Top Five Reasons Why Not Filing An Income Tax Return Is A Bad Idea

As Benjamin Franklin once wrote, in this world nothing can be said to be certain, except death and taxes. With the 2019 income tax return filing deadline of April 15, 2020 looming, many taxpayers dread having to prepare their income tax return and fear owing money to the IRS. This is especially true for those that did not file a tax return last year and those that have not filed tax returns in a number of years. The failure to file a tax return is a serious problem that can come back to haunt you. Whether you owe money to the federal government or you are entitled to a refund of taxes you paid, there are consequences for failing to file an income tax return.

Also Check: Where Is My Income Tax Refund

Reporting Rules Changed For Form 1099

Due to new rules, a single transaction exceeding $600 can require the third-party platform to issue a 1099-K. Money received through third-party payment networks from friends and relatives as personal gifts or reimbursements for personal expenses is not taxable.

The IRS cautions people in this category who may be receiving a Form 1099 for the first time especially early filers who typically file a tax return during January or early February to be careful and make sure they have all of their key income documents before submitting a tax return.

Extra caution could save people additional time and effort in filing an amended tax return. And if they have untaxed income on a Form 1099 that isnt reflected on the tax return they initially file, that could mean they need to submit a tax payment with an amended tax return.

If the information is incorrect on the 1099-K, taxpayers should contact the payer immediately, whose name appears in the upper left corner of the form. Unfortunately, the IRS cannot correct it.

Ask For An Abatement Of Penalties

The IRS often reduces or removes penalties and interest on the penalties if a taxpayer writes a letter explaining the situation.

For example, if you had an unusual tax event, you made an honest mistake, or you or your spouse had a serious illness, the IRS may waive the penalties.

Be sure to ask for an abatement in your letter.

Also Check: Can You Be Married And File Taxes Separately

The Conditions For The Waiver Of Tax Obligation

The first requirement for dischargeability of income tax debt is that it must specifically be income tax debts. This would include federal and state income taxes that have not been paid, but not payroll taxes, such as those for Social Security and Medicare, that have not been withheld.

The second requirement is that the tax liability must not be too recent normally, it must be less than three years old. For greater clarity, the original tax returns due date must have been at least three years previous to the filing date of the bankruptcy petition.

At least two years prior to filing for bankruptcy, you must have filed an accurate tax return for the tax debt being discharged. In addition, the tax return had to be submitted by the deadline. If you requested an extension and were granted one, and then file your return by the date given for the extension, it will be considered timely. If the return was filed after the extended deadline, it is probable that it will not be considered as valid, and the tax debt will not be dischargeable.

At least 240 days previous to the bankruptcy petition, the Internal Revenue Service must have assessed the tax debts, registering them in its records. In addition to the restrictions regulating the age of the tax debt and the timeliness of the repayment, this criterion must be met.

In addition, keep in mind that you cannot discharge payroll taxes, employment taxes, trust funds faxes, sales tax, and any penalties for non-dischargeable taxes.

What If You Owe The Irs Taxes And Can’t Pay Them

From the IRS: Don’t Panic. The IRS now offers both short-term payment plans and long-term payment plans.

It is a situation no one wants to be in instead of getting a refund, you own money. While many self-employed individuals and small business owners typically expect to pay the Internal Revenue Service , there are times when you might owe and not expect.

The reasons can include that you withheld less from paycheck, made extra income not subject to withholding or there were changes in your tax return. If your kids grew up and moved out, they can’t be claimed as dependents and that could result in you owing the taxman. Likewise, if you refinanced your home at a lower interest rate that interest deduction may have fallen.

Then there are the changes in the tax code that could make a difference in your tax bill. If you didn’t adjust the withholding when things changed, you may end up owing money instead of getting a refund.

Last year approximately 125 million Americans received a tax refund, which meant that about 43 million Americans either broke even or owed money according to the IRS. Breaking even is actually the best place to be even if some people like to receive that refund. That meant you didn’t give the government an interest-free loan.

Owing money is something that can be upsetting at least if you’re prepared for it.

However, “don’t panic.”

The IRS now offers both short-term payment plans and long-term payment plans.

Don’t Miss: Was Tax Day Extended 2021

This Irs Payment Glitch Could Result In Past Due Notices For Married Couples

Back in July, the Internal Revenue Service issued a statement announcing that some 2021 tax return payments were not properly deposited into joint taxpayer accounts. This unfortunately resulted in incorrect CP14 balance-due notices being sent to unsuspecting taxpayers.

Find: 6 Types of Retirement Income That Arent Taxable

According to tax expert Bill Nemeth, the issue with these errors most commonly occurring with married filing jointly couples surrounds confusion related to an unwritten rule delineating primary from secondary taxpayers.

They may get a CP14 which shows a balance due and includes a voucher which has the primary taxpayers information on it, which is supposed to go on their check , Nemeth told Accounting Today.

But if the taxpayer or spouse goes online to pay the balance, frequently the spouse who is second on the return will make the payment in their SSN because they were responsible for the balance due for example, if the taxpayer is disabled and the spouse is working and therefore figures that she should pay the tax.

When paying a balance due or an estimated tax payment, if the secondary taxpayer makes a payment in their name and SSN, the system may not accept it.

According to the IRS, conditions cause certain payments to get hung up and stopped from being transferred over to a married filing jointly account. Generally, reasons this can happen are when the payment is:

More: 10 Signs You Really Do Need Professional Help Filing Your Taxes

A Tale Of Two Mileage Rates

If youre self-employed, and you intend to deduct all the wear and tear you put on your car last year getting the job done, it has to be done according to the new rules. You need to be accurate in your record keeping to avoid penalties.

Should your creative bookkeeping set off red flags to IRS employees, you will have to provide a journal detailing every mile you claimed on your return. Youll also have to turn over receipts for all other questions they may have on your entire tax return.

If you are unable to prove your side, there is a 25% accuracy penalty on top of the additional tax and then the interest on the entire amount.

Recommended Reading: Does Roth Ira Get Taxed

You May Like: How To Find Delinquent Property Tax List

Balance Between $10000 And $50000

With a balance due above $10,000, you can qualify for a streamlined installment plan.

- While acceptance isn’t guaranteed, the IRS doesn’t usually require additional financial information to approve these plans.

- With a streamlined plan, you have 72 months to pay.

- The minimum payment is equal to your balance due divided by the 72-month maximum period.

- If you can’t pay an amount equal to what you owe divided by 72, you will need to complete Form 433-F unless you qualify for an exception.

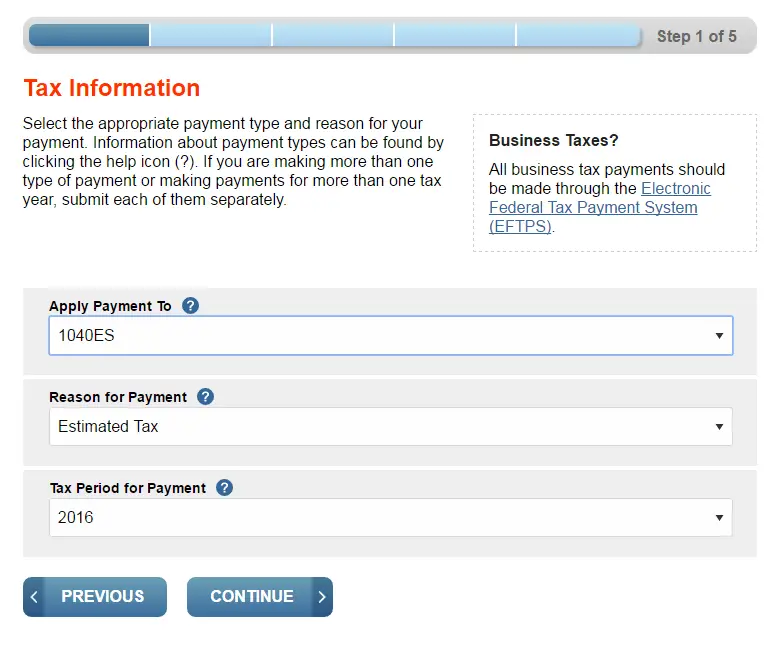

Q& a: What Are My Options For Paying A Balance Due To The Irs

The IRS currently offers three different ways to pay taxes owed to them. The first is to pay via a check or money order through the mail. When doing this you will want to include a payment voucher and make sure to notate the taxpayer’s SSN on the check or money order. Direct debit or electronic check is also an option. In this instance, you will need to provide your routing and checking or savings account number so that the IRS may directly debit your account for the designated payment. The final way to pay your balance is by credit card. In order to pay by credit card you will need to use an IRS Authorized Payment processor. A list of approved processors can be found here.

Read Also: Why Am I Owing Taxes This Year

The Influence Of Irs Tax Liens On Bankruptcy Tax Debt

If the IRS has already filed a tax lien against you, the chance of eliminating tax debt gets considerably smaller. A tax lien converts the tax debt into a secured obligation that must be fulfilled regardless of the chapter of bankruptcy you file under, even if the tax bill is old and would otherwise be dischargeable. This is true even if the tax obligation is old and would have been dischargeable otherwise.

However, from that point, it might be easier to discharge tax debt or find debt relief by arranging monthly payments, considering your total monthly income and monthly expenses.

What Happens When I Request A Payment Plan

When you request a payment plan , with certain exceptions, the IRS is generally prohibited from levying and the IRSs time to collect is suspended or prolonged while an Installment Agreement is pending. An IA request is often pending until it can be reviewed, and an IA is established, or the request is withdrawn or rejected. If the requested IA is rejected, the running of the collection period is suspended for 30 days. Similarly, if you default on your IA payments and the IRS proposes to terminate the IA, the running of the collection period is suspended for 30 days. Last, if you exercise your right to appeal either an IA rejection or termination, the running of collection period is suspended by the time the appeal is pending to the date the appealed decision becomes final. Refer to Tax Topic No. 160 – Statute Expiration Date and Tax Topic No. 202 Tax Payment Options.

Also Check: What Happens When You File Your Tax Return Late

Am I Eligible For A Waiver Or Reimbursement Of The User Fee

Waiver or reimbursement of the user fees only applies to individual taxpayers with adjusted gross income, as determined for the most recent year for which such information is available, at or below 250% of the applicable federal poverty level that enter into long-term payment plans on or after April 10, 2018. If you are a low-income taxpayer, the user fee is waived if you agree to make electronic debit payments by entering into a Direct Debit Installment Agreement . If you are a low-income taxpayer but are unable to make electronic debit payments by entering into a DDIA, you will be reimbursed the user fee upon the completion of the installment agreement. If the IRS system identifies you as a low-income taxpayer, then the Online Payment Agreement tool will automatically reflect the applicable fee.

What If I Am Not Eligible Or Unable To Apply Or Revise A Payment Plan Online

If you are ineligible for a payment plan through the Online Payment Agreement tool, you may still be able to pay in installments.

If you prefer to apply by phone, call or , or the phone number on your bill or notice

If you are unable to revise an existing installment agreement online, call us at or . If you have received a notice of default and cannot make changes online, or you received an urgent notice about a balance due, follow instructions listed on the letter and contact us right away.

Also Check: Have My Taxes Been Filed

Can I Apply For An Irs Payment Plan Myself

Yes. You are not required to pay a third party to apply for a payment plan.

If you do hire a tax-relief company to help you settle your debt, you may have to give it power of attorney to apply for an IRS payment plan on your behalf. And proceed with caution and do your research, as the Federal Trade Commission warns on its website:

The truth is that most taxpayers dont qualify for the programs these fraudsters hawk, their companies dont settle the tax debt, and in many cases dont even send the necessary paperwork to the IRS requesting participation in the programs that were mentioned. Adding insult to injury, some of these companies dont provide refunds, and leave people even further in debt.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

There’s A ‘safe Harbor’ To Avoid Federal Tax Penalties

One key thing to know: Chichester said there’s a “safe harbor” to avoid underpayment penalties for your yearly federal taxes.

You won’t owe federal penalties if you’ve paid, over the course of 2022 and through the Jan. 17 deadline, the lesser of 90% of your 2022 taxes or 100% of your 2021 bill if your adjusted gross income is $150,000 or less.

However, the safe harbor isn’t a guarantee you won’t owe more federal taxes for 2022, Chichester said. He urges clients to set aside at least 20% of earnings to cover federal taxes, plus a smaller percentage for state taxes, depending on where they live.

Read Also: Do Your Taxes For Free

The Benefits Of Working With A Tax Lawyer

Income taxes are complicated, and it is easy to get nervous about dealing with the IRS when you owe back taxes. In most outstanding tax situations, it makes sense for you to hire a tax lawyer.

A professional tax lawyer will investigate the amount of taxes you owe and confirm collection actions already taken by the IRS.

Experienced tax lawyers have the knowledge and negotiation skills to protect you against Revenue Officers and battle the IRS on your behalf.

If you are trying to deal with outstanding tax debt, a tax lawyer can guide you through the resolution process and avoid costly mistakes. Plus, they may be able to negotiate a lesser settlement via an Offer in Compromise or partial relief of tax debts. They can also protect you against garnishment or tax liens.

If you owe back taxes to the IRS, contact a Polston Tax Lawyer to protect your rights and help you negotiate a repayment plan you can afford to get you out of tax debt. You can give us a call at 844-841-9857 to schedule your free consultation.

How Do I Make Changes To An Irs Payment Plan

The IRS offers an online tool that lets you change your monthly payment amount, change the monthly due date, sign up for automatic withdrawals and reinstate a payment plan youve fallen behind on. However, that works only if youre not making payments through direct debit.

-

If youre on a plan where the payments are coming out of your bank account automatically, you have to contact the IRS directly.

-

There might be a reinstatement fee if your plan goes into default.

Also Check: What Is Schedule D Tax Form

What Happens If I Have Made A Mistake On My Tax Return

If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. If you fail to correct the mistake, you may be charged penalties and interest. You can file the amended return yourself or have a professional prepare it for you.

Can I Re-File My Taxes If I Forgot Something?

You can refile your taxes if you need to make a change or forgot to add something. You can file an amended return using Form 1040-X. Form 1040-X is available on the IRS website or at an IRS local office. You can also have a professional prepare the amended return for you.

What Is The Penalty For An Incorrect Tax Return?

There is no specific penalty for an incorrect tax return. However, penalties can apply to your incorrect tax return. For instance, if you have to pay more tax, more penalties will apply in correlation to the increase in tax. On the other hand, if your mistake resulted in less tax, there would be no penalties associated with your corrected return.

Will The IRS Catch It If I Have Made A Mistake?

The IRS will most likely catch a mistake made on a tax return. The IRS has substantial computer technology and programs that cross-references tax returns against data received from other sources, such as employers. When the IRS cross-references your returns with other information, their programs will almost surely catch any mistake or incorrect information reported on your tax return.