What If I Am Not Registered Formyaccount

You can get a paper version of your Statement of Liabilityif you complete a paper Form 12 or Form12S and return to yourlocal tax office.

Unless you are exempt from using Revenues online services, you mustregister with myAccount to access your Employment DetailSummary and Preliminary End of Year Statement.

If you have been granted an exemption, you can access your documents asfollows:

- Employment Detail Summary: Contact your local tax office by phone or in writing and request your Employment Detail Summary. A printout will be posted to your home address.

- Preliminary End of Year Statement: Your Preliminary End of Year Statement will not be available to you as a printout. You can contact your local tax office who can advise you of your position over the phone.

How do I qualify for an exemption from using Revenues onlineservices?

You may qualify for an exemption if you do not have the capacity to makereturns and payments electronically.

Revenue may grant you an exemption if:

- Your internet access is insufficient or

- You cannot file online because of age or a mental or physical disability

If you want to apply for an exemption, you write to your local tax office tostate why you are unable to file online. You should write Exclusionrequest on the envelope.

If Revenue refuses this request, you can appeal the decision. To do this,you must complete a Noticeof Appeal form and send it to the Tax Appeals Commission .

How To Reduce Your Tax Liability

If youre not among the group with no income tax liability and you want to reduce your tax bill, what can you do? There are a few strategies.

How Is Tax Liability Calculated

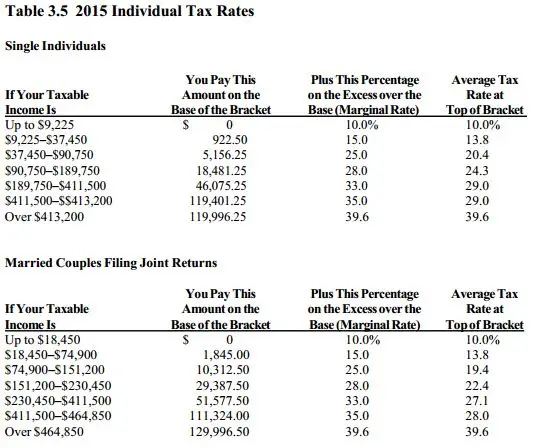

Now, lets put all the pieces together. Taking each of the concepts outlined abovemarginal tax rates and brackets, refundable and nonrefundable credits, and standard and itemized deductionshere is an example of how a taxpayers overall liability might be calculated.

Nate is an engineer and earns $75,000. Emily teaches 7th grade and earns $50,000. The couple has two children, ages 7 and 9. In Scenario 1 they rent a townhouse and have no itemized deductions. In Scenario 2, they own their own home and pay $16,000 annually in mortgage interest. They pay a combined $10,000 in property taxes and state income taxes and contribute $2,000 to their church and various charities.

Lets compare their tax liability in the two scenarios:

Read Also: How To Pay Pa State Taxes

How To File W

- Web Upload – file-based system, multiple file types accepted, files often created using payroll software

- eForms – fillable electronic forms, no files or signup required, best for companies with a small number of employees or payees

- Combined VA6H/ W-2

Note: Your Annual or Final Withholding Summary is separate from W-2 and 1099 data. You are required to send both by Jan. 31. You can file your VA-6 using your regular filing method .

Each method requires authentication as described in the guides below:

If you need help with Web Upload, email us at . If you need help with eForms or have questions about your filing requirements, please call Customer Services.

If your business is required to file Form 1099-K with the IRS, youll also need to file a copy of each 1099-K related to a Virginia taxpayer or an individual with a Virginia mailing address with Virginia Tax.

If your business is a third-party settlement organization and paid $600 or more to a Virginia payee, or to a payee at a Virginia mailing address, you will also need to file a Form 1099-K for that payee with Virginia Tax. This may mean youll need to file 1099-K forms with Virginia Tax that you would not need to otherwise submit to the IRS. You should also send a copy of this form to the payee by February 28, 2022..

These new requirements are in effect for tax year 2020 and later.

Contribute To A Retirement Fund

Contributing to a retirement fund does more than help you save for and grow your retirement nest eggif carefully planned, you can reduce your tax liability for years to come. You can contribute a specific amount per year to your IRA, which is tax-deferred. You contribute to a Roth IRA after you’ve paid taxes.

To lower your tax liability by contributing, you’ll only need to determine how much you plan to be taxed in retirement by projecting your income and withdrawals. If you’re in a higher tax bracket now than you will be in retirement, a traditional IRA can lower your total tax payments because:

- Taxes are deferred

- You’ll be in a lower bracket with less tax liability later

If you’re sure you’ll be in a higher tax bracket after you retire and begin taking withdrawals, a Roth IRA can lower your total tax payments because withdrawals are tax-free.

Also Check: How To Get Social Security Tax Statement

What Happens If I Can’t Even Afford To Enter Into An Installment Agreement To Pay Off My Tax Liability

The IRS has other programs in place if you’re suffering through exceptionally hard economic times. An offer in compromise is one. This option involves reaching an agreement with the IRS that it will accept less money than you owe, but the requirements can be stringent and you’ll have to prove your financial circumstances. You’ll almost certainly need the help of a tax professional to apply, but the Taxpayer Advocate Service stands by ready to help if you can’t afford to pay for assistance.

How To Pay Off A Tax Liability

The bottom line is that you must pay the balance on line 37 of your tax return as quickly as possible to avoid paying interest and penalties on the amount until it’s paid off.

The IRS offers online payment options via Direct Pay or the Electronic Federal Tax Payment System . You can also pay by debit or credit card, electronic funds withdrawal, bank wire, check or money order, or even with cash at certain retail partners.

The IRS offers installment agreements that will allow you to pay off your tax liability over time if you simply don’t have the funds to do so right away. Interest will accrue, and there’s a modest fee. But it’s much better to pay over time than to ignore your debt and hope it goes away, because it won’t.

You May Like: When Will My Income Tax Come In

Tax Liability Vs Tax Due

Tax due is the amount of taxes you still must pay if you have a remaining balanced owed after paying your tax liabilities.

Tax liability means the total taxes due for the taxable year.

Tax liability is not necessarily a bad thing. If you are a working taxpayer, you have tax liabilities. If you want to know more about tax liabilities and have specific questions about your specific tax liabilities, our Tax Professionals at Tax Network USA can help you.

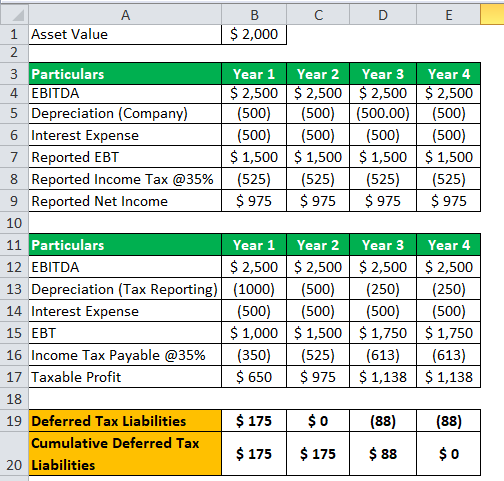

What Is Deferred Tax Liability

- Assets depreciating in value, so there is a difference between accounting earnings and taxable earnings.

- that result in a later revenue-earning date.

- Installment sales, which result in sales revenue that is billed, but not yet earned.

- DTL = Income Tax Expense Taxes Payable + Deferred Tax Assets.

Read Also: What Is The Sales Tax In Washington

Reduce Your Taxes With Credits And Deductions

You may be able to reduce the amount of tax your business pays by taking advantage of targeted tax breaks, including both tax credits and deductions.

For tax deductions, you can choose to either itemize your deductions or take one standard deduction .

If you donât have many deductions to claim, youâll probably want to claim the standard deduction.

If youâve got lots of deductions, youâll probably want to itemize. To claim every deduction you possibly can, check out The Big List of Small Business Tax Deductions.

To see what tax credits you might qualify for, check out The Big List of U.S. Small Business Tax Credits.

An Example Makes This Clearer

Letâs look at an example to see how a hypothetical flow-through entity would determine the amount of federal income tax it owes based on these tax tables. Suppose Wallyâs Widgets ends up with taxable income of $300,000 in 2022, and that Wally files a joint tax return with his wife, Wendy.

Wallyâs tax owed would be:

$30,427 + 24% of the amount over $178,150 .

The calculation: $30,427 + $29,244 = $59,671 total tax due for our friend Wally.

Read Also: How Much Federal Tax Do I Get Back

Tax Liability: Definition Calculation And Example

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

How Can Deskera Help You Calculate Your Federal Income Tax Liabilities

Deskera Books is an online accounting system that will automate several of your accounting tasks, including calculation, payment, and reporting of taxes. Thus, accounting and filing not only becomes a lot easier but also more efficient, thereby saving you from penalties.

Deskera Books will not only keep all your financial records, statements, data, and reports in one place, but it will also let you give access to your account to your accountant or tax professional by sending them an invite link.

In fact, Deskera Books comes with pre-configured tax codes, charts of accounts, and even accounting rules as needed to be followed in the USA. This will thus ensure that you are accurately calculating your federal income tax liabilities. It will also help you in fulfilling all the required forms and adhere to the deadline for it all.

Lastly, through the dashboard of Deskera Books, you will be able to monitor your financial analytics.

Read Also: How To Request Tax Extension

Whats The Difference Between Refundable And Nonrefundable Tax Credits

Both refundable and nonrefundable tax credits reduce taxes owed dollar-for-dollar. Refundable tax credits can be used to lower a taxpayers liability below $0, with the remaining value of the credit being available as a tax refund. Nonrefundable tax credits can be used to reduce a taxpayers liability no lower than $0.

The Earned Income Tax Credit , for example, is a fully refundable tax credit. In fact, most households receive the EITC as a refund. In 2016, 27.3 million tax returns claimed the EITC for a total of $66.7 billion, of which $57.1 billion was refunded.

In contrast, the $500 Child and Dependent Care Tax Credit is nonrefundable. If a taxpayer qualifying for the credit owes just $400, their tax liability will be reduced to $0 and they will not receive a refund for the remaining $100 of the credit.

Credits can also be partially refundable, such as the Child Tax Credit . If the CTC is greater than the taxpayers liability, they may receive a refund only up to $1,400 based on an earned income formula. The maximum credit amount is reduced by 5 percent once adjusted gross income reaches $200,000 for single filers and $400,000 for married filing jointly.

How To Calculate Your Total Business Tax Liability

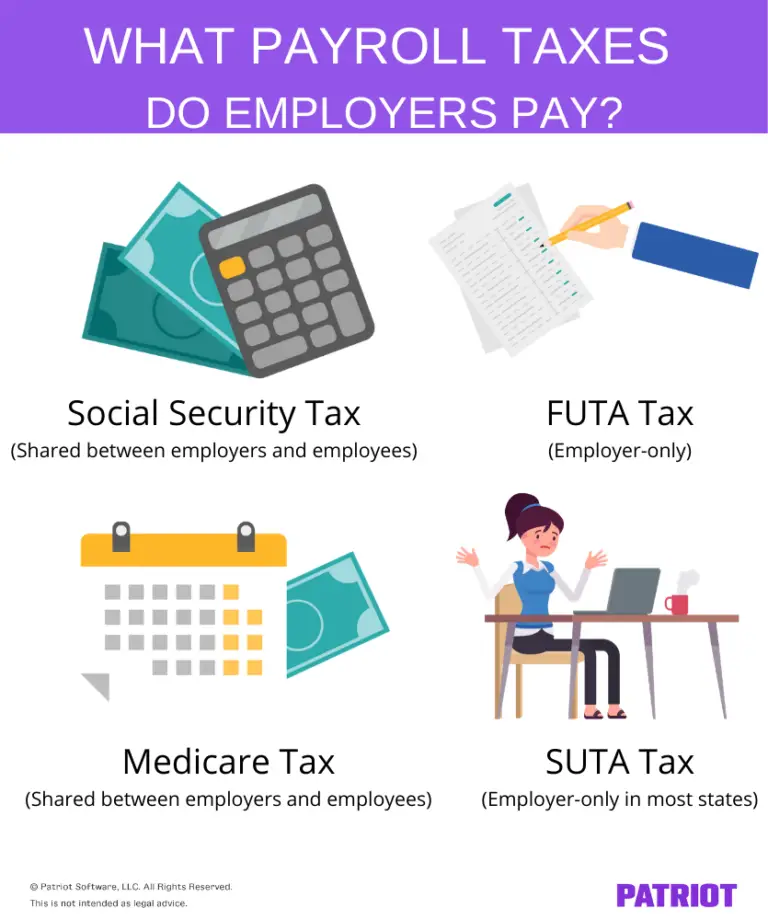

Business tax liability is the amount of taxes owed based on the current income of your business. If your business is structured as a sole proprietorship, partnership, S corporation, or LLC, youll use pass-through taxation, which means that any profits that the business earns are taxed on your personal tax return.

If your business is a C corporation, youll be taxed at the normal federal corporate tax rate, which is 21%, as well as your state tax rate, which varies.

Unless youre a C corporation, you should be calculating your business tax liability quarterly, based on your yearly taxable income. This allows you to make quarterly payments to the IRS based on those estimates, avoiding a big tax bill at the end of the fiscal year. If youre not sure how to calculate tax liabilities, start with the following steps.

You May Like: When Do You Need To File Taxes 2021

How Do I Know If I Have Tax Liabilities

One aspect of being an investor is operating within the framework of the law. Obviously, you want to make investments that provide a positive return on your initial investment, but how you manage those returns may be even more important. The Federal Tax Code, while it does provide some tax breaks and deferral options, is clear about one thing: when you owe the federal government taxes, they want their money. Understanding how to determine when and if you owe taxes and the consequences of not doing so is one aspect of becoming an informed investor in any industry.

How Competitive Is My States Tax Code

When it comes to tax competitiveness, rates matter but are only part of the story. How well a tax system is structured can have significant economic and revenue implications.

A well-structured tax code is easy for taxpayers to comply with and can promote economic growth while raising sufficient revenue. In contrast, a poorly structured tax system can be difficult to comply with, distort incentives, and harm the economy.

Our State Business Tax Climate Index has been designed as a straightforward tool for taxpayers, policymakers, and business leaders to determine how competitive their states tax code is both in terms of rates and overall tax structure.

The Index compares the states on more than 120 variables in the five major areas of taxationcorporate taxes, individual income taxes, sales taxes, unemployment insurance taxes, and property taxesand then adds the results to yield a final, overall ranking. See how your state ranks at the link below.

Recommended Reading: How Do I Pay My Taxes Turbotax

What Are The Main Sources Of State Tax Revenue In The Us

The exact mix of taxes used to raise revenue among U.S. states and localities varies greatly, though the majority of revenue comes from four primary sources: property taxes, sales taxes, individual income taxes, and corporate income taxes.

Other taxes used to raise state and local revenue include excise taxes, such as those on alcohol, tobacco, or motor fuel estate taxes and severance taxes, which are imposed on the extraction of nonrenewable natural resources, such as crude oil.

Sources of State & Local Tax Collections, Percentage of Total from Each Source, Fiscal Year 2017| State |

|---|

How Do I Know If I Have A Tax Liability

Ultimately, you have a tax liability if you have earned income within a tax year. Additionally, you have a tax liability if you have sold an investment and generated a profit. However, there are breaks within the Federal Tax Code that can offset those earnings.

One of the best ways to know whether or not you have a tax liability is to work with an accountant or other tax professional. He or she can work with you to help you identify any areas where you can defer or offset your earnings. Additionally, they can help you understand what sort of tax liability you have.

Learn Ways to Help Reduce or Defer Real Estate Taxes

Read Also: Do I Need Previous Year’s Tax Return To File

Tax Liability For Capital Gains

If you sell any asset, including real estate or other investments, for a gain then youll owe taxes on that gain. For example, if you buy a house for $500,000 and sell it 10 years later for $1,000,000 then your capital gains tax liability basis will be the $500,000 you sold the house for that is above the $500,000 you paid for it.

When an asset is held for more than a year, the transaction becomes a long-term capital gain. Long-term capital gains are taxed at a lower rate than short-term capital gains would be. However, both short-term and long-term capital losses are treated the same way when it comes to tax liability. Losses can be applied against long-term gains that were incurred during the same tax period. They can also be carried forward, in some cases, to future years.

Whats Your Entity Type

There are many business âentity typesâ out there . But for the purposes of figuring out how much tax your small business owes, thereâs only C corporations, and everything else. If youâre not sure what your entity type is, ask your accountant. If you have a small operation, no accountant, and youâve never thought about entity type before, chances are the government is automatically classifying you as a sole proprietor.

C corporations are the only type of business that pays corporate income taxes. If your business is not a C corp, then itâs known as a âflow-throughâ entity because profits and losses flow through the business to owners and shareholders, who pay taxes at their individual tax rates.

Read Also: What Is The Sales Tax For Texas