Does Filing For Unemployment Mess With Your Taxes

How does unemployment affect my taxes? Unemployment benefits are generally taxable. Most states do not withhold taxes from unemployment benefits voluntarily, but you can request they withhold taxes. … Make sure you include the full amount of benefits received, and any withholdings, on your tax return.

When Will Unemployment Tax Refunds Be Distributed

The IRS has begun distributing payments already, starting with those who filed the simplest returns , and then moving on to those with more complicated returns like married couples who filed jointly. Payments will continue to be made throughout the summer, with the goal of distributing all the unemployment refunds by the fall. We will keep you updated as the payments are distributed.

Did The Stimulus Bill Change How Unemployment Is Taxed

Yes. The American Rescue Plan Act of 2021 changed the tax code so that the first $10,200 of unemployment benefits you received in 2020 is free of federal taxes. That means that only the money you received over $10,200 counts toward your taxable income. For couples filing jointly, each person gets up to $10,200 in tax-free unemployment benefits before they have to start paying federal taxes on that income.

This exemption applies to individual and joint filers who made up to $150,000 in 2020. That number is whats known as a hard cliff that applies regardless of whether you file as single, married or any other filing status. So if your households modified adjusted gross income in 2020 was a total of $150,001, you have to pay taxes on all unemployment benefits.

Learn more about the U.S. progressive tax system here.

Important: Many states have not followed the federal governments lead on this. In many states, such as New York, all unemployment benefits are still subject to state taxes. In other states, like California, unemployment benefits are exempt from state tax. And there are some states that simply have no state income tax. Heres how each state is taxing unemployment in 2021.

Also Check: How Much Of Social Security Income Is Taxed

What Can I Do If I Cant Pay My Federal Taxes

If you owe taxes and cant pay them in full, it is important to pay what you can and make a plan. Consider using a payment plan, but note that unless you pay the amount owed in full, you will be charged interest and penalties.

To learn more about your different payment options based on your financial situation, read What to Do if I Owe Taxes but Cant Pay Them.

How Do I Amend My Unemployment In Turbotax 2020

If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted. If you used our CD/download product, sign back into your return and select Amend a filed return. You must file a separate Form 1040X for each tax return you are amending.

Also Check: How To Reduce Taxes In Retirement

Filing Form 940 With The Irs

IRS Form 940 is due on January 31 of the year after the year of the report information. For example, the 940 for 2020 is due January 31, 2021. The best way to file by IRS E-file.

The calculations for FUTA tax are complicated. A payroll processing service can help you figure out how much to pay and when.

I Never Received Form 1099

If you never received Form 1099-G, but you did receive unemployment benefits for the tax year, youre still obligated to report your benefits on Form 1099-G when you file your taxes. Failure to do so may result in heavy tax penalties and fees. Order the form on the IRS website, fill it out, and include it with your tax return.

You May Like: Are Roth Contributions Tax Deductible

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment benefits provided a much-needed lifeline for thousands of Americans dealing with pandemic furloughs and layoffs in 2020. But on April 15 an unpleasant surprise might be waiting for people who got such aid.

According to Kathy Pickering, H& R Blocks chief tax officer, many first-time unemployment recipients dont know those payments count as taxable income for both federal and state returns.

Thanks to extended benefits that stretched up to 39 weeks in some states and additional weekly federal support payments, first of $600 and then $300, unemployment benefit recipients could be facing hefty tax bills theyre unprepared for and ill-able to afford, particularly if they are still out of work.

Legislation proposed by two Democratic Senators on February 2 hopes to prevent this by waiving taxes on the first $10,200 of unemployment benefits a person received last year. However, the bill has yet to be passed and no changes have been made to the existing tax code. So for now, its best to brace for a possible hit from Uncle Sam.

If you relied on unemployment compensation last year, heres what you need to know when you file your 2020 return: how that aid will be taxed ways to reduce your tax bill and your options if you cant pay in full by the deadline.

Donât Miss: Tn Unemployment Sign Up

What If I Cant Pay The Tax Owed On Unemployment

Paying taxes on unemployment insurance payments can seem counterintuitive, since most recipients either are out of work or recently have been. This could lead to a situation where you have a tax bill that you cant afford to pay.

In such a case, its important that you still file a return. If youre unable to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. Theres also a penalty for failure to file a tax return. So try to file on time, whether or not you can afford to pay the full balance due.

If your tax bill is too much for you to pay right now, pay as much as you can to reduce the amount of interest that will accrue. You can also apply to pay the balance in installments, allowing you to make monthly payments. You can request an installment agreement online through the IRS website, by filling out Form 9465, or for help.

Read Also: Where Is My Unemployment Payment

Also Check: How To Pay City Taxes

Taxes Deductions And Tax Forms For Unemployment Benefits

Youre responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance does not automatically withhold taxes, but you may request that taxes be withheld from your weekly benefits when you file your claim.

Your weekly benefits may also be reduced if you have a child support order or if you receive an overpayment on your weekly benefit.

How Much Taxes Do You Pay On Unemployment

If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, were talking about $1,020 in federal taxes that would have been withheld. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

You May Like: How To Learn About Taxes

Paying Taxes When You Are Unemployed

Unless the federal and/or state governments act to change the law, youll likely have to pay federal income tax on the unemployment compensation you receive while out of work because of COVID-19.

You have multiple options for paying your taxes when youre unemployed.

You can choose to have federal income taxes withheld from your unemployment compensation when you apply for unemployment benefits, or you can choose not to do so and just pay estimated taxes each quarter to avoid a tax bill when you file your return.

Of course, you could also wait until you file your taxes and pay any tax you owe at that time. But you may want to think long and hard before choosing that option, especially if youre worried you may continue to struggle financially even after the COVID-19 crisis subsides. The federal tax system is pay-as-you-go, so youre supposed to pay taxes on income as you receive it throughout the year. If you dont pay enough throughout the year, a big tax bill in April might not be your only worry. You could also face a penalty for underpaying your estimated taxes.

If your total income for the year including wages, unemployment benefits, interest, retirement distributions and all other income you made is less than the standard deduction for your filing status, you normally arent required to file a tax return, says Christina Taylor, senior manager of tax operations for Credit Karma Tax®. In that case, you might not need to have tax withheld from your unemployment.

What Is The Federal Tax Rate On Unemployment

If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, we’re talking about $1,020 in federal taxes that would have been withheld. That’s money that could go to cover what income taxes you owe — or possibly lead to a bigger federal income tax refund.

You May Like: How Do I Pay My State Taxes Online

Unemployment Insurance Benefits Tax Form 1099

DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2021. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldnt worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didnt choose to have income taxes withheld from your unemployment checks? Dont panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

Also Check: Maximum Unemployment Benefits Mn

You May Like: How Much Can You Donate For Taxes

Other Factors Youll Need To Consider:

I am collecting unemployment will that impact my income tax?

How Much Money Is Withheld From A Paycheck For Unemployment Insurance

The Federal Unemployment Tax Act authorizes the Internal Revenue Service to collect unemployment tax or insurance. The State Unemployment Tax Act mandates the respective state agency to collect state unemployment insurance. In most cases, an employer is not supposed to withhold unemployment insurance from employee paychecks.

Also Check: How Can I Check My Income Tax Refund Status

Should I Wait To File My Taxes To Claim The Waver

Many out-of-work Americans rushed to complete their taxes to get a possible refund to help make ends meet. The tax break is becoming law after 55.7 million tax returns were already filed by Americans with the IRS, as of March 5.

Some filers may consider waiting to file their taxes until the IRS issues new guidance to claim the new $10,200 waiver, experts say.

To be sure, the stimulus package also offers $1,400 stimulus checks to individuals who earned up to $75,000, and married couples with incomes up to $150,000. Payments would decline for incomes above those thresholds, phasing out above $80,000 for individuals and $160,000 for married couples.

Some taxpayers may opt to file their taxes sooner to get the latest stimulus check, particularly if their 2020 income was lower than in 2019.

Unemployment Compensation Subject To Income Tax And Withholding

The Tax Withholding Estimator on IRS.gov can help determine if taxpayers need to adjust their withholding, consider additional tax payments, or submit a new Form W-4 to their employer. For more information about estimated tax payments or additional tax payments, visit payment options at IRS.gov/payments.

The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax. For a list of state unemployment tax agencies, visit the U.S. Department of Labors Contacts for State UI Tax Information and Assistance. Only the employer pays FUTA tax it is not deducted from the employees wages. For more information, refer to the Instructions for Form 940.

Dont Miss: Can You Have Unemployment And Food Stamps

You May Like: Where Do I Send My Taxes

You May See These Codes On Your Tax Transcript: 971 846 And 776

Some taxpayers whove accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code 290 along with Additional Tax Assessed and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, its best to consult the IRS or a tax professional about your personalized transcript.

How Much Will An Employer Be Liable In Ui For Any Given Employee

If the employer was the only employer that paid wages to the employee during the employees base period, then that employer will be fully liable for the UI benefits collected by that employee. If, however, there were multiple employers, each employers liability will be prorated based on proportionate share of base period wages paid to the employee, provided that, if an employers proportionate share of wages paid was for less than 5% of the total, in most circumstances, the employer will not be required to contribute.

You May Like: What Are Supplemental Unemployment Benefits

Recommended Reading: Where Do My Taxes Go

Where To Find Your 1099

We will mail a paper copy of your 1099-G to the address we had on file for you on December 31, 2021.

We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31, 2022.

It is too late to change your address for the 1099-G mailing, but you can access your 1099-G online.

- Pandemic Unemployment Assistance payments

- Supplemental payments

- Any other kind of unemployment benefit

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2022, even if those payments were for weeks in 2021.

Everyone must pay Federal taxes on Unemployment payments. State taxes depend on the state .

For 2020, if you earned under $150k, the first $10,200 in Unemployment is tax-free .

âStandard paymentsâ and âbonusesâ are both taxable.

- Standard payments

- Weekly payments, either regular Unemployment or Pandemic Unemployment Assistance.

1099-G

Every January, each stateâs Unemployment department provides a Form 1099-G, which includes the total of all your Unemployment payments from the previous year as well as how much federal and state taxes were withheld for taxes. This 1099-G must be included in your tax return.

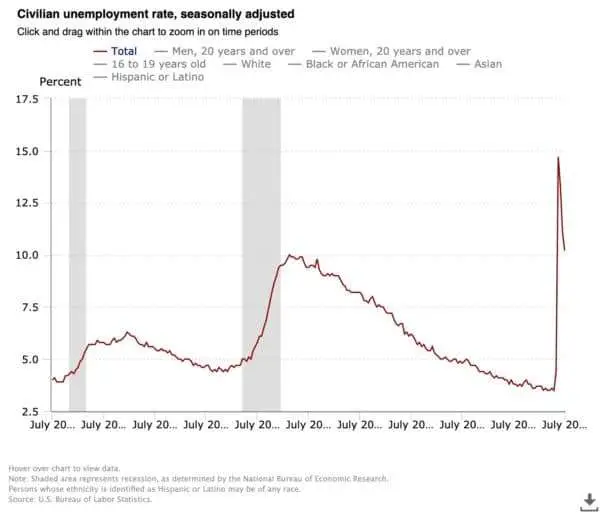

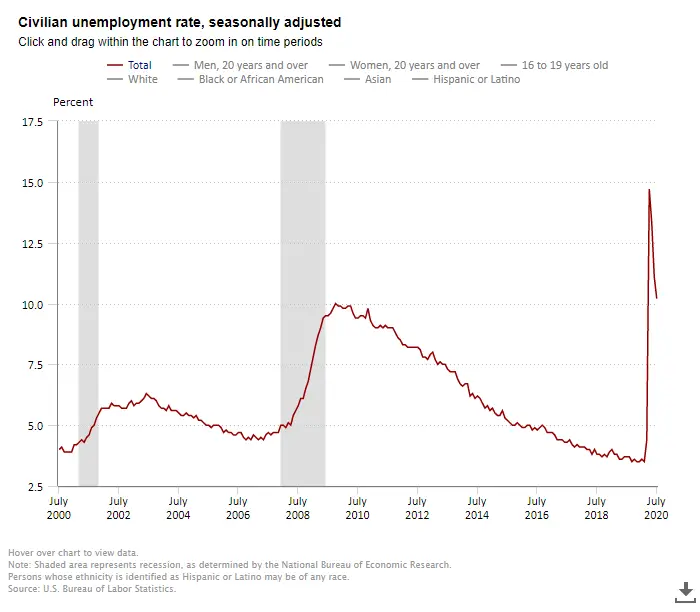

How The Unemployment Landscape Changed

With the U.S. experiencing unemployment rates last year that have not been seen since the Great Depression, Congress had to act quickly to mitigate the effects. To help Americans cope, lawmakers passed the CARES Act, a $2 trillion coronavirus relief package, that boosted unemployment benefits by $600 a week.

The CARES Act also created the Pandemic Unemployment Assistance program, which expanded the eligibility for benefits to include gig workers, independent contractors, self-employed Americans and those who would not traditionally qualify for assistance.

After the initial $600 enhanced unemployment benefits ended in July, an additional $300 boost was granted in August and later extended by lawmakers in December. The $900 billion relief package passed in December extended the program through March 14, as well as the Pandemic Emergency Unemployment Compensation and PUA programs, both of which were set to expire at the end of 2020.

Unemployment benefits replaced about 45% of a worker’s pay nationally in 2019, according the Department of Labor. In terms of dollars, the Brookings Institution estimates that the national average weekly payment was $387 prior to the coronavirus pandemic. But that varies widely by state. Mississippi, for example, paid an average of $215 per week, while those in Massachusetts received $550 per week, on average.

You May Like: How To Do Your Taxes As An Independent Contractor

Types Of Unemployment Tax Breaks

In the past, you could deduct a number of expenses related to your job search, like transportation, relocation costs, and seminar fees. Unfortunately, these deductibles were eliminated by the 2017 Tax Cuts and Jobs Act. But there are still certain ways you can find financial relief during unemployment.

Do You Wish To Have 10% Federal Income Tax Withheld From Your Benefits

You can elect to have federal income tax withheld from your unemployment compensation benefits, much like income tax would be withheld from a regular paycheck. Unfortunately, you don’t have a choice as to how much you want to be withheld. Federal income tax is withheld from unemployment benefits at a flat rate of 10%.

Recommended Reading: What Is The Deadline For Filing Taxes In 2021