What It Means To Itemize Deductions

When you itemize deductions, you are listing expenses that will later be subtracted from your adjusted gross income to reduce your taxable income. If your expenses throughout the year were more than the value of the standard deduction, itemizing is a useful strategy to maximize your tax benefits.

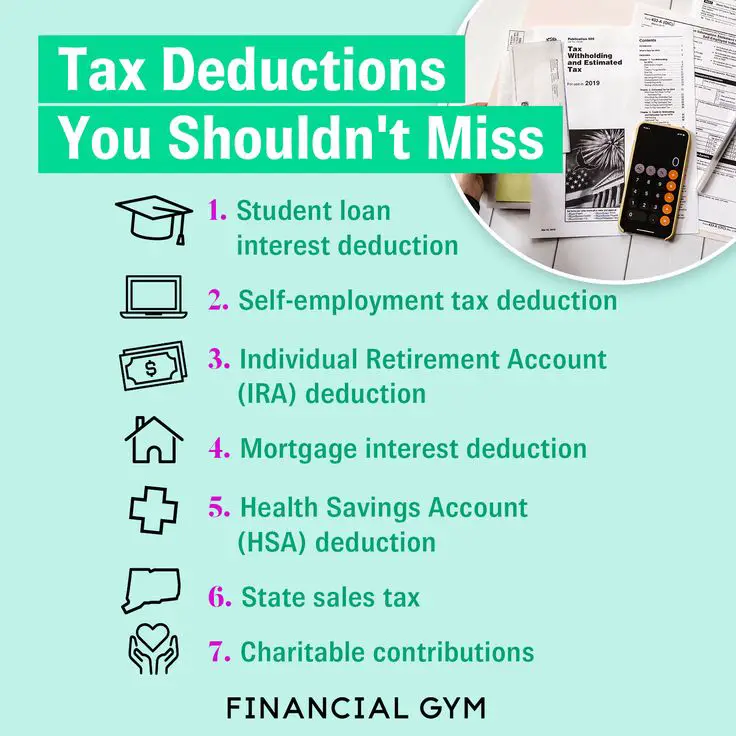

Keep in mind that not all expenses qualify when you itemize. Itemized deductions include products, services, or contributions that have been approved by the IRS. If you arent familiar with which expenses you can deduct, you may want to read a guide to itemized deductions. In brief, things you can deduct include:

- Medical and dental expenses

- Business expenses, including some for travel

- Casualty, disaster and theft losses

Itemized deductions are called below-the-line deductions because they are subtracted from your adjusted gross income. So its worth noting that you can claim above-the-line deductions like IRA contributions without itemizing.

Business Travel Expenses Deduction

If you regularly travel for work, you might be eligible to subtract ordinary and necessary expenses incurred while you travel for work. These expenses might include transportation, airfare, meals, and accommodation.

However, any extravagant costs are exempt from this deduction. As a business owner, you can claim these deductions on Schedule C, Form 1040.

Vehicle Registration Fee Deduction And Worksheet

If you itemize deductions, a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2020 may be deducted as personal property tax on your Iowa Schedule A, line 6, and federal form 1040, Schedule A, line 5c.

This deduction includes annual registration fees paid based on the value of qualifying automobiles and multipurpose vehicles. Multipurpose vehicles are defined as motor vehicles designed to carry not more than 10 people, and constructed either on a truck chassis or with special features for occasional off-road operation .

Annual registration fees on the following vehicles are not deductible: pickups , motor trucks, work vans, ambulances, hearses, non-passenger-carrying vans, campers, motorcycles, trailers, or motor bikes.

This deduction applies only to the annual vehicle registration fee. It does not apply to the 5% one-time registration fee/fee for new registration that is imposed on the initial registration of a vehicle. That 5% fee is only deductible on the IA 1040, Schedule A, line 4b if the taxpayer claimed an itemized deduction for general sales taxes paid on the federal form 1040, Schedule A, line 5a.

Don’t Miss: Do You Have To Pay Inheritance Tax On Life Insurance

How Can I Lower My Tax Bracket

There are a lot of different ways you can lower your tax bracket. If you’re married, filing a joint return with your spouse could qualify you for a lower tax bracket. Or depending on your income and circumstances, you may lower your tax bracket by filing an individual return.

Another way to lower your tax bracket is by contributing to a 401 if your employer offers one. This will lower your taxable income which can put you in a lower bracket. If your employer doesn’t have one, contributions to a traditional Individual Retirement Arrangement could help you qualify for a tax deduction which could also help lower your bracket.

Secure 2.0 Act: What the new retirement law means for your 401, IRA, 529 and more

You may also want to run the numbers on taking the standard deduction instead of itemized deductions since it could put you in a lower bracket, depending on your financial situation.

Elisabeth Buchwald is a personal finance and markets correspondent for USA TODAY. You can follow her on Twitter @BuchElisabeth and sign up for our Daily Money newsletter here

Tax Forms Instructions & Booklets

The resident tax booklets contain both the tax forms and the instructions for each major form. The tax forms on the Web site are available separately from the resident and nonresident instruction booklets.

All of our tax forms have been reformatted to ensure enhanced readability when paper forms are filed. This format has increased the number of pages of some of the tax returns. Make sure that you attach all pages of your return to ensure that your return is processed correctly.

- Tax Forms and Instructions Online – Tax forms and instructions for Individual and Business taxpayers are available here online at Maryland Tax Forms and Instructions .

- Tax Booklets at Libraries – We have provided a limited supply of tax booklets to a number of libraries throughout the State that have requested them.

- Tax Booklets at Comptroller’s Taxpayer Service Offices – Tax booklets are available at all of our local taxpayer service offices.

- Request a Tax Booklet – Taxpayers may request a resident or nonresident tax booklet by calling 260-7951, or by e-mail at .

Read Also: How To Check Your Tax Return

Popular Tax Deductions And Tax Credits

There are hundreds of deductions and credits out there. Here’s a drop-down list of some common ones, as well as links to our other content that will help you learn more.

This could get you up to $2,000 per child for the 2022 tax year, with $1,500 of the credit being potentially refundable.

Its meant to cover a percentage of day care and similar costs for a child under 13, a spouse or parent unable to care for themselves, or another dependent so you can work. Generally, it’s up to 35% of $3,000 of expenses for one dependent or $6,000 for two or more dependents.

This lets you claim all of the first $2,000 you spent on tuition, books, equipment and school fees but not living expenses or transportation plus 25% of the next $2,000, for a total of $2,500.

You can claim 20% of the first $10,000 you paid toward tuition and fees, for a maximum of $2,000. Like the American opportunity tax credit, the lifetime learning credit doesnt count living expenses or transportation as eligible expenses. You can claim books or supplies needed for coursework.

Deduct up to $2,500 from your taxable income if you paid interest on your student loans.

For the 2022 tax year, this item covers up to $14,890 in adoption costs per child. The credit begins to incrementally decrease at certain income levels and completely phases once you reach a modified adjusted gross income of $263,410 or more.

Itemized Deduction Vs Standard Deduction

The vast majority of taxpayers have the option to itemize deductions or claim the standard deduction that applies to their status.

The decision should hinge on a calculation of which deduction type lowers your tax liability the most. For example, if you file as a single taxpayeror youre married and filing separatelyyou will be better off taking the standard deduction of $12,950 for 2022 if your itemized deductions total less than that amount.

Here are the standard deduction amounts for the 2022 and 2023 tax years:

| Standard Deductions for 2022 and 2023 |

|---|

| Filing Status |

-

Tax preparation expenses

-

Natural disaster losses

The list of expenses that can be itemized is extensive, but there are new limits and exclusions compared to deductions allowed before the Tax Cuts and Jobs Act went into effect.

For example, you can deduct mortgage interest on a loan of $750,000 or less for any home bought on or after Dec. 16, 2017. Previously, you could deduct interest on a mortgage up to $1 million.

Usually, you can deduct charitable donations of up to 60% of your AGI .

You can deduct qualified, unreimbursed medical and dental expenses over 7.5% of AGI state and local income or sales taxes plus real estate and personal property taxes up to $10,000 , gambling losses, and investment interest less than investment income.

Read Also: How Much Will My Mortgage Be With Taxes And Insurance

What Can I Take A Tax Deduction For

In order to take a tax deduction for a charitable contribution, you’ll need to forgo the standard deduction in favor of itemized deductions. That means you’ll list out all of your deductions, expecting that they’ll add up to more than the standard deduction.

The most common expenses that qualify are:

- Mortgage interest

Topic No 501 Should I Itemize

There are two ways you can take deductions on your federal income tax return: you can itemize deductions or use the standard deduction. Deductions reduce the amount of your taxable income.

The standard deduction amount varies depending on your income, age, whether or not you are blind, and filing status and changes each year see How Much Is My Standard Deduction? and Topic No. 551 for more information.

Certain taxpayers can’t use the standard deduction:

- A married individual filing as married filing separately whose spouse itemizes deductions.

- An individual who files a tax return for a period of less than 12 months because of a change in his or her annual accounting period.

- An individual who was a nonresident alien or a dual-status alien during the year. However, nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction. For additional information, refer to Publication 519, U.S. Tax Guide for Aliens.

- An estate or trust, common trust fund, or partnership see Code Section 63.

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can’t use the standard deduction.

You May Like: How Should I File My Taxes

How To Claim Itemized Deductions

The first step to claiming itemized deductions is understanding whether this tax election makes sense for you. Gather relevant information on the items mentioned above and compare the amount you may be able to itemized against your potential standard deduction. The standard deduction amounts by filing status for 2022 and 2023 are below.

| 2022 and 2023 Standard Deduction | |

|---|---|

| Filing Status | |

| $19,400 | $20,800 |

If the total amount of eligible deductions exceeds the relevant information above, the taxpayer can choose to itemize their deduction by entering the appropriate information on Schedule A of their tax return. The total amount of itemized deductions is then summed on the form, and this total is carried onto the second page of the Form 1040. A taxpayer’s itemized deduction is then deducted from a taxpayer’s adjusted gross income to arrive at the taxpayer’s taxable income.

Tips To Get You Through Tax Season

- A financial advisor with tax expertise can help you at tax time. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Keeping all of your tax documents organized will help you ace your tax filing. If you choose to itemize, staying organized includes keeping all your receipts. You should keep receipts for at least a few years after you file. It isnt uncommon for the IRS to also look at returns from three to six years prior to the return they are actually auditing. And depending on which deductions you take, like the home office deduction, your return may be more likely to trigger an audit.

- When you file your taxes, there are quite a few tax filing services to choose from. Two of the most popular, H& R Block and TurboTax both offer a user-friendly design with good explanations of the filing process. Heres a breakdown to help you decide which service may be better for you.

Also Check: What Is The Cut Off For Filing Taxes

You Can Deduct Medical Expenses If You Itemize Your Tax Deductions

Like the headline says, to receive the benefits of the medical expense deduction, you have to qualify to itemize your deductions on your taxes, so your itemized deductions like home mortgage interest, state income taxes, property taxes, along with deductible medical expenses have to be more than the standard deduction. For the tax year 2022 the standard deduction is $12,950 single, $19,400 head of household, and $25,900 if married filing jointly. You cant take the standard deduction and claim the medical expense deduction at the same time.

If you are self-employed, you can deduct your health insurance premiums even if you dont itemize your deductions.

Is Itemized Deduction Better Than Standard

Advantages of itemized deductions Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less youll pay in taxes, which is why some people itemize the total of their itemized deductions is more than the standard deduction. There are hundreds of possible deductions.

You May Like: How To Fill Out State Taxes

Advantages Of Taking The Standard Deduction

Here are some big reasons people take the standard deduction instead of itemizing on their tax returns.

-

Its faster. Taking the standard deduction makes the tax-prep process relatively quick and easy, which probably is one reason most taxpayers take the standard deduction instead of itemizing.

-

It usually gets bigger every year. Congress sets the amount of the standard deduction, and its typically adjusted every year for inflation.

|

Filing status |

|---|

Read Also: How To File Income Tax Return Online

Is It Better To Itemize Or Take The Standard Deduction

It depends. For every taxpayer, the answer may be different, as extenuating circumstances may result in a higher itemized deduction for some but a higher standard deduction for others. The only way to determine this for yourself is to compare your potential itemized deductions by the current standard deduction.

Also Check: What Does It Mean To Amend Your Taxes

Child And Dependent Care Credit

Working parents can claim this credit for costs they spent on child care while they actively looked for a job. You can include the cost of a housekeeper, maid, cook, cleaner, or babysitter. For 2021 only, the credit has been expanded and is worth up to 50% of your expenses. The maximum credit for 2021 is $8,000 if you have one dependent under 13, and $16,000 for two or more dependents. Claim this credit with Form 2441 and Schedule 3. You can get necessary information from your care provider with Form W-10. The care provider doesnt qualify if theyre your spouse or dependent.

American Opportunity Tax Education Credit

The American opportunity tax credit offers a tax break for the first four years of higher education. The maximum annual credit is $2,500 per eligible student. If the amount of taxes you owe is zero because of this credit, the IRS says 40% of any remaining amount of the credit can be refunded to you.

The credit is worth 100% of the first $2,000 of qualified education expenses paid for each eligible student and 25% of the next $2,000 of qualified education expenses.

If you, your spouse, or child are in school, make sure to look deeper into education credits, says Daniel Fan, managing director and head of wealth planning at First Foundation Advisors, an Irvine, California-based financial institution. For students who are in the first four years of college, this credit could provide greater tax savings than the lifetime learning credit.

Qualifying expenses include tuition, fee payments and required books or supplies for post-secondary education for yourself, spouse or dependent child.

The amount of your credit is determined by your income. This credit cant be claimed the same year the lifetime learning credit is claimed.

Also Check: Why Do I Owe For State Taxes

How Much Can You Deduct

The amount of money that you can deduct on your taxes may not be equal to the total amount of your donations.

-

If you donate non-cash items, you can claim the fair market value of the items on your taxes.

-

If you donated a vehicle, your deduction depends on if the organization keeps the car or sells it at an auction. A Donors Guide to Vehicle Donation explains how your deduction is determined.

-

If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket.

Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2021.

Disadvantages Of Itemized Deductions

-

You have to understand the rules. Some itemized deductions come with a few hurdles, of course. If you have medical expenses, for example, you can only deduct the portion that exceeds 7.5% of your adjusted gross income.

-

You might have to spend more time on your tax return. If you itemize, youll need to set aside extra time when preparing your returns to fill out the big enchilada of tax forms: the Form 1040 and Schedule A, as well as the supporting schedules that feed into those forms.

-

You need proof. You need to be able to substantiate your deductions. That means keeping records and being organized. If you normally take the standard deduction and are thinking of itemizing when preparing your return next year, start saving your receipts and other proof for your deductions now.

Read Also: How Do I Find My Business Tax Id Number

Medical Isnt Just Medical

The IRS allows tax deductions for dental care and vision, in addition to medical expenses. This means you can potentially deduct eye exams, contacts, glasses, dental visits, braces, false teeth, and root canals.

What else is available for medical deductions? Preventative care and surgeries, psychiatric and psychological treatment, prescription medicine and medical devices such as hearing aids and in-home medical equipment all fall under the medical expenses deduction..

Youre even allowed to deduct the cost of your monthly insurance payments if they are not paid pre-tax through an employer-provided plan, as well as travel expenses to and from the doctor. The medical expense deduction includes medical expenses you pay for yourself, your spouse, and dependents.