Filing Paper Returns Or Payments By Mail

If you do not prefer to e-file, you have the option to file your return using a paper form and related schedules. Most forms are available as fillable PDFs, allowing you to type in the information. Typed characters make processing go more smoothly because the forms can be read more accurately by the Departments scanners.

When you are ready to print the form, be sure to follow the printing instructions carefully to ensure our scanners can read and process your form. Printing the form in a different format slows processing.

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking® included

- 15 business day delivery

- Extra services available

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Also Check: How Old Do You Have To Be To File Taxes

Also Check: How To File State Taxes Online

Hospitality Worker: No Way Can I Afford A House

Pouring pints on an early shift at Hotel CBD on Liverpool Street in central Sydney, hospitality worker Abby Waterman, 20, wondered how her customers can afford to go out.

‘Things are getting more expensive but people still keep coming. Some of these beers cost $16 a pint,’ she said.

‘I’m more aware of how much I’m spending going out now, going out to dinner tonight I know is going to cost $200 for two people.

‘Buying groceries can easily add up to $50 or $100.’

Pouring pints on an early shift at Hotel CBD on Liverpool Street in central Sydney, young hospitality worker Abby Waterman, 20, wondered how her customers can afford to go out

Ms Waterman was relieved she and thousands of other staff at Merivale, Australia’s biggest pub group, would soon get a wage increase.

But with inflation at 6.8 per cent, that salary bump won’t go far to mitigate the rising cost of fuel, groceries, and nearly everything else.

Housing is far worse after Australia’s property boom, pricing out Ms Waterman’s entire generation just as rent also goes through the roof.

‘No way will I be able to afford a house in Sydney any time soon. I moved here from Adelaide and I would be able to buy one if I went back there, but I like the lifestyle here,’ she said.

She pays $375 a week for a studio in North Sydney, and expects that to go up substantially once the lease is up.

‘It was very hard to find somewhere to live coming out of lockdown last year,’ she said.

Deadlines For Mailing Your Tax Returns In 2022

The deadline for 2021 individual tax returns is April 18, 2022 for all states except Maine and Massachusetts. This deadline is specific to this year because April 15, the usual deadline, is a holiday in the District of Columbia. Taxpayers in Maine or Massachusetts have until April 19, 2022, to file their returns because of the Patriots’ Day holiday in those states. April 18, 2022 is also the deadline for making first-quarter 2022 estimated tax payments to the IRS.

If you request an extension on your 2021 tax return, the deadline to file is October 17, 2022.

If you were affected by a federally declared disaster during the tax year, you may be able to delay filing your tax return or making tax payments. The IRS has a list of for 2021.

Read Also: When Do I Pay Taxes On Stocks

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

You May Like: How Long Does Your Tax Return Take

Young Mum: Childcare Costs ‘so Ridiculous’

Young mother Tahnee-Lee Goldman, 30, is desperate to return to work but can’t afford the massive cost of childcare that would wipe out her salary.

‘The price of childcare is so ridiculous that it is stopping me from going back to work. I’m stuck at home until he goes back to school,’ she said.

‘A lot of my friends are in this situation and it really hampers your independence.’

The Budget will include $10.8 million for an yearlong inquiry into the ballooning cost of childcare preventing many new mothers from going back to work.

Young mother Tahnee-Lee Goldman is desperate to return to work two years after her son Leo was born but can’t afford the massive cost of childcare that would wipe out her salary

Ms Goldman welcomed the inquiry as long overdue, but said its effects would come too late to help her situation.

‘I think having more women in government is going to help and this inquiry can only be for the better if they do something about it, but I don’t think it will happen fast enough to get me back to work,’ she said.

‘The privatisation of childcare has made it really hard and just made a few people rich.

‘I used to work in real estate and I missing it, I’m definitely ready to go back, I’m a bit stir crazy at home after two years and tired of hearing Bluey.’

‘The price of childcare is so ridiculous that it is stopping me from going back to work. I’m stuck at home until he goes back to school,’ she said

Read Also: Are Taxes Extended This Year

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

Is It Better To Pay The Irs Online

Most people find that its better to pay the IRS online even if youre sending them documents you cant file online.

When you pay online, you get instant payment confirmation and dont have to worry about your payment getting lost in the mail. You can pay with your bank account for free. Debit and credit card fees are often similar to what youd pay for certified mail, and you dont have to leave your house.

You May Like: What Is Federal Tax Due

Grocery Shopper: Household Budget Strain

Global supply chain problems and the skyrocketing cost of petrol have forced the prices of groceries up five to seven per cent over the past six months.

Suburban dad Paul Nickodem, 57, said he was feeling the pinch as he paid for bags of groceries at Woolworths Marrickville, in Sydney’s inner-west.

‘With two kids who eat us out of house and home and we used to spend about $200 a week but now it’s more like $250 or even $300,’ he said.

‘It’s a huge impact on our household budget. We’re lucky that both my wife and I work but I’m not sure how a lot of other families make it on a single income.’

Aircraft engineer Paul Nickodem said he was feeling the pinch as he paid for bags of groceries at Woolworths Marrickville, in Sydney’s inner-west

The family cut back on holidays, only taking one a year that they spent months saving for, so the children could keep playing sport.

‘They’re our whole lives so we have to sacrifice to keep them healthy,’ he said.

‘Ever since Putin decided to have this stupid war it’s driven the cost of fuel up and everything relies on that .’

Mr Nickodem said the government should focus on helping low income earners and scrap the stage-three tax cuts that mostly benefited the rich.

‘The budget should be trying to help the little man with tax breaks instead of those who are already well off, it makes a big difference to them especially with everyone still recovering from the pandemic,’ he said.

Can I File My Tax Returns Via Mail

Yes, there are many different ways to file your federal tax return. If you want to post it to the IRS you can.

However, if you want to post your tax return you need to make sure you have the correct address and that you are posting it well in advance of the deadline.

We also recommend that you get proof of postage and pay to have the forms tracked so you know when they arrive.

We also recommend that you photocopy all your forms so that you dont have to start from scratch if they get lost in the mail.

Don’t Miss: When Do I Get My Tax Return 2021

Where Do I Send My 1040ez Form

Whichever version of the 1040 form you use , your 1040 form has to be mailed to the IRS upon completion. However, the answer to this question depends on where you are located. You can check our list below to determine your appropriate IRS mailing address.

Whats your biggest 2022 HR challenge that youd like to resolve

Answer to see the results

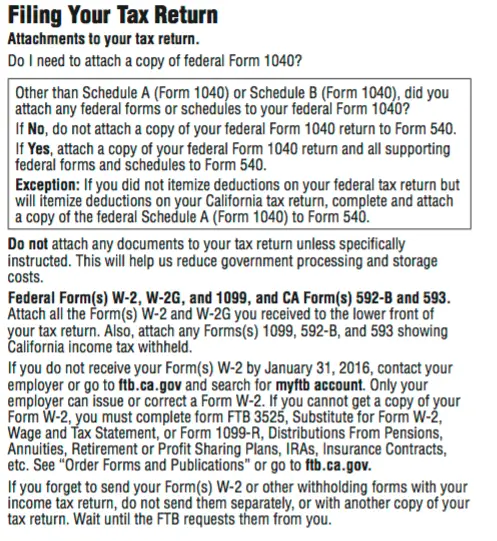

What Do I Need To File Taxes By Mail

Include all necessary tax forms for the IRS if you file by mail: your Form 1040 or 1040-SR, any schedules, and any other additional forms you have to fill out for your particular return. You should also include a check if you owe any taxes, or you can use IRS Direct Pay to make payment online from your checking or savings account.

Read Also: How Are You Taxed On Stocks

Where To Mail Federal Tax Returns

When you are filing your tax returns, you will feel like every single part of the process is complicated. Sadly, finding the where to post said tax return is also a complicated affair.

Today, we will endeavor to make it easier for you.

You will be able to tell where you need to post your tax return by looking in the top corner of the form. There, you should find a list of addresses find the address that applies to your state and to your payment plans.

If you are planning to mail back your return without paying then you will need to post to a different address than if you were sending a payment.

Contents

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasurys Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

Don’t Miss: How Do I Find My Taxes

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

Pay Taxes By Check Or Money Order

Unfortunately, there is no singular IRS payment processing hub. Instead, you must mail your check or money order to the IRS Center that handles your particular type of tax payment, based on where you live. Sending your payment to the proper address helps ensure it will be processed correctly and on-time.

To mail a tax payment, make your check or money order payable to United States Treasury. Be sure to include your name, address, phone number, taxpayer ID number , the tax period, and the related tax form or notice number on your form of payment.

NOTE: Do not mail cash to the IRS.

Recommended Reading: When Is The Deadline To File Your Taxes

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Where To Mail Your Personal Tax Return

The IRS has more addresses than you might imagine because its processing centers are located all around the country. The address you’ll use depends on what you’re mailing and where you live. Go to the Where to File page on the IRS website if you’re sending a personal tax return, an amended return, or if you’re asking for an extension of time to file. The page includes links for every state.

Note that the mailing address is usually different if you’re submitting a payment with your return. You’ll typically mail returns withpayments to the IRS. Returns without payments go to the Department of the Treasury.

IRS addresses change periodically, so dont automaticallysend your tax return to the same place you sent it in previous years.

Note that the IRS uses ZIP codes to help sort incoming mail. Make sure your return gets to the right place as quickly as possible by including the last four digits after the five-digit zip code. For example, the correct address for a California 2021 Form 1040 mailed with a payment in calendar year 2022 is:

Internal Revenue Service45280-2501

Recommended Reading: Do Independent Contractors Pay Quarterly Taxes

How Much Do You Have To Make To File Taxes

The IRS has several criteria for determining who must file a tax return. It depends on your filing status , the amount of federal income tax withheld from your earnings, and your gross income for the year. Even if your income is low enough to avoid filing, you may want to file to claim the earned income tax credit or other tax credits or to get a refund for the year.

You can use the interactive tax assistant on the IRS website, which takes you through a process of answering questions to help you figure out if you need to file a tax return

Table : Fedex Ups And Dhl Tax Return Mailing Address For Form 1040

See Table 1 for the City where the submission center is located for taxpayers living in your state.

Private Delivery Services should deliver returns, extensions and payments to the following Submission Processing Center street addresses only:

Austin Internal Revenue Submission Processing Center3651 S IH35,

Kansas City Internal Revenue Submission Processing Center333 W. Pershing,

Ogden Internal Revenue Submission Processing Center1973 Rulon White Blvd.

source: IRS.gov

Read Also: How Do I Look Up My Car Taxes

Where To Send Your Individual Tax Account Balance Due Payments

| Internal Revenue Service CenterAustin, TX 73301-0010 | |

| Alabama, Alaska, Arkansas, California, Delaware, Georgia, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Washington, Wisconsin | Internal RevenueService CenterKansas City, MO 64999-0010 |

| Arizona, Colorado, Connecticut, District of Columbia, Idaho, Kansas, Maryland, Montana, Nebraska, Nevada, North Dakota, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, West Virginia, Wyoming | Internal RevenueService CenterOgden, UT 84201-0010 |

| All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the Virgin Islands*, Puerto Rico , a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563 | Internal Revenue |