Data Sources And Methodology

This analysis was conducted using theMonthly Treasury Statement as the data source for federal government revenue and spending of the United States and theMonthly Statement of the Public Debt as the data source for federal debt.

U.S. Census Bureau data was used forpopulationandhouseholdestimates.Median home price estimatesare also provided by the U.S. Census Bureau. Rent estimates come from theDepartment of Housing and Urban Development . The Bureau of Labor Statistics Occupational Employment Statisticswas used for wage estimates. Information on the amount of credit card debt added by Americans comes from the Federal Reserve Bank of New YorkâsCenter for Microeconomic Data. The annual 10-K reports of the top S& P 500 companies were compiled in order to find the equivalent revenue from companies to match the federal governmentâs revenue for the year. TheAmerican Road and Transportation Builders Associationprovides information about the cost of building new roads derived from the cost models of different states.

What Is Federal Income Tax

The U.S. federal income tax is a tax levied by the Internal Revenue Service on the annual earnings of individuals, corporations, trusts, and other legal entities. Federal income taxes apply to all forms of earnings that make up a taxpayer’s taxable income, including wages, salaries, commissions, bonuses, tips, investment income, and certain types of unearned income.

In the U.S., federal income tax rates for individuals are progressive, meaning that as taxable income increases, so does the tax rate. Federal income tax rates range from 10% to 37% and kick in at specific income thresholds. The income ranges the rates apply to are called tax brackets. Income that falls within each bracket is taxed at the corresponding rate.

The federal corporate tax rate is a flat 21% .

Sandra King Enrolled Agent

Sandra King is an enrolled agent, empowered by The United States Treasury to prepare your personal or business tax filing. While her services are offered nationwide, Sandra King locally serves the greater Dallas-Fort Worth area, including but not limited to Arlington, Bedford, Colleyville, Euless, Fort Worth, Grand Prairie, Hurst, Mansfield, North Richland Hills, and Richland Hills.

Recommended Reading: What Is The Tax Rate On Unemployment

Using The Mail To Find Out How Much You Owe The Irs

If you have a copy of the latest notice mailed to you by the IRS, you can check that for your tax liability balance. Note that the amount shown does not include any interest or penalties assessed since the notice was sent. Also, many times the IRS will send notices that only contain one year of taxes owed, so if you owe taxes for multiple years it is likely that you will need to add up the balances on all of the notices . To get up-to-date information, you need to check online or by calling the IRS.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Recommended Reading: How Much Can You Earn Before You Owe Taxes

Is Social Security Income Taxable

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an individual and your combined income exceeds $25,000.

Do I Claim Myself As A Dependent

As long as you qualify, you yourself can be claimed as a dependent, even if you paid your own taxes and filed a tax return. But dependents can’t claim someone else as a dependent. If you and your spouse file joint tax returns, and one of you can be claimed as a dependent, neither of you can claim any dependents.

Read Also: Why Am I Owing Taxes This Year

How Do I Find Out If I Owe The Irs Taxes Online

If you are trying to figure out whether you owe the IRS taxes, its probably because you might have not filed your taxes or you got something from the IRS. In either case, its important to know that youre not alone. Statistically, over 14 million taxpayers owe the IRS back taxes. Taxes are complicated and confusing, so its no wonder that you are wondering. So how do you find out if you owe the IRS taxes?

Dont Miss: How To Start Filing Taxes On Turbotax

How Withholding Is Determined

The amount withheld depends on:

- The amount of income earned and

- Three types of information an employee gives to their employer on Form W4, Employee’s Withholding Allowance Certificate:

- Filing status: Either the single rate or the lower married rate.

- Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

- Additional withholding: An employee can request an additional amount to be withheld from each paycheck.

Note: Employees must specify a filing status and their number of withholding allowances on Form W4. They cannot specify only a dollar amount of withholding.

Recommended Reading: Are Property Taxes Paid In Advance

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Read Also: When Do Taxes Come In 2021

In 4 Oregonians Think The Federal Tax System Is Unfair

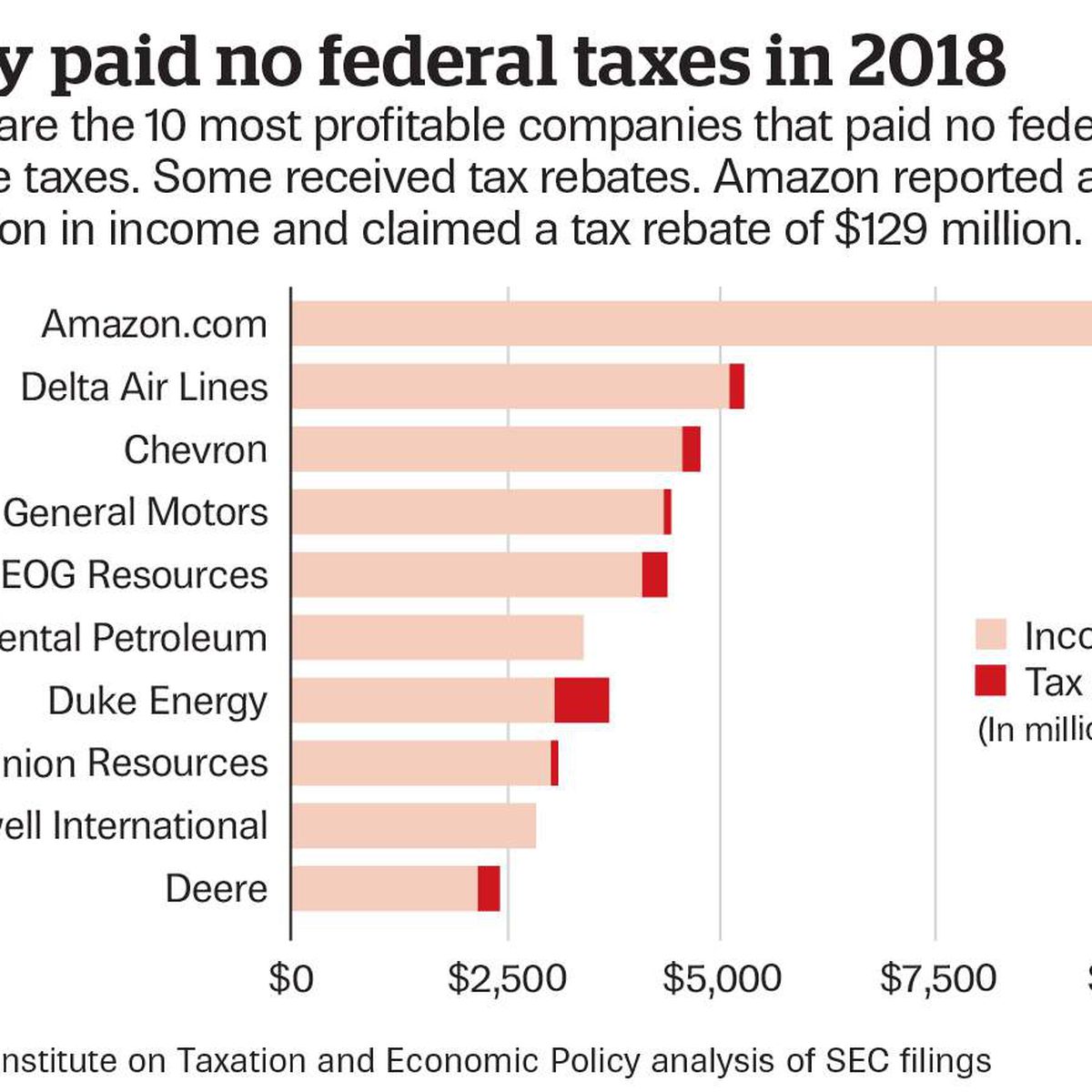

Pollster John Horvick said a 2019 DHM poll shows 77% of Oregonians said they think the federal tax system is unfair. Wasteful spending and misallocation of funds are part of the reason, but Horvick said there’s another reason for taxpayer skepticism.

“A lot of it has to do with who they think isn’t paying their fair share. That’s high-income earners and big corporations. They feel like they’re paying and a lot of others aren’t,” Horvick said.

When Are Estimated Taxes Due

Estimated taxes are paid quarterly, usually on the 15th day of April, June, September and January of the following year. One notable exception is if the 15th falls on a legal holiday or a weekend. In those cases, you must file your return by the next workday.

The deadlines for 2022 estimated taxes are in the table below.

You May Like: How Long Are Taxes Taking To Get Back 2021

Businesses: Governments Biggest Tax Collector

When people think about paying their taxes, they likely think of the Internal Revenue Service . But the days of the tax collector going door-to-door to fill the government coffers are long gone. In fact, the primary collectors of taxes, and certainly payers of taxes, are businesses.

Businesses are absolutely essential to the tax collection process. You would literally need millions of federal, state, and local tax agents to do what businesses do for governments every day.

In addition to the numerous taxes they paysuch as income taxes and property taxesbusinesses collect taxes for the government in three main ways:

- Withholding taxes on labor and capital incomethis is what comes out of your paycheck if youre a salaried employee

- Remitting the employee-share of social insurance taxeswhat you contribute to fund safety-net programs like Social Security in the United Sates

- Sales and value-added taxes the taxes you see on a receipt after purchasing a good or service

The U.S. is one of the most business dependent tax systems in the industrialized world. In 2014, U.S. businesses paid about 29 percent of all taxes collected in the country and remitted another 64 percentadding up to 93 percent of all taxes collected in America that year.

Planning Your Tax Strategy

This look at the amount of federal income taxes paid by the people of each state can serve as a reminder that there may still be time to do something about your own tax burden.

Whether you live in a state with a relatively heavy or light tax burden, a little planning might help lower the amount you pay.

Don’t Miss: What Are The Different Tax Forms

Federal Income Tax Brackets

The federal income tax is built on a progressive tax system, where higher income earners are taxed at higher rates. The table below shows the tax brackets and rates for 2021:

| 2021 Tax Brackets and Rates |

|---|

| 2021 Tax Rate |

| – | $13,223 tax bill |

However, note that while the marginal rate is 22%, the effective tax rate is 16.5%. This figure is arrived at by dividing the total tax bill by income and multiplying by 100. The effective tax rate is the actual rate the individual ends up paying in taxes to the government.

Tax Withholding: How To Get It Right

Note: August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool.

FS-2019-4, March 2019

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. This includes anyone who receives a pension or annuity. Heres what to know about withholding and why checking it is important.

Read Also: Have Not Filed Tax Returns For Years

Consolidation May Be Necessary

Even if the Department of Education ultimately decides not to forgive privately held FFELP loans, it is still possible for borrowers to have the debt forgiven.

Federal direct consolidation loans are eligible for cancellation. Thus, borrowers could consolidate their FFELP loans into a federal direct loan to qualify for forgiveness.

This is excellent news for the FFELP borrowers who want to take advantage of the Limited Waiver on PSLF or the IDR Payment Count Update. Because of these temporary programs, consolidation doesnt restart the forgiveness clock. This makes consolidation less risky than in the past.

Does a new consolidation loan miss the deadline? To be eligible for forgiveness, the borrower must have had the balance by June 30, 2022. Some borrowers worry that a new consolidation loan will miss this critical deadline.

Taxes By Income Level

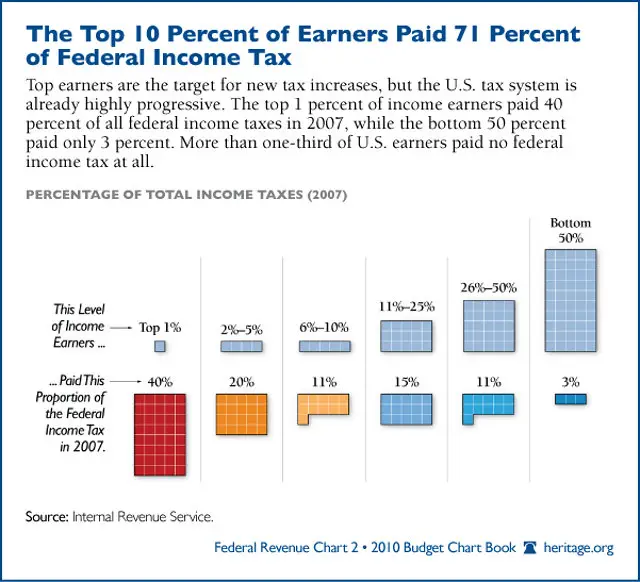

The U.S. tax system has been described as “progressive,” meaning that the share of taxes paid rises with income, through seven here tax brackets.

The very poorest, those making under $9,875 a year, are taxed at a 10% rate, while the wealthiest, or those making $518,400 and over are taxed at a 37% rate. But what the wealthiest pay is often much lower due to a variety of complicated tax loopholes, which can benefit hedge fund managers, private equity firm partners and real estate investors.

The 2017 tax cuts passed by Republicans and signed by Trump largely kept that relationship intact, but shifted more of the tax burden to wealthy and upper-middle-class wage earners. But income deductions for mortgage interest and state and local taxes paid, the biggest middle-class tax breaks, were reduced considerably.

A pre-pandemic Congressional Budget Office estimate here projected the top 20% would pay 69.7% of federal taxes in 2021.

U.S. federal taxes paid by income group:

America’s 37% top marginal tax rate is lower than the top rates for many wealthy and developing countries, including the OECD average of 41.2%, according to here KPMG.

Corporations got a major tax cut in the Republican bill, when their tax rate before deductions was slashed to 21% from 35%.

Don’t Miss: How To Turn Someone In For Tax Fraud

When To Check Withholding:

- If the tax law changes

- When life changes occur:

- Lifestyle Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income The taxpayer or their spouse starts or stops working or starts or stops a second job

- Taxable income not subject to withholding Interest, dividends, capital gains, self-employment and gig economy income and IRA distributions

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, Child Tax Credit, Earned Income Tax Credit

How Much Do I Owe The Irs How To Find Out Federal Back Taxes Owed

The IRS also accepts written requests for account balance information. To request a Record of Account, you must complete Form 4506-T, Request for Transcript of Tax Return. Your Record of Account will include all of the tax liabilities, payments and adjustments for the tax years in question. This document will also list any balances you owe for each tax period.

Also Check: How Much Tax Withheld From Unemployment

State And Local Tax Revenue

The exact mix of taxes used to raise revenue among U.S. states and localities varies greatly, though the majority of revenue comes from four primary sources: property taxes, sales taxes, individual income taxes, and corporate income taxes.

Other taxes used to raise state and local revenue include excise taxes, such as those on alcohol, tobacco, or motor fuel estate taxes and severance taxes, which are imposed on the extraction of non-renewable natural resources, such as crude oil.

As you can see in the table below, some states forgo major tax types, such as Florida, which collects no individual income tax, or New Hampshire, which collects no sales tax.

Given the proximity of states, the decision whether to impose certain taxes and the level at which those taxes are imposed can have significant effects on where businesses and individuals choose to locate.

Sources of State & Local Tax Collections, Percentage of Total from Each Source, Fiscal Year 2017| State | |

|---|---|

| 7.4% | 15.3% |

| Other Taxes include excise taxes , severance taxes, stock transfer taxes, estate and gift taxes, and other miscellaneous taxes. | |

| Note: Percentages may not add to 100 due to rounding. | |

Biggest Percent Increase In Federal Income Taxes

MoneyRates.com first conducted this study of what individuals in different states pay in federal taxes five years ago. People in most states are paying more now than they were then, but there are a couple of exceptions.

On average, people in Florida have seen the biggest increase in their federal income tax bills. The average federal tax paid per adult in the state of Florida has risen by 41.21% in just five years.

Average personal income tax burdens rose in 48 of the 50 states plus the District of Columbia over the last five years. The lone exceptions were Wyoming and North Dakota. Notably, these are two of only three states to also see a decline in average income per adult over that same five years.

Here are the states that have seen the largest percentage increases in average tax burden per person in the past five years:

| 28.77% |

You May Like: Are Donations To Hillsdale College Tax Deductible

Why Is There No Federal Taxes Taken Out Of My Paycheck

You Didn’t Earn Enough. If no federal income tax was withheld from your paycheck, the reason might be quite simple: you didn’t earn enough money for any tax to be withheld. … When deciding whether taxes should be withheld or reduced from your payroll, they will take all those aspects into account.

About Futa Tax Credit

FUTA Tax Credit is charged as 5.4%. In case the employer falls eligible for this maximum tax credit that means the tax rate is just 0.6%. In other words, it is only 6% 5.4%.

However, FUTA Tax Credit can be claimed only if the employer satisfies both of the conditions below:

If they have paid state unemployment taxes timely & fully

If they arent operating under the state with any outstanding federal unemployment insurance loans

While were sharing all the possible information regarding FUTA Tax rates, let us also share when this tax amount is due.

FUTA Tax Payment for Quarter 1 is due by April 30

FUTA Tax Payment for Quarter 2 is due by July 31

FUTA Tax Payment for Quarter 3 is due by October 31

FUTA Tax Payment for Quarter 4 is due by January 31

You dont need to deposit taxes by the end of the quarter if your FUTA Tax Liability for a single quarter is less than $500. Alternatively, you can roll over the tax liability of that particular quarter to the next one & then pay for FUTA Tax Liability if it exceeds $500.

Also Check: Has My Tax Return Been Accepted