I Get Oklahoma Tax Forms

In What Situations Are Home Equity Loans Deductible

Homeowners can now deduct interest paid to home equity loans and HELOCs if they use the money to buy, build, or substantially improve a home secured by the loan.

The IRS doesnt go into detail regarding substantial improvement. But generally, it means anything that adds significant value to the home or increases its usefulness.

See the table below for guidance on whether several expenses qualify for a tax deduction:

| Yes, if used to | |

| Build or buy a home thats secured by the loanReplace the roof on your homeUpgrade your HVAC systemInstall a whole-house generator or solar panelsBuild an additionRemodel your kitchen or bathroom | Consolidate credit cards or other debtsPay education expenses for yourself or your childrenCover medical or veterinary billsPay day-to-day living expensesFund investments or business expensesPay funeral or burial expenses for a loved one who has passed away |

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Is The Irs Extending The Tax Deadline For 2021

Are Credit Card Rewards Taxable

In most cases, you don’t need to pay tax on credit card rewards. Cash back, points and miles are considered discounts on purchases, not earned income. If you have a rewards credit card, feel free to maximize your reward opportunities without having to worry about paying taxes on your rewards earnings — including welcome bonuses.

There are a few cases in which your credit card rewards may qualify as earned income. Referral bonuses, for example, are not considered discounts on purchases and could be considered taxable income. If you earn credit card rewards that are not associated with purchases or spending requirements, you may need to report that income on your taxes.

Interest On Home Equity Loans Deductible In Some Cases

On February 21, 2018, the IRS issued a special advisory to explain that, in many cases, taxpayers can continue to deduct interest paid on home equity loans. The fact that they even issued this advisory indicates the widespread confusion over the subject. In fact, they mentioned it directly:

Responding to many questions received from taxpayers and tax professionals, the IRS said that despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit or second mortgage, regardless of how the loan is labelled.

- Basically, if youre using the money received to build out or improve the property, the interest you pay on the equity loan should be tax-deductible.

- But if youre using the money for other expenses , the tax deduction is no longer allowed.

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Hereâs an explanation for how we make money

You May Like: What Info Do I Need To File Taxes

How To Claim Home Equity Loan Interest

If you used a home equity loan to cover improvements to your home, your mortgage is considered a mixed-use mortgage by the IRS.

Heres how to claim home equity loan interest:

If you hire a tax preparer, inform the preparer about any possible deductions or tax credits you should qualify for and provide them with the documentation.

What about HELOC interest?

Whether you took on a home equity loan or home equity line of credit , the IRS treats them equally in terms of interest. Both are considered mixed-use mortgages.

How To Claim The Home Equity Interest Deduction

If you own a home and are planning to claim the home equity loan interest deduction, there are a few things to remember:

First, the money must be used for home improvements or renovations. For example, you cannot take the deduction if you are using home equity proceeds to pay for personal expenditures or to consolidate credit card debt. The same goes if you are taking out a loan and letting the money sit in the bank as your emergency fund. Whats more, the renovations have to be made on the property on which you are taking out the home equity loan. You cannot, for example, take out a loan on your primary residence and use the money to renovate your cottage at the lake.

Next, youll want to keep proper records of your expenses. The odds of being audited by the Internal Revenue Service are generally low, but you do not want to take any chances. If you plan to use a home equity loan or a HELOC to pay for home repairs or upgrades, be sure to keep receipts for everything that you spend and bank statements showing where the money went.

Finally, remember that this deduction is not unlimited. You can deduct the interest on up to $750,000 in home loan debts if the loans were made after Dec. 15, 2017. If your total mortgage debt is higher than that, then you wont be able to deduct all of the combined interest paid. The $1 million cap applies for mortgages obtained before that date.

Recommended Reading: How To Track Your Income Tax Check

Refinancing Or A Home Equity Loan: Which Is Right For You

A home equity loan borrows from your homes equity. A refinance is an entirely new mortgage loan involving more stringent credit score requirements, out-of-pocket closing costs and escrow payments. However, a refinance may have more tax benefits if you want to use the loan proceeds for debt consolidation, to pay off credit card debt or student loans, or for any other significant expense that doesnt require a home improvement.

Mortgage interest rates are high right now, so refinancing may not be your best option if your mortgage has a significantly lower interest rate than is currently available. In this case, it may be better to use a home equity loan even if the interest is not tax deductible.

Selling Your Home Will Be Affected By Updates To Capital Gains Rules

The IRS grants an exclusion on real-estate capital gains up to $500,000 for married couples filing jointly, and $250,000 for singles . However, you must have lived in the home for at least two of the last five years prior to its sale. For example, if you bought a home a few years back for $300,000 and sold it today for $900,000, youd make a $600,000 profit. So if youre married and filing jointly, as little as $100,000 of your gain could be subject to tax.

You May Like: When Do People Get Tax Returns

How Do Home Equity Loans And Helocs Affect Taxes

You might be wondering: Do I have to pay taxes on home equity loans? And: What is the HELOC tax deduction in 2021?

In general, personal loans will not affect your tax return. You do not need to report loan proceeds as income, and you cannot deduct interest payments on those loans. However, the IRS makes an exception for personal loans that are secured by a residence, as is the case with mortgages, home equity loans, and HELOCs.

As it has been for decades, mortgage interest is deductible as an itemized deduction and will be reported on your Schedule A. Interest paid on home equity loans and HELOCs are also deductible on Schedule A, but beginning in 2018, the deductions may be limited or disallowed.

When Congress passed the TCJA, they placed a handful of restrictions on interest deductions for home equity loans and HELOCs. Beginning in 2018, interest on these loans is generally not deductible. However, if the funds are used to buy, build, or substantially improve the property secured by the loan thereby meeting the definition of acquisition indebtedness the interest can be deducted. Additionally, the TCJA limited the deduction to interest on acquisition loans of no more than $375,000 . If loans exceed these limits, the amount of interest representing the first $375,000 of loans can be deducted, and the remainder would be nondeductible.

You Can Only Deduct A Certain Amount

Under IRS rules, you can only deduct the interest from mortgages up to $750,000 . This is a combined limit for your mortgage and your HELOC together.

So, for example, if you already have a mortgage with a balance of $750,000 or more, you won’t be able to deduct any interest from your HELOC, regardless of what you spend the funds on. But if you have a mortgage balance of $500,000, you’d be able to deduct the interest from any HELOCs you take out up to a limit of $250,000.

You’re also only allowed to deduct interest from mortgages up to your home’s value. So if your home is only worth $200,000, for example, you won’t be able to deduct interest paid on anything above that, even if you owe $250,000 combined between your mortgage and HELOC.

Don’t Miss: How Much Taxes To Pay On Stocks

How To Find The Best Heloc Rate

Its most common to start your search for the best HELOC rate with the lender who holds your first mortgage since they know your home and credit profile already.

You can also look online for rates to compare lenders with your current mortgage lender prior to fully applying for a HELOC. You may want to complete online prequalification with a few lenders, which can give you a sense of the terms and rates theyre offering, as well as the fees theyll charge.

Lenders set their HELOC rates based on something called the prime rate, which is what banks and other financial institutions use for creditworthy borrowers taking out loans and lines of credit. The prime rate is in turn based on the federal funds rate, which is set by the Federal Reserve.

Your Safe Home Equity Line Is Waiting

Maybe its an updated kitchen or bath. Or, tuition for the kids. Or, even the vacation youve always wanted. A SAFE home equity line can make it happen, giving you access to up to 95% of your homes value. With a SAFE home equity line youll enjoy more than a surprisingly low rate. You may not have any out-of-pocket closing costs since were applying up to $500 toward closing costs through January 2023!*

No annual fee Low payment options Interest may be tax-deductible

If youre looking for a great way to make great things possible, a SAFE home equity line may be just for you. Visit any SAFE branch or call us at 800.763.8600, ext. 2308 to get started. You also can apply online day or night through SAFEs website or within our online banking platform. Were here to help!

Youre already approved, so get moving! This offer is valid only through January 31, 2023!

|

You can choose to stop receiving prescreened offers of credit from this and other companies by calling toll-free 1-888-5-OPT-OUT or visiting optoutprescreen.com. See PRESCREEN & OPT-OUT-NOTICE on the reverse side for more information about pre-screened offers. |

|---|

* Consult your tax advisor regarding interest deductibility.

You May Like: When Do You Have To Have Your Taxes Done By

Home Equity Line Of Credit

Home Equity Lines of Credit, also known as HELOCs, are loans that are secured by your primary residence, and they offer a revolving line of credit to meet your borrowing needs. For example, if youre planning on a home renovation, you can borrow new funds for each step of your project, rather than as a single lump sum. Schedule an appointment with a loan officer today to get started.

New Rules For Home Equity Tax Deductions

Since the tax law changed in 2017, the tax deductibility of interest on a HELOC or a home equity loan depends on how you are spending the loan funds. That applies to interest on loans that existed before the new tax legislation as well as on new loans. Heres how it works.

Interest on home equity debt is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve. Whats more, you must spend the money on the property in which the equity is the source of the loan. If you meet the conditions, then interest is deductible on a loan of up to $750,000 .

Note that $750,000 is the total new limit for deductions on all residential debt. If you have a mortgage and home equity debt, what you owe on the mortgage will also come under the $750,000 limitif its a new mortgage. Older mortgages may be covered under the previous $1 million limit .

That gives people borrowing for renovations more benefits than before. Previously, interest was deductible on up to only $100,000 of home equity debt. However, you got that deduction no matter how you used the loanto pay off credit card debt or cover college costs, for example.

Currently, interest on home equity money that you borrow after 2017 is only tax deductible for buying, building, or improving properties. This law applies from 2018 until 2026. At that time, Congress may opt to change the rule once again.

Don’t Miss: What Is Tax Free Weekend

Should I Get A Home Equity Line Of Credit Or A Home Equity Loan For The Tax Deduction

If you need a large amount of cash specifically to fund either an improvement or a repair on your primary residence, and if you are already itemizing your deductions, then a home equity line of credit or a home equity loan is probably an economically sound choice. If you are on the fence about a property remodel, then borrowing against your home just to take advantage of deducting the interest is probably not your best choice.

Is Heloc Interest Still Tax

Yes. The IRS lumps HELOCs and mortgages together when it comes to determining whether you’re able to deduct the interest from these loans. If you’ve paid off your mortgage, then you’re still able to deduct your HELOC interest as long as you meet the other requirements, such as only using the funds for home upgrades.

Also Check: Can I Pay My Personal Taxes From My Business Account

Home Equity Loan Tax Deduction

You can borrow money against the value of your home with a home-equity loan or a home-equity line of credit. You can secure both with a second mortgage. Both provide access of up to 100% or more of the equity in your home.

A home-equity loan is usually distributed in one lump sum. Its rate is often fixed for the entire term of the loan.

You can access a home-equity line of credit at your discretion. Unlike a home-equity loan, the rate for a home-equity line of credit changes based on an index. It often converts to a fixed rate after a set period of time.

Both provide access of up to 100% or more of the equity in your home.

Tax advantages

If you itemize, you might be able to fully deduct interest payments on either type of loan. This distinguishes these loans from other forms of consumer credit. Since the collateral is your home, interest rates are lower than other consumer loans or credit cards.

Potential risks

However, since your house is the collateral for these loans, failure to repay can cost you your home. Make sure you think carefully about what you plan to buy with your loan or credit line. A home-equity loan with a lower, set amount might be better than a flexible line of credit.

To learn more, see these tax tips:

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.