When Should I Hire Someone To Help With My Stores Sales Tax

Shopify is one of the largest e-commerce platforms, which continues to grow year over year. And, if you have a Shopify store, you are already using one of the largest e-commerce platforms. And during your companys growth, youll encounter increasingly complex issues.

So, it is important to hand over control of your online business to bookkeeping professionals who understand Shopify when you reach this stage so that they can assist you in growing your business while you focus only on your own growth. Also, dont spend hours learning a new skill if you dont know much about taxation. Instead, concentrate on the parts of your business that need your help. And let an expert handle taxation tasks.

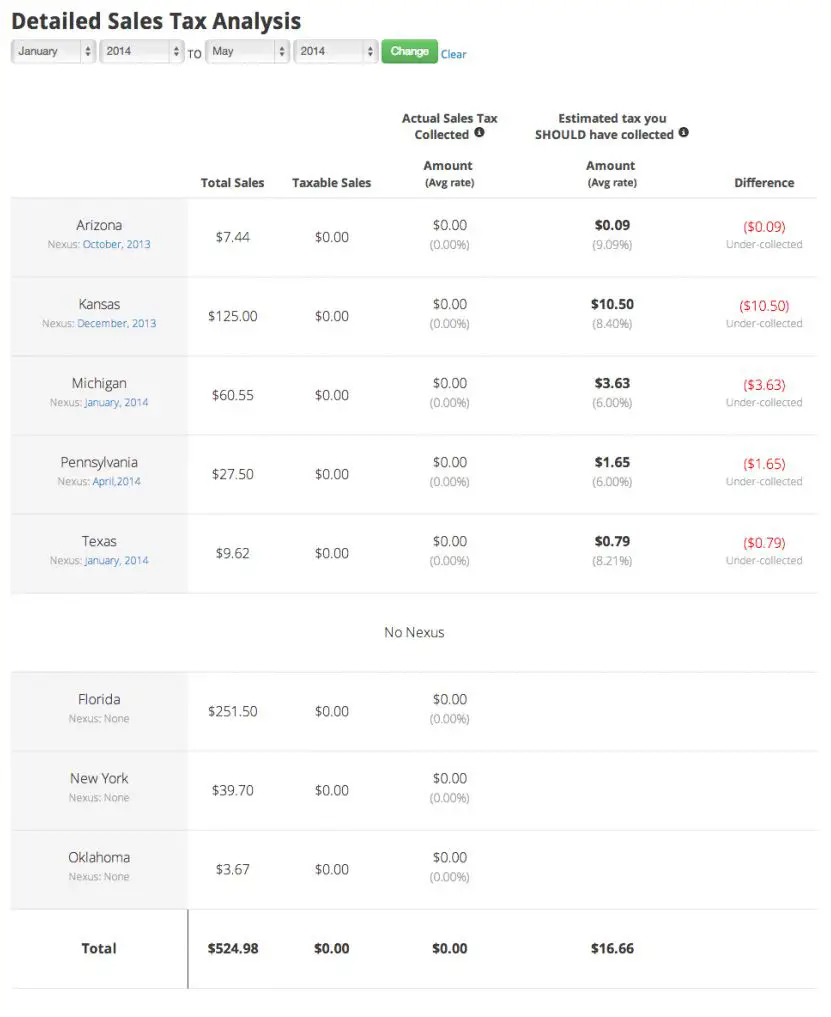

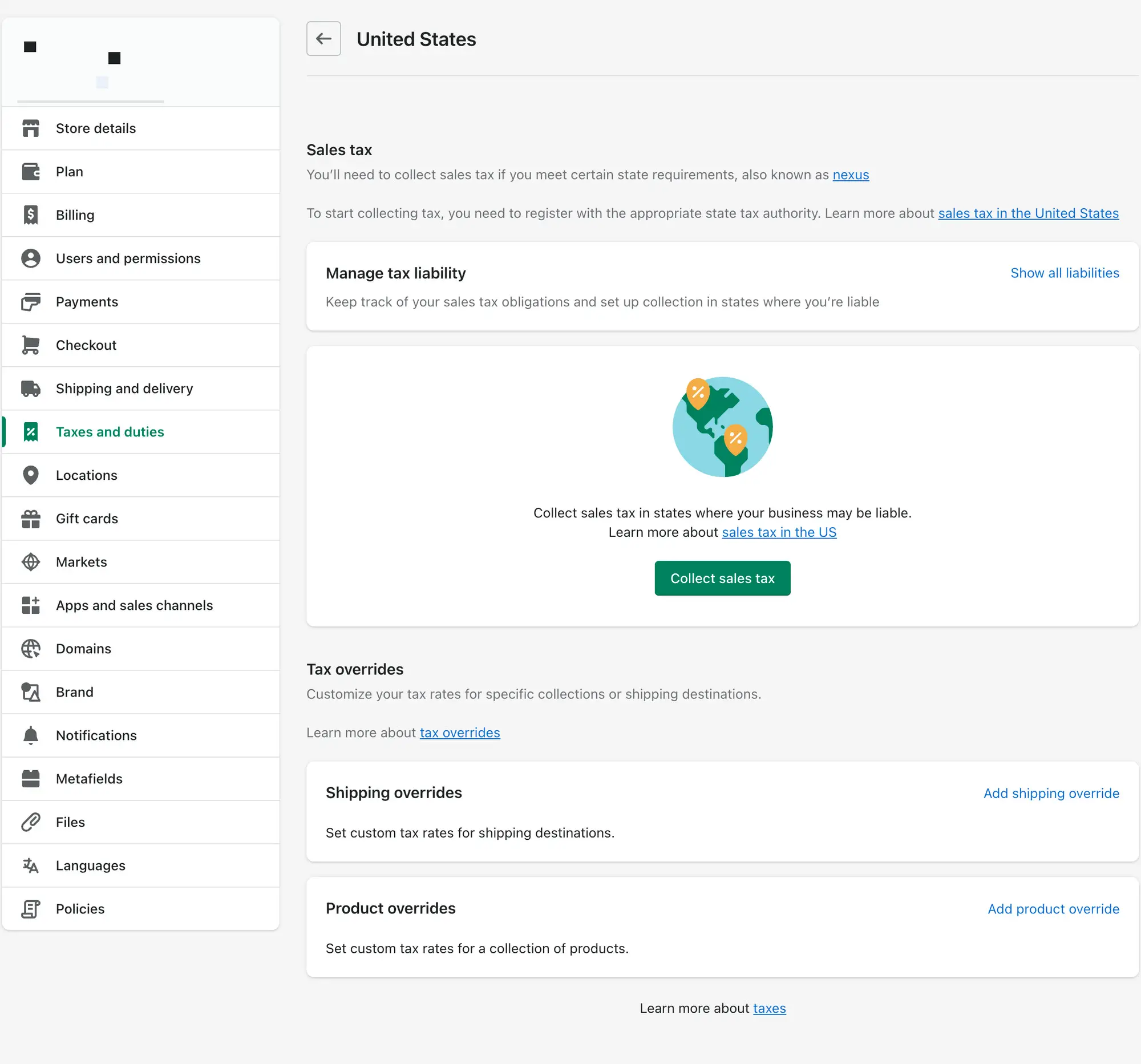

Shopifys Sales Tax Liability Dashboard

Shopifys tax liability dashboard will help you determine if you should register for sales tax.

How to Find Shopifys Liability Dashboard:

After signing in to your Shopify admin page, click on settings and click taxes. Next to the U.S., click manage.

You will see a section at the top of the screen that says manage sales tax liability. To the right of that, click show all liabilities.

You are on the sales tax liability dashboard and can click show details to see Shopifys calculations in relation to the thresholds.

Key Points about Shopifys Data:

- Shopify does not count those sales towards your economic nexus thresholds if you sell on other marketplaces. Some states count marketplace sales towards your thresholds even if the marketplace collects and remits sales tax.

- Do you sell products exempt from sales tax, such as supplements or clothing? If so, exempt sales should not be counted toward your economic thresholds.

- If you have a physical presence in a state with a warehouse that ships your products, that creates nexus even if you have not crossed economic thresholds yet.

- Most states will calculate sales from the previous or current calendar year. Some states are only from the previous calendar year or prior 12 months. Sales are not cumulative from year to year.

Goods And Services Tax

A Goods and Services tax is also levied at every step of the supply chain. But unlike VAT, GST is charged regardless of what value is added itâs usually just a flat-rate percentage of the transaction.

Typically GST works like so: the businesses are charged at each stage of the manufacturing process, and the end customer is charged at the point of sale. The GST is then refunded to everyone through tax credits, except the end consumer.

Also Check: What Happens If You Forget To File Your Taxes

How Does Sales Tax Apply To Amazon Vendors

In addition to reporting earnings to the IRS at the end of the year, most retailers, including Amazon sellers, must collect and submit sales taxes. Fulfillment by Amazon sales taxes varies depending on the transaction and where it occurred. The sales tax rate is determined by the state and city where the customer resides, as well as the location of the item being shipped from, and can range from 0% to 13%.

Calculate Your Nexus States

You must register, collect, and remit Shopify sales tax in any state where you have a physical presence .

After that, when your revenue in a given state reaches $100K or $200K transactions, you should search for that states economic nexus legislation .

Shopify sellers give up the physical connection in order to gain an economic connection. Nexus criteria have changed to account for the kinds of activities involved with eCommerce.

To discover your nexus states, make a list of any jurisdictions where you have one or more of the following:

- If you have a physical storefront or company address, fill it in.

Youre all set to review each state for its requirements once youve compiled a list of them.

If you have nexus in those states and fulfill these requirements, youll have to collect and pay sales tax.

The great news is some jurisdictions do not charge your purchasers any sales tax, or if they do it is only minimal and targeted to specific locations.

Because of their initials, these states are known as the N.O.M.A.D states, which include New Hampshire, Oregon, Montana, Alaska, and Delaware.

Regardless of whether youre based in the United States or not, Physical nexus exists if you sell items to customers in other states.

There are several variables influence the Shopify sales tax that you should charge:

- The destination from which your goods are sent

- The address to which your product is delivered

- Where youll be able to pay your taxes.

- Taxability of goods

Also Check: How To Find Tax Id Number Online

Set Up Automatic Tax Rates For Economic Nexus

Shopify isnt yet fully optimized for automatically calculating economic nexus tax rates. However, there is an approved workaround that you can follow.

If a flat-rate tax rate applies, you can add a physical presence of any ZIP code for that state and then add a tax override for the appropriate products.

If a destination-rate tax rate applies, you can add a physical presence of any ZIP code for that state only. You do not need to add an override.

Shopify Sales Tax Setup

Online sales tax is a complete mess, and its the last thing a Shopify seller wants to worry about. In this blog we will help you understand the basics of your sales tax obligations. In addition, we will take you through the steps for Shopify sales tax setup.

Remember, you only want to setup Shopify to collect sales tax in states that you already have registered for a sales tax permit in. It is illegal to collect tax in a state you dont have a permit in, so dont just go set up all states to collect right from the start. Also, dont register for a sales tax permit in a state you dont already have nexus in. For more information on both of these things, check out these videos: What Online Sellers NEED to Know about Sales Tax Nexus and How to Register for Sales Tax.

Recommended Reading: Where Can I Cash My State Tax Refund Check

Register With Your Tax Agencies

If you need to charge sales tax in one or more US jurisdictions, then you need to contact each of the relevant agencies and register with them. The process varies depending on where your business is based and where you sell, and on the individual government requirements.

For links to various US tax agencies, refer to State tax reference.

Add Your Warehouse Locations

Youre now ready to add your warehouse locations that are processing orders:

This procedure allows Shopify to determine the correct rates.

Sales tax may be different if a product is moved from a warehouse to a customer in the same state as the warehouse than it would be if it were taken to another state.

You may also like:

Recommended Reading: What Happens If I File My California Taxes Late

Use Reconcilely For Easy Shopify Automation

Considering all the tax requirements that you have to stay on top of, it might be a good idea to invest in an online tool that can help you to stay tax compliant. A lot of companies start off doing all of their taxes manually. When using Shopify, this means manually calculating how much sales tax is due on each online purchase.

The problem with this method is that itâs hard to do once you have a significant number of orders to keep track of every month. In order to scale your Shopify business successfully, it would be wise to invest in online software or tools that can automate your tax tasks for you.

Of course, you could also hire someone to take care of your tax needs, but as your business grows, this could become rather costly. If you are starting out, you may not have the means to do this right off the bat, which means you need an alternative solution that will fit your budget.

As previously mentioned, Shopify does not keep track of your sales tax for you. Instead, it pays out a lump sum to merchants each month, which includes sales, tax, return fees, and your monthâs profit. This can make it difficult to differentiate between refunds, transaction fees, and your sales tax.

In order to track where your money is coming from and where it is going, you need a tool that will be able to reconcile all of your Shopify orders with accounting software. Reconcilely does just that.

Add Tax Exempt Buyer Information

Eventually, you may only be required to collect sales tax for a subset of your clients, .

For example, non-profits are tax-exempt organizations. These are most likely repeat purchases, and you dont need to charge sales tax on them.

To deal with these customers, youll need a tax-exemption certificate from them before not charging sales tax.

To identify these clients as tax-free in your Shopify store, go to Customers and select Tax Settings:

Delete the Collect tax checkbox and enter a reason:

You may also like:

Recommended Reading: How To File Previous Years Taxes For Free

Understanding Tax Settings In Shopify For Uk Businesses

We’re aware that tax isn’t the most exciting of topics but certainly one that causes much confusion, especially now we have exited the EU.

We must stress that it is your responsibility to consult with an accountant and/or tax professional to verify that your business is charging the correct rates and to ensure that you file and remit your taxes correctly.

However, as your Shopify partner we want to help you alas this brief overview.

How Do I Automate Sales Tax On Shopify

Sales tax can be a complicated and time-consuming process, but it doesnt have to be. You can use Shopifys built-in sales tax settings to automate sales tax on your store.

To get started, go to your Shopify admin and click Settings > Taxes. From here, you can add and edit your sales tax settings.

If youre just starting out, the best way to automate sales tax is to use Shopifys Automatic Collection feature. This will automatically calculate and collect sales tax for you based on your stores location and the customers shipping address.

PRO TIP:

To enable Automatic Collection, simply check the box next to Enable Automatic Collection. Once youve done this, Shopify will automatically calculate and collect sales tax for all orders placed on your store.

If you need more control over your sales tax settings, you can also use Shopifys manual collection feature. With this method, youll need to manually calculate and collect sales tax for each order.

To enable manual collection, uncheck the box next to Enable Automatic Collection. Once youve done this, youll need to enter the relevant sales tax information for each order during checkout.

Whether you use automatic or manual collection, Shopify makes it easy to automate sales tax on your store. With just a few clicks, you can get started and start collecting sales tax without any hassle.

You May Like: How Much Do Taxes Cost At H& r Block

Determine Your Tax Liability

Before you set up your US taxes, you need to determine your tax liability, which means whether you’re required to collect tax from your customers and remit tax to a state tax authority.

If you’re a US-based merchant, then you potentially have tax liability in your own state because of physical nexus. If you frequently sell products to customers in a specific state, then you potentially have tax liability there because of economic nexus, whether or not you’re based in the United States.

In the United States, the sales tax that you should charge is affected by several factors:

- The location that your product is shipped from

- The location that your product is shipped to

- Where you’re registered to collect tax

- Item taxability

- Buyer exemptions

When To Collect Sales Tax On Shopify

While an LLC is not required to sell on Shopify, collecting sales tax is required . Still, its important to understand that youre not always required to collect sales tax on your Shopify store.

Before you can start collecting sales tax on Shopify, youll need a sales tax permit. This permit is granted to you only if you have economic nexus in a state. In simple terms, economic nexus means youre making so much money in a state that it requires you to start paying sales tax.

So, when do you have an economic nexus in a state? Well, it depends on the state. Different states have different thresholds for economic nexus. For example, state A might have a threshold of $400,000 in revenue or 200 transactions, while state B might cap it at $200,000 in revenue or one hundred transactions. Youll have to stay updated about the nexuses in states where you operate, as they tend to change.

Once you reach the economic nexus threshold for a state, youre required to start collecting sales tax from your customers in that state and remit it to the relevant state tax authority. So, how can you find out whether you have an economic nexus in a state? Well, thats where Shopify sales tax reporting comes in.

Recommended Reading: How Many Years Of Taxes Should You Keep

Shopify Sales Tax: The Complete Guide

Selling products and services on Shopify is convenient, not only for the consumer but also for the merchant. However, e-commerce sales also come with their fair share of administrative duties. One of these duties includes staying on top of your sales tax obligations.

In this article, we will dive into all the Shopify sales tax requirements that you as a business owner will have to understand and oversee.

Figuring out how much Shopify sales tax you owe at the end of your financial year may seem like an intricate or even laborious task. However, once you have the basics down, youâll be able to expedite the entire process.

Letâs dive right in!

How Is Nexus Determined

Nexus is determined by the amount of revenue from sales to customers in Colorado and using sales from the previous and current calendar years. You have a nexus if you have met the following condition:

- Your revenue from sales to customers was $100,000 or greater in the previous or current calendar year.

If youre in doubt about whether youll have to remit taxes in Colorado, contact US State authorities or Local Tax professionals.

Don’t Miss: What Documents Do I Need For My Taxes

Include Taxes In Product Prices

In some countries, such as the United Kingdom, you need to include sales tax in the displayed prices for most types of merchandise.

Note

As of October 22, 2020, new stores that are based in Japan are set to include tax in product prices by default.

If you enable this feature, then the tax is calculated by using the formula Tax = / . You and your customers will still see the tax as a line item, even though no taxes appear to be added. The subtotal and total will be the same, but the amount of tax you need to remit for an order will also be indicated.

Steps:

After you have set up your prices to include taxes, leave Charge tax on this product checked on your product pages so that the taxes are included in the displayed price. Customers will see the included amount of tax beside the total at the checkout.

Setting up your prices to include taxes does not affect your tax reporting.

Note

If you set a customer to be tax exempt, but you use tax-included pricing, then the customer will still be charged the full listed product price.

How To Fill Taxes For Your Shopify Store

- How to Fill Taxes For Your Shopify Store

In most cases, merchants need to charge taxes for sales. Those taxes must then be reported to the appropriate government agency. While tax laws and regulations vary based on factors like location and what youre selling, Shopify makes it easy for you to manage your taxes.

With that said, its worth noting that Shopify does not file or remit taxes for you. However, the tools on Shopifys platform will make it easier for you when its time to file your taxes.

Read Also: When Does My Tax Return Come

Sales Tax Laws By State

Weve included which states have marketplace facilitator laws just in case you want to sell outside of California, as well as Shopify.

Another juicy nugget to consider is that states do not all have the same rate. That would be too simple!

States have their own tax rates, which you must calculate in conjunction with the states overall rate.

You may just average the numbers and pay a minimal amount of money at the end of the year to make things easier.

The table corresponds to everything weve said here:

You may also like:

Have You Received A Nexus Alert From Shopify

To make sure youre compliant in new states and jurisdictions, there are a few steps to follow.

Shopify can help you determine economic nexus, which is established when you reach sales or transaction thresholds in other states. Its also possible to establish nexus if your employees attend trade shows, if you have employees in other locations, or if you store goods off-site. Our nexus assessment can help you gain a more complete picture of where you owe.

If you owe back taxes, consider submitting a voluntary disclosure agreement . Proactively working with states to settle your tax bill can help you reduce or even eliminate late penalties as well as limit the time frame the authorities look back on.

Its important to register to collect sales tax in every jurisdiction where youve crossed a nexus threshold. States have different rules and processes for registering, and Avalara can help if you have to register with multiple states.

Once youre registered, youll have to file and remit returns based on each jurisdictions schedule. Avalara can help you offload a lot of the process by creating signature-ready returns or even filing on your behalf.

AvaTax supports growth for your business, with calculations for 13,000+ U.S. sales and use tax jurisdictions.

Get started easily

We built AvaTax so you can activate it from your Shopify Plus store in just a few quick and painless steps.

You May Like: How Much Is The Federal Tax Credit For Solar Panels