What To Know About Taxes For Texas Llcs

To start a Texas LLC, you need to file specific documents with the state. Here are some important reporting and state tax filing requirements to keep in mind:

- Unlike many other states, Texas doesn’t require LLCs to file annual reports.

- Texas imposes a franchise tax on most LLCs, which is payable to the Texas Comptroller of Public Accounts.

- Franchise tax is based on the LLC’s net surplus, which is the net assets minus member contributions.

- If you have employees, you need to pay Texas employer taxes.

- You need to obtain a federal employer identification number .

- Texas employers may have to pay state taxes, like unemployment insurance .

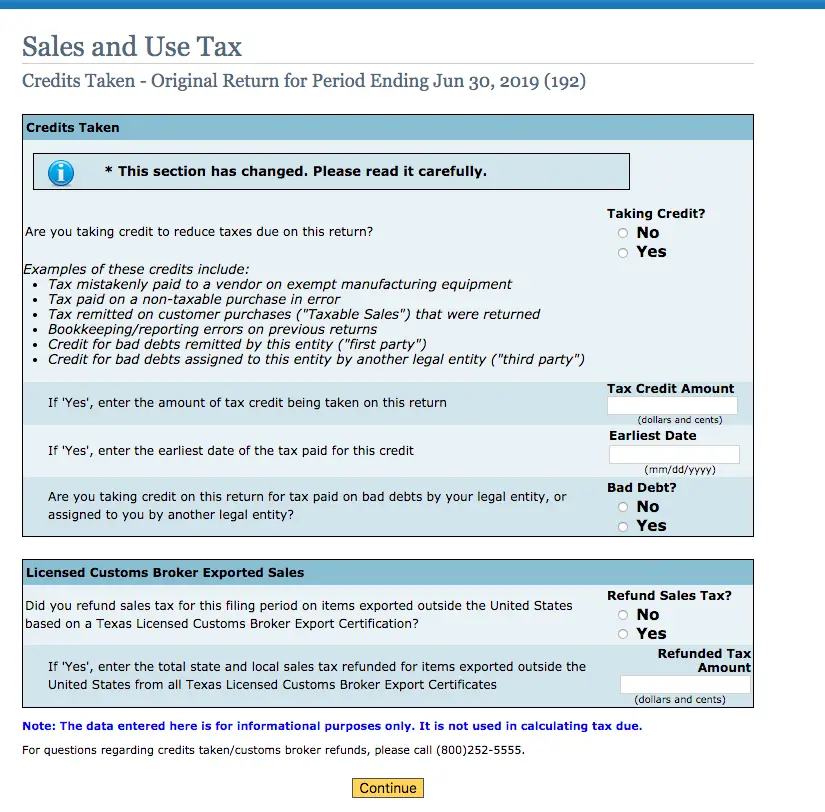

- If you sell goods to Texas consumers, you’ll need to collect and pay sales tax. This needs to be paid throughout the year, typically quarterly.

- If you do business in other states, you’ll need to register in some or all of those states as well.

They Can Earn Social Security Credits

As soon as your child starts working, they can start earning the 40 required work credits to be eligible for Medicare and Social Security benefits. In 2021, theyll earn one work credit for earning at least $1,470, and this increases to $1,510 in 2022 and may continue increasing over time.

To get the credit, they must file an income tax return and pay any owed Federal Insurance Contributions Act or self-employment taxes.

Texas Llc Tax Filing Requirements: Everything To Know

Texas LLC tax filing requirements will vary based on how your business chooses to be taxed.3 min read

Texas LLC tax filing requirements will vary based on how your business chooses to be taxed. An LLC is what’s known as a pass-through entity. This means all income is passed along to the LLC’s members, who are required to report profits on their own federal tax returns. This differs from traditional C corporations who pay tax at the company level on its year’s profits.

Recommended Reading: When Can I File Taxes 2021

They Qualify For The Earned Income Tax Credit

The EITC is a tax credit generally reserved for folks with children of their own, but you can be eligible for it without having kids, so your children may qualify for it too. To qualify without a child, you must meet the following criteria:

-

Worked during the tax year and earned under $57,414

-

Had investment income under $10,000

-

Have a valid Social Security number

-

Been a U.S. citizen or resident alien the entire tax year

-

Cannot have filed IRS Form 2555

-

Must have resided in the U.S. for more than half the year

-

Cannot be claimed as a qualifying child on someone else’s tax return

-

Be at least 18 years old by the end of the tax year

Benefits Of Filing A Tax Return

Get money back. In some cases, you may get money back when you file your tax return. For example, if your employer withheld taxes from your paycheck, you may be owed a refund when you file your taxes.

Avoid interest and penalties. You may avoid interest and penalties by filing an accurate tax return on time and paying any tax you owe in the right way before the deadline. Even if you can’t pay, you should file on time or request an extension to avoid owing more money.

Protect your credit. You may avoid having a lien placed against you when you file an accurate tax return on time and pay any tax you owe in the right way before the deadline. Liens can damage your credit score and make it harder for you to get a loan.

Apply for financial aid. An accurate tax return can make it easier to apply for help with education expenses.

Build your Social Security benefit. Claiming your self-employment income on your return ensures that it will be included in your benefit calculation.

Get an accurate picture of your income. When you apply for a loan, lenders will look at your tax return to figure your interest rate and decide if you can repay. If you file accurate tax returns, you may get a loan with a lower interest rate and better repayment terms.

Get peace of mind. When you file an accurate tax return and pay your taxes on time, you’ll know that you’re doing the right thing to follow the law.

Recommended Reading: Can I File My Taxes Twice

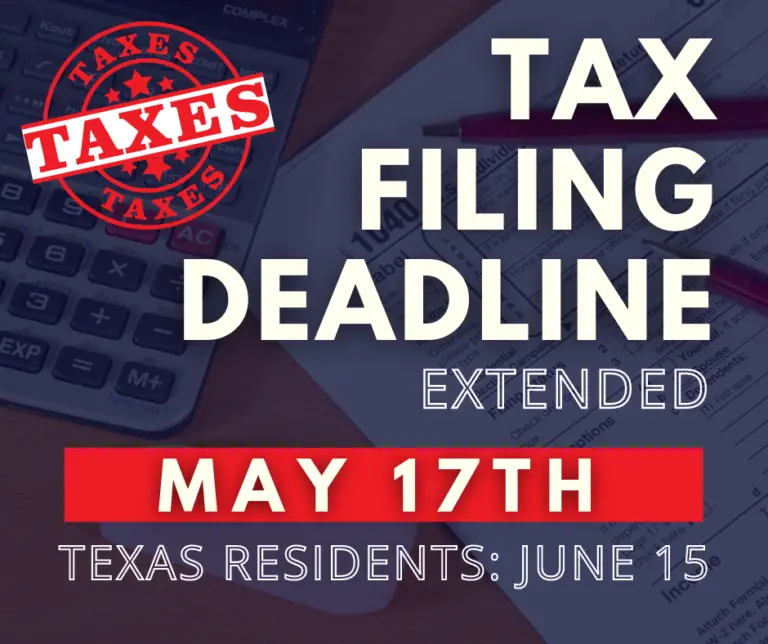

Irs: Tax Return Filing Deadline For Texas Taxpayers Is June 15

AUSTIN, Texas – The IRS is reminding Texas taxpayers the deadline to file their 2020 federal income tax return is June 15, 2021.

The deadline was extended to June due to the February winter storms to give taxpayers more time to file their individual and business 2020 tax returns and make payments without penalties and interest, regardless of amount owed.

“Individual taxpayers who need additional time to file beyond the June 15, 2021 deadline can request an extension until Oct. 15,” said IRS spokesman Michael Devine. “The IRS cant process extension requests filed electronically after May 17, 2021 so they need to print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.”

LIVE: Navigating a pandemic tax season

This week was the beginning of the 2021 tax season. Val Majewski with American Benefits Exchange joined Good Day Austins Casey Claiborne LIVE via Zoom to talk about whats different after a pandemic yearlike stimulus checks and unemployment.

Businesses that need additional time to file income tax returns must file Form 7004.

The IRS is also reminding taxpayers that an extension gives them until Oct. 15 to file but does not grant an extension of time to pay taxes due.

Better Business Bureau talks about tax-related scams

Taxpayers who live and work abroad also have until June 15 to file their tax returns as part of the normally granted automatic two-month extension.

Both Earned And Unearned Income

If youre a dependent under 65 and your gross income includes both earned and unearned income, youll need to do a little math to determine if you must file taxes or not.

As of the 2021 tax year, youre required to file a tax return if your gross income is more than $1,100 or more than your earned income plus $350 whichever number is greater.

For example, lets say you made $4,000 at a part-time job and $300 in interest . Your gross income would be $4,300. First, you would decide which number is higher: $1,100 or your earned income plus $350. In this example, your earned income plus $350 is $4,350, which is higher than $1,100.

Next, compare your gross income of $4,300 to the $4,350 amount. Since your gross income is lower, you dont need to file a tax return.

There are some additional details to be aware of:

-

If your earned income plus $350 is greater than $12,550, youll use $12,550 as your income threshold to determine if you must file a tax return.

-

If youre a married dependent whose spouse files a separate return and itemizes deductions, you must file a tax return if your gross income is $5 or more.

Don’t Miss: How To Get Child Tax Credit 2021

The Texas Franchise Tax

Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. The rate increases to 0.75% for other non-exempt businesses. Also called a “privilege tax,” this type of income tax is based on total business revenues exceeding $1.23 million in 2022 and 2023.

Sole proprietorships and some general partnerships are exempt from the franchise tax.

Franchise tax reports are due annually on May 15 or the next business day when this date falls on a weekend or a holiday. Interest on past-due franchise debts begins accruing 61 days after the due date. Penalties of up to 10% can apply after 30 days.

There’s No Actual Age Limit To File Taxes

There is no minimum age limit to filing taxes. But whether the IRS requires you to file will be based on a number of factors, including your gross income.

Even if you or your child arent required to file taxes this year, it may still be beneficial to do so as a learning experience, to earn Social Security work credits or even to claim the EITC.

For more personal finance and tax tips delivered straight to your inbox, .

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees

Read Also: How Do I Figure Taxes On My Paycheck

Entities Not Subject To Franchise Tax

The following entities do not file or pay franchise tax:

- sole proprietorships

- general partnerships when direct ownership is composed entirely of natural persons

- entities exempt under Tax Code Chapter 171, Subchapter B

- certain unincorporated passive entities

- certain grantor trusts, estates of natural persons and escrows

- real estate mortgage investment conduits and certain qualified real estate investment trusts

- a nonprofit self-insurance trust created under Insurance Code Chapter 2212

- a trust qualified under Internal Revenue Code Section 401

- a trust exempt under Internal Revenue Code Section 501 or

- unincorporated political committees.

Some Residents Of Other States Could Also Soon Qualify For The Same Extension

While Texas suffered catastrophic damage due to the extreme weather, it was far from the only state affected. The IRS assures that residents of other states “impacted by these winter storms that receive similar FEMA disaster declarations will automatically receive the same filing and payment relief,” with all information posted on their disaster relief website.ae0fcc31ae342fd3a1346ebb1f342fcb

You May Like: What Is E File Taxes

Do You Have To File Taxes On Social Security

Some Social Security recipients are required to pay federal income taxes on their payments. Nobody, however, pays taxes on any portion of their Social Security payments that exceeds 85%. If you file a federal tax return as a person and your combined income is more than $25,000, you must pay taxes on your benefits.

Similarly, Do Social Security recipients have to file taxes?

When your gross income exceeds the standard deduction for your filing status, the IRS normally requires you to submit a tax return. Seniors receiving Social Security payments are nonetheless subject to these filing requirements. You dont have to submit a tax return if Social Security is your only source of income.

Also, it is asked, Do you have to report Social Security income to the IRS?

On line 6b of Form 1040 or Form 1040-SR, you must state the taxable component of your social security benefits. If the sum of half of your benefits plus all of your other income, including tax-exempt interest, exceeds the base amount for your filing status, then your benefits may be subject to taxation.

Secondly, Do seniors pay taxes on Social Security income?

Many older citizens are shocked to hear that Social Security payments are taxed. A portion of the pension received by retirees who are still employed is taxed. Half of your social security payments are increased by these earnings by the IRS if the total is more than the allowed income limit, the benefits are taxed.

Related Questions and Answers

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property. “Income” is the key word when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment doesn’t count.

Appraisals of real estate are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

Local governments regularly hold public hearings to discuss tax increases, and citizens of Texas can petition for a public vote on an increase if it exceeds certain limits.

Owners of agricultural or timberland property can apply for special appraisals based on the value of crops, livestock, and timber produced by the land. This can result in lower appraisals and lower taxes.

Also Check: How To Figure Out How Much Property Tax I Paid

States With No Income Tax

In one way or another, taxes are a part of every Americans financial life. But for residents of Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming, they are off the hook for state-level personal income taxes. Additionally, only New Hampshire taxes dividends and investment income, but not wages. While avoiding state income taxes may seem appealing, theres often a catch, like high sales taxes. A financial advisor can help you optimize a tax planning strategy.

What Personal Property Is Taxed In Texas

The property tax in Texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. Property that’s not directly responsible is exempt. It doesn’t count as being used to make income if you drive your car to and from work.

Read Also: How To Check Last Year Tax Return

With Tax Season Underway Texans Urged To File Returns Electronically To Avoid Irs Refund Delays

Tax season is now underway in Texas. Monday was the first day Texans could start filing their 2021 federal income tax returns.

Earlier Start Date

Last years start date to tax season was later Feb. 12. Michael Devine, a spokesperson for the Internal Revenue Service, said this years Jan. 24 opening date is closer to the historical norm.

In the past couple of years, weve had to delay the start of filing season because of circumstances beyond the IRS control, said Devine. Usually, it has to do with tax laws that are changed late in the year. The IRS has to postpone the start of filing season so we can reprogram the computers so that we’re enforcing the current law.

But, Devine added, even with the earlier start date, people may not be able to file right away, since they may not have all the documents they need.

Thats because employers and banks have until Jan. 31 to give everyone the necessary forms, including W-2s.

How to avoid refund delays

For those with documents already in hand, Devine encouraged submitting returns electronically to avoid delays. Underfunding and understaffing are among the challenges his agency still faces this year.

There are fewer people who are actually in the office or working in the IRS processing centers, and all of them are under COVID protocols so we can’t sit shoulder to shoulder. You have to be socially distant, Devine said.

With fewer people, Devine said the paper returns are going to be slower.

Obtaining An Alcohol Permit

- Print and complete the Texas Alcoholic Beverage Commission On-Premises Prequalification Packet.

- You will need a Texas Sales and Use Tax Permit to pay sales or use tax on taxable items that you purchased tax free and then used in a taxable manner. Take the packet to a Comptrollers field office to be certified for sales and use tax.

- EXAMPLE: A permittee owes sales or use tax on the cost of taxable ingredients in a complimentary beverage, and on any napkins and straws served with the complimentary beverage. You will owe use tax on items purchased from a vendor that did not charge Texas tax.

Also Check: How Much Am I Going To Get Back In Taxes

If You Live Here You Don’t Have To File Your Taxes In April

The IRS has announced that the state’s residents and businesses will have extra time to file this year.

Filing your annual income taxes is infamously one of the few things you can count on every single year. But after devastating winter storms battered large sections of the U.S. last week, the federal government has decided that many of the millions of Americans who were affected should be given some extra time to get their finances in order. Because of this recent decision, residents of the state of Texas won’t have to file their income taxes by April 15 this year. Read on to learn more about the changeand how it can affect non-Texans, tooand for another important financial update, check out If You’re Waiting on a Stimulus Check, Read This Before Filing Your Taxes.

Mondays Tax Day But Texans Get Until June Heres What You Need To Know About Filing

WASHINGTON, DC — Okay, last call. Monday, May 17, is the official deadline for individuals to file their 2020 federal tax return, and in most instances their state tax return, too. It’s a month later than usual, thanks to the pandemic.

While people in New Mexico are facing the federal income tax deadline on Monday, residents of Texas have until June 15 to file their income tax because of February’s severe winter storms.

But the filing deadline’s not the only thing that’s changed. Many of the upheavals over the past year have caused other changes to your taxes. Due to the Covid crisis, there are plenty of new and revised provisions and important dates you will need to know about before filing your return this year.

Here are some of the most important ones.

Read Also: How Early Can You File Your Taxes 2021