What Happens If Don’t File Taxes

Individuals who owe federal taxes will incur interest and penalties if they don’t file and pay on time. The penalty for not filing your taxes on time is 5% of your unpaid taxes for each month that the return is late, maxing out at 25%. For every month you fail to pay, the IRS will charge you 0.5%, up to 25%.

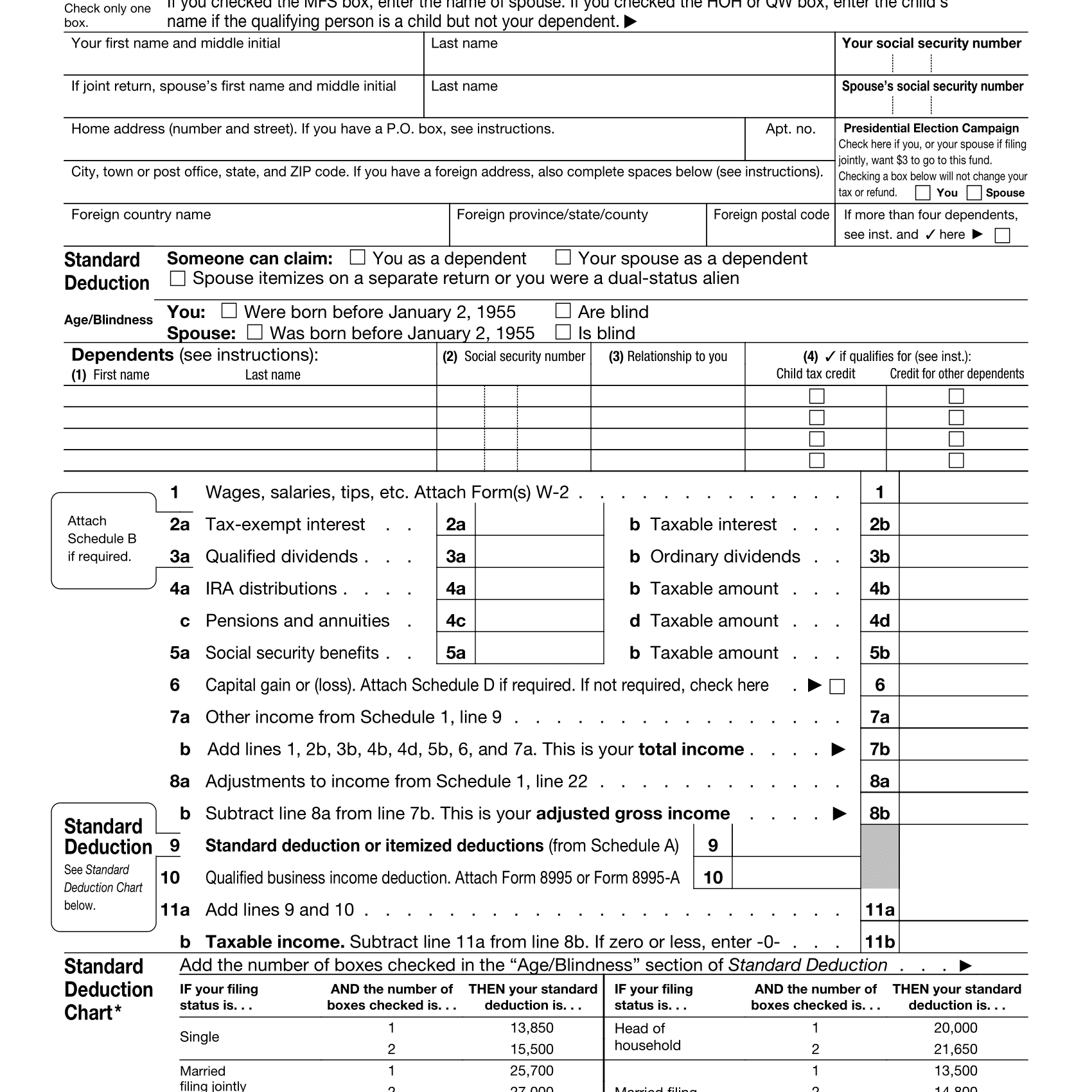

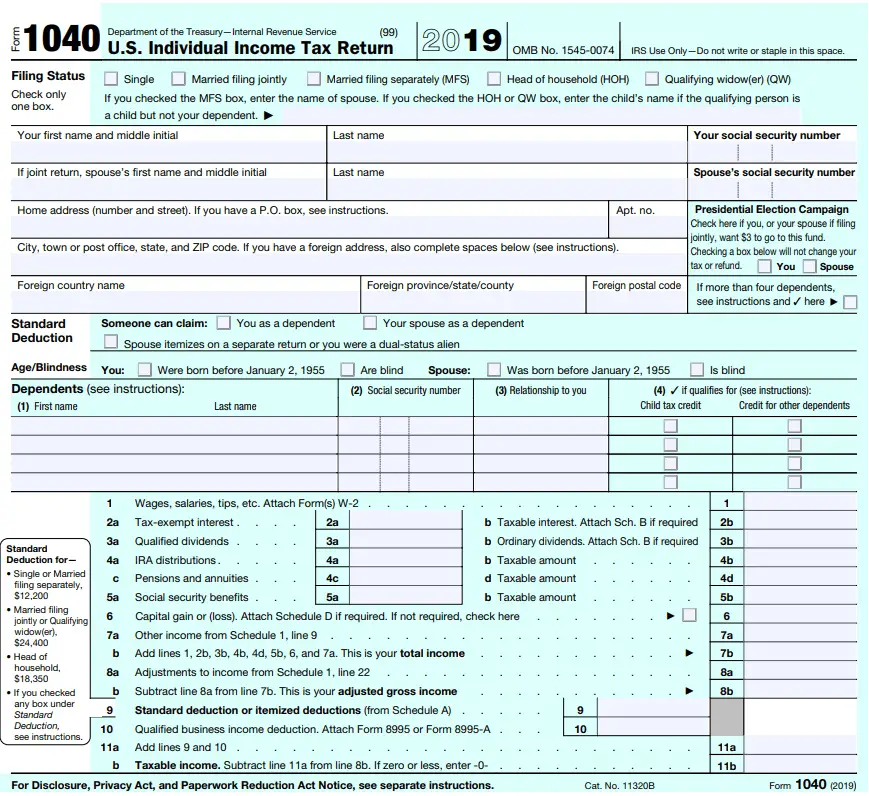

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

How To Get A Copy From Your Employer

If your employer has an online system for viewing and printing W-2 forms, obtaining a copy of your W-2 should be quick and easy. Simply log in to the system and print out the form. If youre an employee, your W-2 should come from your employer by January 31.

If your employer does not have an online system, you must request a copy of your W-2 from your HR department. They should be able to provide you with a physical copy or an electronic version that you can print out yourself.

If you cannot obtain a copy of your W-2 from your employer or a previous employer, you can always request one from the IRS. The IRS can take up to six weeks to process your request, so it is best to try and get a copy from your employer first if possible.

Read Also: When’s The Last Day To File Your Taxes

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

What Is The Fastest Way To File Taxes

The fastest way to file taxes is online. IRSs e-file system enabled 122 million taxpayers to file their returns electronically last tax year. According to the IRS, e-Filed returns not only offer better accuracy. They also provide better security and faster refunds.

With TurboTax, you can do your taxes, your way. Do it yourself, get expert help, or hand it off start to finish lets get your taxes done right.

Recommended Reading: How Much Does It Cost To Amend Taxes

Ology: How We Select The Best Free Tax Software

CNET reviews tax software by comparing products across a set criteria. We use the software to prepare personal tax returns, examine tax products’ terms and offers, communicate with software representatives to resolve questions about products, compare feature sets and analyze each software for its effectiveness in common tax situations.

We consider the features and functionality of the tax preparation software, the user experience, the software interface, website performance, quality of help and support, and the value based on price. We are also looking for and evaluating specific features, including file importing or photo capture of forms, number and type of available IRS forms and schedules, contextual help, desktop and phone/tablet compatibility and syncing, professional tax assistance, maximum refund and accuracy guarantees, live support and security protections.

Specifically for best free tax software, we consider the limitations and restrictions of the free services offered, unique features for each service, functionality related to low-income tax filers, in-person support and assistance, and whether or not a free state tax return is included with the free federal return.

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it can also help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, doesn’t make enough to earn a Social Security credit, and doesn’t want to open a retirement account, learning how the tax system works is important enough to justify the effort.

Read Also: What Is The Tax Assessed Value Of My Home

Is My Personal Information Safe With You

We offer state-of-the-art encryption to help keep your data secure, with two-step verification for an added layer of security. Wealthsimple Tax is also certified by the CRA and Revenu Québec.

Have a tax question we haven’t tackled?

*PitchBook Benchmarks **PitchBook Benchmarks Accolade Partners

Generally, any offer or sale of, or advice related to, any securities described in this material will be made only by an adviser or dealer registered in the appropriate registration category in the applicable Canadian Jurisdiction. No Canadian securities regulatory authority has reviewed or in any way passed upon this information or the merits of any securities described here, and any representation to the contrary is an offence.

An investment allocation to Wealthsimple Venture Fund I and its direct and indirect underlying funds will be subject, directly or indirectly, to management fees, incentive allocation and other fund expenses.

How Much Is The Child And Dependent Care Tax Credit

The child and dependent care tax credit covers work-related or school-related expenses while youre working or looking for work. You can claim up to $4,000 of expenses per child under 13.

The American Rescue Plan Act, which was signed into law on March 11, 2021, made the credit significantly more generous .

However, taxpayers with an adjusted gross income over $438,000 are not eligible for this credit even though they may have previously been able to claim this credit.

You May Like: How To Lower Your Tax Bracket

How To Get A Copy Of My W2 Fast

If youre one of the many people who are wondering how to get a copy of their W2 online fast, youre in luck.

This article will explain how to get a copy of your W2 online in just a few simple steps. By following these steps, you can get your W2 form quickly.

Get Organized For Next Year

If you end up with a big tax refund or a large tax bill, you probably want to go ahead and adjust your withholdings so that youre not taking too much or too little out of your paycheck for taxes.

And one more thing: Once your taxes are signed, sealed and delivered to the IRS, you might be tempted to celebrate by starting a bonfire and burning all those receipts and tax forms in a blaze of glory dont do that.

Instead, promptly file any tax documents and important receipts when you receive them so you dont have to search the house for them next spring. Buy a few manila folders, an accordion file or a filing systemthat will hold your tax documents and save those documents for at least three years. You might need them if the IRS comes knocking.

Also Check: How To Pay Off Back Taxes Fast

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

What Is The Best Free Tax Software

Based on its feature set, included IRS forms, interface and support, Cash App Taxes earns CNET’s pick for best free tax software in 2022.

Cash App Taxes’ biggest strength is that it will work for almost any tax filer. Its very short list of restrictions includes foreign income, nonresident state returns, increased standard deduction , and married filing singly in community property states.

Cash App Taxes doesn’t even have any paid tax preparation services, so you don’t have to worry about pitches for upgrades. If you can file your return with Cash App Taxes, it will certainly be 100% free. It works with every state that requires a tax return except for Montana.

The level of support in Cash App Taxes is not comparable to top products like TurboTax or H& R Block, but it does include live chat and contextual help content.

You May Like: Do I Need To Charge Sales Tax Online

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

What Should I Expect When Filing Taxes Online

Filing taxes online should be a quicker process than completing your return by hand. If you have a simple tax situation, you shouldnt expect to spend a long time preparing your tax return.

For example, if you only have W-2 income and claim the standard deduction, your tax return shouldnt take long to prepare, review, and e-file.

On the other hand, if you have a more complex tax situation, you may still need to enter a good amount of data manually, especially if you are itemizing your deductions or claiming certain tax credits.

For example, if you have several investment and bank accounts, work for yourself, have rental property, claim tax credits, or need to account for the Alternative Minimum Tax , your tax return may take a while longer to prepare.

Tax software can assist with handling these finer details and also provide objective explanations on the impacts of taking certain tax positions. Should you need help, several tax software packages offer to connect you with a qualified tax professional to answer questions, guide you through preparing your return, and check for any missed deductions or credits you might qualify for.

Recommended Reading: How To Know If You Owe Federal Taxes

Where To File A Simple Tax Return For Free

All of Selects best tax software programs offer the opportunity to file a simple tax return for free. The only exception is TaxAct, which charges $39.95 to $54.95 per state return filing a simple federal tax return is free.

Here are your options:

- Accuracy and maximum refund guarantee

- Better Business Bureau rating

- Customer reviews, when available

Cost was one of the most important factors. While many of these services offer free versions, many people have complicated finances that require them to pay to file their taxes. We evaluated the price per plan and weighed the features you receive, like the ability to maximize deductions and credits. The more bang for your buck, the higher a service ranked.

Whether youre new to filing taxes or a seasoned pro, user experience is crucial to filling out and submitting your return quickly and with little frustration. The services we chose had to be relatively user friendly.

The ability to speak with a tax expert or support representative was a big plus. Four out of five of the best tax software offered some form of support.

And if a service supported consumers with a generous accuracy and maximum refund guarantee, it was ranked higher.

We also considered the Better Business Bureau rating associated with the software. BBB ratings help determine whether a business is operating responsibly and if it helps to resolve customer complaints in a timely manner. Customer reviews were also taken into consideration.

Editorial Note:

Goodbye Paperwork Hello Auto

-

Auto-fill your return

Seamlessly import your income tax slips and investment info from CRA, Revenu Québec, and Wealthsimple accounts to speedily complete your 2021 return.

-

Smart search

Quickly find all the forms, deductions, and credits you need to file easily all by searching simple keywords.

-

The simple way to declare crypto

Link your crypto wallets from multiple exchanges and have the capital gains or losses on your transactions calculated automatically.

-

Optimize your return

Our platform automatically finds the optimal split for donations, medical expenses, and more to make your return work for you.

Recommended Reading: How To File Nj Taxes

I Traded Stocks And Crypto Last Year Can Wealthsimple Tax Handle Calculations Like Capital Gains Or Losses

You bet Wealthsimple Tax can be an easy and seamless solution for investors. Link your Wealthsimple accounts to have your trades on stocks and crypto sorted automatically even if you hold crypto in other places. Check out our Help Centre for more details and the full list of supported exchanges.

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Don’t Miss: When Are Va State Taxes Due

How Do I Use Free Tax Software

Free tax preparation software allows you to complete all of the necessary forms for your tax return and file them with the IRS. Simple, guided interviews let users answer questions that populate electronic IRS forms for completing their income tax returns.

These free tax programs include reviews of your tax return and options to receive your tax refund by direct deposit or as a check in the mail.

Free tax software users should be wary of paid upgrades. Some software publishers earn money by enticing free filers to upgrade for extra support or required IRS forms that aren’t included with free versions. If the software you’re using requires an upgrade while you’re filing, see if Cash App Taxes will work for you — it includes the vast majority of IRS forms at no cost.

What If You Dont Qualify For A Simple Tax Return

If your taxes are a bit more complicated, youll need to file a complex tax return. Most tax software programs will charge you fees to file complex returns. Here are some scenarios where you wont qualify for a simple tax return:

- Youre self-employed or a freelancer

- Youre a small business owner

- You earn rental income

- You have earnings from investments, like bonds and stocks

When you’re going through the tax filing process using an online service, you’ll receive notice if you cant file a free simple tax return and instead need to upgrade and pay for a more complex return.

Read Also: What Forms Are Needed To File Taxes

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

How To File Your Taxes Online For Free

Anyone with simple tax returns can file their taxes for free. Here are some optionsand how to use them.

For the past six years, Milagros Melendez, a 72-year-old retired home-care worker, has filed her taxes digitally with the help of volunteer tax professionals in an immigrant-assistance program.

The program, called the Volunteer Income Tax Assistance , is just one of many free tax filing options available to consumers.

For Melendez, who lives in a predominantly Latino neighborhood in Northern Manhattan, the free service offers peace of mind. Her tax preparation is performed by volunteers who speak Spanish and who must take and pass tax-law training that meets or exceeds Internal Revenue Service standards.

Ive never dedicated myself to learning about taxes, it just wasnt my area of expertise, she says.

Plus, now that shes retired and on a fixed income, using the free tax prep service eliminates a financial burden. Before, she would go to her neighborhood tax preparation service, a travel agency, which, she says, charged her around $125.

And since the service files her taxes digitally, the time for processing and delivery of any refund is expedited.

With that in mind, here are some options to consider.

You May Like: When Will The Child Tax Credit Payments Start