Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct-deposited or mailed your refund.

The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

I Received A Form 1099

If you claimed itemized deductions on your federal return and received a state refund last year, you will receive a postcard size Form 1099-G statement. This form shows the amount of the state refund that you received last year but does not mean that you will receive an additional refund. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income tax paid as an itemized deduction on your federal income tax return. Please view the Frequently Asked Questions About Form 1099-G and Form 1099-INT page for additional information about Form 1099-G and Form 1099-INT.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real-time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Read Also: How Do Day Traders Pay Taxes

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

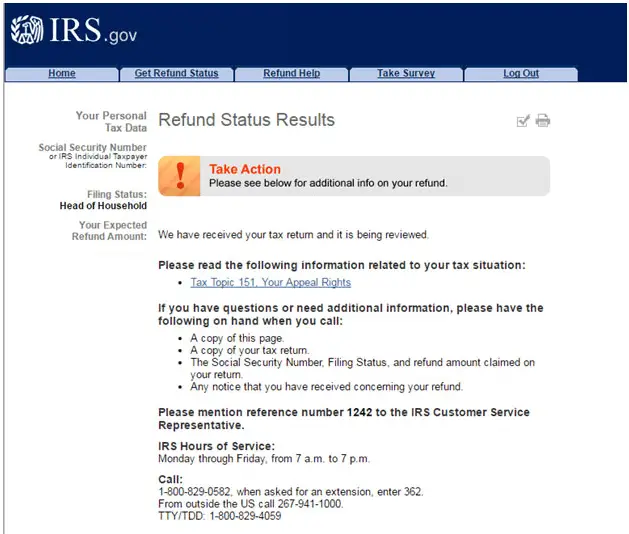

Don’t Let Things Go Too Long

If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

Don’t Miss: When Are We Getting Our Taxes

How Do I Calculate My State Tax Refund

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Also Check: How To Keep Receipts For Taxes

Do I Need An Id To Cash My Tax Refund Check

Regardless of where you cash your tax refund check, you should expect to show identification. A valid ID may include a state-issued photo drivers license or identification card, an unexpired passport, or a permanent resident card. In some cases, you may be able to provide a birth certificate and proof of your social security number if you dont have a valid picture ID.

Usps Informed Delivery: How To Get Notifications

Informed Delivery has some limitations. For example, it will work with many residential and personal post office box addresses — but not businesses. It also won’t work for some residential buildings where USPS hasn’t yet identified each unit.

To check whether Informed Delivery is available in your area, head to the Postal Service’s Informed Delivery page.

1. Tap Sign Up for Free.

2. Enter your mailing address and confirm that it’ll work with the service then accept the terms and conditions and tap Continue.

3. On the next page, choose a username, password and security questions. Enter your contact information and tap Continue.

4. On the next page, you’ll need to verify your identity. Tap Verify identity online if you want to receive a verification code on your phone or tap Request invitation code by mail if you want the USPS to mail you a code. You may also have the option to visit a post office to verify your identity in person.

You May Like: When Are Nc State Taxes Due

Who Qualifies For An Inflation Relief Payment

Roughly 23 million California residents are eligible for the rebate plan, which has been set up in three tiers based on the adjusted gross income on your 2020 California state tax return. Residents who filed individually and made $250,000 or less or couples who filed jointly and made $500,000 or less qualify for a refund.In addition to income requirements, residents must have filed their 2020 tax refund by Oct. 15, 2021, have lived in the state of California for at least half of the 2020 tax year and still be California residents on the date the payment is issued. Individual filers who earned more than $250,000 and couples who made more than $500,000 combined in 2020 aren’t eligible for the payments. You also cannot have been claimed as a dependent by someone else in the 2020 tax year.

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 2 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

Don’t Miss: Which State Has The Lowest Tax Rate

How To Check On Your State Tax Refund

Any state tax refund you have coming can come at a variety of times, depending on what state you filed in. Most of the time, state returns are processed faster than federal returns. Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Checking The Status Of A Federal Tax Return Over The Phone

You May Like: How To Calculate Sales Tax From Total

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

Start Tracking Right Away

Another myth is that theres no way to tell where your refund is until you get it and you’ll be asking ‘Where’s my refund?’ for a while. Reality: You can track your IRS refund status in fact, if you file using tax software or through a tax pro, you can start tracking your IRS refund status 24 hours after the IRS receives your return. If you’re thinking ‘Where’s my state refund?’ there’s good news: You can also track the status of your state tax refund by going to your state’s revenue and taxation website.

You May Like: How To Figure Out How Much Property Tax I Paid

Looking For Information About Your Tax Refund

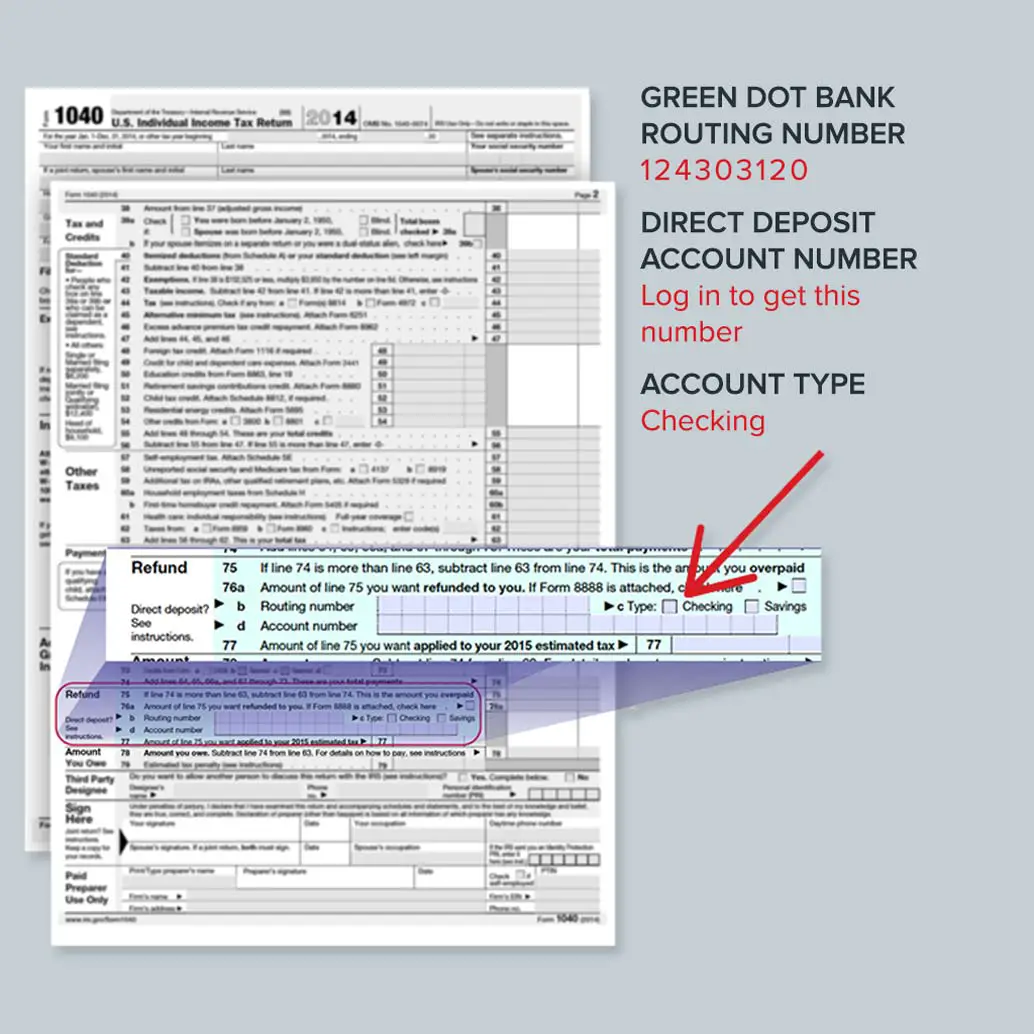

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Also Check: Do You Pay Taxes On Social Security Disability

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

One More Thing To Know About Your Tax Refund

It’s actually something you kind of want to avoid. It may seem great to get a big check from the government, but all a tax refund tells you is that you’ve been overpaying your taxes all year and needlessly living on less of your paycheck the whole time.

For example, if you got a $3,000 tax refund, you’ve been giving up $250 a month all year. Could having an extra $250 every month have helped with the bills? If you want to get that money now rather than later, you can adjust your withholdings by giving your employer a new IRS Form W-4 .

Recommended Reading: How Many Years Do You Have To File Taxes

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

What Is A State Tax Lien

Read Also: What’s The Deadline For Filing Taxes

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.