Virginia Housing Opportunity Credit

You may qualify to claim this credit if:

You may qualify to claim this credit if you own or are invested in a building used to provide low-income housing. A building qualifies if:

- It was put into service in Virginia on or after January 1, 2021, and

- It meets the definition of low-income building provided in §42 of the Internal Revenue Code.

What is it?

A tax credit equal to the amount of the federal low-income housing tax credit Virginia Housing allows for the project. You dont need to reduce the amount of credit used in the first year of the project. You cant claim a credit greater than your tax liability. Carry forward any unused credits for 5 years.

Claim the credit against the following taxes administered by Virginia Tax:

- Individual income tax

- Bank franchise tax

- Insurance premiums license tax

The credit may also be claimed against certain utilities taxes administered by the State Corporation Commission. Please visit the SCC website for more information.

Is there a cap?

Yes. Beginning 2022, Virginia Housing can issue no more than:

- $60 million in Housing Opportunity Credits per year, and

- $225 million in credits over the life of the Housing Opportunity Credits program.

To apply for this credit:

Virginia Housing administers this credit. Visit their website for more information.

Using this credit:

To claim the credit, complete the following and attach it to your return:

You should also attach a copy of the eligibility certificate issued to the project by Virginia Housing.

Differences Between The Aotc And Llc

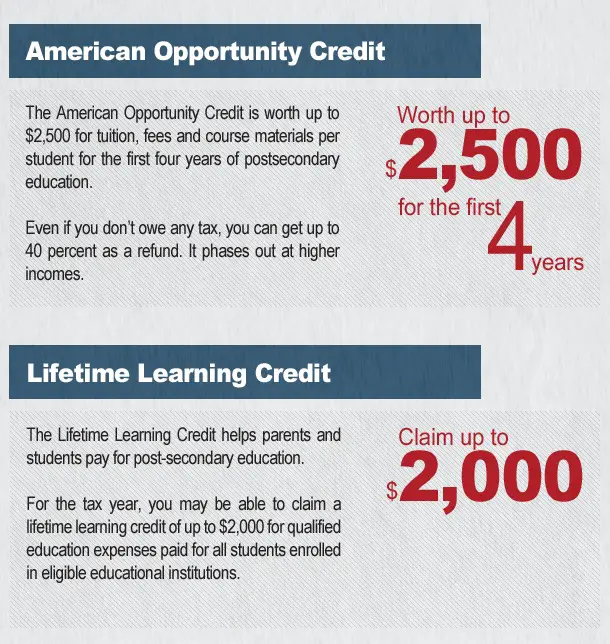

While you can draw a lot of similarities between the AOTC and LLC, there are several differences between the two that are important to note as they may impact your eligibility.

- With the AOTC, you can only claim up to $2,500 while, with the LLC, the most you can claim is $2,000.

- In order to qualify for the AOTC, you cant have a felony drug charge on your record however, this is not the same case for the LLC.

- To be eligible for the AOTC, students need to be enrolled at a minimum of half time during an eligible academic period. The LLC, on the other hand, only requires that youre enrolled in at least one course.

- You can only claim the AOTC for up to four years while the LLC has no cap on how long you can claim this education tax credit.

What Are The Major Differences Between The Aotc And The Lifetime Learning Credit

The AOTC has a maximum of $2,500, and the Lifetime Learning Credit maximum is $2,000. Both credits cannot be claimed in the same tax year for the same student.

The AOTC can only be used for undergraduate expenses, while the Lifetime Learning Credit is more flexible. The AOTC can only be claimed for four tax years the Lifetime Learning Credit can be claimed an unlimited number of times.

The AOTC requires the student to be enrolled at least half time for an academic period, while the Lifetime Learning Credit is available to students enrolled in at least one course for an academic period.

Students cannot have a felony drug conviction and claim the AOTC. This is not a requirement for the Lifetime Learning Credit.

You May Like: How Much Will I Make After Taxes California

Tuition And Fees Deduction

You can no longer get the tuition and fees deduction because the Consolidated Appropriations Act repealed it.

However, you can achieve tax-advantaged savings in other ways. Lets take a quick look at 529 plans and Coverdell education savings accounts .

529 Plans

529 plans are operated by individual states. You can choose to go the prepaid tuition route or the investment savings plan route.

- Prepaid tuition plan: Prepaid tuition plans allow you to pay ahead for tuition. You can buy four years of college now at todays prices instead of paying the costs of college 18 years from now. However, you can only choose from an in-state public institution, you only cover tuition and your state might shut down the program.

- Investment savings plan: An investment savings plan allows you to invest in stocks, bonds and mutual funds. Your child isnt restricted to attending a certain school like in a prepaid tuition plan. You can choose to invest more conservatively or aggressively, depending on the age of your child. However, its important to note that you can lose money through your investments.

Many states allow full or partial tax deductions in the form of income state tax deductions and state tax credits. Your investment grows on a tax-deferred basis and you can withdraw money tax free when its time for your child to head off to college. You cannot deduct contributions from your federal income taxes.

Retirement Contribution Limits Increased

For 2022, the individual 401 contribution limit increased to $20,500, a $1,000 increase from 2021. If you’re over 50, you can contribute an additional $6,500. The total contribution limit, which includes your employer’s contributions, is $61,000 for 2022 . IRA contributions remained unchanged at $6,000 for the year, with a $1,000 additional catch-up contribution for those 50 or older.

Contributions to SIMPLE IRAs were also increased in 2022, rising from $13,500 to $14,000. Those over 50 can contribute an additional $3,000.

With the end of the year fast approaching, maximize your retirement contributions before the end of December. However, if you have an IRA, you can continue contributing for tax year 2022 until April 18, 2023, next year’s tax filing deadline.

More Americans may qualify for the Saver’s credit this year, since the IRS increased the income thresholds for 2022. It’s worth up to $1,000 for single filers , as long as you contribute to a retirement account and meet AGI requirements. For this tax year, your AGI must not be over $34,000 for single filers and those married filing separately, $68,000 for married, joint filers and $51,000 for head-of-household filers.

You May Like: When Us The Last Day To File Taxes

Criticisms Of Education Tax Credits

Critics of subsidies for higher education have long argued that education tax credits are one reason that the cost of higher education has been rising many times faster than inflation. According to these critics, education tax credits simply raise the overall cost of college without an actual increase in access to it. Tax credits make more money available for spending on education, but they do nothing to increase the supply or quality of schooling.

How Has The Coronavirus Pandemic Affected 2021 Taxes

The student loan interest deduction wont be an option for most federal student loan borrowers this year, since both payments and interest accrual remained paused through May 1, 2022.

As you get ready to file your tax return, consider working with a tax professional to help you navigate your 2021 tax situation.

Don’t Miss: Are You Taxed On Cryptocurrency Gains

What To Do To Avoid A Gift Card Scam

If someone asks you to pay them with gift cards, hang up on the caller or dont answer their email.

You can report it to your local police department, state attorney general, or online to the FTC. Even if you didnt pay, your report helps law enforcement stop scams.

If you suspect that you gave gift card information to a scammer, keep the card and your receipt and report it to the card issuer immediately. If money is still on the card, the company may be able to refund your money.

Apple, for example, recommends calling Apple Support right away and saying gift card to connect with a live representative if you think youve given an iTunes or other Apple gift card to a scammer. Apple can put a freeze on the card, and you might be able to get your money back.

Apple gift cards can only be used to buy Apple products and services. If youre approached to use the cards for any other payment, Apple says youre likely the target of a scam and should report it to your local police department and the FTC.

What Is An Education Tax Credit

Education tax credits are available for taxpayers who pay qualified higher education expenses for an eligible student to an eligible educational institution, such as a college or university. The two types of education tax credits are the American Opportunity Tax Credit and the Lifetime Learning Credit .

Don’t Miss: How To Find Out Why I Owe Taxes

How Will This Affect Me

You can only claim one education credit for any student and their expense. If you or your dependent qualifies for both credits, you may want to figure which deduction would give you the best benefit.

If you receive tax-free educational assistance, such as a grant, you need to subtract that amount from your qualified education expenses.

The PATH Act prevents you from filing past due returns or amended returns claiming the American Opportunity Tax Credit if the reason youre filing is because you now have the type of valid Taxpayer Identification Number required for each credit but such TIN wasnt issued on or before the due date of the return .

If for any reason you or one of your family members didnt receive a valid taxpayer identification number on or before the due date of the tax return you cant file a past due return or an amended return to claim any of these credits. A valid taxpayer identification number could be a SSN, ITIN, or ATIN depending on the requirement for each credit.

For tax years beginning after June 29, 2015, generally 2016 tax year returns, you must have received an IRS Form 1098-T from an eligible educational institution to claim the American Opportunity Tax Credit or Lifetime Learning Credit.

Claiming The American Opportunity Tax Credit

Taxpayers can claim the AOTC by completing Parts I, III, and IV of the 8863 form, , instructions are available at and submitting it the completed 1040 form.

See below, Additional Resources, for free tax preparation information.

Recommended Reading: How To Avoid Capital Gains Tax On Property

Minnesota State Tax Benefits

- Student Loan Interest Deduction: A $500 to $1,000 tax credit toward student loan principal or interest payments beginning in 2017. See the Minnesota Department of Revenue for more information.

What Are College Tax Credits

Tax credits are some of the best tax breaks for college students. These credits apply directly toward the amount of tax you owe rather than just reducing the amount of income subject to tax.

The two major education tax credits offered by the federal government are the American opportunity tax credit and the lifetime learning credit. Taxpayers may claim only one of these college student tax credits.

To claim either credit, you must use Form 8863. You’ll also need Form 1098-T, which should be mailed to the student from the school and shows how much you paid in tuition and qualified expenses that year.

You May Like: What’s The Last Day To File Taxes 2021

What Should I Do

Compare the educational credits to see which fits your situation best

Each credit has different requirements and benefits. You can compare education credits on the IRSs comparison chart.

Determine your eligibility

You may be eligible to claim an education credit if:

- You, your spouse, or a dependent on your tax return is the student.

- You, your dependent, or a third party is paying qualified education expenses for higher education.

- Qualified education expenses are tuition, fees, and other related expenses required for enrollment or attendance at an eligible educational institution. Nonacademic fees are qualified only if the fee must be paid to the institution as a condition of enrollment or attendance. Personal expenses are never qualified education expenses.

Youre NOT eligible if:

Learn More About Tax Breaks For College Students

For a complete rundown on all education tax benefits, visit the IRS Tax Benefits for Education Information Center. You can also check with your state to see what benefits it offers. For example, New York offers a credit/deduction on qualifying college tuition.

As U.S. tax laws, rules, and regulations are constantly changing, it’s important you consult with a tax professional such as an accountant, tax attorney, certified tax preparer, or IRS enrolled agent.

DISCLAIMER: The information provided on this website does not, and is not intended to, constitute professional financial advice instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact a professional advisor before making decisions about financial issues.

You May Like: How Do I Request An Extension On My Taxes

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Q20 In 2020 My School Went Out Of Business And Closed I Did Not Get A Form 1098

A20. Yes. You can still claim an education credit if your school that closed did not provide you a Form 1098-T if:

- The student and/or the person able to claim the student as a dependent meets all other eligibility requirements to claim the credit

- The student can show he or she was enrolled at an eligible educational institution

- You can substantiate the payment of qualified tuition and related expenses.

Be sure to keep records that show the student was enrolled and the amount of paid qualified tuition and related expenses. You may need to send copies if the IRS contacts you regarding your claim of the credit.

Recommended Reading: What Is The Income Tax Rate In Texas

How Do I Claim Either Credit On My Tax Return

Every year that you pay college tuition you should receive Form 1098-T from the college, showing the tuition expenses you’ve paid for the year. Then, at tax time, you must file Form 8863 to take either credit. If you are married, you must file a joint return to take either credit. For more information, see IRS Publication 970 or consult a tax professional.

Information provided has been prepared from sources and data we believe to be accurate, but we make no representation as to its accuracy or completeness. Data and information is provided for informational purposes only, and is not intended for solicitation or trading purposes. Please consult your tax and legal advisors regarding your individual situation. Neither Equitable nor any of the data provided by Equitable or its content providers, such as Broadridge Investor Communication Solutions, Inc., shall be liable for any errors or delays in the content, or for the actions taken in reliance therein. By accessing the Equitable website, a user agrees to abide by the terms and conditions of the site including not redistributing the information found therein.

Education Tax Credit Choices:

American Opportunity Tax Credit:is a credit for qualified education expenses paid for an eligible student for the first four years of higher education.You can get a maximum annual credit of $2,500 per eligible student. The AOTC modifies the previous Hope Credit .

Lifetime Learning Credit: is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. This credit can help pay for undergraduate, graduate and professional degree courses–including courses to acquire or improve job skills. There is no limit on the number of years you can claim the credit. It is worth up to $2,000 per tax return.

Recommended Reading: How To Reduce Taxes On Stock Gains

Advance Child Tax Credit

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Learn more about the Advance Child Tax Credit.

Access The Irs Child Tax Credit Update Portal

The IRS Child Tax Credit Update Portal is an information portal where you can view information about your family’s child tax credit status, including:

- Your eligibility

- Your mailing address

And so forth.

You can also use it to update the IRS about changes that may affect your family’s eligibility and / or filing status.

Read Also: How Much Federal Income Tax Should Be Withheld