Offsetting Short Term Capital Loss

Any short-term capital loss from the sale of equity shares can be offset against short-term or long-term capital gain from any capital asset. If the loss is not set off entirely, it can be carried forward for eight years and adjusted against any short-term or long-term capital gains made during these eight years.

It is essential to consider that a taxpayer will only be allowed to carry forward losses if he has filed his income tax return within the due date. Therefore, even if the total income earned in a year is less than the minimum taxable income, filing an income tax return is a must for carrying forward these losses.

Are you planning to save taxes? Do you want to invest in mutual funds for the same?

The Fi Money app helps you choose from various tax-saving mutual fund schemes. All you have to do is complete your mandate and instruct the app to deduct a fixed amount, say, â¹12,000, on the first of every month and invest in an Equity Linked Savings Scheme of your choice. Investing in mutual funds with Fi Money is smart, simple and secure.

Recommended Reading: Who Can I Talk To About My Taxes

Max Out Contributions To Health Savings Accounts

Like a 401, a health savings account takes money out of your paycheck pre-tax, with the requirement that you spend it on health care costs. Anyone with a high health insurance deductible defined as $1,400 or over for a single person or $2,800 for a family can open an HSA, and there’s no time limit to use the money .

For those who buy health insurance from an Affordable Care Act marketplace, “It’s not too late to open and fund an HSA,” noted Chris Diodato, a financial planner based in Palm Beach Gardens, Florida. “Many banks and online brokerages offer HSAs, and you can contribute and deduct $3,650 if you’re just insuring yourself and $7,300 if you’re on a family plan,” Diodato said.

Although many marketplace plans are HSA-eligible, they don’t automatically open an HSA account when a patient signs up for the health insurance plans, which is why marketplace shoppers should be sure to take a second look, Diodato said.

How Long Do You Need To Hold A Stock To Avoid Capital Gains Tax

If you sell shares of stock for a price greater than the amount you paid for the shares, you will be subject to capital gains no matter how long you have owned the shares. If youve held the shares for less than one year, the gains will be considered short-term. If youve held the shares for at least a year, they will be considered long-term. The advantage of paying long-term capital gains taxes is that the rates are lower than short-term capital gains taxes for most taxpayers.

Read Also: Do You Have To Pay Taxes On Inheritance

Recommended Reading: Do I Need To File Federal Taxes

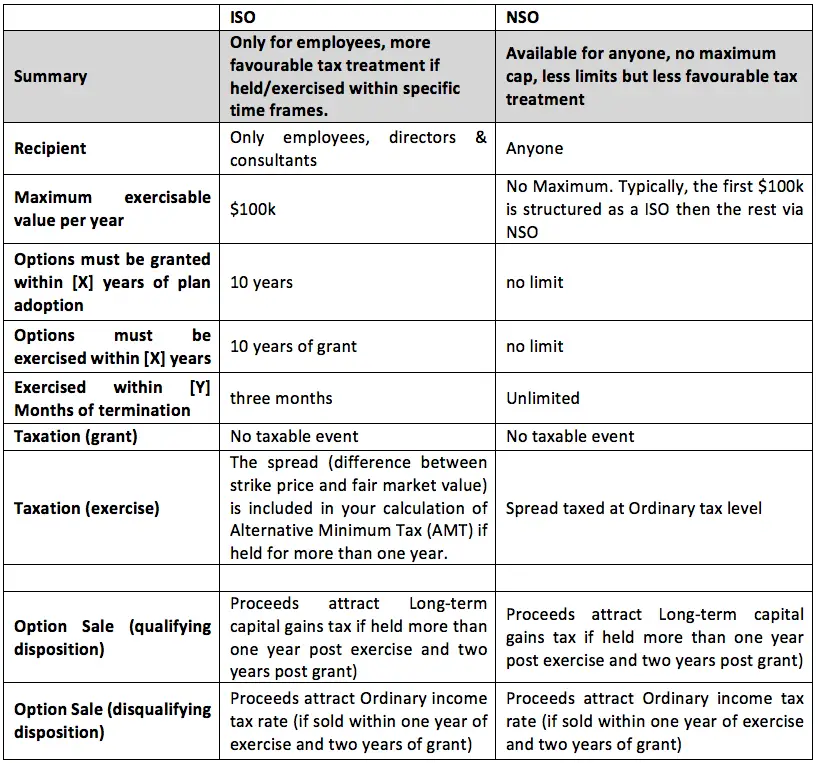

Taxes On Statutory Vs Nonstatutory Stock Options

Stock options are considered either statutory or nonstatutory, and taxes work differently for each type.

- Statutory stock options: You usually dont incur any taxes when you exercise your options, though you may be subject to alternative minimum tax when you file your tax return. When you sell the stocks, any income you make will generally be subject to taxes. The rate at which your profit is taxed depends on a few factors, including whether your options are qualified or non-qualified and how long you have held the stock. Your capital gains will be classified as short- or long-term based on how long youve held the stock.

- Nontatutory stock options: If the common price of the stock is higher than the grant price when you exercise your option, like in the example above, the difference between what you paid and what the shares are worth is usually considered taxable by the IRS. Youll also be subject to short- or long-term capital gains taxes when you sell your stocks.

State Capital Gains Tax On Stocks

The federal government is going to take a bite out of your profits, but dont think the taxes stop there. Depending on the state you live in, youll have to fork over more money.

Most states are going to tax you at the normal rate as your income for any money made from stock growth. There are 9 states that tax less for capital gains:

Living in these states will give individuals some advantages over the regular income tax rate that almost all other states use. In a few more states, like Colorado, Idaho, or Louisiana, there are other tax incentives to reduce the burden on payers.

Different state taxes on capital gains range from 0% for some of the states mentioned above to 13.30% in California. The situation in each state can be dynamic in the future, some taxpayers could be paying as much as 50% for their gains.

Read Also: How To Buy Tax Lien Properties In California

Sell Your Losing Stocks

It’s likely that you’ve made at least a few trades where you’ve lost money on your investments. While it may have stung to been wrong on a stock, there’s fortunately a way to make a bad situation a bit better.

By selling a stock for less than you bought it, you can use the strategy of tax-loss harvesting to your advantage. For example, if you bought a stock for $500 and then sold it for $300, you can take the $200 loss and reduce your taxable income for the year. With this strategy, you can reduce your income up to $3,000 per year. However, to qualify for this tax break, you can’t sell a stock and buy back into the same one within a 30 day period. This is considered a wash sale.

Do I Have To Pay Taxes On Stocks Robinhood

As always, you wont have to pay tax on a stock simply because its value increased. You will, however, need to pay tax on any profits you make when you sell stock. Stocks held less than one year are subject to the short term capital gains tax rate, which is the same tax rate you pay on your ordinary income.

You May Like: Where To Mail Your Federal Tax Return

How Are Dividends Taxed

Dividends are income paid out to shareholders of a stock, mutual fund or other investment. They’re typically paid quarterly or monthly, in cash or shares, and are taxable based on your income and the type of dividend paid.

- Qualified dividends come from investments in U.S. or qualifying foreign companies whose stock you’ve held for at least 61 days of a 121-day holding period. Qualified dividends are taxed at long-term capital gains rates.

- Non-qualified or ordinary dividends, which include most dividends paid to shareholders, are taxed at short-term capital gains rates.

IRS requirements for qualified dividends can be complicated. Fortunately, if you’ve earned dividends of $10 or more from any investment, you’ll receive Form 1099-DIV or Schedule K. These forms report your dividend income as either qualified or ordinary dividends, so you don’t have to make the distinction yourself.

How Capital Gains Are Taxed On Stocks

The tax rates for the capital gains you earn on your stocks are going to be determined by both your tax filing status as well as your adjusted gross income . You will end up being taxed between 0% and 20% of your profit, depending on your filing status. You will likely end up paying either 15% or 20% if your AGI is greater than either $41, 676 as a single filer or $83,350 as a married couple filing together.

In addition to the capital gains tax, high-net-worth individuals or high-earners might end up being on the hook for additional taxes for their investment profits. The net investment income tax can add an additional 3.8% tax on top of your capital gains tax if your modified adjusted gross income is above $200,000 for single filers or $250,000 for married filing jointly.

You May Like: Is Interest From Home Equity Loan Tax Deductible

What Will I Owe In Taxes On My Stock Gains

Here’s where it gets tricky. The amount you owe in taxes on your stocks will depend on what tax bracket you’re in. Short-term capital gains are taxed as ordinary income, just like your paycheck.

We don’t need to go through every bracket here , but for most investors, the rate is tolerably low. For example, a married couple filing jointly with taxable income of $81,051 to $172,750 will be in the 22% bracket. So, if that’s you, and you earned $1,000 in short-term trading, you’ll be paying $220 in capital gains taxes.

If you sold stock that you owned for at least a year, you’ll benefit from the lower long-term capital gains tax rate. In 2021, a married couple filing jointly with taxable income of up to $80,800 pays nothing in long-term capital gains. Those with incomes from $80,801 to $501,600 pay 15%. And those with higher incomes pay 20%.

There’s also a 3.8% surtax on net investment income, which applies to single taxpayers with modified adjusted gross incomes over $200,000 and joint filers with MAGI over $250,000. Net investment income includes, among other things, taxable interest, dividends, gains, passive rents, annuities and royalties.

The important thing to remember here is that most tax software even the cheap ones will generally do these calculations for you. You don’t have to remember any of this. You can just pull the numbers off the 1099-B, input them into your tax program, and voila, the program does the rest.

Do I Have To Pay Taxes On Gains From Stocks

If you enjoyed stock market success in 2021, you might owe the IRS. Here’s our quick, easy guide to paying taxes on your stock gains.

2022 might be off to a rough start, but we started this year with the major stock market indices hitting new all-time highs. That was largely built on momentum from 2021, which was profitable year for many investors, including many first-time investors.

But now that we’ve entered tax season, a great many of them are finding that they have to pay taxes on the wild gains from their stocks.

The Wall Street Journal reported that more than 10 million new brokerage accounts were opened in the first half of 2021, roughly matching number of new accounts for all of 2020 which was itself a huge year for first-time investors.

Recommended Reading: How To Avoid Capital Gains Tax On Cryptocurrency

How To Calculate Long

Most individuals figure their tax using software that automatically makes the computations. You can also use a capital gains calculator to get a rough idea. Several free calculators are available online. Still, if you want to crunch the numbers yourself, here’s the basic method for calculating capital gains tax:

Donate For The Sake Of Donating

With year’s end also being “giving season,” many taxpayers give to charities or donate household goods, or even stock, as another way of lowering their tax liability. While this is a standard move, tax pros caution against charitable giving if your only intent is to lower your tax bill.

The main reason: You’ll only get a tax deduction for giving to charity if you itemize, which the vast majority of Americans don’t.

“Even a thousand-dollar charitable deduction is likely not enough to make you itemize rather than taking the standard deduction,” Slagle said.

Her advice: “Donate to donate don’t donate for the tax deduction. If it’s something you want to do, do it, regardless if you’ll benefit from a tax perspective.”

Recommended Reading: Can I Pay My Pa State Taxes Online

Will My Broker Give Me A Form

In a word: yes.

If you sold any investments, your broker will be providing you with a 1099-B. This is the form you’ll use to fill in Schedule D on your tax return. The beauty of this is that it’s generally plug-and-play. Everything you need can be ripped right off of the 1099-B and inputted into the tax return.

Furthermore, if you received dividends from stocks or interest from bonds, you should also receive a 1099-DIV or a 1099-INT. Often, you’ll all of these forms in a single package from your broker, which is supposed to be sent to you no later than Jan. 31.

How Stocks Are Taxed

The IRS taxes individuals for earned and unearned income. Earned income comes from things like your wages, salary, or tips. Unearned income comes from the gains you make from the sale of stocks and even dividends you are paid. Yes, not even dividend investors will escape the Eye of Sauron that is the IRS.

While some of the top stock brokers dont charge investors commissions, taxes are unavoidable. Uncle Sam dipping into your profits can seriously suck, but the upside is the costs can be calculated and prepared for.

Stocks are going to be taxed based on the gains they generate. If you saw your holdings appreciate in 2020 and then sold them for more than you paid for them, thats again you will owe taxes on the profits.

Capital gains tax rates are categorized as either long-term or short-term. Generally, long-term investments are those that have been held longer than 365 days and they have a lower tax rate than earned income and short-term investments.

Don’t Miss: How To Stop Unemployment From Taking Tax Return

When Do You Pay Taxes On Stocks

Taxes on investment income are usually due on the same schedule as other taxes. For most people, thats when you file your annual tax return, but some people pay quarterly estimated tax or use another fiscal calendar. One exception is if you hold stock in a tax-advantaged account, like a 401, 403, or IRA. In that case, you probably wont owe taxes unless youve made a qualified withdrawal if you have a Roth IRA, qualified withdrawals arent usually taxed at all. Non-qualified withdrawals, however, may trigger tax liability plus a penalty.

Die With Appreciated Stock

The standard calculation for capital gains in your retail brokerage account , IRA, or other tax-qualified retirement plan) after commissions and fees is:

capital gains = sale proceeds cost basis

Should you sell the stock during your lifetime, the net proceeds in this equation are your capital gains . Should you gift the stock, the cost basis carries over to the new owner.

Yet when you die before selling or gifting, this cost basis in most situations is stepped up to the fair market value on the date of death. The stock escapes the capital gains tax on the price increase during your lifetime, regardless of the size of your estate. Thus, no taxable gain is recognized when the inherited shares get sold at no higher than the death-date price.

All the 2020 Democratic presidential candidates seem to be calling for the elimination of this provision. This tax rule, which was not changed when the estate tax income exemption amount increased, is viewed as a tax loophole for super-wealthy people who create sophisticated trusts and estate-planning strategies. However, this tax treatment at death to step up the basis is available for everyone and does eliminate the taxes your heirs and beneficiaries pay.

Don’t Miss: Do You Get Money Back From Taxes

What Is The Capital Gains Tax

Capital gains tax = taxation on your capital gains. So what are capital gains?

Capital gains occur when you sell your securities for a higher rate than you initially paid for them or earned dividends. In the eyes of the government, this market return is likened to income. You can earn capital gains from a number of different assets, including:

There are two types of capital gains taxes: short term and long term.

Back to those dividends. You may incur capital gains even if you didnt sell a security. This is because certain positions earn dividends, which companies typically dole out on a quarterly basis.

The government taxes most dividends at the income tax rate. However, there are certain types of dividends called qualified dividends that the government taxes at just 015%.

Dividends from retirement savings accounts like a 401k or IRA are not taxed.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Is My Tax Refund Calculated