North Texas Students Get Taste Of West Africa In Immersive Experience

The chairman of the House Democratic Caucus wants to see it higher, pointing to the surplus and rainy day fund.

I say why stop at 70? That is a good start, I think we can do better than that, said Texas House Democratic Caucus Chair Trey Martinez Fischer.

Telvin Branch will be paying attention. He is a first-time homeowner who has been in his home for just over a year.

Who doesnt want savings? You know, I would love to have extra spending money for something else toward my home rather than just paying it in taxes, said Telvin Branch.

Both the House and Senate must agree on a budget.

This article tagged under:

Texas Property Tax Increase 2022

Property tax bills may be shocking in 2022! If youve received your tax bill as a property owner, you may wonder why the taxes increase yearly. Its because local governments in Texas rely heavily on property tax revenue to pay for salaries of police officers and firefighters, as well as for government services including roads, libraries, and public schools.

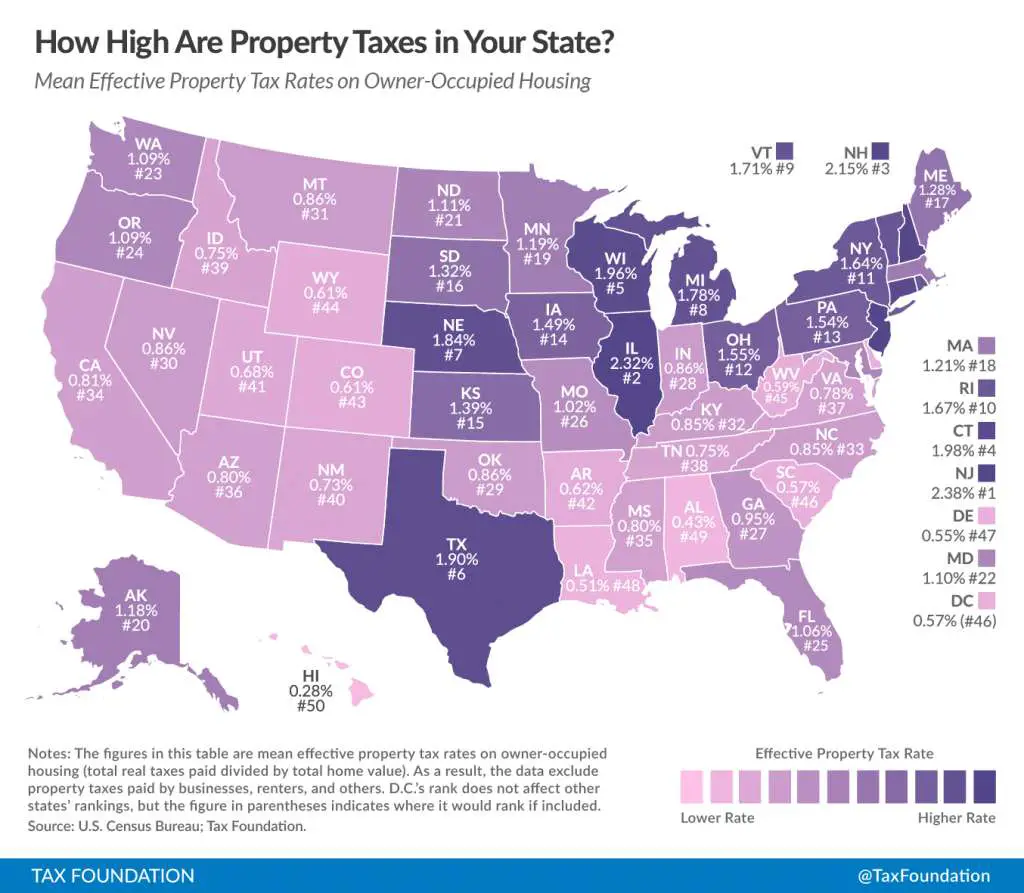

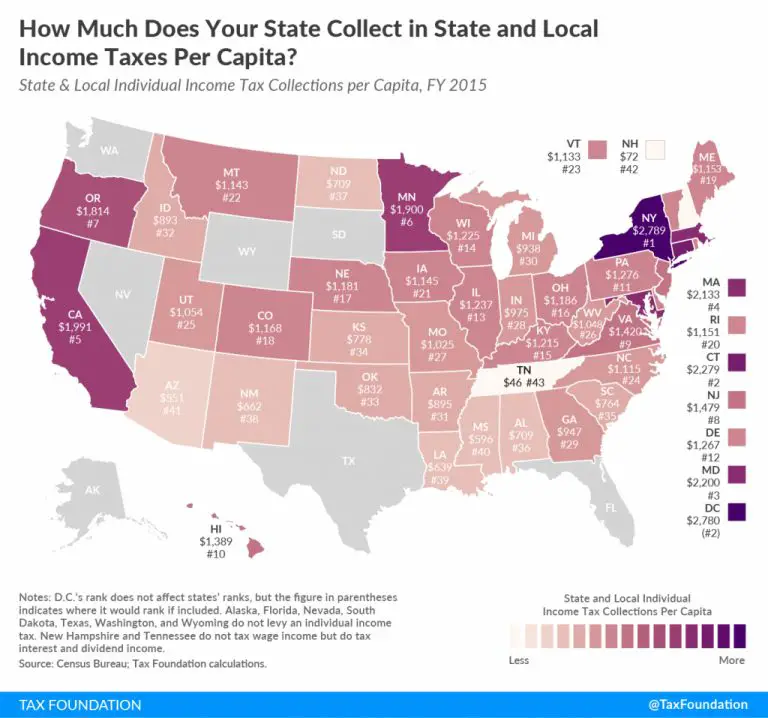

Unlike most other states, Texas does not have a state income tax, and property tax bills are among the highest in the nation According to the comptrollers office, property tax collections have risen more than 20% since 2017.

Rising property taxes result when appraisal districts and local taxing entities need a proposed tax rate increase to cover their expenses. There is then a vote. If voters approve tax increases, your taxes can go up. A tax increase increases total property tax revenue to meet your countys needs.

For example, Harris county uses the tax collected to finance its general government expenditures. These expenses may include school districts also.

What Information Will I Find On The Truth In Taxation Website

The website provides information from your local appraisal district and local taxing units to determine a property tax estimate for properties in your county. Taxpayers can see how the changes between the no-new-revenue rate and proposed tax rates would affect the amount of taxesâ¯they would have to pay. The current yearâs information will be available online beginning in early August 2021 and updated regularly as each taxing unit updates their information.

Taxing units must hold a public hearing on the proposed budget and tax rate and publicize the date, time, and location. The website includes details on the public hearings for your county and their proposed budget and tax rate. Additionally, the website gives you an opportunity to provide feedback to your taxing unit.

Don’t Miss: What Is The Sales Tax In Alabama

Texas Property Tax Calendar

Effective date of valuation. Improvements constructed after January 1 are not taxable in the current year.

Appraisal districts send notices of assessed value if they revalue property.

May 15thDeadline to file a property tax appeal.

May to SeptemberAppraisal district and appraisal review boards conduct hearings.

Tax entities set tax rates

Tax entities send tax bills

Property tax payments are due the later of January 31 or 30 daysafter the tax bill is mailed.

Property Owner Has Right to Protest Late Assessments

Assessment of Split-Outs Can be Years Late

Tax Due Date for Late Assessments

Who Sets My Property Tax Bill

Texas has no state property tax. Local governments set tax rates and collect property taxes that they use to provide local services including schools, streets, roads, police, fire protection, and more. Your locally elected officials decide your property tax burden. These local officials can also help answer questions and respond to inquiries.

The Texas Legislature does not set the tax amount of your local taxes nor does your local appraisal district.

Read Also: What Do You Claim On Your Taxes

Texas Property Tax Loans

Even if you have the best intentions, circumstances can crop up in anyones life that make paying property taxes a challenge. Reputable property tax loan companies like American Finance & Investment Company, Inc. understand the cash flow challenges that home and business owners face and can step in and give you a loan to pay property taxes no credit check or deposit required. This means fast, effective tax relief that allows you to keep your home or business. Our compassionate, skilled team will quickly settle your Texas property tax bill and structure your loan repayments to be as affordable as possible.

Texas Property Tax Rates

Property taxes are collected on a county level, and each county in Texas has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Texas.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Texas. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Texas.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Texas property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Texas Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Texas.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

Don’t Miss: How To Qualify For Farm Tax Exemption

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

Reason Number Two Property Values Are On The Increase

How Are Property Taxes Calculated in Texas in Relation to Property Values?

Ad Valorem Tax is based on an items assessed value, so ad valorem property taxes refer to the assessed value of a property. Texas tax laws dictate that an appraisal district in each county, administered by a chief appraiser, is responsible for appraising property values each year.

For a the appraisal of a taxable property, property tax is determined as a percentage of your homes value, so the more your home increases in value, the higher your property tax bill will increase. For example, a residential property in Austin that is appraised at a value of $250,000 will pay around $4,933 per year. If this same homes value increases to $275,000, the annual property tax bill will increase to $5,426. This is great for selling your home but is a substantial increase in annual taxation if youre not. If property owners do not agree with the property appraisal value or find that their home has been overvalued, they can lodge a formal protest with the appraisal review board to have the property re-evaluated.

Don’t Miss: How To File Llc Taxes As S Corp

Why Are Property Taxes In Texas So High

Texas local governments rely heavily on property taxes to paythe salaries of police officers and firefighters and for government services like roads, libraries, parks and public schools. Coupled with the fact that Texas has no state income tax, Texans property tax bills are among the highest in the nation.

Texas homeowners pay a higher proportion of their home value toward property taxes than most homeowners in other parts of the nation, according to the Tax Foundation. Texas depends more on property taxes than almost any other state to pay for government services edged out only by New Hampshire, Alaska and New Jersey.

In no arena is that more apparent than in Texas public schools which depend greatly on property taxes for funding.

School districts use local property tax revenue to cover as much of their base budgets as possible then the state chips in the rest. Over time, that formula has often resulted in fewer state dollars paying for public education as local property values have grown.

In any given year, revenue from property taxes makes up more than half of the states pot of funds to pay for public schools, the rest of which comes from state and federal sources. Of the $69.3 billion that went to public education in fiscal year 2020, property taxes kicked in $38.4 billion while the state provided $23.3 billion. The rest came from federal funds.

Which Counties Have The Lowest Property Taxes In Texas

Each county in Texas is responsible for setting its own property tax rates, resulting in taxes in Texas that vary across the state. When you compare property taxes with other counties, keep in mind that, typically, counties with low property taxes have smaller populations. As of 2020, the five counties with the lowest property tax rates in Texas were:

Recommended Reading: What Is Futa Payroll Tax

Reason Number Three These Taxes Are Set At A Local Government Level

The State of Texas doesnt determine what your property tax bill will be, as this is set by your local authorities. While this is a good thing in some ways, as it keeps the power to change taxes local to your own community, it does mean that the state government cant act to regulate or influence this taxation. The most they can do is pass a bill that tightens regulations on tax hikes, pass a law that allows residents of Texas to vote on tax increases in their local community, or increase state funding for public education . For these changes to occur, they would have to be passed by the state legislature, which hasnt happened at this point. In fact, state funding for public education has dropped in recent years from 45% to 38%.

Washington State Property Tax Rates

Property tax rates in the Evergreen State can be divided into two groups: general, non-voter approved rates, and voter-approved special levies. Non-voter approved rates are used to support the ongoing functions of municipalities and counties, while voter-approved levies have specific purposes .

The Washington State Constitution limits the total of all non-voter approved property tax rates to 1% on a given property. Even if your county rate is 1% and your city rate is 0.75%, your total general rate will still be 1%. There is no limit on voter-approved levies, so it is common for a total rate to exceed 1%.

Tax rates in Washington State are expressed in dollars per thousand in assessed value, equal to one-tenth of a percent. The table below shows the effective tax rate for every county in Washington State, which is the amount paid annually as a percentage of overall home value.

| County |

|---|

Looking to calculate your potential monthly mortgage payment? Check out our mortgage loan calculator.

Read Also: How To Find Property Tax Information

Property Tax System Basics

Translation:

Property taxes provide the largest source of money that local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the property’s value, ensuring that values are equal and uniform, setting tax rates and collecting taxes.

Texas has no state property tax. The Texas Constitution and statutory law authorizes local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

The property tax system consists of officials who administer the process, property tax agencies, and the laws or regulations that govern what they do.

Officials in the property tax system consist of the governing bodies who oversee the operations of local property agencies also known as a taxing unit. There are several types of local taxing units, cities, county, school districts, junior colleges, and special districts who set tax rates, collect, and levy property tax to fund annual public services. Cities, county, and junior colleges have access to other revenue sources, a local sales tax. School districts rely on local property tax, state, and federal funding.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

How Is This Tax Calculated

Real property tax rates vary from state to state. In fact, state and local governments use various methods to calculate your real property tax base. In Texas, real property taxes are assessed based on the market value of your property. View more information on how Texas properties are assessed.

Your propertys value is determined by a tax assessor. The assessment is based on the market value of the real property, which can be calculated by sales comparisons, the cost method, or the income method.

The state typically assesses the real property value by estimating the real property cost. Some states tax the entire assessed value of the real property . Others tax a part of the assessed value.

Assessments can be performed every year or even just once every five years depending on local laws. If you receive an assessment, you will get your estimated value first, then your real property tax bill.

Don’t Miss: When Are My Taxes Due 2021

What Are Property Taxes

For property tax purposes, January 1 of each year is the effective date of the tax roll. A tax lien is automatically attached to all taxable properties on January 1 of each year to secure the tax liability. During the course of the year, there are several phases involved in the taxation process.

During these phases, appraisal districts identify and appraise all real and business personal properties. The governing bodies of the taxing jurisdictions adopt a tax rate to support their fiscal year budget. In the final phase, the Tax Assessor-Collector assesses and collects property taxes for each of the taxing jurisdiction they are responsible for collecting.

The Texas Franchise Tax

Texas has no individual income tax, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. The rate increases to 0.75% for other non-exempt businesses. Also called a “privilege tax,” this type of income tax is based on total business revenues exceeding $1.23 million in 2022 and 2023.

Read Also: How To Apply For Tax Exemption

A Brief Background Of Property Taxes In Texas

The high property taxes in the Lone Star State are needed to compensate for the fact that there is no individual income tax in Texas. Texas is one of the 9 states in the USA that does not impose income tax on its citizens, which is something most residents really enjoy. However, as a result, the counties need to get their funding for public services like schools, libraries, parks, roads, and emergency services from another source, which is where property taxes come in.

Property taxes in Texas are set at a local government level as there are no state property taxes, so theyll be different from county to county. For example, property taxes in Dallas county are an average of 2.74% of your propertys estimated value . The same home in San Antonio will cost you around $6,6500 as it has an average of 2.66% property tax. In Terrell County, youll pay around $5,600 in property taxes on that same house, with an average 2.24% property tax.

What Is Truth In Taxation

Truth in Taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to limit or approve tax increases. The type of taxing unit determines its applicableâ¯Truth in Taxation requirements.

Read Also: How Do I Pay My State Taxes In Missouri

Overview Of Florida Taxes

At a 0.83% average effective property tax rate, property taxes in Florida rank below the national average, which currently stands at 1.07%. Median annual property tax bills in the Sunshine State follow suit, as its $2,035 mark is over $500 cheaper than the U.S. median.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

How Do You Pay Texas Real Property Tax

If you pay your mortgage, you are likely already paying your Texas property taxes. A standard mortgage payment usually includes:

- Homeowners insurance

- Texas real property taxes

Look at your current mortgage statement and determine if your Texas real property taxes are paid as part of your monthly mortgage. It will likely be listed as a line item on the statement.

You can check with the Texas government at for more information.

Also Check: How Much Taxes Does Illinois Take Out Of Paycheck