I Am Over 65 Do I Have To Pay Property Taxes

If you are over 65 years of age, or permanent and totally disabled , or blind , you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption. For county contact information, view the county offices page.

A mill is one-tenth of one cent. The number of mills an agency charges for taxes is multiplied times the assessed value of the property, and the result is the tax amount due. For example: $100,000 X = $10,000 X .0325 = $325.00

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes you’ve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, it’s up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements you’ve made to the property, you should be fine.

How Does Property Tax Work And How Often Do You Pay Property Taxes

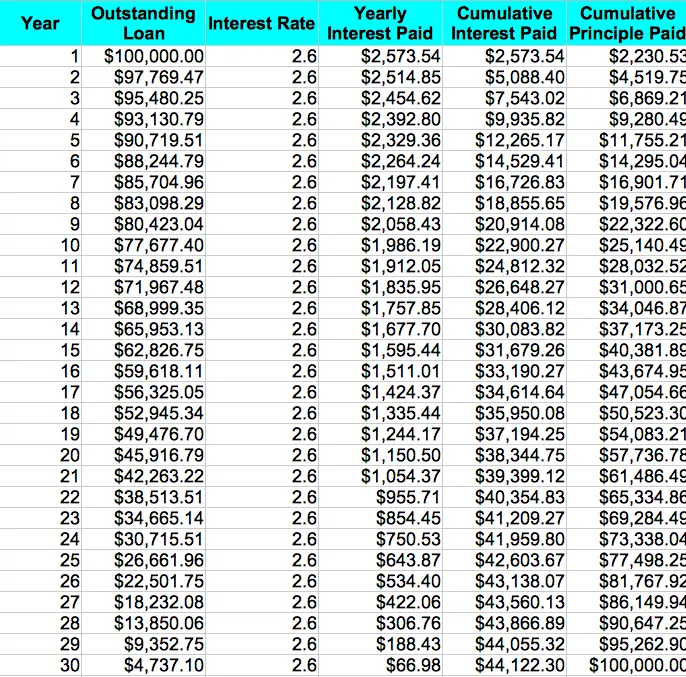

Lenders often roll property tax payments in with a mortgage, so in these cases, your property taxes are paid monthly as part of your monthly mortgage payment and handled directly by your lender. If you do not have a mortgage, you will be responsible for paying your own property taxes. Property taxes are due annually, but some counties may allow you to pay in installments instead of one lump sum. If installments arent an option, you can deposit your monthly amount due to a high-yield savings account so it can earn interest until you pay your bill at the end of the year.

Ultimately, to be fully prepared for your home purchase, learn as much as you can about property taxes by state and in your county. Property taxes can be a significant expense for your household, so its important to know what percentage of your budget will go toward them.

More From GOBankingRates

You May Like: Do I Pay Taxes On Social Security Income

What Age Do You Stop Paying Property Tax In Texas

Property taxes may be deferred by taxpayers 65 and older in accordance with Section 33.06 of the Texas Tax Code until the estate is settled.

The state of Texas does not require seniors to pay property taxes. What happens if a person 65+ refuses to pay child support? That is, they will not go away . If you do not pay your property taxes, the government has the authority to seize your home. Texas homeowners who are elderly or disabled are afforded certain protections. Property tax deferral, in essence, means that the tax is delayed until the due date. A specific qualifying event is subject to a deferral period of 181 days after it occurs. The two most common qualifying events are the sale of the property and the death of the property owner.

If you are a Texas resident over the age of 65, you may be eligible for a Property Tax Credit. Property owners who have paid all of their taxes on their primary residence may be eligible for this credit. To be eligible, you must submit an application and provide documentation of your tax payments.

How Are Property Taxes Paid After I Pay Off My House

Theres nothing more freeing than making your final mortgage payment, walking out to the backyard of your completely paid-off home, and feeling the grass beneath your feet. It just feels different.

No more monthly house payments for you! But does that mean youre also finished with property taxes?

We hate to be the bearers of bad news, but you have to pay property taxes forever.

The difference is how you pay your property taxesand when you pay your property taxes.

Once you pay off your house, your property taxes arent included in your mortgage anymore, because you dont have one. Now its on you to pay property taxes directly to your local government.

How often you pay property taxes depends on where you live. Your local government may want you to pay your property taxes in a lump sum once a year. Or they may break it into smaller payments that are spaced a few months apart.

The exact day when you have to pay your property taxes also depends on where you live, so make sure you pay close attention to the due date on your property tax bill when it arrives in the mail!

And dont think you can just skip a payment here and there, either. If you get behind on paying your property taxes or you dont pay them at all, the local government can take your house and sell it to recoup the tax debt you owe them . . . and they can do that even though your house is completely paid for. Dont let it come to that!

The best way to handle property taxes on your own is to plan ahead.

Don’t Miss: When Do You Pay Quarterly Taxes

What Are Property Taxes

Often considered the financial backbone of local government, property taxes are generally levied by your municipality, county government, and in some cases, your local public school system. When collected, they help pay for your community’s needs, such as emergency services, trash collection, and public libraries, to name a few.

Property taxes are what’s called an ad valorem tax, which is considered by some circles to be a regressive tax, which means it’s based on the assessed value of a property. How much you’ll pay in property taxes will depend on several factors and varies among municipalities. Furthermore, some municipalities may levy taxes on more than just real estate, opting to include other tangible personal property, such as vehicles or furniture.

When Do You Pay Property Taxes

The City of Houston Property Tax Bill is mailed out once a year in late May/early June. The bill is for the Citys fiscal year, which runs from July 1st to June 30th. The due date for payment is August 31st. If you have a mortgage, your lender will likely pay your property taxes for you as part of your escrow payment.

By using our secure e-check, we can reduce postage and mailing costs. It is possible to withdraw property tax payments directly from your account twice a year using Direct Debit. Payments are due on May 15 and October 15 unless those dates fall on a weekend. This method of payment is not currently available to manufactured home or personal property owners. Paymentus Corporation accepts credit cards such as Visa, MasterCard, American Express, and Discover, as well as debit cards such as Visa and MasterCard. Minnesota counties are authorized to accept credit cards to pay real estate taxes. Despite the fact that it does not charge a fee, Hennepin County receives no revenue from the fees you are charged.

Recommended Reading: How To Check Income Tax Refund

Do Seniors Have To Pay Property Taxes In Oklahoma

A property tax exemption in Oklahoma can only be obtained if it is valid and exempt. Senior citizens, who earn less than $12,000 per year, can claim an income tax credit of up to $1,000 for any amount of property tax paid that exceeds 1% of the propertys taxable value. A $100,000 propertys taxable value would be $100,000.

Why Oklahoma Is The Perfect Place To Retire

It is a fantastic place to retire in Oklahoma. There are few obstacles to overcome, and the weather is pleasant. There are numerous retirement communities, resorts, and golf courses in the state. Furthermore, there are numerous cultural and recreation activities available to residents.

Does North Carolina Have A Personal Property Tax

Yes, North Carolina does have a personal property tax. This tax is imposed on the value of all taxable personal property owned by a taxpayer as of January 1st of each year. The tax rate is set by the county in which the property is located and is generally between 0.25% and 2.0% of the propertys value.

When looking for a retirement home in North Carolina, consider the states moderate tax rates. In comparison to the national average, state property taxes and sales taxes are lower in California. Furthermore, a manufacturer is exempt from paying sales tax on retail sales of electricity, fuel, and piped natural gas. This exemption reduces a retirees overall tax burden, which is advantageous.

Read Also: What Does It Mean When Your Tax Return Is Accepted

Do You Pay Personal Property Tax In Alabama

In Alabama, you are not required to pay personal property tax on your vehicle.

Alabama has an unusual tax year, which lasts from October 1 to September 30. Tax returns for personal property of businesses in Alabama are due by December 31. The tax return filed on 12/31/2019 shows the value of assets held at that time, but the tax return itself shows the tax liability for 2020. Alabamas accounting practices are unique, and CrowdReason provides solutions to address this by utilizing its MetaTaskerPT and TotalPropertyTax solutions. The Alabama depreciation schedules are now available for public use through TPT. Furthermore, our system includes a number of other features that make filing and paying bills easier. Furthermore, it can generate hundreds of returns in a matter of minutes.

A tax assessment is used in Alabama to calculate your property tax bill. According to the Alabama Constitution, all real and taxable personal property will be taxed at 20% of its fair market value. As a result, if your propertys assessed value is $100,000, Alabama taxes would be $20,000.

How Do I Apply For A Homestead Exemption

For details on homestead tax exemptions, go directly to your county or local tax assessor’s website. Some states require you to fill out an application . Make sure you comply with your state’s application deadlines.

Also, be aware that some sites may be fraudulent and may request payment to fill out an application. Your county or local tax assessor will not require you to pay a fee to fill out an application for homestead tax exemption.

Don’t Miss: Can I File My Taxes By Mail

Where Do I Pay My Property Taxes In Dallas County

If you want to pay your property taxes, you can do so online at the Dallas County Tax Office, or you can renew your vehicle registration at the Texas Department of Motor Vehicles. Our Customer Care Center can also assist you in obtaining documents for both property taxes and motor vehicle ownership.

You Will Pay These 6 Types Of Taxes Forever

Please note this post contains affiliate links which help to fund this blog at no cost to you. Thanks for your support!

Its a new year and with that comes the hope that everything is just plain going to get better. We all hope that. That means everything including your finances, especially after what will go down as a disastrous 2020 and so many who have suffered economically. But with a new year also comes the reality that tax season is now upon us. Aprils due date is just a few months away and January is the start of your prep time for that event. But while your income tax returns get all the fanfare, there are different types of taxes we are subject to.

Taxes affect just about every facet of your life, even if you dont realize it. Learning the different types of taxes you pay can help you understand the true cost of your financial fortunes. Heres what may be a shocker to you. Income tax isnt the only tax that you will be paying this year. In fact, you will be paying taxes every yearwait for itforever!

Don’t Miss: Where’s My State Tax Refund 2021

Property Tax Exemptions For Seniors In The United States

Seniors in the United States should be familiar with the property tax exemption programs available to them. Seniors have a wide range of property tax exemptions in the United States. Most states generally require that seniors 60 and older qualify for senior property tax exemptions, though Washington has an exemption age of only 61, so it may be too late. Understanding these exemptions is important because not all of them will be available in each state.

How Do Property Tax Payments Work When You Buy A House

Whether you pay toward property taxes each month through a mortgage escrow account or just once-yearly directly to your local government is a choice youll make. Most homeowners set up an escrow account.

Escrow accounts are free to use. They estimate how much this years property taxes will be, divide it into monthly parts, and withdraw that amount from your bank account every month. The advantage of a mortgage escrow account for taxes and insurance is that you wont be responsible for remembering when taxes are due, calculating how much they are, or budgeting for them every month. Its all automatic!

» READ MORE: Whats a Mortgage Escrow Account? Do I Need One?

Read Also: Did The Irs Get My Tax Return

When Can I Get An Escrow Waiver

There are some situations where youre permitted to pay your property taxes and insurance on your own. Keep in mind that your lender may still keep track of the status of these expenses to protect their financial interest in your house. Its common to get an escrow waiver in the following cases:

Your mortgage doesnt require mortgage insurance. Conventional loan guidelines recommend escrow accounts for first-time homebuyers and borrowers with poor credit, but dont require them. However, loans that require borrowers to pay mortgage insurance must have an escrow account.

Youre taking out a reverse mortgage. A reverse mortgage is a special loan product for homeowners ages 62 or older that doesnt require you to make any monthly payments. That also means you arent required to set up an escrow account. However, you will need to prove that you have the means to pay these expenses based on your income or assets. If the lender is concerned you might not be able to pay the costs, they may set aside reverse mortgage funds to make sure that theyre paid.

THINGS YOU SHOULD KNOW

Some lenders charge a fee for an escrow waiver. It may be charged as a percentage of your loan amount or an increase in your interest rate. Ask your lender about a partial escrow waiver, which allows you to choose whether you want just your homeowners insurance or property taxes impounded. Lenders must disclose any escrow waiver fee charged on Page 4 of your loan estimate.

Exemptions For People With Disabilities

Homeowners living with a disability are likely to be eligible for a property tax exemption. How much relief your disability will garner you when it comes to property taxes depends on where you live. In some cases, you’ll have to provide a legal affidavit to explain your disability. Still, if you’re having a hard time moving around and are living on a single, fixed income, a reduction in your property taxes could be a significant financial help.

Recommended Reading: Do You File Unemployment On Taxes

Who Pays Property Taxes

Just like closing costs, there may be some variation in who pays property taxes depending on each individual transaction. As a general rule: Both the buyer and seller will pay property taxes at closing. The seller will typically pay a prorated amount for the period of time theyve spent in the home that year, and the buyer will pick up where they left off.

However, this may vary based on the market. For example, a seller wanting to sell their home fast may offer to cover property taxes for the rest of the year to incentivize a buyer to act quickly. On the other hand, a buyer up against competition with other offers might offer to pay the sellers portion of the taxes for the year.

Keep in mind that the current years property taxes will be due at closing. Its usually up to the lender to determine the amount that will be due, and the seller and buyer to make an agreement about who is going to pay what.

When Can You Appeal A Tax Assessment

No one wants to pay more in taxes than they should. If you believ that your property taxes are too high, you can appeal your property tax bill. Typically, you will have a predetermined amount of time after receiving your property assessment or tax bill for which you’ll be able to argue that the assessor’s determination was wrong.

Like nearly every other aspect of the property tax conversation, the process by which you would go about appealing your property taxes varies from state to state, county to county, or even municipality to municipality. For example, property owners in Marion County, Oregon, are required to file their appeals after receiving their tax statement but before Dec. 31. Meanwhile, taxpayers in Wake County, N.C., have 30 days after receiving their initial notice of value to appeal.

Keep in mind that you won’t get an immediate response to your appeal. It will take time to fill out the appropriate paperwork and pay any associated fees in order to even begin explaining why you believe your property is actually worth less than the assessed value. Again, what that process looks like will be determined by where you live. Even then, it could take a while before you hear back from whichever agency handles your property assessments because they are likely slammed with other assessment appeals at the same time.

Don’t Miss: How To Obtain Prior Year Tax Returns