How Much Is The Car Sales Tax In Missouri

The current state sales tax on car purchases in Missouri is a flat rate of 4.225%. That means if you purchase a vehicle in Missouri, you will have to pay a minimum of 4.225% state sales tax on the vehicle’s purchase price.

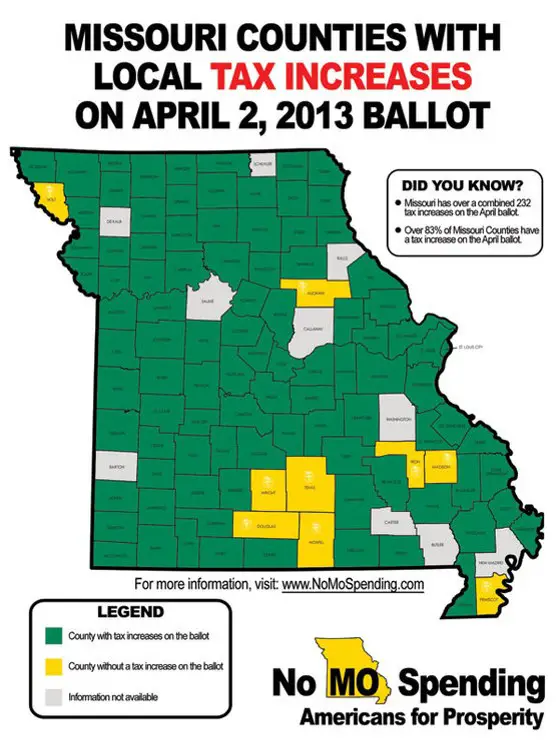

There may be an additional local tax rate as well, which can go as high as 6.125% or as low as 0.5%. However, the average local tax rate is 2.796%, making the average total tax rate in Missouri 7.021%.

We have seen instances that Missouri can only charge a maximum of $725 in taxes, but we could not verify it through Missouri’s DMV site. It might be worth bringing up at the dealership but plan on paying more than the quoted $725 figure in taxes.

The Missouri Income Tax

Missouri collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Unlike the Federal Income Tax, Missouri’s state income tax does not provide couples filing jointly with expanded income tax brackets.

Missouri’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Missouri’s %. You can learn more about how the Missouri income tax compares to other states’ income taxes by visiting our map of income taxes by state.

In Missouri, taxpayers can deduct up to $5,000 of Federal income tax from their Missouri taxable income for individuals and $10,000 for married couples filing jointly.

There are -869 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Missouri Property Taxes By County

You can choose any county from our list of Missouri counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the Missouri property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In Missouri By County

Don’t Miss: How To Maximize Your Tax Return

Kansas City Missouri Sales Tax Rate

kansas city Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Kansas City, Missouri?

The minimum combined 2022 sales tax rate for Kansas City, Missouri is . This is the total of state, county and city sales tax rates. The Missouri sales tax rate is currently %. The County sales tax rate is %. The Kansas City sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Missouri?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Missouri, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Kansas City?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Kansas City. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

Don’t Miss: What Are The Taxes On Investment Income

Charges To Accounts Of Contributing Employers

A contributing employer’s account is charged with the unemployment benefits paid out based on the percentage of base period wages paid by the employer that were used to establish a claim. Charges for contributing employers are not amounts the employer must pay instead, the DES tracks these charges and uses them when figuring an employer’s tax rate.

Does Mo Tax Social Security

Missouri. State Taxes on Social Security: Social Security benefits are not taxed for married couples with a federal adjusted gross income less than $100,000 and single taxpayers with an AGI of less than $85,000. Taxpayers who exceed those income limits may qualify for a partial exemption on their benefits.

Recommended Reading: What Is The Sales Tax Rate In Florida

Missouri Tax Brackets 2022

Looking at the tax rate and tax brackets shown in the tables above for Missouri, we can see that Missouri collects individual income taxes similarly for Single and filing statuses, for example. We can also see the progressive nature of Missouri state income tax rates from the lowest MO tax rate bracket of 1.5% to the highest MO tax rate bracket of 5.3%.

For single taxpayers living and working in the state of Missouri:

- Tax rate of 0% on the first $111 of taxable income.

- Tax rate of 1.5% on taxable income between $112 and $1,121.

- Tax rate of 2% on taxable income between $1,122 and $2,242.

- Tax rate of 2.5% on taxable income between $2,243 and $3,363.

- Tax rate of 3% on taxable income between $3,364 and $4,484.

- Tax rate of 3.5% on taxable income between $4,485 and $5,605.

- Tax rate of 4% on taxable income between $5,606 and $6,726.

- Tax rate of 4.5% on taxable income between $6,727 and $7,847.

- Tax rate of 5% on taxable income between $7,848 and $8,968.

- Tax rate of 5.3% on taxable income over $8,968.

For married taxpayers living and working in the state of Missouri:

For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household filing statuses, the MO tax rates and the number of tax brackets remain the same.

Special Needs Adoption Tax Credit

Missouri residents who adopt a special needs child who is also a resident of Missouri may take a one-time nonrefundable tax credit of up to $10,000 for adoption expenses per child. As of January 2022, if you adopt a child, you may claim the credit regardless of whether the child is a special needs child. However, the state will prioritize taxpayers who adopt a special needs child. adoptions of any Missouri resident child will be eligible for the tax credit, regardless of special-needs status.

Don’t Miss: What Is $600 After Taxes

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Registration And Tax Filing

Before you can collect Missouri state sales tax, you need to be registered with the state. This can be done online, but for your application to be complete, you will also have to remit a bond. The amount of the bond will depend on the total tax youve collected over the last several months, or the total you expect to collect.

The state offers a bond tax calculator tool to help you determine the proper amount to pay, and you must mail this payment along with the appropriate bond form to complete the registration process and receive your state tax ID number. You should receive that number within 10 days of the receipt of all parts of your completed application unless there is additional information the state needs from you. In that case, they will contact you by mail. When youre ready, you can file your return and make payments using the state website as well.

Don’t Miss: When Do Non Profits File Taxes

Is Food Taxed In Missouri

In Missouri, groceries are taxed at a statewide reduced sales tax rate of 1.225%. This includes all food items that may be purchased with Food Stamps, seeds and plants used to produce food for personal consumption, and food items refrigerated or at room temperature.

Saint Louis Missouri Sales Tax Rate

saint louis Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Saint Louis, Missouri?

The minimum combined 2022 sales tax rate for Saint Louis, Missouri is . This is the total of state, county and city sales tax rates. The Missouri sales tax rate is currently %. The County sales tax rate is %. The Saint Louis sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Missouri?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Missouri, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Saint Louis?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Saint Louis. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Read Also: How To File Taxes On Crypto Gains

Is Social Security Taxed In Mo

Missouri. State Taxes on Social Security: Social Security benefits are not taxed for married couples with a federal adjusted gross income less than $100,000 and single taxpayers with an AGI of less than $85,000. Taxpayers who exceed those income limits may qualify for a partial exemption on their benefits.

Get Licenses And Permits

While Missouri doesnt require every business to obtain a business license, it does require every business that sells tangible goods or taxable services to obtain a sales tax license. You must get this license before you begin business operations. This form is available via their online portal, or you may complete Form 2643 and mail it to:

Missouri Department of RevenueP.O. Box 357Jefferson City, MO 65105-0357

Additionally, each county or municipality has different requirements for permits and licenses, so it is a good idea to check with your local government.

Read Also: How Do I Check If My Property Taxes Are Paid

Are Missouri Taxes High

According to their calculations, Missouri has the 22nd-highest marginal income tax rate in the country. While this does not mean Missouri has the highest tax rate, it does mean that Missouri is not one of the lower-rate states, either. This ranking can understate how Missouris rates compare for most people.

Missouri Sales Tax Rates

The state rate for sales tax in Missouri is 4.225%, and some localities add their own taxes onto this as well. The rate that you will collect depends on the physical location of your business or the location of the warehouse the goods ship from, so you will always charge the same rate to your customers no matter where in the state they live. Guidance for economic tax nexus of out-of-state sellers will be provided by the state in advance of implementation of the new requirements in 2023.

One exception to this is goods that are shipped from out of state but that still require sales tax to be collected. For these purchases, sales tax rates from the destination location should be applied. To determine the total tax due, simply add the local rate to the state rate and multiply that by the purchase price. A complete listing of all local tax rates can be found on the Missouri Department of Revenue website. There is also a separate sales tax rate for food in Missouri, which is 1.225% and applies to all food not meant to be immediately consumed unless purchased with food stamps or WIC coupons.

You May Like: How To Amend 2020 Tax Return

Domestic Violence Shelter Or Rape Crisis Center Tax Credit

Donations of $100 or more to a domestic violence shelter or rape crisis center are eligible for a tax credit for 50% of the donation. Donations may include cash, stock, bonds, or real property, and the organization must be a nonprofit located in Missouri. The credit may not exceed your tax liability for the year, and canât exceed $50,000 per taxable year.

What Was The Third Stimulus Check

Third round of stimulus checks: March 2021 The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

What is Missouri adjusted gross income?

1. The Missouri adjusted gross income of a resident individual shall be the taxpayers federal adjusted gross income subject to the modifications in this section.

What is the federal tax rate in Missouri?

Tax Bracket Tax Rate $0+. 6.250%. Missouri has a flat corporate income tax rate of 6.250% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.There are a total of thirty three states with higher marginal corporate income tax rates then Missouri.

Recommended Reading: Where To Report Bitcoin On Taxes

University Of Missouri Economist Suggests Deliberate Investment Could Pay Bigger Dividends Than Income Tax Cuts

COLUMBIA To pass a $700 million tax cut plan in a short special session, an important consideration is to keep it simple, Missouri Gov. Mike Parson said Thursday morning.

Thats why Parsons proposal accelerates income tax cuts already set to be phased in over several years rather than reduce other tax sources, he told reporters after touting his plan to a gathering of about 75 business, farm and local political leaders.

Earlier this week, Parson set Sept. 6 as the starting date for a special session to consider a one-half percent reduction in the top tax rate and a six-year sunset on a package of tax credit programs aimed at agriculture. He said Monday he hopes lawmakers can wrap up work by Sept. 14.

Its about as simple a bill as you could make it in Jefferson City that everybody understands, Parson said. Everybody knows exactly what were doing.

The state general revenue fund is enjoying its largest-ever surplus, with $4.2 billion on hand at the end of July. Growth so far in the current fiscal year is running at 23.8%, compared to an estimate of 2.1% made in January.

The three largest sources of general revenue in the state budget are income taxes, which brought in $10 billion in the fiscal year that ended June 30 sales tax, which brought in $2.7 billion and corporate taxes, which totaled $900 million.

A sales tax cut equal to the $700 million income tax cut would see the 3% charged for general revenue reduced to 2.25%.

Maternity Home Tax Credit

Donations of $100 or more to a maternity home are eligible for a tax credit for 50% of the donation. Donations may include cash, stock, bonds, or real property, and the organization must be a nonprofit located in Missouri. The credit may not exceed your tax liability for the year, and canât exceed $50,000 per taxable year.

Also Check: Can I Request An Extension To File My Taxes

Missouri State Payroll Taxes

Now that were done with federal taxes, lets look at Missouri state income taxes. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings, starting at 1.5%. Its a progressive income tax, meaning the more money your employees make, the higher the income tax. The top tax bracket is 5.3%, which applies to employees who make more than $8,585.00 annually.

In addition, any residents, as well as anyone who works in St. Louis or Kansas City, must pay a local income tax of 1%.

Do I Have To Pay Income Tax In Missouri

Youâre required to file a Missouri tax return if you receive income from a Missouri source.

There are a few exceptions:

- Youâre a Missouri resident, and your state adjusted gross income is less than $1,200

- Youâre a nonresident, and your Missouri income was less than $600

- Your state adjusted gross income is lower than the state standard deduction for your filing status.

Recommended Reading: How To Check Last Year Tax Return

Lees Summit Missouri Sales Tax Rate

lees summit Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Lees Summit, Missouri?

The minimum combined 2022 sales tax rate for Lees Summit, Missouri is . This is the total of state, county and city sales tax rates. The Missouri sales tax rate is currently %. The County sales tax rate is %. The Lees Summit sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Missouri?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Missouri, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Lees Summit?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Lees Summit. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.