Irc Section And Treas Regulation

IRC Section 61 explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

IRC Section 104 permits a taxpayer to exclude from gross income the amount of any damages received on account of personal injuries or physical sickness

Reg. Section 1.104-1 defines damages received on account of personal physical injuries or physical sickness to mean an amount received through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

Dont Miss: Amended Tax Return Deadline 2020

Working With An Attorney

If you or somebody you care about is involved in a legal case, you need to make sure you have an Atlanta personal injury attorney by your side who can help you understand the actions you need to take to win your case. If you are concerned about tax deductions or being taxed on your settlement, you should speak to your accountant both before a settlement comes in as well as after your case is over. You need to know what tax breaks you can legally take, and you also need to make sure that your taxes get paid each year appropriately.

Fees For Securing Interest In A Qualified Retirement Plan

Lastly, you may be able to individually deduct the fees that you paid for securing interest in a qualified retirement plan. For example, you may wish to divide the contribution plan between you and your spouse.

If you meet with an accountant or a specific legal expert to work out an agreeable plan between you and your spouse, the fees from that meeting specifically could be deductible. The fees for the broader divorce proceedings, of course, are not.

Recommended Reading: How To See My Past Tax Returns

General Rule: Personal Legal Fees Arent Deductible

In the past, personal or investment-related legal fees could be deductible as a miscellaneous itemized deduction. However, the Tax Cuts and Jobs Act eliminated these deductions for 2018 through 2025. So, personal or investment-related legal fees arent deductible starting in 2018 through 2025, subject to a few exceptions.

Recommended Reading: State Of California Sales Tax

Can You Write Off Licensing Fees

Like many deductions, you can write off license fees and expenses if they qualify as a business expense. For example, a lawyer must pay an annual licensing fee to remain licensed in the state. This fee can be written off.

License fees for personal purposes such as pet licensing fees and marriage licenses are generally are not allowed as a tax deduction.

Read Also: How To Search Irs Tax Liens

Contact A Skilled Attorney

If you or somebody you care about has sustained an injury caused by the negligent or intentional actions of another individual or entity in Kentucky, reach out to an experienced personal injury attorney immediately. A lawyer can help walk you through every aspect of the process. If you are concerned about tax deductions and tax implications of a settlement, we encourage you to speak to your accountant while your claim is ongoing. You need to keep proper documentation of all expenses that you incur as a result of the legal action.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: What Happens If I File Taxes Late

Recent Changes To Tax Deductions

While it may have been possible to deduct certain divorce attorney fees on taxes or other expenses from divorce proceedings before 2017, the Tax Cuts and Jobs Act or TCJA changed that. Signed into law by then-President Trump, the TCJA significantly changed the deduction types and amounts individuals could claim on annual tax returns from 2018 on.

For example, before the TCJA, individuals who owed legal fees that related to business income could deduct the fees under Tax Code Section 212. This deduction is now suspended until 2025 per the TCJA.

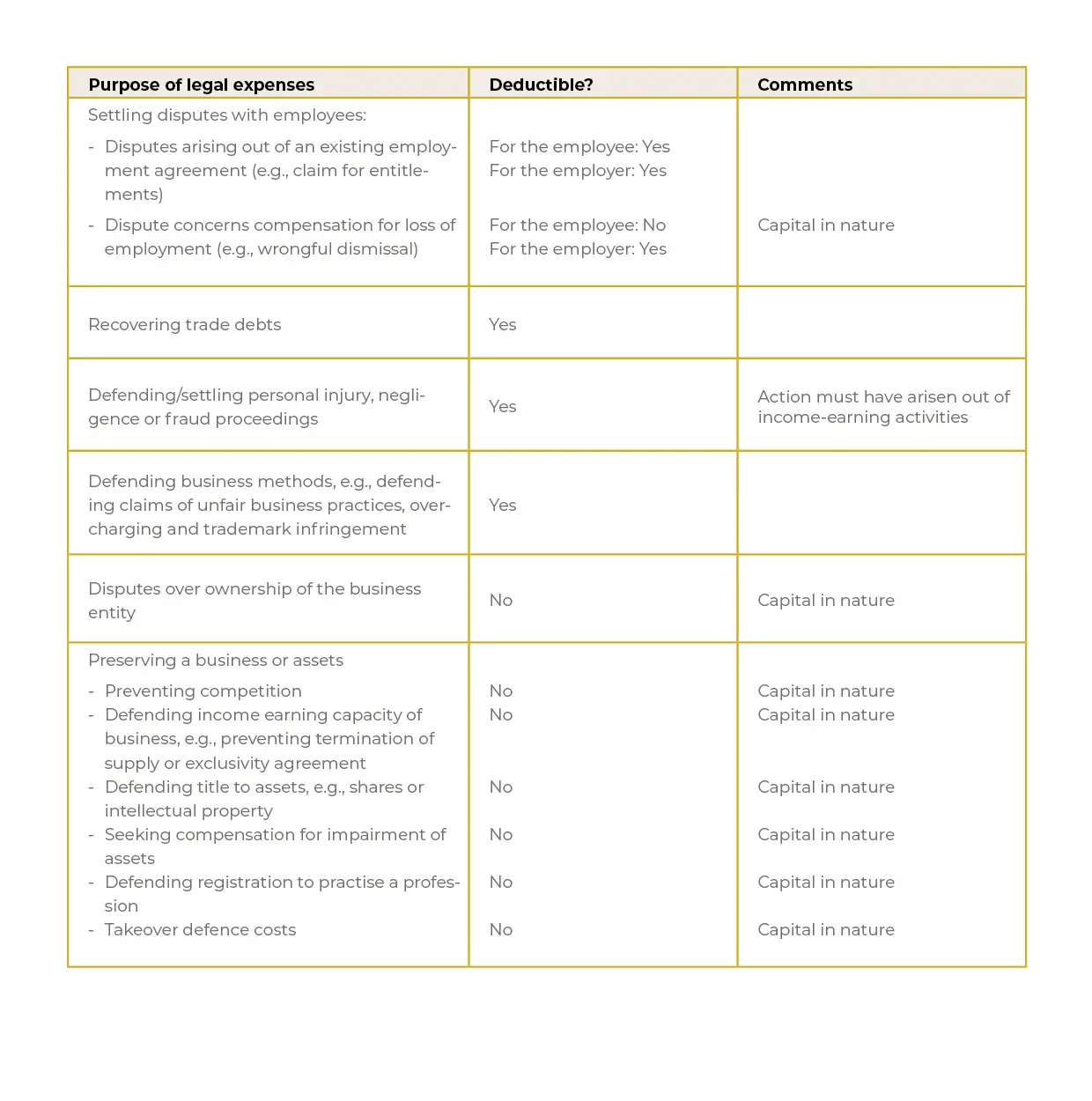

Tax Deductible Legal Fees

1) Fees associated with creating or forming a corporation or limited liability company. There is a cap on the deductible per year, but it can be deducted over the first 60 months you are in business if over that cap.

2) Fees and expenses that are ordinary and necessary expenses directly relating to operating your business. Here are examples, this is not an exhaustive list:

a) Collecting money owed by a customer.

b) Negotiating or drafting of contracts for the sale of goods and services.

c) Defending against trademark, copyright or patent claims.

3) Fees associated with resolving tax issues, advice, or preparation of tax forms related to your business.

4) Fees associated with rental or royalties on properties for which you earn income. This applies to things like evicting a tenant.

5) Fees associated with creating or acquiring property, including real property, are not immediately deductible. Instead, they are added to the tax basis of the property and may be deducted over time through depreciation.

6) Fees associated with whistleblower claims.

7) Fees associated with unlawful discrimination claims.

8) Fees associated with adopting a child if you qualify for the federal adoption tax credit.

9) Fees associated with certain personal property claims against the Federal Government where damage was caused to the property. This applies to civilians, federal employees, and even military.

Also Check: How Do You Report Bitcoin On Taxes

When Are Attorney Fees Tax Deductible: On What Basis Fees Becomes Deductible

Legal fees of the attorney can be tax deductible on different grounds. The deduction can be made if the fees have been incurred in business matters. The deduction of the legal fees would then be claimed on business returns. For instance, if the business has been done in partnership, you need to fill Form 1065.

The answer to the question: when are attorney fees tax deductible depends on the circumstances and legal expenses.

According to the Internal Revenue Code that works under the supervision of the United States Congress, and sanctioned by the sitting president, the code mentions that except for the legal expenses, like itemized deductions, nothing should be deducted from the amount that is allowed for the living and other family expenses.

IRC also allows individuals and business personnel to claim the money they incur to obtain the services of any professional which can be treated as legal expenses.

However, for fee deduction to apply, the legal expenses should directly relate to the business procedures or the expenses which involve the procurement costs, including a legal fee to start or take over the business.

What Are Lawyer Fees

The charge for the legal fees varies from client to client as the lawyers charge according to the paying capacity of their clients. It has been seen that lawyers charge around Rs.3 to Rs.6 lakh per hearing for cases in High Court and if the lawyer has to travel to other High Courts, then the fees can go up to Rs.

Read Also: What’s The Property Tax In Texas

Are Attorney’s Fees Tax Deductible

The odds are good you’re going to need legal advice someday. Maybe you’re thinking about getting a divorce, need help writing a lease for the house you want to rent, or were injured in an auto accident and want to sue the other driver.

No matter why you need an attorney, you’re going to have to pay for the lawyer’s legal services. We all know that lawyers arent cheap. Can you at least offset some of that cost by taking a tax deduction for attorneys’ fees? Generally, you can’t deduct personal legal fees, but business-related attorneys’ fees are deductible.

Exceptions To The Rule

That being said, there are several potential exceptions to the above rule. It all lies in the intricacies of itemizing your deductions.

In a nutshell, you are allowed to itemize your deductions on your annual tax return provided that the miscellaneous deductions account for more than 2% of your AGI or adjusted gross income. In other words, your miscellaneous deductions combined have to be more than 2% of the income for which you are projected to be taxed.

If your itemized deductions dont pass the 2% AGI test, you cant deduct any of the legal costs outlined below. But if they do, read on!

Read Also: What Am I Getting Back In Taxes

Why Claim Divorce Attorney Fees On Taxes In The First Place

Both parties in a divorce typically pay for separate lawyers. There may be a number of meetings required to divvy up possessions or assets. And proceedings can drag on for quite a long time if one or both spouses cannot agree easily. A protracted divorce proceeding can result in a significant amount of legal fees.

Because of these expenses, many individuals wonder whether they can claim the legal fees from their divorce proceeding on their taxes. In this way, they might enjoy a higher tax return or be taxed on less income. Obviously, no one wants to pay more in taxes than they are legally required to pay.

Are Divorce Lawyers Fees Tax Deductible

A tax deduction is an allowance whereby the IRS allows you to reduce your total taxable income by a certain amount because of some event.

By allowing tax deductions, the United States tax code is encouraging certain behavior by removing the tax penalty associated with that behavior. For example, the interest on a mortgage payment or the expenses of running a business are all tax deductible.

Maybe the government cares after all?

The law regarding tax deductions and expenses is as follows:

In the case of an individual, there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year

for the production or collection of income

for the management, conservation, or maintenance of property held for the production of income or

in connection with the determination, collection, or refund of any tax. 26 U.S. Code § 212

A divorce, in theory, involves the collection of income, the management and maintenance of property. So, are divorce expenses tax deductible?

The United States Supreme Court answered this question in 1963 by stating that the issue turns on whether litigation costs a business, rather than a personal or family, expenseUnited States v. Gilmore, 372 U.S. 53, 1963

The lawyers fees will not be deductible If the spouses claims stemmed entirely from the marital relationship, and not, under any tenable view of things, from income-producing activity United States v. Gilmore, 372 U.S. 53, 1963

Read Also: What’s The Income Tax Rate

Personal Legal Fees You Can’t Deduct

Examples of attorneys’ fees you may not deduct include fees for:

- filing and winning a personal injury lawsuit or wrongful death action

- estate tax planning or settling a will or probate matter between your family members

- help in closing the purchase of your home or resolving title issues or disputes

- obtaining custody of a child or child support

- legal defense in a civil lawsuit or criminal casefor example, attorneys’ fees you pay to defend a drunk driving charge or against a neighbor’s claim that your dog bit and injured her child

- lawsuits related to your work as an employeefor example, you can’t deduct attorneys’ fees you personally pay to defend a lawsuit filed against you on a work-related matter, such as an unlawful discrimination claim filed by a former employee that you fired

- tax advice during a divorce case, and

- attempting to get an ex-spouse to pay past-due alimony.

Fees For Obtaining Taxable Income

If you are the spouse trying to obtain taxable income, including spousal support like alimony or child support, the fees from those legal efforts may be individually deductible. This is a little more complicated now than it was before. The TCJA removed the requirement for spouses receiving alimony to report that money as income.

But this may still apply in your case or your state. To determine whether these fees are truly deductible, speak to a family law attorney or accountant and get their opinion on the matter.

You May Like: What Do I Need To Gather For My Taxes

Deducting Legal Fees For Rental Activity

Any legal fees acquired from rental property activity, if it qualifies as a business activity can be deducted.

This does not include money that is spent getting a rental property. But it will be deductible if it is money spent doing something like evicting a tenant.

Most rental legal fees will count as business expenses, but this does not include everything so make sure to check your specific situation.

So these are most of the most common situations when attorney fees are either deductible and those which are not.

Deductible Cost From General Business Cases

If an attorney is hired to help with a business matter this cost can be deducted as a cost for a business operating expense, there are some exceptions, but here are some examples of cases you can deduct the costs for:

- Money spent collecting fees owed by a customer.

- Fees spent on defense when an employee files a work-related claim.

- Attorney fees on negotiating contracts with clients or customers.

- Money spent defending trademark, patent, or copyright claims.

- Legal fees for providing tax advice for the business.

- Money that is spent with legal advice starting up a business.

Recommended Reading: What Happens If You Pay State Taxes Late

Many Business Legal Fees Are Deductible

The other side of the coin for taxpayers who are running or starting a business is that many business-related legal fees are deductible on Schedule C . If you are a businessperson, the legal fees you can deduct must be related to the profit or loss from a business, include those pertaining to:

- Collecting income from a customer

- Your business declaring bankruptcy

- Handling and caring for income-producing equipment

- Defending your business or trade

- Drafting or negotiating contracts between you and your customers

- Defending any patent, trademark, or copyright claims

Tax Deduction For Legal Fees: Is Legal Fees Tax Deductible For Business

Legal fees are tax-deductible if the fees are incurred for business matters. The deduction can be claimed on business returns or directly on the Schedule C of personal income tax returns.

The Internal Revenue Service allows individuals and businesses to claim as a business expense the money they pay for certain professional services, which includes legal expenses. However, to be eligible for deductions, the legal fees must be directly related to your business operations or be a part of acquisition costs which may include legal expenses to start or buy a business.

What this article covers:

Recommended Reading: Where Do I Put Business Expenses On Tax Return

What Tax Deductions Are Available For Me

The general rule for tax deduction is that any fee directly or indirectly related to income generation is eligible for a deduction. Therefore, businesses can deduct legal fees ordinary and necessary for the operation of the business. This can include justifiable business expenses such as the following:

- Attorney fees for a business-related lawsuit

- Any legal fees incurred for the necessary and standard operation of a business

- Attorney fees for an employment lawsuit involving a whistleblowing claim or unlawful discrimination lawsuit

- Legal expenses related to the hiring of an attorney to defend a business against criminal charges

- Legal expenses owed to a lawyer who helped an individual claim or obtain an IRS tax refund

- Legal expenses owed in connection to a lawsuit where an attorney to a business had to defend the business against a claim

- Legal expenses owed to a lawyer who helped facilitate the adoption of a child

- Visa application fees if an employer required an employer to enter another country as part of their employment duties

- Fees related to the drafting and reviewing of contracts

- Expenses related to business incorporation and planning

- Commercial properties or business real estate closings

- Legal expenses for a business to file for bankruptcy

- Expenses related to farm income and expenses

Its important to keep personal fees separate from business fees which can be deducted on a federal tax return.

Are Immigration Lawyer Fees Tax Deductible

If you have had to renew or acquire U.S. visas within the past year, you may be wondering if any of your legal and immigration fees can be written off as a deductible expense from your tax return. Learn more about what expenses can be deducted here.

If you need further help navigating the U.S.s complicated immigration system, contact one of our immigration experts today at . We are dedicated to finding the right lawyer for you!

Also Check: Will Capital Gains Tax Increase In 2021