Sales & Use Tax In California

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those salesspecifically exempted by law. The use tax generally applies to the storage, use, or other consumption in Californiaof goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchasesshipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate,and any district tax rate that may be in effect.

State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific statefund allocations, and to other local jurisdictions.

Understand How To Collect Sales Tax

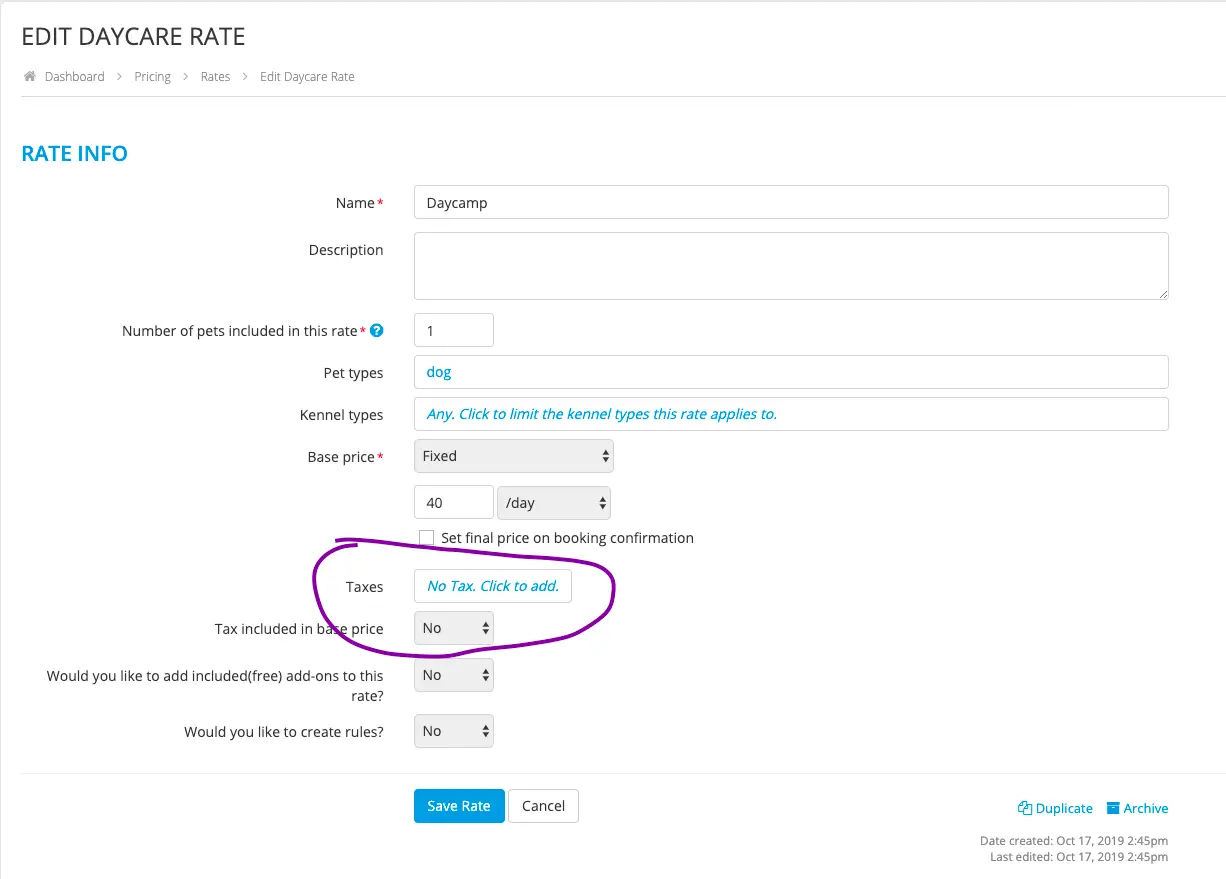

Thankfully, collecting sales tax is relatively simple if you run a digital-age business online.

Many of todays most popular online shopping cart options have built-in features that take care of this for you.

However, collecting tax via additional eCommerce platforms like Amazon, Magento, Shopify, and eBay, to name just a few examples is still relatively simple, especially if you leverage the right tools to help.

Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

Also Check: Are Home Improvements Tax Deductible

Check On Sales Tax Exemptions

In some instances, the products you are selling may be exempt from sales taxes. For example, in some states and localities food and prescription medications may be exempt from sales tax check with your state if you think your products might be exempt.

You may also want to look into getting a sales tax certificate if you buy products for resale. The process of getting this exemption certificate and the requirements are different for each state. It applies to products purchased for resale, raw materials, and some non-profits in some states

If someone wants to buy from you and says they are a “reseller” or that they are buying for “resale,” they need to show you a valid reseller’s permit. Make sure to keep a copy of this permit in case you are questioned by state sales tax agents.

Accounting For Sales Tax: What Is Sales Tax And How To Account For It

Sales tax is the tax that businesses impose on customers when they purchase goods and services. The sales tax is then remitted to the state or local government within a prescribed period. This is why its known as a pass-through tax.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Read Also: When Do Llc File Taxes

What States Dont Charge Sales Tax

Five states in the U.S. don’t charge sales tax at the state level. Instead, they charge sales taxes through different avenues.

- Delaware: Delaware doesn’t charge a state sales tax, but it does have a gross seller’s tax. This tax is paid by the seller, and it’s based on the amount of total sales of goods and services.

- Alaska: Alaska has no state sales tax, but its counties, or boroughs, can charge sales taxes. For example, the Yukon-Koyukuk Census Area charges a 4% sales tax.

- Montana: Montana doesn’t have a sales tax, but it enables popular tourist destinations to charge sales taxes at the municipal level.

- New Hampshire: There are no sales taxes anywhere in the state of New Hampshire. The state makes up for its lack of sales tax collection by having the highest property tax rates anywhere in the country.

- Oregon: Oregon also bars the collection of sales taxes at all levels but generates income through a very high personal income tax rate and a higher-than-average property tax rate.

Example Of How To Find Sales Tax

Lets say your business is located in Cleveland, Ohio. You dont have a secondary business location. You must collect sales tax at Cuyahoga Countys rate of 8.00% . Your customers bill before adding sales tax is $399.

Sales Tax = $399 X 0.08

Sales Tax = $31.92

Collect an additional $31.92 from the customer for sales tax. Then, remit the sales tax to the appropriate government. Contact the state for more information.

Need help tracking your businesss income? Patriots small business accounting software makes it easy to organize your money records. Plus, we offer free support if you have any questions. Get your free trial today!

This article is updated from its original publication date of July 12, 2018.

This is not intended as legal advice for more information, please

Also Check: How To Check Federal Tax Refund

Determine Which Customers You Should Charge

In an internet-reliant world where many businesses sell online to people who may live in other states, its important to know who should be charged.

Generally speaking, you must charge sales tax in any state where you have sales tax nexus.

To have sales tax nexus in a state is to have a significant business presence there. You will always have this in your own state.

However, you may also have sales tax nexus in other states if you have a location there, sell at a trade show there, or have personnel located there.

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Read Also: Are Charity Donations Tax Deductible

How To Calculate Sales Tax On Almost Anything You Buy

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- It’s not hard to calculate sales tax.

- However, it’s much more complicated to figure out the exact tax rate, since it varies by state and by purchase amount.

When you buy something in the US, you almost always pay more than the sticker price.

That’s because of sales tax, which can vary by state or city but is generally about 4% to 8% of the item’s retail price, imposed when you check out of brick and mortar stores, online retailers, and restaurants.

Sales tax in the US is determined at the state level. There are five states that do not impose a sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. The remaining 45 states and Washington DC all have a sales tax, which varies depending on the product and service for sale.

If you’re shopping in most US states and you want to know how much you’ll be paying in total before you check out, here are steps you can take to calculate the sales tax.

Bulk Assign Default Sales Tax Codes To Your Chart Of Accounts

That’s it! The new default code will show in the Sales TaxRate column.

Was this helpful?

Don’t Miss: Can You File Your Own Taxes

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

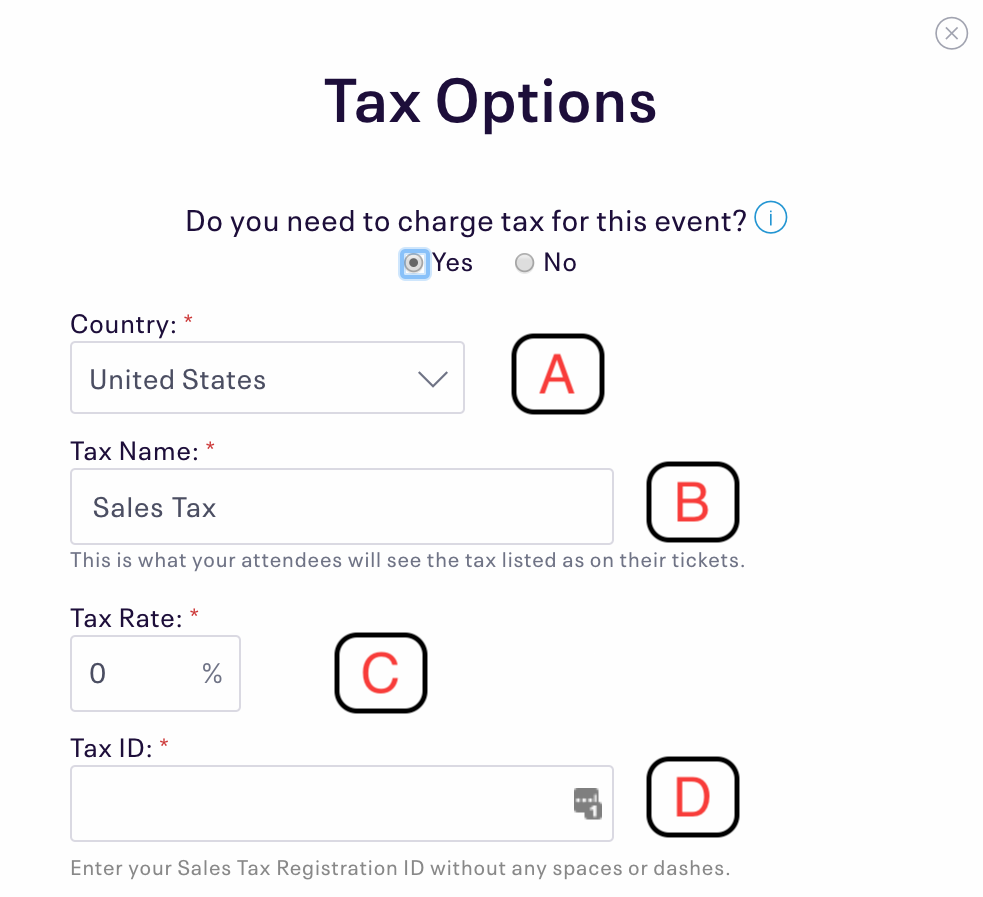

How To Add Sales Tax

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 14 people, some anonymous, worked to edit and improve it over time. This article has been viewed 107,638 times.Learn more…

When browsing in your favorite department store, the prices listed aren’t actually telling you the total cost. Most cities and states charge a sales tax, driving the price of a cool new jacket or a fabulous piece of jewelry past what is listed on the tag. Depending on where you are sales tax may differ, so it’s important to be able to quickly and easily figure out how much you’ll be charged at checkout. Follow one of these easy methods to figure out your final tab.

Don’t Miss: What Is The Sales Tax In Philadelphia

Do Businesses Need To Charge Sales Tax

Since sales tax is determined by state , whether or not you as a business owner need to be charging it depends mainly on where you live.

But its essential that all business owners know the law and follow it to the letter.

That said, every business owner should thoroughly research sales tax law where they live and learn how to calculate sales tax correctly.

Heres a look at how to determine which of your goods and services need to be taxed if you dont happen to live in one of the few states that dont charge sales tax at all.

Collecting Sales Tax Step

To help you sort this out, we’ve collected the steps you will need to go follow in order to collect, report, and pay sales taxes on the products or services you sell. Here are the main steps in the process of preparing to collect, report, and pay sales taxes:

Recommended Reading: What Does It Mean To Amend Your Taxes

Example Of A Sales Tax Calculation

Here’s a look at the sales tax formula in action with an item that costs $50 and a sales tax rate of 5%:

- $50 x .05 = $2.50 for a total of $52.50.

- The 5% got turned into the decimal number of .05 and was multiplied against $50, resulting in a sales tax amount of $2.50.

- Let’s look at how it works with a sales tax of 9.25%.

- $50 x .0925 = 4.63 for a total of $54.63.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Where To Do Taxes For Free

Additional Example Of The Sales Tax Calculation

Now let’s assume that total amount of a company’s receipts including a 7% sales tax is $32,100. The true sales will be S, and the sales tax will be 0.07S. Therefore, S + 0.07S = 1.07S = $32,100. The true sales, S, will be $30,000 . The sales tax on the true sales will be 0.07 X $30,000 = $2,100. Our proof is $30,000 of sales + $2,100 of sales tax = $32,100. In general journal form the accounting entry to record this information is: debit Cash $32,100 Sales $30,000 Sales Tax Payable $2,100.

What Is The Sales Tax Formula

The formula for sales tax is a simple algebra equation that involves converting a percentage to a decimal, then using the decimal as a multiplier on the cost of the item to get the final sales tax amount.

When written out, the equation looks like this:

- Sales tax rate = Sales tax percent / 100

- Sales tax = List price x Sales tax rate

In the event the tax rate is a percentage, you drop the percentage sign and divide the tax amount by 100 to get the decimal numbers for the tax rate. Or you can move the decimal point two places to the left, which puts a 0 in front of the sales tax percentage. A 10.00% sales tax becomes .010. Multiply the price of the item with the decimal tax number to get the tax amount. Add the sales tax number to the price of the goods for the final price.

Don’t Miss: What Medical Bills Are Tax Deductible

How Do Tax Sale Properties Work

A tax lien sale is a method many states use to force an owner to pay unpaid taxes. It gives homeowners a chance to pay those taxes along with high penalty fees. Twenty-nine states, plus Washington, DC, the Virgin Islands, and Puerto Rico allow tax lien sales.

Each state uses a slightly different process to perform tax lien sales. A typical process works like this:

- A property owner neglects to pay his or her taxes.

- A waiting period initiates. State laws vary on the waiting time before the tax collectors intervene it can range from a few months to a few years.

- The unpaid taxes are auctioned off at a tax lien sale.

- The highest bidder gets the lien against the property.

- The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes.

- The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

Pay Sales Taxes To Your State

Check with your state to see when you must pay the sales taxes you’ve collected. The frequency of payment depends on the volume of your sales. In most states, you must pay monthly if you have a high volume of sales, but at least quarterly in almost every state. Be sure you pay on time to avoid fines and penalties for late payment.

Also Check: Can You File Taxes After The Deadline

Find Out How Much Sales Tax Your State Charges

Because sales tax can vary by state and by item, it can be difficult to predict exactly how much you’ll pay, but not nearly as hard to get a general idea.

The Sales Tax Institute keeps an updated list of the range of sales taxes in every US state. While you can go down an online rabbit hole trying to figure out whether you’ll owe 3% or 3.5% sales tax, you might want to just use the high end of the tax range. No one is ever disappointed to pay less than they expected.

It can be much more complicated to calculate sales tax for national retailers that operate across multiple states. Amazon, for instance, clearly lists the factors that go into determining sales tax: It will be the “combined state and local rates of the address where your order is delivered to or fulfilled from.”

However, that statement is followed by a laundry list of exceptions and caveats, like whether the order is delivered to a residential or business address. Amazon does present an estimated tax amount right before you check out, and in that case, you might just want to wait for your estimated tax to be presented to you instead of trying to do the math yourself.