Ask A Friend Or Relative

Finally, the other time-tested way to get your taxes done for free is to rely on a relative or trusted friend to do it for you.

If theres an accountant in the family or some other kind soul with in-depth tax knowledge who offers to take care of your return this year, you need to give them formal permission to handle your affairs. You can do so by using the Authorize my representative service through your online CRA account or by sending Form T1013 in the mail to the CRA.

Whatever you do, consider a bottle of wine or home-cooked meal for your volunteer tax preparer. Thats not in the tax code but will likely be much appreciated.

Take Time To Understand Your Taxes

I cant stress this enough: there is no substitute for your own personal knowledge of your tax information. Unless your situation is extremely simple, no one but you could possibly know all of the details of your financial situation.

You should really strive to understand your own taxes, even though it will require some effort. Start with last years return. Look at the different sections and learn how they work together.

If you use a CPA, have them thoroughly review the return with you so that you understand what they did. A tax preparer of any kind should really just be for assurance, not so that you can turn a blind eye to what is going on.

Want to use the CPA that I use to get my taxes done? Check out my Dad, Larry G. Taylor, CPA.

Is It Worth It To Pay Someone To Do Your Taxes

There are several reasons it could be worth it to have an experienced professional do your taxes instead of self-filing. For example, it can help reduce the chance of you making a mistake that could land you in trouble with the IRS. And, it could save you time for other important tasks. If you have a side job, rental property or many assets, having someone do your taxes can pay off in the short- and long-run.

Contact several tax professionals near you to discuss your needs and get free estimates. Then, decide if hiring a pro is right for you.

You May Like: How To Buy Tax Lien Properties In California

Free And Discounted Tax Preparation For Military

Tax season is here again. And while filing for tax returns can be tricky for the average family, it can get even more complicated for military families.

Thankfully, military personnel and their families have access to a variety of tax preparation and filing services for free or discounted prices. Whether you choose to file taxes yourself online or you prefer some outside assistance from a trained professional, there are a several free and discounted options to choose from.

File Taxes Free With Jackson Hewitt

Free File with Jackson Hewitt:

Jackson Hewitt offers a Free File program for federal taxes ideal for first-time taxpayers. Users may also choose from a variety of paid versions for more complicated tax returns.

For inexperienced filers, Jackson Hewitts Free File program is like a breath of fresh air, providing step-by-step training, secure data storage, and filing instructions in laymans terms.

No matter which software a user chooses, Jackson Hewitt guarantees accurate tax return calculations and assumes liability for any IRS-imposed penalties.

Recommended Reading: Www.1040paytax.com.

Identity Theft And Unemployment Claims

If you collected unemployment benefits during the year, you will get a tax form from the Michigan Unemployment Insurance Agency called a 1099-G form. During the pandemic, some people have used stolen identities to collect money from unemployment benefits. If someone used your name to collect unemployment benefits, you will get a 1099-G form in the mail even though you did not get unemployment benefits.

The envelope with the 1099-G form will have instructions about what you should do if you were a victim of identity theft. After the UIA investigates the fraud claim, it will send a new 1099 form showing that you did not actually receive benefits. To learn more about this issue, visit the UIAs page about tax forms and identity theft.

Tax Filing For Veterans

In 2015, the U.S. Department of Veterans Affairs and the Internal Revenue Service entered into a Memorandum of Understanding aimed at ensuring that military members and veterans receive free tax preparation services. Subsequently, there are numerous ways that you can access services, both in-person and online, to make the most of this benefit.

Recommended Reading: Tax Lien Investing California

What Is A Tax Preparer Called

A tax preparer can take the form of several different job titles, but they must have an IRS Preparer Tax Identification Number to be authorized to prepare federal tax returns, according to the IRS. Some titles may include enrolled agents, who are licensed by the IRS, as well as certified public accountants . Some tax attorneys may offer tax preparation and planning services, though not all are qualified to do this.

Choose The Right Free Tax Clinic For You

A free tax clinic is a place where eligible people can get their tax returns done for free by volunteers. These tax clinics are hosted by community organizations across Canada through the Community Volunteer Income Tax Program and the Income Tax Assistance – Volunteer Program in Quebec.

There are different types of free tax clinics.

Walk-in: Show up during advertised hours and a volunteer will do your tax return for you on a first-come, first-served basis.

Drop-off and pick-up: Show up during advertised hours and drop off your documents. A volunteer will do your return, and you will pick it up at a later time.

You will have to prove your identity when you pick up your return and documents.

Also Check: Do You Have To Report Plasma Donations On Taxes

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

I Dont Know My 2019 Agi What Should I Do

You can find it on line 7 of your 2019 return if you still have a copy of your return. If you filed your taxes at a United Way of King County Free Tax Prep location last year, email and include your phone number so we can provide you with a copy of last years return. If you did not file with us last year, IRS.gov/get-transcript can help you retrieve a copy of last years tax return.

Read Also: How Much Is H& r Block Charge

Filing Taxes Doesnt Have To Be Difficult Or Expensive

However you choose to file your taxes, I hope you are able to get your taxes prepared and filed with few hassles. Use these tips for organizing your tax documents to help the process go more smoothly. You may also wish to use this tax refund schedule to find out when you might expect to receive your refund.

Finally, if you have been deployed, or havent had enough time to file your tax return, then you should look into filing a tax extension to delay filing your tax return. Just be sure to file your return by October 15th .

Free Tax Return Preparation For Qualifying Taxpayers

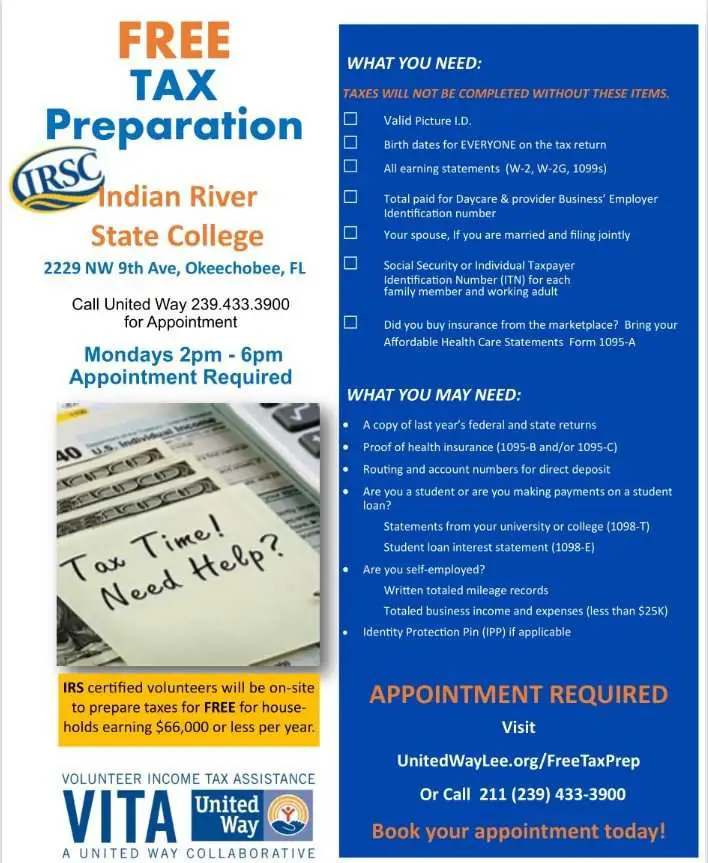

The IRS’s Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $57,000 or less

- Persons with disabilities and

- Limited English-speaking taxpayers

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are operated by IRS partners and staffed by volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

Don’t Miss: Michigan.gov/collectionseservice

Military Installation Tax Centers

Many large military installations worldwide offer service members and their families free income tax filing assistance through the Volunteer Income Tax Assistance program which is sponsored by the IRS. VITA sites have volunteers that are trained by the IRS to provide assistance with some of the more complicated military-specific tax issues, such as combat zone tax exclusions.

Visit Military.com’s Base Guide to contact your local installation for more information about location of tax centers, hours of operation, scheduling appointments, and necessary documentation.

The Army & Air Force Exchange Service is also teaming with H& R Block to offer tax preparation services to military members and their families at a 10% discount in select Exchange locations around the world. for the list of participating Exchanges.

Is It Better To Have A Cpa Do Your Taxes

Hiring a certified public accountant could be a better option instead of doing your taxes by yourself, but it depends on your tax situation and preferences. Having a CPA do your taxes is usually recommended if you have a business or any type of side job, or if youve been contacted by the IRS for a tax-related matter. Others who can benefit are those who own rental properties or have many assets. You can also hire a CPA if you need help understanding what deductions or credit you might qualify for.

You May Like: Where’s My Tax Refund Ga

Get Help With Your Taxes And Save

IMPORTANT UPDATE

- Federal and State Tax Deadline has been extended to May 17, 2021.

- Agency VITA sites are operating with a combination of remote and drop off procedures to keep everyone safe while optimizing service.

- Agency VITA sites are working with both taxpayers and those who have not filed in the past to access the recovery rebate credit.

The Volunteer Income Tax Assistance program offers free tax help to people who generally make $57,000 or less, including persons with disabilities, the elderly and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

VITA sites help thousands of people living with low incomes each year access tax credits that can add up to over $8,000.

VITA volunteers are trained to access the Earned Income Tax Credit and other tax credits to allow taxpayers to pay bills, cover essential needs , save and plan for the future. Community Action Agency VITA sites also are able to link taxpayers to other critical services that strengthen families.

Alternative Filing Methods That Do Not Require Going To A Free Tax Prep Site

MyFreeTaxes is a self-filing option.

Click the MyFreeTaxes icon to utilize the self-filing method.

GetYourRefund is a virtual volunteer tax preparation option.

An IRS certified volunteer can prepare your tax return virtually. You will need to click the icon, follow the prompts, fill out the intake packet, upload the items mentioned to the system, and respond to any contacts made by the volunteer. This process can be completed via computer, laptop, smartphone, tablets, etc. Please click the icon to utilize this feature.

Read Also: How Much Does H& r Block Charge To Do Taxes

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

How To Get Your Taxes Done For Free

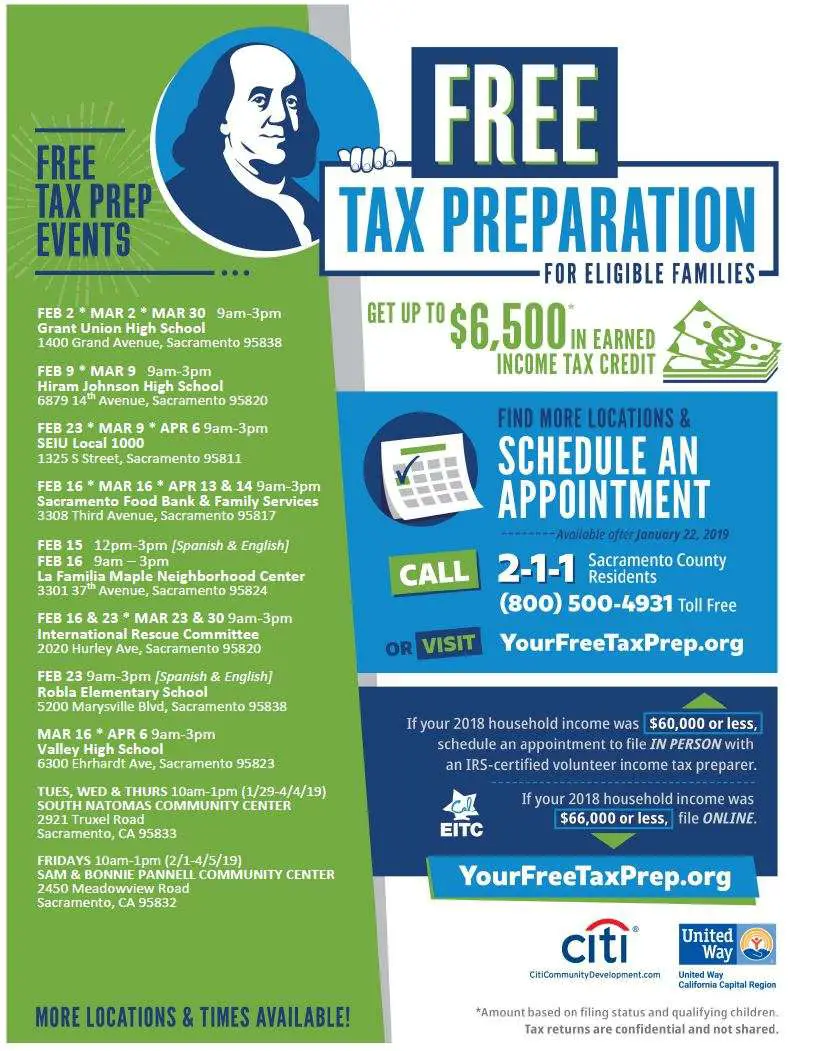

If you earn $54,000 a year or less, or have disabilities or limited English language skills, you may be eligible for free in-person help to prepare your tax returns. Youre also eligible if youre over 60, regardless of income.

IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals under the Volunteer Income Tax Assistance program, known as VITA. A similar program, Tax Counseling for the Elderly, offers free help to those age 60 or older. Some VITA locations also provide assistance on the Free File system to those whose incomes are as much as $66,000.

Many of the IRS-certified volunteers who provide tax counseling are retirees or accounting students associated with non-profit organizations that receive IRS grants.

VITA sites are generally located at community and neighborhood centers, libraries, schools, shopping malls and other locations across the country. To find one near you, use the VITA locator tool or call 800-906-9887. For TCE sites, use this AARP locator tool or call 888-227-7669.

Heres what you need to know before using the program:

Not All Locations Deliver The Same Services.

While all VITA sites use the same IRS software and guidelines, the client experience varies. Some locations require appointments, while others take walk-ins. Hours of operation often depend on the availability of volunteers.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Free Virtual Tax Filing Service

Code for America, in partnership with VITA, has created a fully virtual intake process for free tax assistance. In light of COVID-19, Code for Americas Get Your Refund service is a free and safe alternative to prepare your tax return without the risk of in-person interaction.

Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

Code for Americas Get Your Refund service is free for those who earn less than about $66,000. This is a good option if you are comfortable using technology, including sending pictures or documents electronically.

When Are Taxes Due

The IRS began accepting 2020 income tax returns on Feb. 12. The deadline for those returns is on May 17 this year.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Don’t Miss: How Much Does H& r Block Charge For Doing Taxes

Find Free Tax Help In Maryland

Some community groups, like the Montgomery County Community Action Agency, are offering free, virtual tax preparation assistance for those who qualify. Schedule a virtual appointment now, if you live in Montgomery County and make less than $57,000 per year.

The CASH Campaign of Maryland is another popular tax assistance program. You can get help with your taxes if you made $57,000 or less in 2020. Call 410-234-8008 for a virtual appointment. Theres also a drop-off option for 2021

You can also find free tax assistance through MyFreeTaxes. You can choose if you want to prepare you return by yourself or with assistance.

There are income qualifications for free, in-person tax prep programs. The income guidelines are $57,000 per year but check with the individual provider.

If you want to do your own taxes for free, the IRS also offers Free File which links you to partner sites for free federal tax filing. State taxes are free with some offers. Its available for those making $72,000 and below. There are free fillable forms if you make more income every year, but free state filing is not included. Learn more about the IRSs Free File program.

- Find an IRS Volunteer Income Tax Assistance program near you

- Find an American Association of Retired Persons Tax-Aid site near you. This service is available to taxpayers over age 50 with low to moderate income.

Can I Use Digital Payments To Pay For Tax Preparation Services

Before you hire a tax professional, visit their business profile to see how they handle payments. Many CPAs and tax experts accept digital payments through Venmo, PayPal, Square Cash, Zelle and other online platforms. More businesses may be changing their payment methods to accommodate social distancing. Check with your tax preparer to see how they handle payments.

Also Check: How Can I Make Payments For My Taxes