What Is Subject To State Tax

Sales and use taxes are collected on the retail sale or use of tangible personal property within the State of California.

Sales tax is imposed on items such as:

- Toys

- Furniture

- Giftware

Some services require sales tax to be collected as well, but it can get tricky. If the service is inseparable from the sale of a physical product, that service may be taxed as well. It includes services such as machine or equipment set-up, fabrication, or assembly.

Installation and repair, on the other hand, are not taxable but installation and set-up sound like the same type of services. Construction is another service where it can be debated whether sales tax applies.

If you think that is complicated, shipping and handling are worse. California has unusually complex rules surrounding shipping which can be tax-exempt, partially taxable, or fully taxable depending on the situation.

If you do not keep accurate records of your shipping costs, include delivery charges in the cost of the product, or deliver it using your own vehicle instead of a common carrier, the shipping charges may be fully taxable and you, as the seller, are stuck for it.

When it comes to drop shipping and tax nexus, more complications set in.

When Are Services Subject To California Sales Tax

California law restricts the application of sales or use tax to transfers or consumption of tangible personal property or physical property other than real estate. Unlike many other states, California does not tax services unless they are an integral part of a taxable transfer of property. The law does not specifically name most services as exempt, but such activities are automatically excluded from the tax base because they are outside the definition of tangible personal property.

Two types of service activities still may be swept into the tax base, however. The first is any service that is so tied to the sale of property that it is considered a part of that sale and, thus, inseparable from the measure of the tax. Example: a taxable sale of machinery that the seller must calibrate as a condition of the sale. The calibration fee will be taxable even if the seller separates the charge.

The second taxable service is fabrication. Fabrication is the labor involved in creating tangible personal property that is different in form or function from its component parts. This type of labor includes something as simple as drilling holes in a metal strap and bending the strap to make a bracket. The charge for drilling and bending would be taxable unless some other exemption applied.

Sales and use tax law is often assumed to be relatively simple and straightforward.

As you can see, that assumption may be hazardous to your financial health.

This Page Has Been Updated And Can Be Found In Our Ultimate Guide

Sales taxes are imposed on individuals and businesses which sell goods within the State of California. The amount is calculated by the CDTFA as the total receipt of sales minus any non-taxable sales.

An item is taxable if it is tangible personal property, which includes retail goods of all kinds. Although in general services are excluded, they may be subject to sales tax if they result in the production of a retail good.

A use tax differs in that it applies where a good is purchased from an out-of-state retailer who is selling the good within California but does not have sales nexus within California such that they are required to collect sales tax. The applicable tax rate is the same for both sales and use taxes.

As a business owner, you are responsible for paying the sales tax to be remitted to the CDTFA and you carry the liability for any unpaid amounts. However, you may pass the cost of that sales tax onto the consumer as long as the buyer is made aware that they are paying sales tax as part of the transaction.

Business owners must have a permit in order to collect sales tax and should register for the permit as soon as possible.

Recommended Reading: When Do I File Business Taxes

How Does Sales Tax Work

Sales taxes are generally charged at the point of sale where goods or services are sold to end users for final consumption.

For example, if a retailer sells clothes to its customers, it must charge sales taxes on the clothing items sold at the point of sale.

Sales taxes will not be charged to companies that are producing goods and services that are not destined for final use.

For instance, a furniture manufacturer selling furniture to distributors will not charge sales taxes as the distributors will have resale certificates stating that they are not the end users.

Ultimately, when the furniture is sold to an end customer, the retailer must charge that customer sales tax as its destined for final use.

Recommended article:

Whats The Difference Between Sales Tax And Use Tax

The main difference between sales tax and use tax is that sales tax is charged at the point of sale for in-state transactions, whereas use tax is a sales tax on purchases made outside of your state of residence.

For example, if you purchase goods in your home state, youll pay sales taxes to the retailer at the point of sale.

However, if you travel to another state and purchase something your home state would have charged sales taxes on, youll need to pay use taxes.

Recommended article:

So there you have it folks!

What is a sales tax?

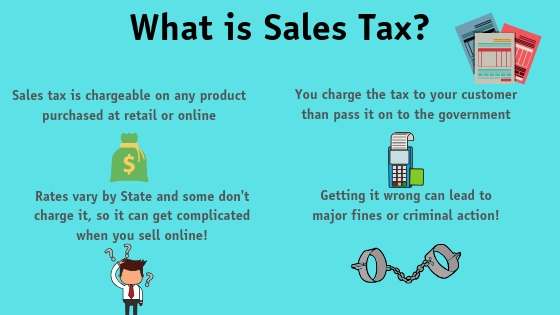

In a nutshell, sales tax is a type of tax that is imposed on most retail sales of tangible property and certain services at the point of sale.

Although some goods and services may be exempt from sales taxes, most companies will need to register for sales taxes and collect them from their customers.

The sales tax is typically charged as a percentage of the purchase price and must be remitted to the government after it is collected.

Companies and individuals doing business in a state with sufficient nexus will be obligated to register for sales taxes in such a state.

Now that you know what are sales taxes and how they work, good luck with your research!

You May Also Like Related to Sales Tax Meaning

Tax pyramiding

Don’t Miss: How Long Does It Take For Taxes To Come Back

Are Cleaning Services Taxable In Tennessee

Business Tax Registration Residential house cleaning services are not taxable in Tennessee. Cleaning businesses do not have to collect and send sales taxes to the Department of Revenue.

How do you calculate Tennessee sales tax?

Tennessee: Sales Tax Handbook Tennessee has a 7% statewide sales tax rate, but also has 307 local tax jurisdictions that collect an average local sales tax of 2.614% on top of the state tax.

Are computer software services taxable in Tennessee?

Under Tenn. Code Ann. Section 67-6- 102, packaged or customized software is considered tangible personal property which is subject to the sales and use tax.

Determine If You Need To Collect Sales Tax

Small businesses operating in Canada are required to collect sales tax. Itâs one of the responsibilities you have as a business owner. There are very few exemptions, but they do exist.

Small providers are exempt

To qualify, your businessâs worldwide yearly revenue needs to fall below $30,000. When it comes to sales tax, the CRA measures your âyearâ as the last four quarters. As soon as you surpass the $30,000 mark, youâre no longer a small supplier, starting in that calendar quarter.

Thereâs some print on who exactly qualifies as a small supplier, so weâd suggest reading what the CRA says about small suppliers.

Supplies taxable at 0% are exempt

Some goods are considered essentials, and thus arenât taxed. These include: basic grocery items like milk, bread, and vegetables agricultural products prescription drugs and drug-dispensing services and certain medical devices. Check the full list if you think your business might fall into this exemption category.

Some people groups are exempt

Some customers may be exempt from paying sales tax. In general, Indigenous Peoples, Governments, and Diplomats are not required to pay GST or HST.

Recommended Reading: How To Access Past Tax Returns

Examples Of Taxable Tangible Personal Property Services And Transactions That Are Subject To Sales Tax Are:

- tangible personal property:

What Services Are Subject To Sales Tax In Florida

SHOULD YOUR BUSINESS BE COLLECTING OR PAYING SALES AND USE TAXES ON SERVICES?

We get a lot of inquiries from new companies or companies migrating into Florida about WHAT SERVICES ARE SUBJECT TO FLORIDA SALES AND USE TAX? If this is your question, then you’ve come to the right place. In a nutshell, below is a list of services that are specifically subject to Florida’s sales tax use tax. However, even if your company does not fall into one of these categories, I suggest reading the whole article as the Florida Department of Revenue never makes things simple.

- Nonresidential Cleaning Services

- Commercial/Residential Burglary and Security Services

- Detective Services

If your company provides one of the above-listed taxable services, then the company MUST file a Form DR-1 to register with the Florida Department of Revenue to collect and remit sales tax. Invoices for specifically taxable services are required to have ‘FLORIDA SALES TAX’ as a separate line item on each customer invoice / receipt. The state of Florida imposes a tax rate of 6% plus any local discretionary sales tax rate . The company must collect and remit the tax on the schedule provided by the Florida Department of Revenue for your particular company .

Business must always be mindful of services that may not fall under the Florida sales and use tax realm, but are subject to Florida’s Communication Services Tax, such as:

- Telephone Services

- Cable Services

- Direct-to-home Satellite Services

Chapter 202, Florida Statutes

Recommended Reading: How Do I Fill Out My Tax Return

Two: What Kind Of Sales Tax Does Your State Have

Once youve determined that your state has sales tax, you need to figure out what type of sales tax your state has. In other words, you need to find out the general information about your states taxes. There are two different kinds of sales tax. There is product based sales tax, which taxes products and goods when you’re a consumer at the store buying products, and there’s service based sales tax, which taxes any services you hire out. If your state has service based sales tax AND you service tangible goods as part of your sales to customers , then youdefinitely have to include sales tax in your service contracts.

Destination Vs Origin Tax Rates And Nexus

Some states require you to collect sales tax for the state where the purchase originated while others require you to collect sales tax for the state where the merchandise was purchased .

Other states, including California, determine whether you have a nexus within the state requiring you to pay sales or use tax.

A nexus is a significant presence in the state. In California, this means every retailer engaged in business within the state for the purpose of commerce according to the clause of the U.S. Constitution has a nexus.

It also includes any retailer that federal law allows the state to impose a use tax collection duty.

You could have a nexus simply because you have a presence at a trade show or you have affiliate sales within the state. Selling through Amazon FBA may cause you to have a nexus the amount of tax depends on the location of the California warehouse where your products are stored.

Recommended Reading: Can I Pay My Irs Tax Bill In Installments

Is It A Product

As the distinction between products and services blurs, it’s more and more difficult to determine which is which for sales tax purposes. And states are all over the place, each enacting laws that seem logical but might be different from other states.

For example, if your CPA prepares your income tax return, is that a service or a product? What’s the true or basic purpose of the service? In another example, if you pay for a company to install a computer system in your office, with thousands of dollars of computers, connectors, routers, etc., that sounds like a product.

Just to show you an example of how complex this product/service issue is, consider the state of Connecticut. The state charges sales tax on computer and data processing services, differentiating between employees and independent contractors. In one example, the sale of prewritten software for website creation is taxable at 6% when “tangible personal property” is given to the purchaser, but is not taxable when delivered electronically.

Are Shipping & Handling Subject To Sales Tax In Texas

In the state of Texas, the laws regarding tax on shipping and handling costs are relatively simple. Essentially, if the item being shipped is taxable, and if you charge for the shipping as part of the order, then the shipping charge is considered to be taxable. If the item is not taxable, then the shipping is not seen as being taxable either.

Recommended Reading: How To File Stock Taxes

How To Stay Compliant With Sales Tax When You Sell Services

Its important for every business to perform a nexus study. A nexus study reviews all your business activities and sales in a state or multiple states and determines if these activities create sales tax nexus.

Youll want to perform a nexus study when you start selling in a new state, or when you start selling a new product or service.

For example, say you are a CPA in Arizona, where CPA services are not taxable. But you open up a second office in neighboring New Mexico. While Arizona doesnt require CPAs to charge sales tax on their services, New Mexico does. This means registering with the state and ensuring you collect and remit New Mexico gross receipts tax at state-specified intervals. If you fail to collect from your New Mexico customers, youre on the hook for paying New Mexico GRT out of your own profits.

Once youve conducted a nexus study, your next steps are:

- Ensure you are registered for a sales tax permit in every state in which you are required to collect sales tax.

- Ensure that you charge the right sales tax rates. Establish rate tables and do your product taxability research, understand jurisdictional boundaries and where those rates apply, and keep up with any changes.

- File your returns. In the states where youre registered, be sure to know your due dates, submit your returns and remit any payments necessary.

Canadian Provincial Sales Tax And Gst/hst

In the provinces of Ontario, Nova Scotia, New Brunswick, Prince Edward Island , Newfoundland and Labrador, you must charge HST because these provinces have combined the GST with their provincial sales tax to create a HST.

Other provinces, such as British Columbia,Saskatchewan, Quebec and Manitoba, have kept their provincial sales taxes separate from the federal GST tax system. Therefore, in those provinces, your business must charge, collect, and remit both GST and PST/RST/QSTand fill out two sets of forms.

Still other provinces and territories, such as Alberta, Northwest Territories, Nunavut, and Yukon, have no PST. Thus, in those provinces, your business only has to charge, collect, and remit GST.

| Province |

| 5% |

Recommended Reading: Do You Have To Pay Taxes On Stocks

Services Subject Only To New York City Sales Tax Are:

- beautician services, barbering, and hair restoring

- tanning

- electrolysis

- massage services

- services provided by weight control and health salons, gymnasiums, Turkish and sauna baths, and similar facilities, including any charge for the use of these facilities

- written or oral credit rating services S, New York City Local Sales Tax on Credit Rating Services) and

- oral credit reporting services not delivered by telephone.

Tangible Personal Property And Services

Whether sales of a particular good or service are taxable may depend on many factors. You should consult our publications and tax bulletins for more detailed explanations of what property and services are subject to sales tax. See the listing below for examples of taxable tangible personal property and services.The term tangible personal property means any kind of physical personal property that has a material existence and is perceptible to the human senses .

You May Like: How Much Is North Carolina Sales Tax

What Services Are Exempt From Sales Tax In Tennessee

Tangible personal property, taxable services, amusements, and digital products specifically intended for resale are not subject to tax. Retail sales to the federal government or its agencies and the State of Tennessee or a county or municipality within Tennessee are not subject to tax.

Are consulting services taxable in Tennessee?

Consulting and testing services in Tennessee are typically not taxable, while the sale or licensing of computer software and hardware and any related installation services are taxable.

Are landscaping services taxable in Tennessee?

Are landscape services taxable for Tennessee sales tax? Services such as grass cutting, trimming, bush trimming, leaf raking, and similar activities are all services performed on real property. Charges for such services are not subject to sales tax.